Report Overview

The biologics regulatory affairs outsourcing industry is highly competitive, with a strong presence of specialized firms adopting distinct strategies to maintain and enhance revenue share in the market. Key players in the industry include global CROs such as IQVIA, ICON Plc, etc., and CDMOs such as Eurofins Scientific SE and Catalent Inc., which offer comprehensive regulatory support across global markets. Additionally, specialized regulatory consulting firms such as ProPharma Group and Freyr provide focused expertise in biologics and biosimilars. Market competition is primarily driven by the growing complexity of regulatory requirements, the upsurge in the demand for biologics, and the need for specialized knowledge in navigating global regulatory frameworks. Companies compete based on regulatory expertise, geographic reach, cost affordability, and regulatory-compliant solutions.

Technology-driven firms like Certara integrate advanced technologies such as AI and digital platforms to streamline regulatory processes, enhancing accuracy and reducing time-to-market. Moreover, several regional CROs, including Syneos Health, capitalize on local expertise in emerging markets, offering specialized knowledge of regional regulations. Meanwhile, cost-effective providers like Caidya target Small and Medium Enterprises (SMEs) with affordable regulatory services, balancing cost and quality to meet the needs of smaller clients. These diverse strategies reflect the dynamic nature of the biologics regulatory affairs outsourcing industry, catering to a wide range of client needs and market demands.

Competitive Landscape: Biologics Regulatory Affairs Outsourcing Industry Report Coverage

|

Report Coverage |

||||

|

Market Overview |

Market Share Analysis |

Company Categorization |

Company Position Analysis |

Service Offering Analysis |

|

List of Key Service Providers, by Region |

Key Service Offerings |

Financial Reporting |

Recent Strategic Developments |

SWOT Analysis |

The key industry participants operating in the biologics regulatory affairs market are proactively focused on implementing several strategic initiatives such as collaborations, mergers, partnerships, acquisitions, agreements, expansions, and others to gain a competitive edge in the overall market. For instance, in October 2023, Samsung Biologics partnered with Kurma Partners to develop and manufacture novel biologics. Through this partnership, Kurma Partners gained access to Samsung biologics' CDMO services, including regulatory support throughout the development of advanced therapeutics. Such partnerships broadened company’s revenue growth opportunities in the market.

Market Characteristics:

The biologics regulatory affairs outsourcing market growth stage is medium, and pace of market growth is accelerating. The market is characterized by a degree of innovation, Level of M&A activities, the impact of regulations, service expansions, and regional expansions.

- Degree of Innovation: The market fortifies a high degree of innovation. The growth is owing to the increasing complexity of biological products and the evolving regulatory landscape. Several companies are adopting advanced technologies such as artificial intelligence, machine learning, and big data analytics to enhance the accuracy and efficiency of regulatory submissions. Additionally, firms are implementing digital platforms to streamline processes, reduce time-to-market, and improve compliance with global regulatory standards. This focus on innovation among service providers to maintain competitiveness and meet the stringent demands of the biologics market.

-

Impact of Regulations: Regulations have a high impact on competition within the biologics regulatory affairs outsourcing market, influencing compliance requirements, quality standards, and market entry barriers. The complexity and stringency of global regulatory frameworks drive demand for specialized expertise, giving an edge to companies with deep regulatory knowledge and experience. Further, ongoing reforms and amendments in regulatory guidelines require companies to stay informed and adaptable. Biopharmaceutical companies find it critical to track updated regulatory guidelines, so they outsource regulatory affairs services to comply with updated regulatory standards.

For instance, in August 2024, the U.S. government announced the passing of the Biosecure Act, which restricts U.S. federal agencies from contracting or procuring equipment and services from biotechnology companies of concern and will extend to companies that source or utilize equipment or services from these listed companies. The list includes prominent Chinese companies, including WuXi AppTec, Complete Genomics, WuXi Biologics, MGI, BGI, and several other firms considered as a risk to U.S. national security. However, this act will offer lucrative growth opportunities to emerging Asian countries such as India to dominate the overall landscape, thereby positively impacting the outsourcing of biologics regulatory affairs.

-

Level of M&A Activities: The market is highly active in mergers and acquisitions. Numerous market participants are implementing mergers and acquisition strategies to broaden regulatory affairs offerings for biologics and enhance clientele. For instance, Icon acquired PRA Health Sciences, and PharmaLex merged with Regulis Consulting Limited are some of the key M&A activities reshaping dynamics in the significant market.

-

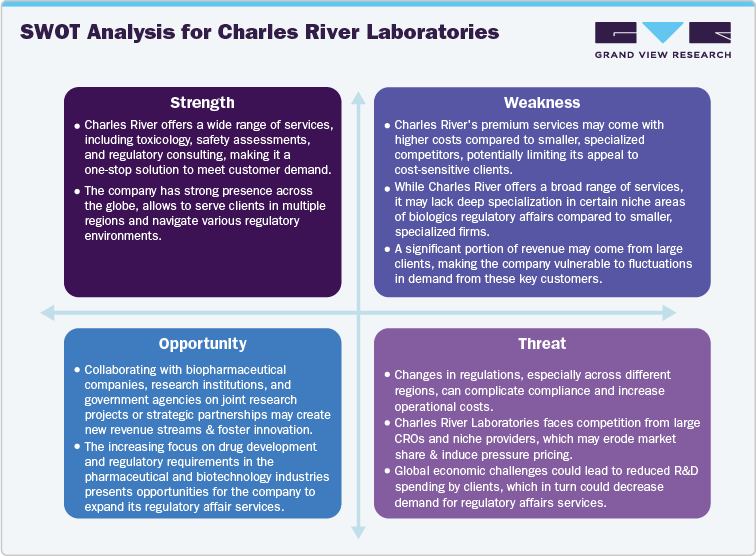

Service Expansion: Service expansion in the market is medium owing to increasing demand for specialized and comprehensive regulatory services in the biologics sector. This expansion includes adding new service capabilities, such as support for emerging therapies like gene and cell therapies, enhancing global regulatory compliance services, and integrating advanced technologies for more efficient regulatory submissions. Numerous companies are expanding service offerings to attract a wider client base, strengthen client relationships, and remain competitive in a rapidly evolving market. For instance, in November 2022, Charles River Laboratories expanded its cell therapy contract development and manufacturing (CDMO) plant in Memphis, Tenn.

-

Regional Expansion: The market is experiencing significant regional expansion, with service providers strategically expanding their presence in emerging markets such as Asia Pacific, Latin America, and parts of Eastern Europe to tap into new client bases, benefit from cost-effective operations, and navigate the specific regulatory environments of these regions. Moreover, changing regulatory scenarios in several economies, such as the planned introduction of the Biosecure Act in the U.S., will offer tremendous growth opportunities to several developing markets such as India, South Korea, Brazil, and several others. This act will pose a long-term impact on the China healthcare market and enhance the R&D investment, partnership, and collaboration strategies with emerging markets that cater cost-effective solutions in the market.

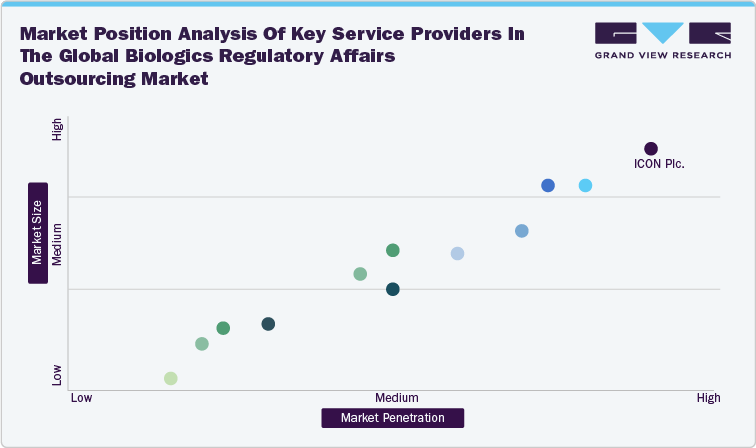

Market Position Analysis

Market position analysis in the biologics regulatory affairs outsourcing industry involves the evaluation of a company's position relative to their competitors based on various factors such as revenue generation, service offerings, geographic reach, technological capabilities, client base, and expertise in niche areas. Companies with broad, integrated services and global reach, like major CROs and CDMOs, often hold leading positions. Specialized consulting firms excel in niche markets like gene therapies and are strong in personalized services. This analysis assists in identifying market leaders, innovators, niche players, and emerging firms in the industry, guiding strategic decisions and market strategies.

Market position analysis of key Service Providers in the global biologics regulatory affairs outsourcing market:

Market Share Analysis

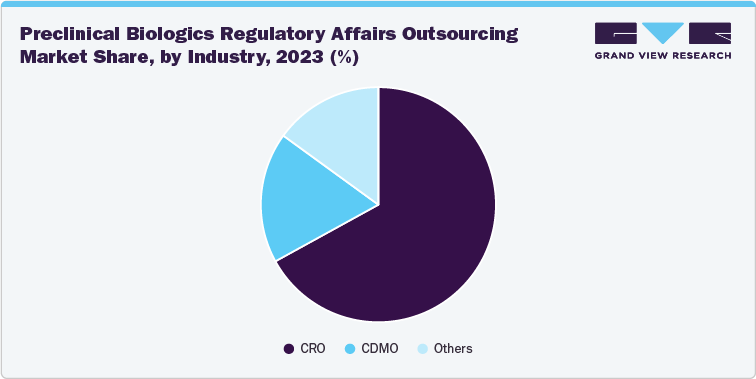

Market share analysis by phase in the biologics regulatory affairs outsourcing market includes analyzing market share distribution across various stages of the biologics development lifecycle, such as the preclinical and clinical phases.

- Preclinical Phase: Biologics regulatory outsourcing in the preclinical phase focuses on early-stage activities such as safety assessments and IND (Investigational New Drug) submissions. Specialized CROs with expertise in navigating initial regulatory barriers dominate in this segment.

-

Clinical Phase: The clinical phase accounted for a significant portion of the market, with CROs and CDMOs providing services for clinical trial applications, monitoring, and compliance with evolving regulations. The complexity of biologics trials, including requirements for biologics license applications (BLA), preference for CDMOs for novel drug development, and increasing utilization of scale-up production services drive high demand for outsourcing regulatory services to CDMOs.

Along with the aforementioned factors, the market share analysis by industry/phase indicates the demand for CROs, CDMOs, and specialized service providers within biologics regulatory services, as well as showcases the leading industry in each specific phase of the biologics development process. This analysis also highlights the varying degrees of competition and specialization within the regulatory affairs outsourcing industry. The changing scenario in each phase is owing to number of clinical trials, outsourcing trends, service offerings, and penetration rate among others.

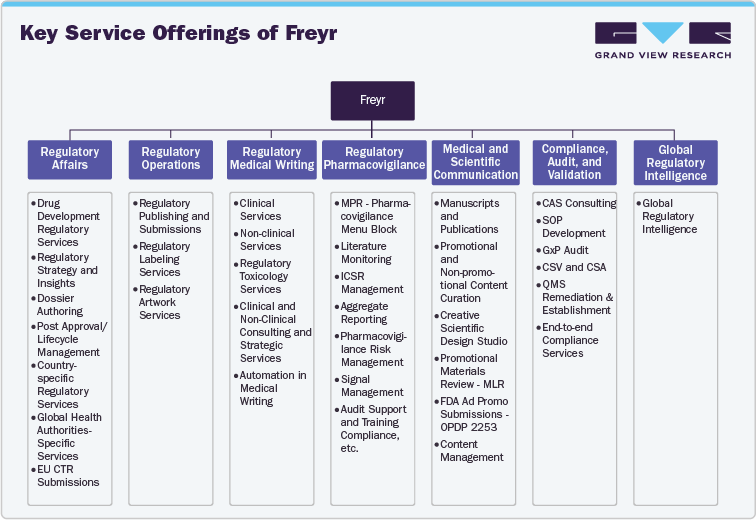

Other aspects that will be analyzed will include the PORTER’s five forces analysis, key service providers by region, and major company profiles that cover company overview, financial reporting, service benchmarking, key strategic initiatives, and SWOT analysis to gain thorough insights regarding the competitive scenario in the biologics regulatory affairs market. Key parameters are represented as below:

Key Service Offerings of Freyr

|

Financial Reporting for ICON Plc |

|||

|

Key Financials |

Revenue (in USD Million) |

||

|

As of dated 31st December |

2021 |

2022 |

2023 |

|

Total Revenue |

8,120.2 |

7,741.4 |

5,480.8 |

|

Operating Income/(loss) |

956.2 |

795.2 |

378.5 |

|

EBITA |

1,420.6 |

1,257.5 |

616.4 |

|

Net Income |

612.3 |

505.3 |

153.2 |

|

Cash from operating activities |

1,161.0 |

563.3 |

829.1 |

|

Cash from investing activities |

226.7 |

145.9 |

6,024.2 |

|

Asset Turnover |

3.6% |

2.9% |

1.5% |

SWOT Analysis for Charles River Laboratories

An in-depth analysis shall be provided for the below listed biologics regulatory affairs service providers:

-

ICON Plc.

-

Charles River Laboratories

-

Wuxi AppTec Inc.

-

Genpact

-

Labcorp

-

Parexel International

-

Freyr solutions

-

Lonza AG

-

IQVIA

-

Eurofins Scientific SE

-

Catalent Inc.

-

AGC Biologics