- Home

- »

- Market Trend Reports

- »

-

Competitive Landscape: Top Biologics CDMOs

![Competitive Landscape: Top Biologics Contract Development And Manufacturing OrganizationReport]()

Competitive Landscape: Top Biologics Contract Development And Manufacturing Organization

- Published: Aug, 2024

- Report ID: GVR-MT-100221

- Format: PDF, Horizon Databook

- No. of Pages/Datapoints: 50

- Report Coverage: 2024 - 2030

Report Overview

Our healthcare portfolio has been developing since our inception in 2014, wherein we have tracked numerous sub-domains and their R&D activities. We have actively been tracking the CDMOs space and have seen the evolution of these players from just a handful to now over 100 companies. To help understand and highlight their development journey, we have made this special study that focuses on the Top 50 contract development and manufacturing organizations (CDMOs) in the healthcare industry.

Currently, the dynamic for biologics drugs has been evolving among pharmaceutical and biotechnological companies owing to them increasingly relying on outsourcing partners to meet clinical and commercial research, development, and production needs. In addition, due to the rapid demand for biologics, biotechnology/pharmaceutical manufacturers are requiring more outsourcing capability owing to complex processes requiring specialist equipment, aseptic processing, and expert support across product production. These CDMOs provide unique expertise enabling established pharmaceutical innovators to bring new products to the market more quickly. Therefore, CDMO offers the best support to pharmaceutical and biopharmaceutical companies to develop new products further supporting to accelerate the latest product innovations.

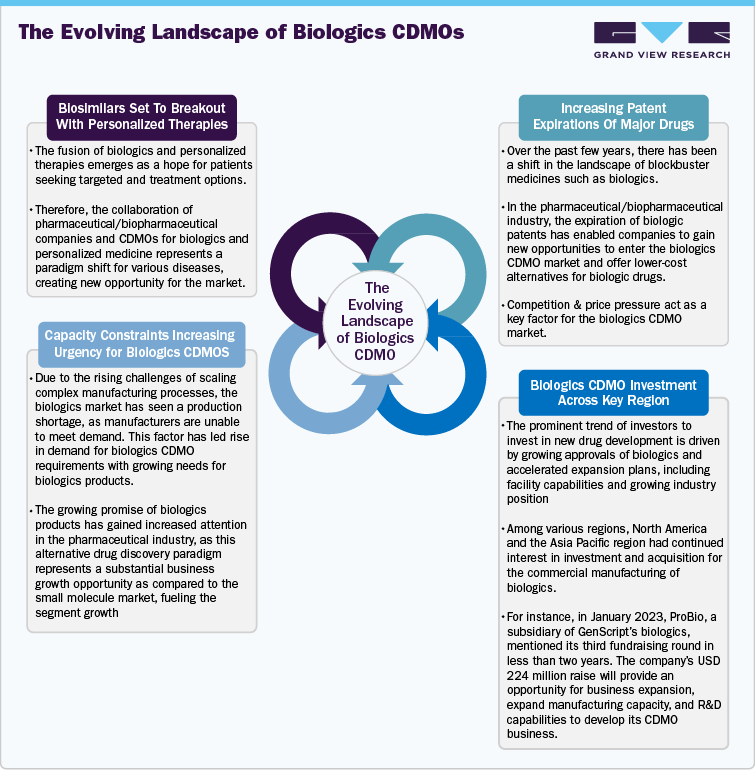

Competitive Scenario: Biologics CDMOs Market

The CDMOs are the major contributors to the healthcare outsourcing industry. In recent years, the biologics CDMOs have experienced substantial growth with growing research and development, innovation in the biologics pipeline, rising number of clinical trials, breakthroughs in manufacturing capability, the growing burden of oncology & other diseases, and the need for extensive product manufacturing facilities. These factors have led to a rise in the number of CDMOs to offer integrated services for manufacturing biologics products.

Competitive Landscape Biologics CDMOs

Competitive Landscape: Top Biologics CDMOs Report Coverage

Market Outlook

Company Categorization

Company Position Matrix

Service Offering Matrix

List of Key CDMOs by Region

Company Overview

Key Service Offerings

Financial Reporting

Recent Strategic Developments

SWOT Analysis

Furthermore, the Biologics CDMOs market is concentrated with the presence of established market players. The below-mentioned biologics CDMOs are some of the key market players in terms of overall revenue. The top position of these companies is due to strong service portfolios, the presence of a large number of facilities across the globe and growing strategic initiatives. Key players are focusing on several strategic initiatives, such as service launches, expansions, collaborations, agreements, partnerships, and mergers & acquisitions, to increase their market share.

Along with these established market players, a number of emerging biologics CDMOs are entering the market with innovative CDMO services offering various services such as drug discovery to market supply for various biologics products. Further, the companies are focusing on customers who benefit from high levels of expertise with advanced product lifecycles and venturing into new domains of biologics manufacturing.

Lonza Group AG

Headquartered: Switzerland

Establishment Year: 1897

Company Overview:

Lonza is a CDMO that provides development and manufacturing services for biologics, small molecules, & gene therapy, among others. The company provides a wide range of products and services, ranging from early-phase discovery to custom development & manufacturing of Active Pharmaceutical Ingredients (APIs). The company has worldwide operations in North America, Europe, and Asia, with a strong presence in France, the UK, and other countries.

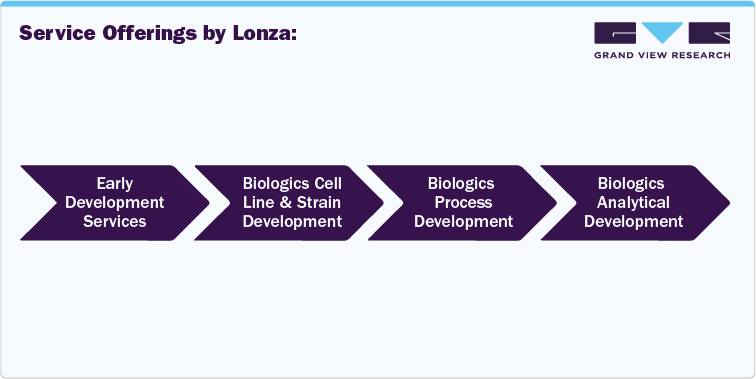

Service Offerings by Lonza:

Some of the Key Biologics Development by Lonza:

-

In March 2024, Lonza announced agreement to acquire the Genentech large-scale biologics manufacturing site in U.S. from Roche for USD 1.2 billion. The acquisition will increase the company’s large-scale biologics manufacturing capacity to meet demand for commercial mammalian contract manufacturing from customers with existing commercial products, and molecules currently on the path to commercialization.

-

In April 2023, Lonza had announced an agreement with ABL Bio to support the development and manufacturing of ABL Bio’s new bispecific antibody product.

SWOT:

AGC Biologics

STRENGTH

WEAKNESS

- Lonza is established in the CDMO market, offering biologics services, and accounts for the major market share in the Biologics CDMOs market

- The company has a presence across North America, Europe, and Asia Pacific markets.

- The high operational costs may affect pricing competitiveness

OPPORTUNITY

THREAT

- There is significant potential for growth in the emerging market owing to growing commercial biologics capacity, which is expected to remain high in the CDMO industry as innovative new therapies reach approval.

- Increasing competition among established players and new entrants may hamper the company’s market share

An in-depth analysis shall be provided for below listed 20 biologics CDMOs:

-

Lonza

-

Catalent, Inc.

-

Samsung Biologics

-

WuXi Biologics

-

Boehringer Ingelheim BioXcellence

-

Thermo Fisher Scientific Inc. (Patheon Pharma Services)

-

FUJIFILM Diosynth Biotechnologies

-

AGC Biologics

-

Recipharm AB

-

Cytiva

-

Curia Global, Inc.

-

Novartis AG

-

CoreRx, Inc.

-

AbbVie Inc.

-

Eurofins Scientific

-

Almac Group

-

Sai Life Sciences Limited

-

Pace Analytical

-

AmplifyBio

-

Delpharm

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified