Yeast Extract Market Size, Share & Trends Analysis Report By Technology (Autolyzed, Hydrolyzed), By Form, By Application (Food & Beverages, Animal Feed, Pharmaceuticals), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-877-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Yeast Extract Market Size & Trends

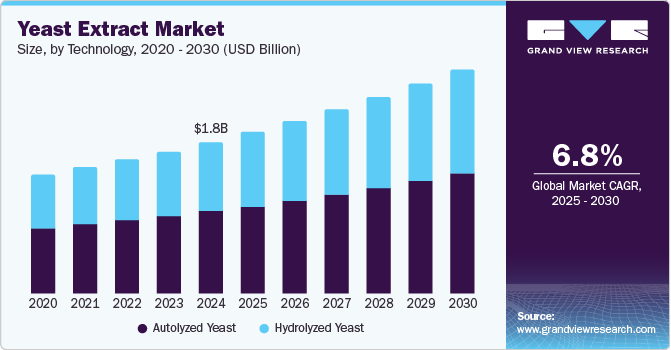

The global yeast extract market size was valued at USD 1.77 billion in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2030. A continued increase in the consumption of alcoholic beverages worldwide and rising demand for baked goods are major factors aiding market expansion. Yeast extract is a clean-label ingredient that is considered a natural flavoring agent, similar to spices and herbs. The product is also known for its GMO-free, Halal, Kosher, and gluten-free nature, making it popular among health-conscious consumers. Growing preference for healthy food items that consist exclusively of natural ingredients is projected to drive market growth in the near future. Furthermore, the widespread availability of resources, such as saccharides and other sugar derivatives, at economical prices is further expected to create more opportunities for industry players to launch their products.

According to the European Association for Specialty Yeast Products (EURaSYP), the increasing pace of product developments within the vegan and plant-based category and the meat alternative sector is expected to highlight the importance of yeast extract in providing a clean-label advantage and savory flavor profile. The ingredient also contributes to the sustainability objectives of consumers and companies, as it is made from a completely natural fermentation process, and the by-products from its production process are used in human and animal health applications.

Yeast extract has high protein, B vitamins, and fiber content, making it a valuable ingredient for dietary supplements and animal feed. It provides essential amino acids necessary for human nutrition, with an article by EURaSYP stating that it has a rich glutamic acid content. It is also considered a good source of minerals such as chromium, zinc, selenium, phosphorus, magnesium, manganese, copper, vanadium, molybdenum, and lithium. Chromium, in particular, helps regulate blood sugar levels and can aid in managing diabetes. Increasing awareness regarding these health benefits is thus anticipated to drive positive developments in the yeast extract industry.

Yeast extract is rich in glutamates, which are compounds that provide the umami flavor in savory food items. Plant-based products typically lack the depth of flavor found in animal products, and yeast extract is widely used to address this deficit. Growing sales of packaged and convenience food items due to urbanization and the busy lifestyles of consumers further aid the demand for this product. Yeast extract is often added to snacks, ready-to-eat meals, and frozen food products as a natural flavor enhancer that improves their taste, giving them a rich, savory profile. The pet food industry is another notable application area for this market. Increasing pet ownership rates, particularly in emerging economies, have led to increased demand for pet food products. Pet owners are becoming more selective about the quality of ingredients in pet foods, focusing on natural and functional ingredients. Yeast extract is commonly used in these items to improve flavor and provide nutritional benefits such as B vitamins and amino acids. The ingredient additionally offers a nutritious alternative to artificial flavor enhancers in such formulations, driving its sales through the pet food category.

Technology Insights

The autolyzed yeast segment accounted for the largest revenue share of 54.6% in 2024 in the global yeast extract industry. Autolysis refers to the natural breakdown of yeast cells through enzymatic processes, typically facilitated under controlled conditions. The enzymatic breakdown releases free amino acids, peptides, and nucleotides, such as glutamate and inosinate, which are responsible for the umami flavor. This results in a rich, savory profile that enhances the taste of various food products, including soups, sauces, snacks, and plant-based alternatives. Moreover, the technology breaks the yeast cell walls and releases valuable nutrients such as B vitamins, amino acids, proteins, minerals, and antioxidants. This contributes to the nutritional value of yeast extract, making it a beneficial ingredient in both food and beverage products as well as dietary supplements. Since autolysis is a more natural process compared to hydrolysis, it generally requires fewer chemicals or expensive external enzymes, which can make it more cost-effective in the long term.

The hydrolyzed technology is expected to grow at the fastest CAGR in the global market from 2025 to 2030. Hydrolysis, especially when using enzymes or acid/alkali treatments, is generally much faster than autolysis. The breakdown of yeast cells occurs more quickly, allowing manufacturers to produce yeast extract at a higher throughput. Hydrolysis also offers substantial control over the flavor profile of the final yeast extract. By adjusting the type of enzymes or chemicals used (acidic or alkaline), manufacturers can manage the intensity of flavor, amino acid composition, and the degree of breakdown. The technology can also improve the solubility of yeast extract, especially in liquid or paste form. The breakdown of yeast cell walls makes the final product more easily dissolvable in water, which is crucial for applications such as soups, sauces, and beverages.

Form Insights

The powdered form of yeast extract accounted for a substantial revenue share in the global market in 2024. This form is extensively utilized in several major industry applications, including bakery & confectionery, dairy, meat, dietary supplements, and medicines. The product is a natural flavor enhancer or flavoring agent, making it a viable substitute for monosodium glutamate (MSG). Powdered yeast extract is much easier to handle, store, and transport than other forms, with the absence of water greatly reducing the risk of microbial contamination and extending the shelf life. It is an essential ingredient in seasoning blends for meats, vegetables, and snack foods and is further used in vegetarian or plant-based products to provide a meaty flavor and enhance their overall taste.

The paste segment is expected to advance at the fastest CAGR during the forecast period. The paste form is created by concentrating yeast extract through evaporation or other processes, resulting in a thick, spreadable substance that is widely used in various food applications. These products can be blended smoothly into recipes, making them ideal for formulations requiring a viscous and concentrated ingredient. Yeast extract paste is used in convenience food items, including instant soups, ramen, and meal kits, to improve their taste and nutritional content. It also helps in enhancing the mouthfeel and texture of liquid-based dishes.

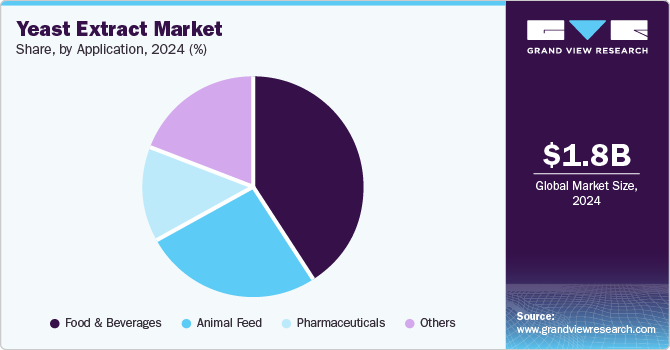

Application Insights

The food & beverages segment accounted for the largest revenue share in the global yeast extract industry in 2024. The properties of yeast extract, such as umami flavor, nutritional benefits, and versatility, have driven its usage as a flavor enhancer, protein source, and functional ingredient in this sector. Yeast extract is commonly used in liquid and powdered forms in soups, broths, gravies, and sauces to provide a savory base without the need for artificial flavorings. It enhances the overall flavor profile, making it richer and more satisfying. The promising growth of the vegan industry provides another major avenue for market expansion. Yeast extract is frequently used in plant-based meat substitutes such as veggie burgers, sausage alternatives, and meatless sausages to impart a meaty or savory flavor, essential for improving plant-based proteins' taste. The natural occurrence of glutamate and other flavor-enhancing compounds in this product has made it a partial alternative for salt in recipes without compromising its flavor. This makes it a popular ingredient in low-sodium or sodium-reduced food products.

The animal feed segment, meanwhile, is expected to advance at the highest CAGR in the market from 2025 to 2030. The increasing demand for nutritious and clean-label ingredients to safeguard animal health and lower the risk of issues caused by synthetic compounds has enabled market growth in this area. Yeast extract contains essential amino acids such as glutamine, glutamate, aspartic acid, and proline, which are crucial for protein synthesis, muscle growth, and tissue repair in animals. The rich presence of B-Vitamins such as B1 (thiamine), B2 (riboflavin), B6 (pyridoxine), B12, niacin, and folic acid further supports energy metabolism, nervous system health, and immune function. Due to its umami flavor, yeast extract is widely utilized to improve the palatability of animal feed and encourage animals to increase their consumption. The ingredient is also known for its positive impact on the digestive health of animals. It is rich in beta-glucans, which are known to have immune-modulating effects and can help improve gut health.

Regional Insights

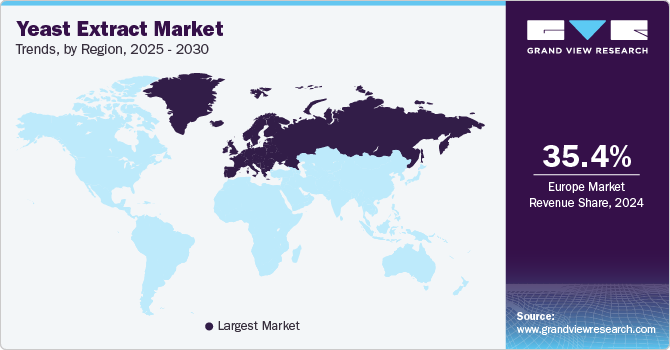

The Europe yeast extract market accounted for the largest global revenue share of 35.4% in 2024. Rising consumption of processed food items in the region, coupled with increasing demand for nutritional yeast extract, have been the primary drivers of market expansion. Moreover, the increasing pace of urbanization, changing lifestyles of regional consumers, a noticeable shift in preference toward natural ingredients, and widespread use of organic yeast extracts in the food & beverage industry present other major growth avenues for companies in this industry. Yeast extract is rich in umami, which has seen a surge in popularity in European cuisine. The increasing desire for umami-rich flavors in a variety of food products, including savory snacks and plant-based alternatives, has thus driven demand for this product as an ingredient in regional economies.

Germany Yeast Extract Market Trends

Germany yeast extract accounted for the largest revenue share in the regional market in 2024. The economy has one of the largest vegan and vegetarian populations in Europe, and this trend is driving the demand for yeast extract as a flavor enhancer in plant-based foods. With more consumers shifting toward plant-based diets for health, environmental, and ethical reasons, yeast extract is expected to play a crucial role in providing savory flavors in meat alternatives, dairy-free products, and other plant-based items. Moreover, the clean-label trend is growing rapidly in the economy, with consumers strongly preferring transparency in food labeling. As a natural ingredient, yeast extract fits well into this trend, offering a cleaner alternative to artificial flavor enhancers such as monosodium glutamate (MSG). The need for minimal and widely recognizable ingredients encourages more food manufacturers to incorporate yeast extract into their products.

North America Yeast Extract Market Trends

North America yeast extract market accounted for a substantial revenue share in the global yeast extract industry in 2024. Regional consumers are increasingly concerned about their health and nutrition, as well as ingredient transparency in the food industry. The natural origin of yeast extract, combined with its high protein and vitamin content, appeals to health-conscious consumers. Furthermore, North America has a strong market for convenience foods, which includes ready-to-eat meals, snacks, and meal kits. This has further enabled market expansion, as yeast extract is commonly used in these products to enhance their flavor, prolong their shelf life, and maintain quality without refrigeration.

The U.S. yeast extract market accounted for a dominant revenue share in the regional market in 2024. The growing popularity of plant-based and vegan diets and the steadily expanding health-conscious consumer base in the economy have led to the emergence of yeast extract as an important ingredient in the food & beverage industry. The product, which is typically produced through fermentation and often uses by-products from the brewing industry, is considered an environmentally sustainable ingredient. Furthermore, technological improvements in yeast extraction processes over the past few years have made their production more cost-effective and efficient. Advances in fermentation and biotechnology have lowered manufacturing costs and improved the quality of yeast extract, making it a more affordable and accessible ingredient for companies across the country.

Asia Pacific Yeast Extract Market Trends

The Asia Pacific region is expected to expand at the highest CAGR in the global market from 2025 to 2030. The steadily expanding middle-class demographic and increasing disposable income levels in several regional economies, particularly China, India, and Southeast Asian nations, are driving the demand for more convenient and premium food products. Yeast extract is often used in processed and packaged food items, as well as ready-to-eat meals, as it enhances flavor and helps with shelf-life stability. Asian cuisines, including Chinese, Thai, Indian, and Japanese, are widely popular, both regionally and internationally. As a result, yeast extract is being incorporated into various notable food preparations and processes, such as the Japanese Tonkotsu recipe, pork flavor soup seasoning and fish sauce (Thailand), and masala and tomato seasoning (India).

China yeast extract market accounted for the largest revenue share in the regional market for yeast extract in 2024. The growing vegan and wellness-focused population in the country is expected to provide notable growth avenues to market players. According to a report by The China-Britain Business Council (CBBC), estimates suggest that 4-5% of the country's population identifies as vegan or vegetarian, amounting to 56-70 million people. Moreover, according to the Good Food Institute, the market for plant-based meat substitutes is expected to show exponential growth in the coming years. Yeast extract's natural origin and diverse flavor options, combined with its ability to mask unwanted flavors from vegetable proteins in meat alternatives, are expected to support positive market growth in this sector.

Key Yeast Extract Company Insights

Some major companies involved in the global yeast extract industry include Lesaffre Group, Kerry Group, and Angel Yeast, among others.

-

Lesaffre Group is a French company specializing in baker's yeast, yeast extracts, and other yeast-based products. It is known for bringing innovations such as the first active dry yeast and the first instant dry yeast product, SAF-INSTANT. The company leverages its fermentation technology across various sectors, including baking, healthcare, and industrial biotechnology. Biospringer by Lesaffre is a major business unit of the company that is involved in the development of yeast-based ingredients for food and beverage products. These solutions are natural and vegan, halal- and kosher-certified, umami-rich, and sustainable.

-

Angel Yeast is a China-based company specializing in producing and distributing yeast and yeast derivatives. The company offers diverse products, including brewing/distilling yeast, baker's yeast, healthy products, biological feeding additives, yeast extracts, and food materials. These solutions cater to several major application areas, such as seasoning, alcohol, baking, human health, and animal nutrition. Within yeast extract, Angel Yeast's notable offerings include Angeoprime, Angeotide, Angeoboost, Angearom, and Angeocell. They are used in sauces, flavorings, sausages, vegan, meat products, snacks, and beverages, among other items.

Key Yeast Extract Companies:

The following are the leading companies in the yeast extract market. These companies collectively hold the largest market share and dictate industry trends.

- Lesaffre

- Kerry Group plc

- AngelYeast Co., Ltd.

- Leiber

- Lallemand Inc.

- Synergy Flavors, Inc.

- Thai Foods International Co.,Ltd.

- Halcyon Proteins Pty. Ltd.

- Ohly

- KOHJIN Life Sciences Co.,Ltd.

- Sensient Technologies Corporation

- Biorigin

- Oriental Yeast Co., ltd.

Recent Developments

-

In October 2024, Lesaffre announced that it had completed the acquisition of the yeast extract business division of dsm-firmenich, which is a major name in the health, nutrition, and beauty segments. The development is expected to strengthen Lesaffre's presence in the savory ingredients market, with the company's Biospringer unit integrating the yeast derivative processing technologies of dsm-firmenich, its employees, and innovative products. This would enable the company to cater to its customers in savory and fermentation-focused applications.

-

In May 2024, the specialty yeast extract supplier Ohly announced the launch of its innovative NEIVA health product range, which has been developed to serve customers' immunity and wellness needs. This range includes powdered ingredients manufactured through the company's cutting-edge drying technology, thus creating versatile ingredients providing consistent texture and flavor. The company launched this line with NEIVA Glucan Max and NEIVA MCT Immune for immune support and improving cardiovascular health.

Yeast Extract Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.89 billion |

|

Revenue forecast in 2030 |

USD 2.63 billion |

|

Growth rate |

CAGR of 6.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, form, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Spain, China, Japan, India, Australia, Brazil, Argentina, South Africa |

|

Key companies profiled |

Lesaffre; Kerry Group plc; AngelYeast Co., Ltd.; Leiber; Lallemand Inc.; Synergy Flavors, Inc.; Thai Foods International Co.,Ltd.; Halcyon Proteins Pty. Ltd.; Ohly; KOHJIN Life Sciences Co.,Ltd.; Sensient Technologies Corporation; Biorigin; Oriental Yeast Co., ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Yeast Extract Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global yeast extract market report based on technology, form, application, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Autolyzed

-

Hydrolyzed

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder

-

Paste

-

Flakes

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Food

-

Bakery & Confectionery

-

Soups

-

Sauces & Savory Flavors

-

Prepared Meals

-

Dairy Products

-

Others

-

-

Beverages

-

Alcoholic Beverages

-

Non-alcoholic Beverages

-

-

-

Animal Feed

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."