Overview of Asia Pacific Advanced Wound Care Products Industry

The advanced wound care products industry in the Asia Pacific (APAC) region is growing rapidly, driven by a combination of rising healthcare expenditure, an aging population, increased prevalence of chronic diseases, and advancements in wound care technology. Advanced wound care includes products that promote wound healing by providing an optimal healing environment, such as wound dressings, wound therapy devices, and biologics. The rising incidence of chronic conditions like diabetes, obesity, and vascular diseases is a key factor contributing to the growing demand for advanced wound care products. Chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, are common complications in patients with these conditions.

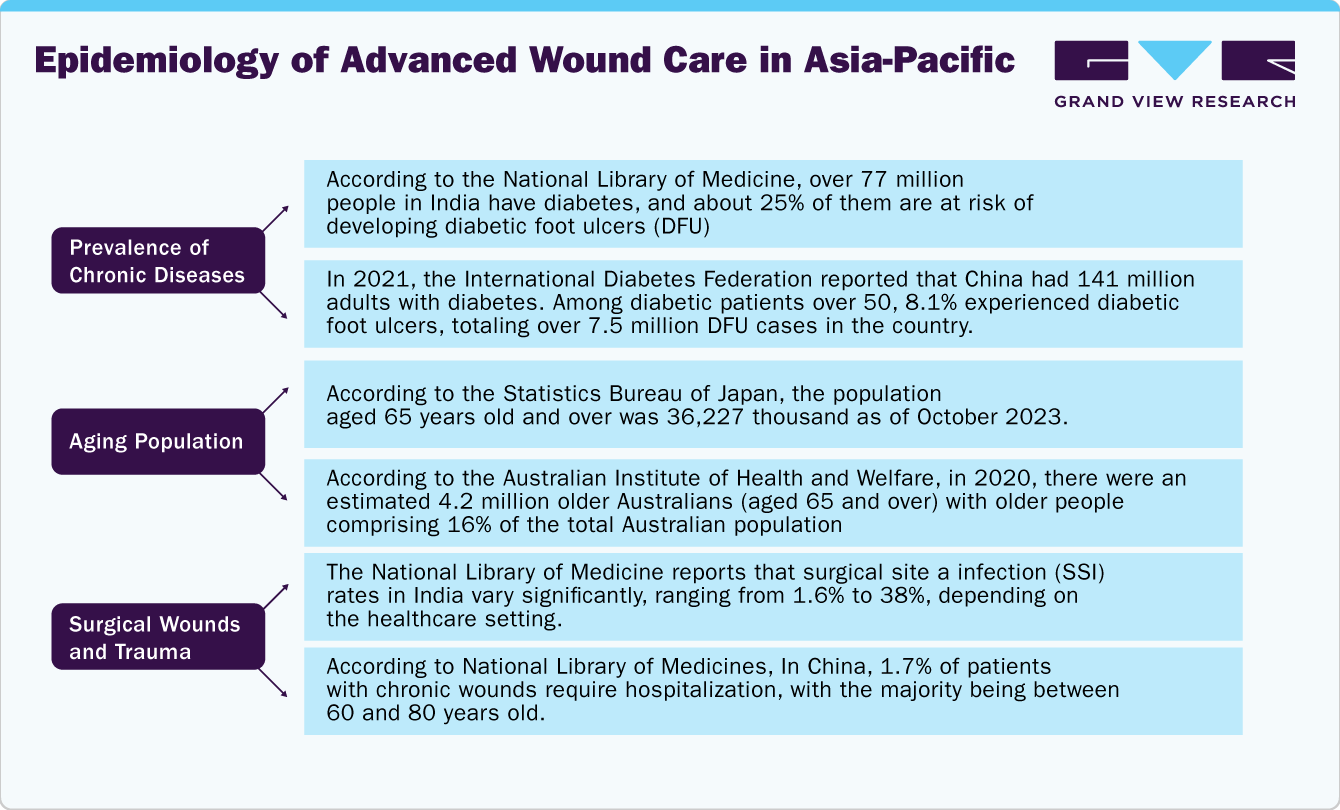

Epidemiology Analysis of Advanced Wound Care in Asia Pacific

The epidemiology of advanced wound care in Asia Pacific is shaped by several demographic and clinical factors, particularly the aging population and the rising prevalence of chronic diseases such as diabetes and cardiovascular conditions. This region is experiencing rapid growth in demand for advanced wound care products, driven by an increase in chronic conditions like diabetic foot ulcers and pressure ulcers. For instance, the APAC region accounts for half of the world's new cancer diagnoses, with a projected 36% rise in cancer-related deaths by 2030, according to Janssen Asia Pacific.

Aging populations, lifestyle changes, and an increase in chronic conditions like diabetes and obesity are contributing to a surge in chronic infections that require advanced wound care. China, for example, is witnessing a rapid increase in its elderly population, with individuals over 60 projected to make up 28% of the population by 2040. This demographic shift poses significant public health challenges, especially in ensuring equitable healthcare access for older people. Chronic infections like diabetic foot ulcers and pressure ulcers are becoming more prevalent in the region, necessitating the use of advanced wound care products and techniques. The World Health Organization (WHO) highlights that as these chronic conditions rise, healthcare systems will need to adapt to meet the growing demand for specialized treatments.

Surgical wounds and traumatic injuries are also contributing to the demand for advanced wound care products in APAC, especially with the region's fast-growing economies and industrial activity. This has led to an increase in surgeries and industrial accidents, further driving the need for advanced wound care solutions. According to the National Library of Medicine, 1.7% of patients in China require hospitalization for chronic wounds, primarily those aged 40 to 80. However, the use of modern dressings and advanced techniques remains limited, with only 22.36% of patients receiving such treatments. Bacterial resistance, particularly from gram-negative bacteria like Pseudomonas aeruginosa, further complicates chronic wound management, underscoring the need for innovation in wound care practices.

Products Overview in APAC Advanced Wound Care Products Market

Advanced Wound Dressings:

-

Hydrocolloid Dressings: These dressings are made from gel-forming materials that provide a moist wound environment.

-

Hydrogel Dressings: Hydrogel dressings are used for dry or necrotic wounds.

-

Foam Dressings: These are highly absorbent and are suitable for wounds with moderate to heavy exudate.

-

Alginate Dressings: Made from seaweed, alginate dressings are highly absorbent and form a gel when in contact with wound exudate.

-

Silver-Containing Dressings: Silver is incorporated into various dressing types to provide antimicrobial properties.

Advanced wound dressings are a cornerstone of modern wound care, offering superior performance in managing various wound types. These dressings create optimal healing environments by maintaining moisture, controlling infection, and protecting the wound from external contaminants. Companies are consistently introducing innovative wound care solutions to address the growing demand for effective and efficient treatment options. For instance, in February 2023,3M introduced its novel medical adhesive for use with a variety of sensors, long-term medical wearables, and health monitors. This adhesive can adhere to the skin for up to 28 days.

Specialized Products:

-

Hydrofiber Dressings: These are highly absorbent dressings that form a gel when in contact with wound exudate, suitable for managing highly exudative wounds such as venous leg ulcers and diabetic foot ulcers.

-

Collagen Dressings: Collagen-based dressings promote healing by providing a scaffold for new tissue growth.

-

Bioengineered Skin Products: These products are designed to mimic the natural skin structure and function, providing a biological solution for complex wounds, such as extensive burns or large ulcers.

Certain specialized products cater to unique needs within the advanced wound care market. Product expansion in the Asia Pacific advanced wound care market is rapidly accelerating, driven by key players introducing a variety of innovative solutions. For instance, in January 2023, Convatec Group PLC announced the introduction of ConvaFoam in the U.S. ConvaFoam is the simpler dressing solution for wound management as it can be used on a wide range of wound types at any point in the wound healing process.

Antimicrobial Wound Care Products:

-

Antimicrobial Dressings: Dressings containing substances like silver, iodine, or honey have antimicrobial properties to control infection.

-

Antiseptic Solutions and Ointments: These products are applied directly to the wound to reduce microbial load and prevent infection.

Antimicrobial products are designed to reduce or prevent infection in wounds. For instance, in October 2022, Healthium Medtech (Apax Partners), a provider of medical devices specializing in surgical, post-surgical, and chronic care solutions, introduced its injuries dressing collection, TheruptorTM Novo, specifically designed for treating chronic diseases such as diabetic foot ulcers and leg ulcers.

Overview of Pricing Analysis of Advanced Wound Care Products in APAC region

The pricing analysis of advanced wound care products in APAC reveals a dynamic and multifaceted landscape influenced by various factors including market demand, regional economic conditions, and regulatory frameworks. Advanced wound care products, encompassing items such as hydrocolloid dressings, foam dressings, and antimicrobial wound dressings, are crucial for managing chronic and complex wounds, particularly in rapidly growing economies with increasing healthcare needs. The APAC region, characterized by a diverse range of economies from high-income countries like Japan and Australia to emerging markets in Southeast Asia and South Asia, exhibits significant variability in product pricing. Medical care costs in the Asia Pacific rose from 7.2% in 2022 to a high of 9.9% in 2023, indicated by the WTW Global Medical Trends Survey, with expectations for the insurer-reported cost trend to plateau at 9.9% in 2024, reflecting stability impacted by regional market variations, where some areas experience minimal changes while others show slight fluctuations in costs from 2023 to 2024.

In high-income countries within the APAC region, such as Japan and Australia, advanced wound care products tend to be priced higher due to higher manufacturing standards, advanced technology integration, and comprehensive regulatory approvals. These markets often benefit from robust healthcare infrastructure and higher per capita healthcare expenditure, which supports the adoption of premium products. For instance, in January 2022, Wounds Australia offered a solution fund totaling USD 2 million to be allocated over four years. This fund aims to establish a nationwide media and digital initiative focused on chronic wound prevention and treatment, leveraging the platform provided by Wound Awareness Week.

Pricing Range of Advanced Wound Care Products in APAC countries (in USD, per unit)

|

Country |

Average Price Range |

High-End Products |

Low-End Products |

|

India |

USD 5 - USD 15 |

USD 15 - USD 25 |

USD 5 - USD 10 |

|

China |

USD 8 - USD 18 |

USD 18 - USD 30 |

USD 8- USD 12 |

|

Japan |

USD 20 - USD 40 |

USD 40 - USD 60 |

USD 20 - USD 30 |

|

Australia |

USD 25 - USD 45 |

USD 45 - USD 70 |

USD 25 - USD 35 |

Competitive Landscape of APAC Advanced Wound Care Products

The competitive landscape for advanced wound care products in the APAC region is characterized by a mix of local and international players, with varying strategies and market dynamics. Major global brands such as Smith & Nephew, Johnson & Johnson, 3M, and Coloplast dominate the market with a wide range of advanced wound care products, leveraging their strong R&D capabilities and extensive distribution networks. There is a strong focus on innovation, with companies investing in advanced technologies like bioengineered skin substitutes and smart wound care solutions. Pricing varies widely, with high-end products commanding premium prices in markets like Japan and Australia, while cost-effective solutions are more common in price-sensitive markets like India and China. Companies are forming partnerships with local distributors and healthcare providers to enhance market penetration and launch new products, such as,

-

In July 2023, Smith & Nephew PLC introduced the REGENETEN Bioinductive Implant, accessible in India. The REGENETEN implant, a novel solution for rotator cuff surgeries, has been utilized in over 100,000 procedures.

-

In April 2023, 3M announced the U.S. FDA approval for 3M Veraflo Therapy dressings intended for hydromechanical removal of nonviable tissue.

-

In April 2023, Convatec Group PLC acquired 30 Technology Limited’s anti-infective nitric oxide technology platform, which includes new product assets and R&D. In addition to enhanced wound care, Convatec plans to explore the technical platform for use in other businesses.