- Home

- »

- Automotive & Transportation

- »

-

Yard Crane Market Size, Share And Growth Report, 2030GVR Report cover

![Yard Crane Market Size, Share & Trends Report]()

Yard Crane Market Size, Share & Trends Analysis Report By Product (Rubber-tired Gantry Cranes, Rail-mounted Gantry Cranes), By Region (North America, Asia Pacific, Europe), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-145-3

- Number of Report Pages: 118

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2022 - 2030

- Industry: Technology

Yard Crane Market Size & Trends

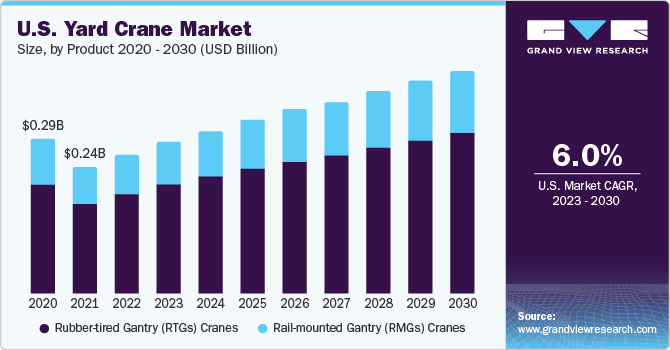

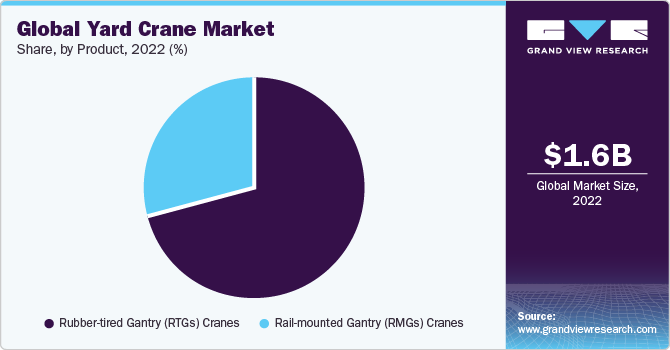

The global yard crane market size was estimated at USD 1.63 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The market growth is attributed to the growing international trade and globalization. International trade heavily relies on containerized shipping due to its cost-effectiveness and efficiency in transporting goods. As a result, ports have had to expand their infrastructure and invest in advanced yard cranes to cope with the increased demand. As per the World Trade Organization, the global merchandise trade witnessed a significant surge of 12% and reached USD 25.3 trillion in 2022. In addition, the world's commercial services trade also experienced substantial expansion, with a 15% increase, reaching a total value of USD 6.8 trillion in the same year and this is anticipated to drive the demand for yard cranes in the coming years.

The U.S. market is driven by the expanding e-commerce sector in the country. According to the U.S. Department of Commerce, retail sales for the 2nd quarter of 2023 were anticipated at USD 1,798.2 billion, showing an increase of 7.5% from the second quarter of 2022. Furthermore, emerging economies, such as China, India, and Brazil, invest significantly in new port development and terminals, creating considerable product demand. For instance, in January 2023, the Ministry of Ports, Shipping and Waterways (MoPSW), an Indian government agency, announced a public-private partnerships (PPPs) initiative in port infrastructure in India.

With a pipeline of 44 projects worth Rs 22,900 crore (USD 2.75 billion) planned until 2024-2025. The MoPSW aims to leverage PPPs to modernize and expand port infrastructure, enhancing India's maritime competitiveness. This initiative can contribute to modernizing port infrastructure, enhancing operational efficiency, and boosting India's maritime competitiveness. A well-designed port infrastructure can accommodate bigger containers, which results in more cargo transportation at once. Consequently, installing larger yard cranes has become vital to these upgrades.

This will increase the demand for yard cranes, which are vital in loading and unloading cargo containers. One of the primary challenges for yard cranes is the availability and quality of infrastructure. Many ports and terminals struggle with outdated or inadequate infrastructure that restricts the movement and productivity of yard cranes. Insufficient space, inadequate berth lengths, and limited storage areas can significantly impact the efficiency of crane operations. Upgrading infrastructure to accommodate larger cranes and improve traffic flow remains a constant challenge for port authorities.

Moreover, many countries have developed into major transshipment hubs, serving as intermediary points for cargo to be transferred between different shipping routes. These hubs require extensive port infrastructure, including yard cranes, to facilitate the efficient transfer of containers from one vessel to another. Yard cranes are equipped with features that enable them to handle various goods, such as containers, bulk materials, and specialized cargo, with precision and speed. These cranes are equipped with advanced control systems and sensors that enable precise positioning, improved safety measures, and enhanced load-handling capabilities.

According to the United Nations Conference on Trade and Development, in 2021, approximately 40% of the overall containerized trade comprised the primary East-West routes, connecting Asia, Europe, and the U.S. In addition, non-mainline East-West routes, such as the South Asia-Mediterranean route, contributed to 12.9% of the total containerized trade. Hence, the increasing size of container ships and the need for faster process time at ports fuel the demand for larger and more efficient yard cranes.

Product Insights

Based on product, the rubber-tired gantry (RTGs) cranes segment held the largest share of over 71% in 2022. The ability of RTGs to operate on rubber tires provides mobility, allowing them to navigate efficiently within container yards, maneuver around obstacles, and travel at higher speeds when required. In addition, RTGs are equipped with advanced automation systems and driver assistance technologies that enhance productivity and safety for crane operators. These features include automated stacking, precise positioning systems, collision avoidance systems, and remote-control capabilities. For instance, in August 2022, DCT Gdansk, a member of the PSA Group, placed an order for ten Automated RTG (ARTG) cranes from Konecranes Plc. The retrofitting process will begin with the first two manual RTGs, with 13 manual RTGs will be installed by January 2024.

The rail-mounted gantry (RMGs) cranes product segment is expected to register a significant growth rate over the forecast period. Automation in ports and terminals has become a global trend to increase the efficiency of port functions and reduce operational costs. RMGs are an essential component of port automation as they allow for quick and accurate handling of containers, reducing the need for manual labor. RMGs can also be integrated with other automated systems, such as automated stacking cranes and automated guided vehicles, to create a fully automated terminal, which is anticipated to drive the demand for RMG.

Regional Insights

Asia Pacific dominated the market with a revenue share of over 39.0% in 2022. The region has witnessed rapid economic growth in recent years, which has increased the volume of trade and shipping activities. The ongoing infrastructure development projects in countries, such as China, India, and Southeast Asian nations, have led to significant investments in port expansion and modernization, fuelling the demand for yard cranes. For instance, in September 2022, Adani Ports secured a ₹25,000 crore (USD 3.1 billion) contract to construct a deep-sea port in collaboration with the West Bengal government. North America is expected to register a considerable CAGR over the forecast period.

North America is home to several major ports, including the Port of Los Angeles, the Port of Long Beach, and the Port of New York and New Jersey. For instance, in the U.S., the Port of Long Beach can accommodate the largest modern vessels. It facilitates 175 shipping lines, establishing connections with 217 global seaports. In 2022, the Port managed to handle over 9.1 million container units, marking its second-busiest year on record. The logistics and transportation industry in North America is experiencing significant growth due to increased e-commerce activity and the growth of online retail. The expansion of the logistics and transportation industries will drive the demand for yard cranes, as they are necessary for loading and unloading cargo from trucks and other vehicles.

Key Companies & Market Share Insights

Manufacturers are focusing on various growth strategies, including new product launches, agreements, mergers & acquisitions, partnerships, and geographical expansion, to stay afloat in the competitive market. For instance, in January 2023, Konecranes Plc entered into a license agreement with Larsen & Toubro Ltd. (L&T) to manufacture and distribute the former company’s cranes in India. Through the agreement, L&T will manufacture and distribute Konecranes' port cranes, including manually operated Rubber-Tired Gantry cranes, Rail-Mounted Gantry cranes, and shipyard cranes, leveraging its manufacturing capabilities and local expertise.

Key Yard Crane Companies:

- Andritz

- Cargotec Corporation

- Kato Works Co., Ltd.

- Kobelco Construction Machinery Co., Ltd.

- Konecranes

- LIEBHERR

- Palfinger AG

- SANY Group

- Tadano Ltd.

- Terex Corporation

- The Manitowoc Company, Inc.

- XCMG Group

Yard Crane Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.77 billion

Revenue forecast in 2030

USD 2.59 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Kato Works Co., Ltd.; Andritz; Cargotec Corporation; Konecranes; LIEBHERR; Palfinger AG; Sany Group; Tadano Ltd.; Terex Corporation; The Manitowoc Company, Inc.; XCMG Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Yard Crane Market Report Segmentation

The report forecasts revenue and volume growth at global, regional, and at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global yard crane market report on the basis of product and region:

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Rubber-tired Gantry Cranes (RTGs)

-

Wheel Type

-

8 Wheel

-

16 Wheel

-

-

Propulsion Type

-

Diesel

-

Electric

-

-

-

Rail-mounted Gantry Cranes (RMGs)

-

Type

-

Cantilever

-

Non-cantilever

-

-

Technology

-

Manual

-

Autonomous

-

-

Lifting Capacity

-

<40 Tons

-

>41 Tons

-

-

-

-

Region Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E.

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global yard crane market size was estimated at USD 1.63 billion in 2022 and is expected to reach USD 1.77 billion in 2023.

b. The global yard crane market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 2.59 billion by 2030.

b. The Asia Pacific dominated the yard crane market with a share of 39.0% in 2022. This is attributable to economic developments and infrastructure development across China, India, and Japan in the region.

b. Some key players operating in the yard crane market include KATO WORKS CO., LTD.; ANDRITZ; CARGOTEC CORPORATION; Konecranes; LIEBHERR; PALFINGER AG; SANY Group; Tadano Ltd.; and Terex Corporation.

b. The growth of the yard crane market is attributed to increased construction spending worldwide in port development and growing e-commerce industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."