- Home

- »

- Market Trend Reports

- »

-

Biopharmaceutical CMO & CRO Production Capacity Report

More Biopharmaceutical Firms to opt for Contract Services

Based on the improvement in outsourced services, the biopharmaceutical industry continues to show a surge in the number of biopharmaceutical firms opting for contract services. CMOs are making enormous investments for the expansion of their manufacturing capabilities. Following are the examples of such investments and expansions:

- In July 2022, Wuxi Biologics announced the expansion of their R&D and large-scale drug product & drug substance manufacturing capabilities in Singapore. This would add 120,000 L biomanufacturing capacity.

- In March 2022, Cambrex, a U.S.-based CDMO expanded its biopharmaceutical testing services business with the addition of 11 cGMP laboratories in its U.S. facility. The expansion included the addition of instruments for nanoparticle size analysis, qPCR, imaging, mass spectrometry, immunoblotting, next-generation sequencing (NGS), and other applications.

Biopharmaceutical CMO & CRO Production Capacity Report Scope

CMO Capacity mapping (for 88 companies)

Key Players: Location Mapping & existing Capacities

Recent expansions/ Future plans

Comparative Heat Map

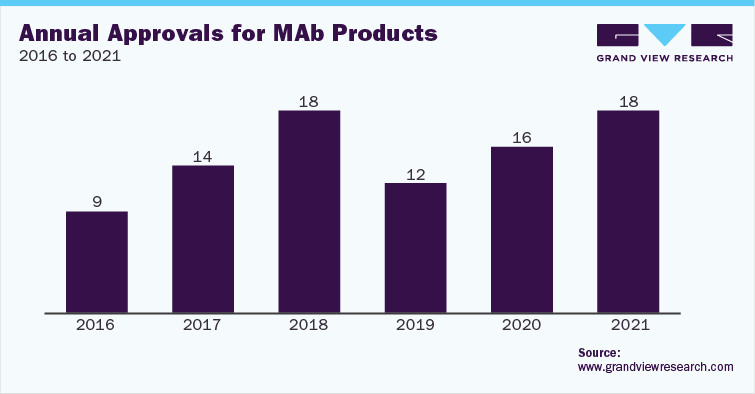

Due to the growing demand for Monoclonal Antibodies (MAbs), manufacturers are facing the issue of production capacity. The construction of a MAb plant costs between USD 20.0 million and USD 60.0 million. The time required to construct a MAb pilot plant is about 2 to 3 years. These factors have led to the rapid adoption of Contract Manufacturing Organization (CMO) & Contract Development & Manufacturing Organization (CDMO) services for the production of MAbs.

Few commercially available MAb products

Product

Supplier

Bebtelovimab

Eli Lilly and Company

Abthrax (raxibacumab)

GlaxoSmithKline

Actemra (tocilizumab)

Roche

Adcetrisc (brentuximab vedotin)

Seattle Genetics

AlprolIXd (Factor IX Fc fusion protein)

Biogen Idec

Arcalyst (rilonacept)

Regeneron Pharmaceuticals

Avastin (bevacizumab)

Roche

According to Genetic Engineering & Biotechnology News, there is an increased use of single-use technologies, more flexible & multiproduct facilities, and platform methods & technologies in CMOs, which increase the delivery speed. There will be greater integration of 2,000 L disposable bioreactors, producing higher cell lines and higher capacity chromatography resins, thereby promoting expansions.

With the growing demand for biopharmaceutical contract manufacturing services, several CMOs are expanding their capacity for mammalian cell culture production. There are a number of companies in the space, such as Lonza and Charles River, which offer services for biotherapeutics production using mammalian cell line. These firms are making significant investments in advancing their mammalian cell culture manufacturing facilities for biologics and biosimilar development. For instance, in May 2021, Lonza announced an investment of USD 936 million to expand its mammalian drug substance manufacturing sites in Switzerland and U.S.

Some commercially available biopharmaceuticals and biologics produced using mammalian cell lines

Product

Cell factory

Biological role

Humira

CHO

Recombinant human monoclonal antibody

Rituxan

Recombinant humanized monoclonal antibody

Enbrel

Recombinant soluble dimeric fusion protein

Avastin

Recombinant humanized antibody

Herceptin

Recombinant humanized monoclonal antibody

Darbepoetin alfa (Aranesp)

Hormone

Lenograstim (CERBIOS)

Cytokine

Epoetin alfa (Binocrit)

Hormone

Ziv-aflibercept

Growth factor receptor fused to IgG1

Thyrotropin alpha

Hormone

Trastuzumab biosimilar

Monoclonal antibody

Remicade

Hybridoma cell line

Recombinant chimeric, humanized tumor necrosis factor alpha (TNF) monoclonal antibody

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified