- Home

- »

- Medical Devices

- »

-

Zirconia Based Dental Materials Market Size Report, 2030GVR Report cover

![Zirconia Based Dental Materials Market Size, Share & Trends Report]()

Zirconia Based Dental Materials Market (2025 - 2030) Size, Share & Trends Analysis Report, By Product (Zirconia Disc, Zirconia Blocks), By Application (Dental Crowns, Dental Bridges), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-473-5

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

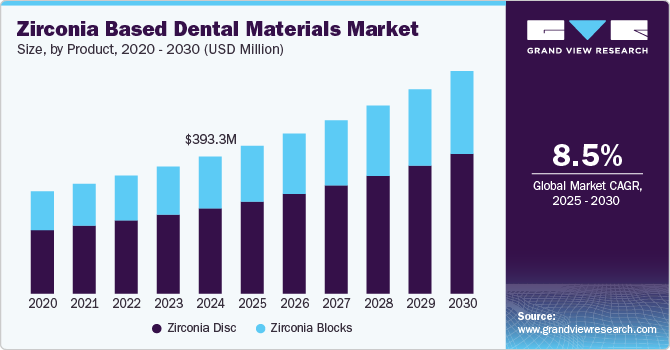

The global zirconia based dental materials market size was estimated at USD 393.3 million in 2024 and is projected to grow at a CAGR of 8.5% from 2025 to 2030. The rising prevalence of dental diseases is one of the factors boosting market growth. According to the WHO article published in March 2023, globally, dental health challenges continue to rise, with untreated dental caries affecting approximately 2.5 billion individuals. In addition, about 1 billion people suffer from severe periodontal disease, leading to progressive damage and tooth loss if left unmanaged. Complete tooth loss, which significantly impacts quality of life and functionality, affects around 350 million people worldwide. These widespread dental issues drive the demand for advanced, durable, biocompatible restorative materials. Zirconia-based dental solutions offer strength, aesthetic appeal, and longevity, making them a key choice for addressing the needs of a growing patient base facing diverse dental health challenges.

Social media platforms emerged as powerful tools for disseminating information regarding oral health and available treatment options. Influencers in the dental field share insights about the benefits of modern materials such as zirconia, which can lead to increased patient interest and demand. Educational content provided by dental professionals on platforms such as YouTube or Instagram helps demystify complex procedures involving zirconia-based materials. Patients who are better informed about their choices are more likely to advocate for high-quality materials during consultations with their dentists. In February 2023, the American Dental Association (ADA) reported that 99% of dentists prefer zirconia for creating natural-looking dental prosthetics. Zirconia outperforms other ceramic materials, providing numerous benefits, and is subject to ongoing development to enhance its performance further.

Integrating Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM) technology with zirconia enables the creation of highly personalized restorations that fit seamlessly within a patient’s mouth. Digital modeling allows for intricate designs and shapes, enhancing zirconia's performance by reducing gaps and ensuring a precise fit. Moreover, improvements in zirconia formulations have enhanced translucency and color accuracy, making these materials increasingly attractive for aesthetic dental applications. In December 2023, Roland DGA launched an innovative Chairside Zirconia specifically designed for CAD/CAM milling, representing a major leap forward in same-day zirconia restorations. This fully sintered zirconia is optimized for wet milling with the DGSHAPE DWX-42W Series, streamlining dental procedures significantly. Offered through authorized resellers, it boasts a distinctive 3-layer gradient design that enhances both aesthetics and strength, providing dental professionals with an efficient solution for creating zirconia restorations.

Technological advancements drive market growth. For instance, in March 2023, Amann Girrbach offered a 10-year warranty on Zolid zirconia restorations. Users can create an authenticity certificate online detailing product specifics and warranty and email it for printing and customizing. In addition, Zolid blanks include identification stickers and access to a quality information page.

Number of Dentists in the U.S.

Year

Total Number of Dentists

Dentists per 100,000 Population

2023

202,304

60.4

2022

202,536

60.8

2021

201,927

60.8

2020

201,117

60.7

Market Concentration & Characteristics

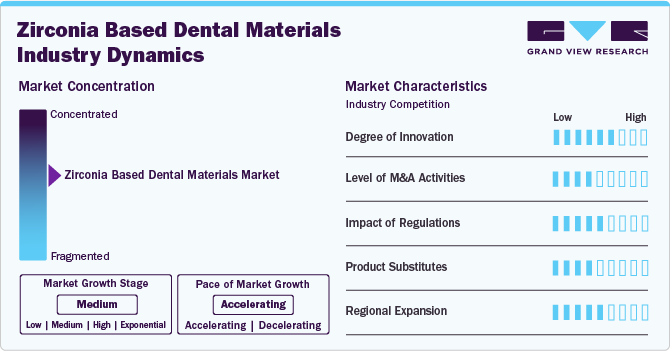

The market is experiencing significant innovation as companies introduce enhanced materials, bioactive components, and digital advancements within dental products. These developments, including crowns, fillings, and bonding agents, boost consumables' durability, aesthetic quality, and performance. For instance, in January 2024, Ivoclar Vivadent upgraded its Prime Esthetic zirconia materials and IPS e.max ZirCAD Prime by introducing a new ring feature to improve efficiency in dental laboratories and optimize production processes. This enhancement utilizes proprietary GT technology, which guarantees smooth transitions in shade and translucency, resulting in dental restorations of superior aesthetics.

Key players, including Dentsply Sirona, Ivoclar Vivadent, Kuraray Noritake Dental, Inc. (Kuraray America, Inc.), and Argen, actively mergers and acquisitions to strengthen their market positions. In addition to M&A initiatives, these organizations pursue essential strategies such as innovation in product types, forming strategic partnerships, and expanding into new geographical regions to meet the increasing demand for zirconia-based dental materials.

Regulatory frameworks are crucial in shaping the zirconia based dental materials market by establishing safety, quality, and efficacy standards. Although stringent regulations can prolong the approval timeline for new products, potentially hindering market entry and innovation, they also enhance patient confidence and ensure product reliability. These regulations guarantee that only safe, high-quality materials are used in dental practices, promoting market growth through a strong emphasis on patient safety and trust in product performance.

There are no direct substitutes for zirconia-based dental materials. Their significance in dental care is paramount, as they provide essential components for restorative, preventive, and cosmetic treatments. These materials are vital in facilitating effective dental procedures and promoting oral health.

Leading companies in the zirconia-based dental materials market are broadening their scope by venturing into new geographical areas, forming strategic partnerships with local distributors, and tailoring their product lines to address the specific healthcare requirements of various regions. This strategy allows them to meet local demands better and strengthens their global market position.

Product Insights

The zirconia disc segment held the largest share of over 62.2% in 2024 due to the increasing prevalence of dental diseases and technological advancements. Zirconia discs are a key component of the larger category of zirconia-based dental materials, mainly used to manufacture dental restorations like crowns, bridges, and implant abutments. These discs comprise Zirconium Dioxide (ZrO2), a ceramic substance recognized for its remarkable strength, longevity, and aesthetic appeal. Technological advancements drive segment growth. For instance, In April 2024, Sagemax, a dental materials producer, introduced the NexxZr+ Multi 2.0 disc, a new zirconia product designed for enhanced aesthetics and durability in dental restorations. This product features a gradation in color and translucency from a 4Y-TZP composition in the cervical area to a 5Y-TZP in the incisal area. It has a flexural strength of 850 MPa cervically and 650 MPa incisally, making it suitable for creating realistic, monolithic restorations for both front and back teeth, as highlighted in the company's press release.

The zirconia blocks devices segment will show lucrative growth during the forecast period. The growth of the zirconia blocks segment is significantly driven by advancements in dental technology and increasing demand for aesthetic dental solutions. Innovations such as CAD/CAM systems have streamlined the production process of zirconia restorations, allowing for greater precision and customization. This technological evolution enhances the fit and finish of dental prosthetics and reduces chair time for patients, making it an attractive option for dentists and patients alike. As more practitioners adopt these technologies, the market for zirconia blocks continues to expand. In February 2024, Kuraray introduced KATANA Zirconia ONE Blocks, a revolutionary multi-layered zirconia for CEREC systems that combines strength, aesthetics, and efficiency, enabling dental practices to streamline their workflow and reduce inventory by offering a versatile chairside material option suitable for any dental region.

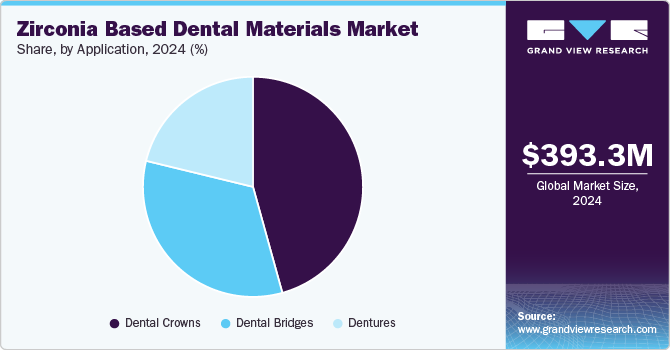

Application Insights

The dental crowns segment held the largest share of over 45.7% in 2024. The growth of zirconia-based dental crowns is driven by increasing demand for aesthetic dentistry. Patients are becoming more aware of their dental appearance and seeking solutions that provide functionality and visual appeal. Zirconia crowns can be designed to match the natural color of surrounding teeth, making them an attractive option for those looking to enhance their smile. Advancements in digital dentistry and CAD/CAM technology have streamlined the process of designing and manufacturing zirconia crowns, allowing greater precision and customization in fit and aesthetics. According to the NCBI article published in October 2024, the study in the Journal of Dentistry highlights how CAD/CAM technology streamlines the creation of endocrowns from ceramic materials directly in the dental office. This research assessed the performance of 141 endocrowns made from various ceramics, including feldspathic, zirconia lithium silicate, and lithium disilicate, in restoring teeth treated with root canals over 2 years in 85 patients. The findings suggest that endocrowns manufactured in-office from any of these ceramics effectively repair molars and premolars after endodontic treatment.

The dental bridges segment is projected to grow more during the forecast period. The demand for dental bridges made from zirconia is driven by the increasing prevalence of dental issues such as caries, periodontal disease, and tooth loss among various age groups. In May 2024, the CDC reported that approximately half of the men and one-third of the women aged 30 years or older were affected by some form of periodontitis. As populations age and awareness of oral health rises, more individuals seek restorative solutions like dental bridges. Advancements in dental technology have led to improved fabrication techniques for zirconia materials, enhancing their usability in creating precise and durable restorations. This technological progress increases patient satisfaction and encourages dentists to adopt zirconia-based solutions more widely.

Regional Insights

North America zirconia based dental materials market dominated with a share of 38.3% in 2024, owing to an increased prevalence of dental diseases and the rising demand for dental procedures among the aging population.According to the Centers for Disease Control and Prevention (CDC), in May 2024, more than half of children aged between 6 and 8 years old had cavities in their primary teeth. Similarly, an estimated 57% of the adolescents aged around 12 to 19 years had cavities in their permanent teeth. Moreover, more than 90% of the adults aged 20 years and above had cavities. The high prevalence of cavities among all age groups highlights the region's need for zirconia based dental materials.

U.S. Zirconia Based Dental Materials Market Trends

The U.S. zirconia based dental materials market accounted for the largest share of North America's market in 2024-increased prevalence of dental diseases and the rising demand for dental procedures among the aging population. As per dental statistics by the Centers for Disease and Prevention (CDC) in June 2024, one-quarter of the U.S. adults ages 20 to 64 suffer from at least one untreated cavity, and 42% of adults have periodontal (gum) disease. Technological advancements in endodontic devices, offering more efficient and less painful treatment options, also contribute to the market expansion. Dental health awareness and the growing emphasis on aesthetic improvement fuel the demand for advanced endodontic treatments, propelling market growth.

Europe Zirconia Based Dental Materials Market Trends

The zirconia based dental materials market in Europe held the second-largest revenue market share in 2024. Government initiatives aimed at enhancing healthcare access and affordability have made restorative dentistry more accessible to a broader segment of the population. For instance, the "Dentist Pass" program, launched in June 2023, received over 86,000 applications, with 71,057 approved in Greece. This initiative, managed by Information Society S.A., aims to improve preventive dental care for more than 660,000 children in the country born between 2011 and 2016. The program seeks to enhance dental health accessibility for families across the country. High consumer awareness and technological advances are expected to drive market growth over the forecast period.

Germany zirconia based dental materials market dominated with the highest revenue share of 25.6% in 2024. The rising number of dental diseases and technological advancements fuel the market's growth. Moreover, strategic initiatives by the key players and government organizations drive the market's growth. For instance, in October 2022, the German Society for Implantology (DGI) introduced new S3 guidelines regarding using zirconia dental implants, highlighting their increasing recognition as a viable alternative to titanium implants. These guidelines are founded on comprehensive literature reviews designed to offer practitioners evidence-based recommendations for applying ceramic implants.

The zirconia based dental materials market in the UK held the second-largest market share in 2024. The rise in dental care highlights the need for continued innovation and healthcare technology advancement to reduce this trend effectively. With an increasing number of patients pursuing dental treatment and a growing awareness of oral health, the need for high-quality zirconia-based dental materials is rising. For instance, in July 2024, from January to March 2024, 2.56 million adults took part in the GP Patient Survey, offering insights into their experiences with NHS dentistry. Innovations in technology, including the creation of high-precision instruments and advancements in imaging techniques, improve treatment results and patient comfort, thereby driving market expansion.

France zirconia based dental materials market is anticipated to witness a significant CAGR of 9.8% during the forecast period. Growing awareness of oral health and aesthetics among the French population, along with heightened initiatives from the government and various organizations, is expanding access to dental care for a broader segment of the community. According to the French Dental Organization report, in July 2023, professional associations and several insurance programs in the country established a five-year agreement targeting multiple areas. This initiative emphasizes investment in preventive and conservative care for individuals aged 3 to 24, aiming to cultivate the first "cavity-free generation." It also includes mandatory oral checkups for residents entering nursing homes, full coverage for successive treatments, annual dental checkups for children aged 3 to 18, and reimbursement for various other dental procedures.

Asia Pacific Zirconia Based Dental Materials Market Trends

The Asia Pacific zirconia based dental materials market is expected to grow fastest during the forecast period. The rising number of dental care centers, increasing dental tourism, growing R&D activities, and rising awareness about dental care. In developing economies such as India, access to oral health services is often restricted or unavailable, resulting in a significant prevalence of dental diseases. According to DCI figures, in April 2024, India hosts 323 colleges offering Bachelor of Dental Surgery degrees and 279 providing Master of Dental Surgery degrees. In addition, nine institutions offer postgraduate diplomas in various dental specialties, including zirconia based dental materials. Furthermore, 111 colleges focus on dental hygiene and mechanics.

China zirconia based dental materials market accounted for the largest share of the zirconia based dental materials market in the Asia Pacific region in 2024. China's high prevalence of oral diseases coupled with various organizations' increasing dental health awareness initiatives. For instance, in March 2024, the Graduate Student Union of the National Astronomical Observatory (NAOC) partnered with Dr. Gong Xi from Peking University Hospital of Stomatology to promote the 8020 Campaign, advocating for retaining 20 or more natural teeth by age 80. The campaign addresses significant tooth loss among the elderly in China, where less than 20% of those over 80 retain this number of teeth. The event included a lecture on oral hygiene practices and lifestyle choices for better oral health, engaging attendees with practical questions, and distributing dental care kits to enhance awareness and education on oral health issues. Such initiatives significantly increase the awareness about oral health in the country’s population, which is expected to increase the demand for zirconia based dental materials.

The Japan zirconia based dental materials market held a significant market share in the Asia Pacific region. The increasing focus on dental aesthetics and heightened awareness of the significance of oral health motivate more individuals to pursue treatments involving zirconia-based dental materials, contributing to the market's growth. For instance, in June 2024, Fujitsu Japan Limited, in collaboration with Kamoenai Village in Hokkaido, launched an initiative to raise awareness about dental care. On June 27th and 28th, 2024, they will conduct oral checkups for approximately 40 students, leveraging Fujitsu's Preventive Dentistry Cloud Service to promote proactive dental health. This service identifies the risk of tooth decay, allowing students and their guardians to monitor results on their smartphones and fostering greater personal awareness of oral health. In addition, the Japanese dental industry's dedication to maintaining high standards of care, coupled with the adoption of digital dentistry, is improving the accuracy and success rates of procedures involving zirconia-based dental materials.

India zirconia based dental materials market is experiencing significant growth. India has witnessed a significant increase in efforts by the government and various bodies to enhance dental awareness. For instance, the Anant Muskaan project, launched by the Amrita School of Dentistry in July 2024, aims to enhance oral health education for primary school children in India. This initiative, the first of its kind in the country, focuses on instilling good oral hygiene habits among young students. Funded by the Indian Council of Medical Research (ICMR), the program will run for three years across eight locations, including Kochi and New Delhi. Collaborating with government bodies and schools, Anant Muskaan seeks to foster a healthier future generation through improved dental care practices. This growing consciousness about oral hygiene is expected to increase the demand for zirconia based dental materials.

Latin America Zirconia Based Dental Materials Market Trends

The zirconia based dental materials market in Latin America is growing considerably. The increasing prevalence of dental diseases is a strategic initiative by key players and organizations that primarily drive it. For instance, in July 2023, Chubb and HealthAtom partnered to provide comprehensive dental healthcare protection and services for patients throughout Latin America. This alliance enables both individual clients and corporate groups to access fully digital dental insurance products that are easy to contract. The innovative digital insurance is designed to enhance coverage and deliver lasting value to customers through their preferred channels. Due to cost-effective and high-quality dental care, dental tourism expansion in countries like Argentina and Brazil also plays a crucial role in driving the market.

Brazil zirconia based dental materials market is expanding due to several distinct growth drivers. The growing awareness among Brazilians regarding oral hygiene and dental health has increased dental visits for zirconia based dental materials procedures. For instance, in April 2024, a Brazilian version of a British and Jordanian oral health education game was tailored for children, incorporating insights from local specialists. The study included three phases: first, experts assessed the suitability of the original game; second, we created the Brazilian version with adjustments; and third, we evaluated it with 15 children aged 4 to 8. Results showed an average correct response rate of 75.3%, with children enjoying the game and parents finding it informative. This interactive tool effectively teaches Brazilian children about dental caries prevention, supports professionals in enhancing oral health education, and drives growth in the zirconia based dental materials market.

Middle East & Africa Zirconia Based Dental Materials Market Trends

The zirconia based dental materials market in MEA is expected to grow lucratively due to the rising dental diseases and the increasing adoption of advanced medical technologies in the region. Several countries in the Middle East and Africa region are adopting educational initiatives to encourage better oral hygiene practices. According to the WHO article published in June 2024, social media platforms in Bahrain and Saudi Arabia have been leveraged to engage communities through oral health awareness campaigns. Likewise, schools in Kuwait and Qatar have implemented programs that teach children the fundamentals of oral hygiene alongside healthy dietary habits. These efforts aim to instill positive habits early on, contributing to improved dental health across the population and driving demand for advanced dental materials such as zirconia-based products.

Saudi Arabia zirconia based dental materials market is growing at a CAGR of 6.2% over the forecast period. Supportive policies by the Saudi government aimed at strengthening healthcare infrastructure, along with significant investments in advanced dental technologies and facilities, have fostered a favorable environment for market growth. For instance, in May 2024, the Saudi Dental Society introduced several activities during World Oral Health Day (WOHD) 2024 in Saudi Arabia to boost public awareness of oral health and encourage proactive management of chronic oral issues. These efforts and the increasing incidence of dental disorders within the Saudi population drive the demand for zirconia-based dental materials and the associated devices.

Key Zirconia Based Dental Materials Company Insights

Some of the key players operating in the industry include Ivoclar Vivadent, Kuraray Noritake Dental, Inc. (Kuraray America, Inc.), and Argen. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Pritidenta and GC Corporation are emerging players in zirconia based dental materials.

Key Zirconia Based Dental Materials Companies:

The following are the leading companies in the zirconia based dental materials market. These companies collectively hold the largest market share and dictate industry trends.

- Ivoclar Vivadent

- Kuraray Noritake Dental, Inc. (Kuraray America, Inc.)

- Argen

- Dentsply Sirona

- B&D Dental Technology

- Henry Schein, Inc.

- VITA North America (VITA Zahnfabrik)

- Dental Direkt

- Pritidenta

- GC Corporation

Recent Developments

-

In April 2023, BEGO Medical formed a strategic alliance with VITA North America, leveraging VITA's high-quality YZ SOLUTIONS zirconium material at its milling center in Bremer. This collaboration comes after extensive evaluations of the material, signaling a new partnership between these two prominent German firms in the dental field.

-

In May 2023, Zolid Bion blends aesthetics with safety, marking a new era in zirconia-based all-ceramic materials. The material, available for order from June 2023, features a continuous color gradient and enhanced incisal translucency for unmatched naturalness without sacrificing durability. Its innovative composition delivers an average strength of 1,100 MPa, ensuring versatility and security for all approved uses.

-

In January 2023, Kuraray Noritake Dental Inc. launched a new Esthetic Colorant for KATANA Zirconia, offering a range of user-friendly shading liquids that penetrate the zirconia structure, allowing for the mimicry of various internal shades. This product is ideal for establishing the initial restoration features before sintering, setting the stage for quick and straightforward customization.

Zirconia Based Dental Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 424.8 million

Revenue forecast in 2030

USD 639.6 million

Growth rate

CAGR of 8.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dentsply Sirona; Straumann Holding; 3M; Henry Schein, Inc.; Patterson Companies, Inc.; Envista (Danaher Corporation); CompZimmer Biomet7; Ivoclar; Coltene Group; Benco Dental

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

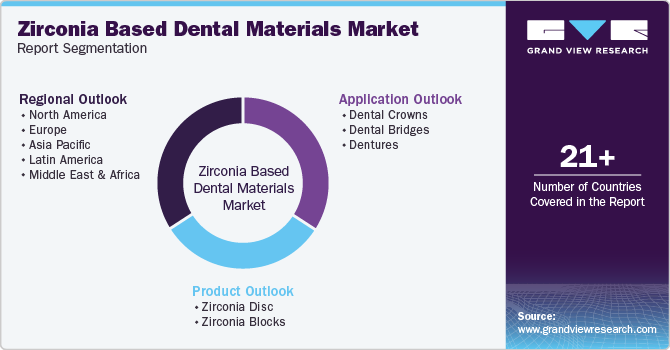

Global Zirconia Based Dental Materials Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. for this study, Grand View Research has segmented the global zirconia based dental materials market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Zirconia Disc

-

Zirconia Blocks

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Crowns

-

Dental Bridges

-

Dentures

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global zirconia based dental materials market size was estimated at USD 393.3 million in 2024 and is expected to reach USD 424.8 million in 2025.

b. The global zirconia based dental materials market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030 to reach USD 639.6 million by 2030.

b. North America dominated the zirconia based dental materials market share of 38.3% in 2024 owing to the presence of a large number of skilled professionals and significant awareness among people in the region regarding the advancement in the dental market.

b. Some key players operating in the zirconia based dental materials market include 3M ESP, GC America, SAGEMAX, Huge Dental, Zirkonzahn, KURARAY NORITAKE DENTAL INC., Glidewell Laboratories.

b. Key factors that are driving the zirconia based dental materials market growth include the inert characteristics of zirconia such as high mechanical and biocompatibility of zirconia dental material, the rapid rise in the geriatric population, and increased outsourcing to dental laboratories for customized prosthetic solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.