- Home

- »

- Beauty & Personal Care

- »

-

Zero Waste Shampoo Market Size, Industry Report, 2030GVR Report cover

![Zero Waste Shampoo Market Size, Share & Trends Report]()

Zero Waste Shampoo Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Shampoo Bars & Liquid Shampoo), By Distribution Channel, By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-801-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Zero Waste Shampoo Market Size & Trends

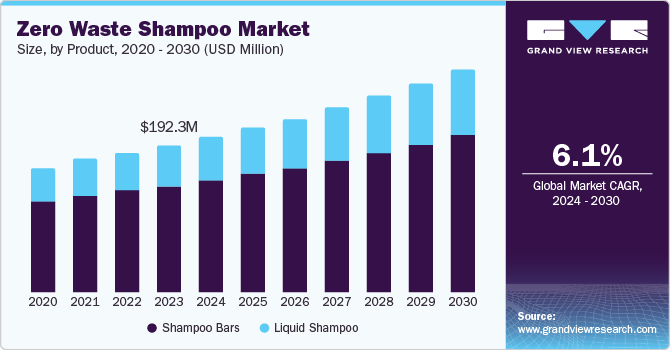

The global zero waste shampoo market size was valued at USD 192.3 million in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. A growing environmental consciousness among consumers primarily drives the demand for zero-waste shampoo. The increased awareness of the detrimental impact of plastic pollution, particularly from personal care products, has prompted a shift towards sustainable alternatives.

Consumers are increasingly seeking products that align with their eco-friendly values, and zero-waste shampoos offer a practical solution to reduce plastic waste. Furthermore, the drive to adopt a healthier lifestyle has fueled interest in natural and organic personal care products, as consumers perceive them to be less harmful to their bodies and the environment.

Government regulations and policies have significantly influenced the market growth by addressing plastic pollution. Plastic bans and restrictions imposed by various governments require exploring alternative packaging solutions. This has led to increased innovation and the development of solid shampoo bars and other zero-waste options. Furthermore, the availability of a wide range of zero-waste products on e-commerce platforms has helped to expand market reach and accessibility, contributing to further market growth.

A strong product innovation and development focus further drives the zero-waste shampoo market. Companies are investing heavily in R&D to develop high-quality, efficient, and appealing zero-waste shampoo formulas. The focus on using natural ingredients, offering a variety of products, and providing convenient packaging options has drawn a larger consumer base. Additionally, the growing adoption of eco-friendly practices by beauty and personal care brands has enhanced the credibility and popularity of zero-waste shampoos, driving market growth.

Product Insights

The shampoo bars segment dominated the market and accounted for a revenue share of 72.2% in 2023 primarily attributed to the increasing environmental consciousness among consumers seeking less plastic waste. Shampoo bars offer a practical solution by eliminating the need for plastic bottles, thereby aligning with the zero-waste lifestyle. Moreover, compact and portable nature of the shampoo bars makes them ideal for travel and outdoor activities, enhancing their appeal to consumers. Shampoo bars' perception as more concentrated and economical than liquid shampoo has also contributed to the growth. Additionally, the growing trend of natural and organic personal care products has intersected with the shampoo bar market, driving the segment growth.

The liquid shampoo segment is expected to register the fastest CAGR of 6.9% during the forecast period. Manufacturers focus on product innovation regarding packaging to avoid using plastic bottles. Adopting a “reduce, recycle, and reuse” ideology to target the problem of garbage dumping is anticipated to create growth opportunities for the segment. Various brands use aluminum as a packaging material as it is easily recyclable and less environmentally harmful. They also provide refill services for shampoo bottles to reduce wastage.

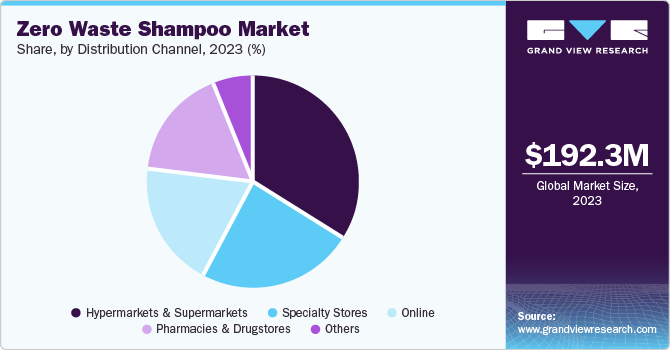

Distribution Channel Insights

Hypermarket & supermarket accounted for the largest revenue share in 2023. The widespread availability of these retail formats across diverse geographic locations facilitated easy access to zero-waste products for a broad consumer base. Additionally, hypermarkets and supermarkets' established trust and brand recognition influenced consumer-purchasing decisions. Furthermore, the integration of zero-waste shampoos into these stores' product portfolios aligned with the growing consumer preference for sustainable and eco-friendly options, driving sales. Moreover, the effective marketing and promotional strategies implemented by these retail giants significantly impacted product visibility and consumer awareness.

The online distribution channel is expected to register the fastest CAGR during the forecast period. The increasing penetration of internet and smartphone usage has facilitated seamless online shopping experiences, enabling consumers to purchase zero-waste products conveniently. Moreover, e-commerce platforms offer a wider range of zero-waste shampoo options from various brands, providing consumers with more options and flexibility. Additionally, online retailers often focus on sustainability and eco-friendliness, aligning with the target market's values. The ability to reach a global audience through online channels has expanded the market reach for zero-waste shampoo brands, further driving the growth of this distribution segment.

Regional Insights

North America zero waste shampoo market dominated the global market with a revenue share of 41.8% in 2023. Factors such as increased consumer awareness of the environment, stringent regulations on plastic waste, and a growing focus on natural and organic ingredients in wellness culture drive the robust growth of the industry in North America. Furthermore, the region's early adoption of sustainable living practices and established e-commerce infrastructure has greatly influenced the market's growth.

U.S. Zero Waste Shampoo Market Trends

The U.S. dominated the North America zero waste shampoo market in 2023. The region's robust economy and early embrace of sustainable lifestyle trends have created a favorable environment for market growth. Moreover, a sizable population with solid digital awareness and a well-established e-commerce infrastructure has eased the distribution and availability of zero-waste shampoo products, contributing to further market expansion in the country.

Europe Zero Waste Shampoo Market Trends

Europe zero waste shampoo market was identified as a lucrative region in 2023. The region's strong focus on sustainability and environmental protection has created a market for eco-friendly products. The region's early adoption of eco-friendly practices and strict rules on plastic disposal have fostered a convincing setting for zero-waste options. Furthermore, the market's expansion has been fueled by an increasing disposable income and an established consumer group that prefers high-quality, natural products, leading to increased market growth in the region.

The UK zero waste shampoo market is expected to grow rapidly in the coming years. An increasing awareness of the environment among UK consumers and a focus on sustainability have paved the way for eco-friendly products. The nation's forward-thinking approach to plastic pollution and the enforcement of strict rules to decrease plastic garbage has hastened the acceptance of zero-waste options. Furthermore, the advanced e-commerce system and the growing popularity of online shopping have made distributing and accessing these products easier, driving market growth.

Asia Pacific Zero Waste Shampoo Market Trends

Asia Pacific zero waste shampoo market is anticipated to grow with the fastest CAGR over the forecast period. The growing upper-middle class, with higher purchasing power and an increasing environmental concern, is driving the need for eco-friendly products. The young and tech-savvy people in the region are open to eco-friendly practices, and the growing use of social media amplifies the impact of sustainability. Furthermore, the trend of time-saving and convenient personal care products is being fueled by rapid urbanization and shifting lifestyles, increasing the usage of zero-waste shampoos. Moreover, government efforts to encourage sustainability and decrease plastic waste establish a positive regulatory atmosphere for the market's growth.

China zero waste shampoo market held a substantial market share in 2023. The focus on environmental protection by the Chinese government and the introduction of policies to decrease plastic waste have established a conducive regulatory environment for the zero-waste shampoo industry. Furthermore, the increasing urbanization and evolving lifestyles in China have resulted in a growing demand for convenient and time-efficient personal care options, which resonates with the popularity of zero-waste shampoos in the country.

Key Zero Waste Shampoo Company Insights

Some of the key companies in the zero waste shampoo market include Ethique, HiBAR, Lush Retail Ltd., J.R. Liggett, Ltd, Oregon Soap Company, Rocky Mountain Soap., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives such as partnership, acquisition, new launches and others.

-

Ethique offers solid shampoo and conditioner bars remove plastic packaging while still maintaining hair health. The company's dedication to utilizing natural ingredients and sustainable methods has appealed to eco-friendly consumers, leading to its quick expansion and impact in the industry.

-

Lush Retail Ltd. is well known for its ethical and handcrafted beauty products. Lush is dedicated to sustainability and has incorporated solid shampoo bars into its product range to meet the increasing demand for environmentally friendly alternatives. Their focus on using natural ingredients and minimal packaging has established them as a frontrunner in the zero-waste movement.

Key Zero Waste Shampoo Companies:

The following are the leading companies in the zero waste shampoo market. These companies collectively hold the largest market share and dictate industry trends.

- Ethique

- HiBAR

- Lush Retail Ltd.

- J.R. Liggett, Ltd

- Oregon Soap Company

- Rocky Mountain Soap.

- Beauty and the Bees

- Plaine Products, LLC

- The Refill Shoppe

- By Humankind, Inc

Recent Developments

-

In April 2022, Lush acquired its U.S. partner, significantly expanding its sales by over 80% and reinforcing its commitment to rejuvenating its UK operations post-pandemic. The deal, valued at USD 145.54 million, was strategically funded via property sales and leveraging surplus cash from the U.S. and Canadian operations.

Zero Waste Shampoo Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 203.0 million

Revenue forecast in 2030

USD 289.8 million

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, Argentina, South Arabia, South Africa

Key companies profiled

Ethique; HiBAR; Lush Retail Ltd.; J.R. Liggett, Ltd; Oregon Soap Company; Rocky Mountain Soap.; Beauty and the Bees; Plaine Products, LLC; The Refill Shoppe; By Humankind, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Zero Waste Shampoo Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global zero waste shampoo market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shampoo Bars

-

Liquid Shampoo

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

South Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.