Market Overview

The global AI in healthcare market size was estimated at USD 19.27 billion in 2023 and is expected to grow at a CAGR of 38.5% from 2024 to 2030. This growth is primary driven by the increasing adoption of AI-powered tools to enhance clinical outcomes, streamline operations, and reduce costs. According to a March 2024 Microsoft-IDC study, 79% of healthcare organizations are presently utilizing AI technology. In addition, the return on investment (ROI) is realized within 14 months, generating USD 3.20 for every USD 1 invested in artificial intelligence (AI). AI technologies hold transformative potential in various areas including medical imaging analysis, predictive analytics, personalized treatment planning, and drug discovery, potentially transforming conventional healthcare practices.

Regulatory Trends In Artificial Intelligence In Healthcare Technologies

As AI becomes increasingly integrated into healthcare delivery, diagnostics, and drug development, there is a growing need for clear regulations that balance innovation with patient safety and data privacy. Several trends and instances highlight how the regulatory environment is shaping the future of AI in healthcare.

Growing Focus on Regulatory Frameworks for AI in Healthcare: Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are developing specific guidelines and frameworks for AI in healthcare. In 2021, the FDA released its Artificial Intelligence/Machine Learning (AI/ML)-Based Software as a Medical Device (SaMD) Action Plan, which outlines the agency's approach to regulating AI-based medical devices. This plan emphasizes a risk-based approach, considering the potential risks and benefits of AI technologies. The FDA is also working on a Predetermined Change Control Plan to allow for ongoing learning and updates in AI models without requiring new approvals, facilitating continuous improvement while maintaining patient safety.

Emphasis on Real-World Evidence and Post-Market Surveillance: There is a growing emphasis on Real-World Evidence (RWE) and post-market surveillance to monitor AI performance after deployment. The FDA’s Total Product Life Cycle (TPLC) approach to AI-based devices includes continuous monitoring of AI performance using real-world data. This approach is exemplified by the FDA’s approval of Viz.ai’s AI-powered stroke detection software in 2018, which was one of the first AI tools to receive clearance under the TPLC framework. The system's ability to learn and improve from real-world data is closely monitored, ensuring it maintains safety and efficacy over time.

Introduction of New Regulatory Categories for AI Technologies: The unique nature of AI technologies has led to the creation of new regulatory categories and classifications. In 2020, the FDA introduced a new regulatory classification for Clinical Decision Support (CDS) Software that incorporates AI, distinguishing between tools that support healthcare professionals’ decisions and those that automate clinical decisions. This distinction is crucial for determining the level of regulatory oversight required. AI tools that automate decisions typically require more rigorous testing and validation compared to those that merely assist clinicians.

Some Of The Current AI Act And Framework Releases

-

In April 2024, initially proposed by the European Commission in April 2021, the EU AI Act approved by the European Parliament. is poised to significantly impact life sciences and healthcare companies. The Act will influence AI usage across various areas, including production, pre-launch activities, clinical studies, post-marketing, and day-to-day operations such as recruitment, procurement, and legal affairs.

-

In January 2023, National Institute of Standards and Technology (NIST) introduced the AI Risk Management Framework (AI RMF 1.0), a voluntary guideline designed to support organizations in the design, development, and implementation of AI systems.

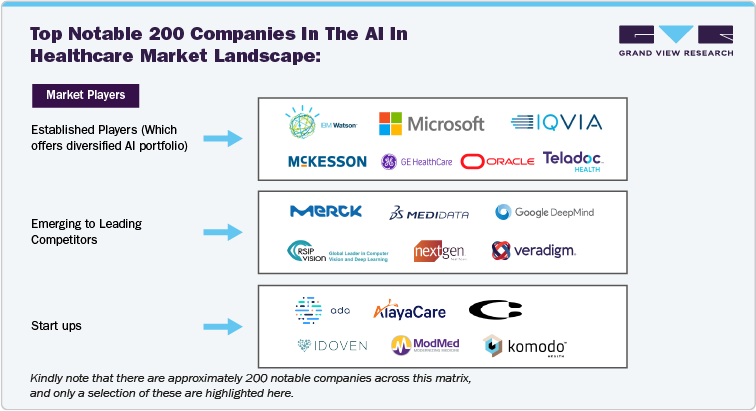

Competitive Landscape Of Artificial Intelligence In Healthcare

The competitive landscape of AI in Healthcare is characterized by intense competition, strategic partnerships, and significant investments as companies strive to develop and deploy AI technologies that can transform healthcare delivery, diagnostics, drug discovery, and patient care.

Top Notable 200 companies in the AI in healthcare Market Landscape:

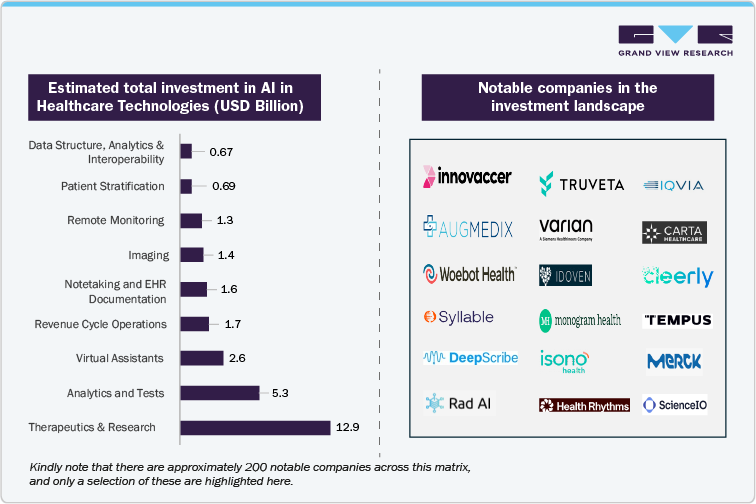

Notable investment areas in AI in Healthcare:

Surge in Investment: The AI in healthcare sector witnessed unprecedented investment levels, with venture capital (VC) firms, private equity, and corporations pouring billions into AI-driven healthcare startups. A notable example is Insitro, leveraging machine learning to accelerate drug discovery, which raised $400 million in a Series D funding round in 2021. This investment highlights the growing confidence in AI's potential to revolutionize drug development processes, reduce costs, and improve success rates.

Increased volume of investments in AI healthcare since 2021

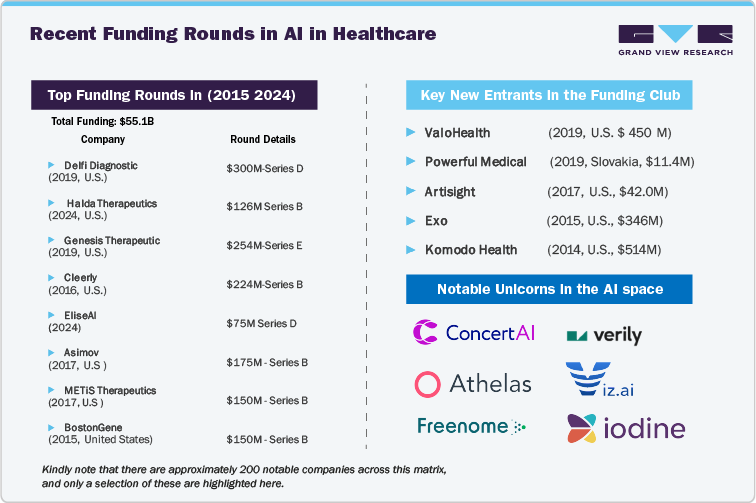

Recent Funding Rounds in AI in Healthcare

|

Dominance Of Tech Giants |

The Rise Of Specialized AI Healthcare Startups |

|

|

Strategic Partnerships and Collaborations: Collaboration between healthcare and AI firms is a defining trend in the competitive landscape. For instance, in February 2024, Virtua Health partnered with Care.ai. In 2019, Novartis partnered with Microsoft to create an AI innovation lab to leverage AI for drug development and personalized medicine. Such partnership highlights how pharmaceutical companies are increasingly collaborating with tech giants to stay competitive in the AI-driven future of healthcare. Another example is Pfizer’s collaboration with IBM Watson for drug discovery, utilizing AI to accelerate research in oncology and immunotherapy.

Mergers and Acquisitions to Gain Competitive Edge:

Mergers and acquisitions also shape the competitive landscape as companies seek to bolster their AI capabilities.

-

In March 2022, Microsoft acquired Nuance Communications, a leader in AI-driven healthcare transcription, for $19.7 billion. This acquisition is part of Microsoft’s broader strategy to enhance its AI offerings in healthcare, integrating Nuance’s conversational AI and ambient clinical intelligence technologies into its healthcare cloud services.

-

In August 2020, Teladoc Health’s acquisition of Livongo Health for $18.5 billion combined AI-driven chronic disease management with telehealth services, creating a robust platform that addresses the growing demand for remote and personalized healthcare.

Government and Institutional Funding Initiatives: Governments and public institutions recognizing the transformative potential of AI in healthcare. In September 2023, the National Institutes of Health (NIH) launched the expansion of the Bridge2AI initiative, committed $130 million to advance AI technologies in biomedical research. This initiative focuses on building diverse, high-quality datasets necessary for training robust AI models, facilitating breakthroughs in areas such as disease prediction, diagnostics, and personalized treatment.

Expansion of AI in Diagnostic Imaging: AI’s role in diagnostic imaging has attracted significant investments, with companies like Aidoc raising $110 million in 2022 to expand its AI-powered radiology platform. Aidoc’s solutions are used in over 500 medical centers worldwide, aiding radiologists in quickly identifying abnormalities in medical images, thus improving diagnostic accuracy and patient outcomes. Such investment highlights the growing reliance on AI to enhance the speed and precision of diagnostic processes.

Investment in AI-Driven Personalized Medicine: Personalized medicine is another area where AI investment is booming. Tempus, a company that uses AI to analyze clinical and molecular data for personalized cancer treatment, secured $200 million in 2023, pushing its valuation to $8.1 billion. Tempus’s AI-driven platform helps oncologists make more informed decisions by providing insights tailored to individual patients, demonstrating the critical role of AI in the shift towards personalized healthcare.