- Home

- »

- Automotive & Transportation

- »

-

Yacht Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Yacht Market Size, Share & Trends Report]()

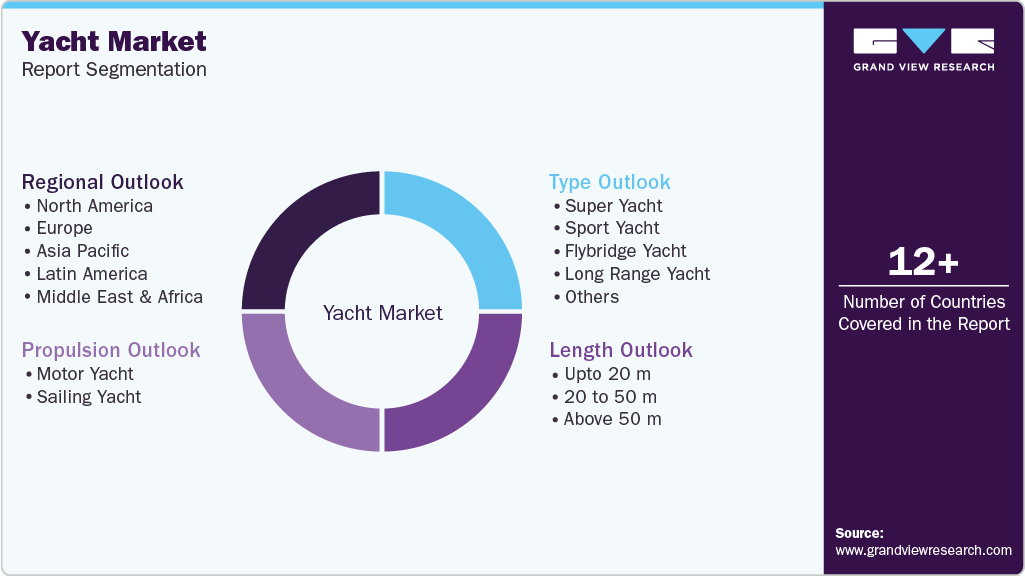

Yacht Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Super Yacht, Sport Yacht, Flybridge Yacht, Long Range Yacht, Others), By Length (Upto 20 m, 20 to 50 m, Above 50 m), By Propulsion (Motor Yacht, Sailing Yacht), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-586-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Yacht Market Summary

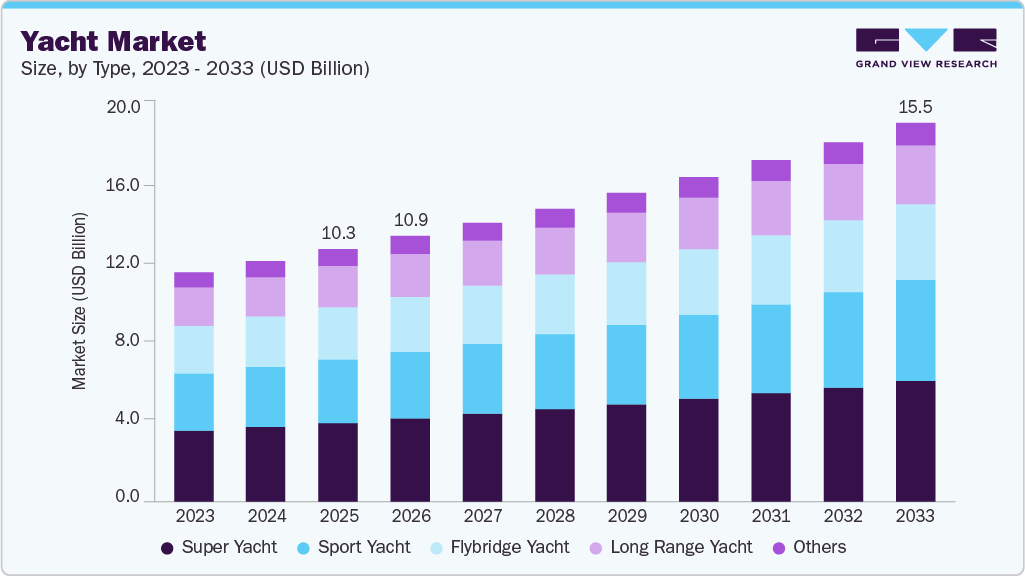

The global yacht market size was estimated at USD 10.34 billion in 2025, and is projected to reach USD 15.52 billion by 2033, growing at a CAGR of 5.2% from 2026 to 2033. The yachting industry has experienced a steady rise in demand in recent years, driven by increasing disposable income and a growing desire for leisure pursuits.

Key Market Trends & Insights

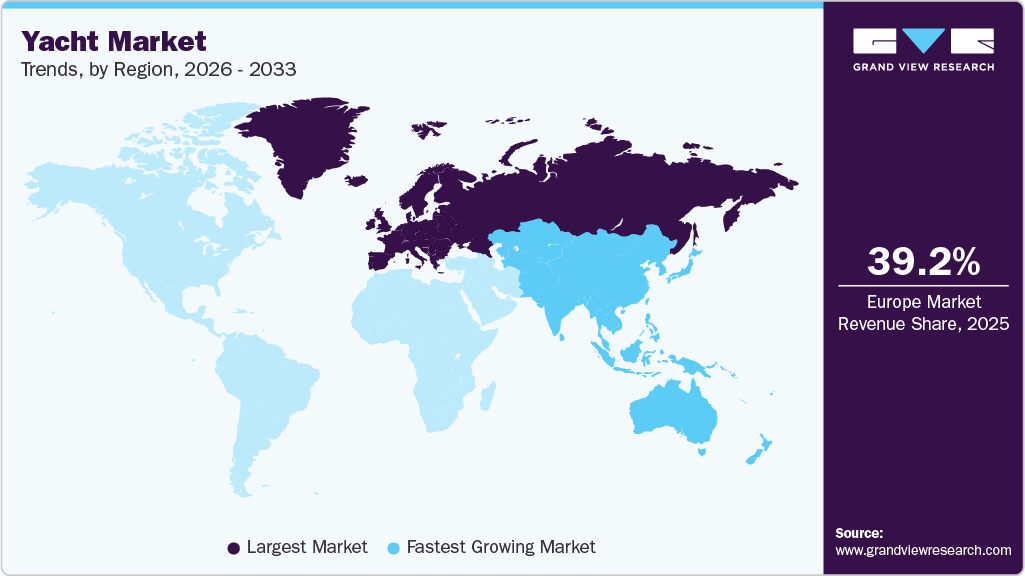

- The Europe yacht market accounted for a 39.2% share of the overall market in 2025.

- The yacht industry in the France held a dominant position in 2025.

- By type, the super yacht segment accounted for the largest share of 31.3% in 2025.

- By length, the 20 to 50 m segment held the largest market share in 2025.

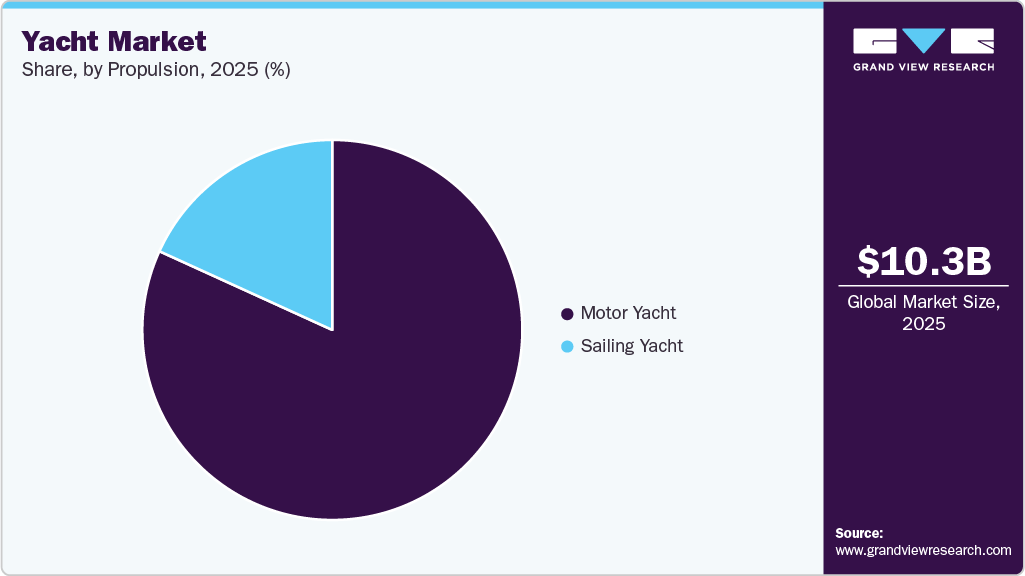

- By propulsion, the motor yacht segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 10.34 Billion

- 2033 Projected Market Size: USD 15.52 Billion

- CAGR (2026-2033): 5.2%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

This trend is further fueled by the growing luxury travel market, where high-net-worth individuals (HNWI) seek personalized service and exclusive experiences. Manufacturers are responding by incorporating premium features that enhance both performance and the overall customer experience. Yacht construction has also undergone a significant transformation. Traditionally built with wood and fiber-reinforced polymers (FRPs), the industry has increasingly embraced composite materials due to their superior corrosion resistance, lower maintenance requirements, and improved strength-to-weight ratio.

Technological innovation is transforming the yacht industry across various domains, including design, engineering, navigation, and sustainability. Hybrid and fully electric propulsion systems are gaining momentum, driven by the need to reduce emissions, fuel consumption, and operating noise. Advanced hull materials, such as carbon fiber, are being adopted to enhance speed and efficiency, while digital twin technologies enable shipbuilders to optimize performance and predict maintenance. Smart-yacht solutions, integrating IoT sensors, AI-powered navigation, autonomous docking, and remote diagnostics, are becoming a core differentiator.

Investment activity in the industry is rising as manufacturers, private equity firms, and technology providers capitalize on the growing demand for premium marine assets. Shipyards are expanding production capacities, acquiring specialized suppliers, and investing in automation to reduce build times. Significant capital is also being invested in R&D for sustainable propulsion, lightweight materials, and modular interiors that enable customization on a scale. The charter and fractional-ownership models are attracting venture investment due to their strong growth potential and recurring revenue profile.

The regulatory environment for the yacht industry is becoming increasingly stringent, particularly in terms of environmental standards, maritime safety, emissions compliance, and crew management. International bodies, such as the International Maritime Organization (IMO), are implementing carbon-intensity reduction targets that apply to large yachts, encouraging the adoption of greener propulsion systems. Classification societies are enforcing stricter standards on fire protection, stability, and structural integrity for new builds. Coastal countries are also introducing regulations for waste disposal, anchoring restrictions in ecologically sensitive zones, and mandatory insurance and registration requirements.

Despite strong demand drivers, the yacht industry faces several challenges that could moderate growth. High ownership and maintenance costs, including crew salaries, docking fees, insurance, and fuel, continue to deter potential buyers, encouraging a shift toward charter-based or yacht rental usage. Supply-chain constraints in specialty materials, skilled labor shortages in shipyards, and lengthy build times are also contributing to delivery delays. Economic fluctuations and geopolitical uncertainties can significantly affect luxury spending patterns, making the market vulnerable to downturns.

Type Insights

The super yacht segment accounted for the largest share of 31.3% in 2025. This dominance is fueled by their immense popularity among high-net-worth individuals and corporations. Superyachts, colossal vessels ranging from 80 to over 600 feet, represent the pinnacle of luxury and extravagance in the boating world. These are meticulously crafted to deliver unparalleled luxury, style, and amenities. Featuring extensive deck space, luxurious cabins, and cutting-edge entertainment systems, these vessels offer a variety of amenities, including swimming pools, Jacuzzis, helipads, and even private cinemas, all customizable to meet the owner's specific requirements. These yachts also have powerful engines that offer unparalleled comfort and style.

The sports yacht segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is attributed to the rising demand in key markets such as China and France, where participation in recreational boating activities and sporting events is rising among adults. Sport yachts cater to a diverse range of leisure pursuits, including marine tourism, sports tournaments, cruising, fishing, and various water sports. These vessels seamlessly blend the elegance and comfort of a classic yacht with the performance and style of a sports boat. Sport yachts are distinguished by their aerodynamic design, characterized by sleek lines that embody both modern aesthetics and high performance. Their hulls prioritize minimal drag and enhanced stability, optimizing handling and overall yachting experience. Notably, these vessels seamlessly integrate luxurious living spaces. Sport yachts often boast well-appointed bedrooms, salons, and galley areas, all designed with high-quality materials and finishes that offer enhanced performance and luxury.

Length Insights

The 20 to 50 m segment held the largest market share of 57.3% in 2025. The growth of the segment is attributed to the growth of the fractional ownership and yacht charter service market. Charter operators increasingly prefer 20-50 m yachts because they deliver high utilization rates and appeal to a broad customer base seeking premium yet accessible luxury experiences. These vessels are easier to manage, require smaller crews, and offer flexible itineraries, all of which improve charter profitability. The rise of fractional ownership models, where multiple users share the cost and access, also benefits this segment by lowering financial and operational barriers for customers.

The up to 20 m segment is expected to grow at a significant CAGR during the forecast period. The versatility of these yachts, suitable for both competitive and recreational use, is a key driver. Furthermore, North America and Europe are pioneering the use of renewable energy sources like solar and wind power in marine vessels. This shift toward sustainability is expected to play a crucial role in reducing fuel consumption and emissions, particularly for these smaller, more energy-efficient yachts. The compact size and lightweight nature of these vessels make them ideal for harnessing renewable energy, further propelling growth within this segment.

Propulsion Insights

The motor yacht segment dominated the market in 2025. The superior speed and power of motor yachts make them ideal for efficiently traversing vast distances, appealing to those seeking a swift and versatile maritime experience. In addition, the integration of innovative technology, from advanced navigation systems to luxurious amenities, enhances the entire ownership or chartering experience. Continuous innovation in equipment and technology fosters sustained growth in the motor yacht segment. As technology evolves, so do the capabilities and allure of motor yachts, ensuring they remain in high demand among consumers.

The sailing yacht segment is projected to grow at a significant CAGR of 4.3% over the forecast period. Unlike motor yachts, which rely on engines for propulsion, sailing yachts utilize sails driven by wind power, providing a unique and environmentally friendly cruising experience. While motor yachts have historically dominated with their luxurious design, spacious decks, and amenities, sailing yachts boast distinct advantages. These include serene sailing experiences, lower operating costs, and a reduced environmental footprint. The rise of sustainability-conscious consumers seeking greener alternatives in recreational boating is propelling interest in sailing yachts. In addition, advancements in sail technology, such as efficient rigging and improved hull designs, are enhancing both performance and appeal, solidifying sailing yachts' position in the global market.

Regional Insights

North America yacht market held a significant share in 2025. The market is robust and diverse, driven by a combination of affluent consumers, extensive coastlines, and a strong boating culture. The market benefits from a high concentration of UHNWIs, who drive demand for custom-built, high-end yachts. Innovations in technology and design, coupled with a focus on sustainability, are shaping the industry, attracting a younger demographic interested in eco-friendly yachting solutions. Canada also contributes to the market growth, offering pristine cruising grounds and growing yacht ownership. However, the market faces challenges, such as regulatory complexities and environmental concerns that require ongoing attention. Economic fluctuations can impact consumer spending on luxury items like yachts.

U.S. Yacht Market Trends

The yacht market in the U.S. is growing at a notable pace. The region witnesses a large population of UHNWI who drive significant domestic demand for yachts, ranging from luxury superyachts to recreational cruisers. The market is also supported by a robust ecosystem of renowned yacht builders such as Viking and Westport, catering to a wide range of clients. The extensive U.S. coastline, featuring premier yachting hubs, such as Florida and California, offers abundant leisure boating opportunities. However, the market faces challenges, including stringent environmental regulations that can increase manufacturing costs, vulnerability to economic downturns affecting UHNWI disposable income, and competition from established European players and emerging Asian markets offering lower costs or custom builds. Despite these challenges, the U.S. market maintains a dominant position due to its strong domestic demand and well-established industry infrastructure. Successfully navigating environmental regulations, economic fluctuations, and global competition will be key to sustaining this growth.

Europe Yacht Industry Trends

The yacht market in Europe dominated the global market in 2025 with the largest revenue share at 39.2%. This trend is propelled by the increasing presence of HNWIs seeking luxurious experiences and the growing popularity of water sports and fishing activities. Europe's allure extends beyond its affluent clientele, with its stunning coastlines and growing marine tourism industry poised for continued expansion. Supportive government policies, coupled with anticipated investments in coastal regions, further bolster optimism for future growth. This not only translates to a wealth of recreational opportunities beyond yachting, including white-water rafting, kayaking, and boating excursions, but also fosters a vibrant community of yacht enthusiasts. With its captivating beauty, diverse leisure options, and inclusive community spirit, Europe emerges as a quintessential yachting paradise.

The yacht market in France represents a significant segment of the nation's luxury and tourism sectors, reflecting both a rich maritime heritage and a commitment to modern innovation. France is renowned for yacht manufacturing, with prestigious shipyards such as Group Beneteau leading the charge in design and engineering. The French Riviera, with its ports like Cannes, Nice, and Saint-Tropez, is a premier destination for international yacht enthusiasts. This established market benefits from a robust infrastructure - high-end marinas, comprehensive maintenance facilities, and premium services tailored to the specific needs of yacht owners and charter clients. In addition, France's strong regulatory framework ensures adherence to high safety and environmental standards, further enhancing the market's appeal.

The Italy yacht market is expected to witness the fastest growth of 7.0% from 2026 to 2033. Leveraging its rich maritime heritage and renowned craftsmanship, Italy boasts exceptional yacht design and engineering, led by esteemed shipyards like Ferretti Group, Azimut-Benetti, and Sanlorenzo. Its picturesque coastline, from the iconic Amalfi Coast to Sardinia and the Italian Riviera, adds allure to Italy's yachting appeal. Beyond aesthetics, Italy offers a comprehensive yachting experience with a robust network of marinas, shipyards, and luxury services, ensuring seamless maintenance and top-tier amenities. This commitment to excellence, complemented by Italy's cultural embrace of luxury and strategic Mediterranean location, establishes Italy as the epitome of luxury yachting. For those seeking unparalleled yachting experiences, Italy stands out as the ultimate destination.

The yacht market in Spain is expected to witness significant growth from 2026 to 2033. Spain's long maritime tradition, picturesque coastlines, particularly the Balearic Islands, and a well-developed infrastructure featuring high-end marinas and skilled service providers make it an attractive destination for yacht owners. The thriving luxury tourism industry and recent regulatory changes have enhanced Spain's competitiveness in the large yacht segment, broadening its appeal. However, economic fluctuations also pose risks to high-value purchases like yachts, and competition from emerging destinations with potentially lower costs or unique experiences presents additional challenges. To fully realize its potential, Spain must leverage its strengths in infrastructure and location, innovate in yacht design and construction, address regulatory hurdles, and maintain competitiveness in the global market for sustained growth.

Asia Pacific Yacht Industry Trends

The Asia Pacific yacht market is anticipated to grow at a CAGR of 6.3% during the forecast period. The market is experiencing a shift in consumer preferences driven by two key factors, including increasing disposable income and government support for tourism development. Rising affluence allows individuals to allocate more resources towards leisure activities like yacht travel. In addition, government initiatives aimed at boosting tourism, such as the Incredible India campaign and the Swadesh Darshan Scheme, are expected to generate significant growth within the regional market over the forecast period. However, market expansion could be hampered in countries facing economic instability, political unrest, or restrictive foreign direct investment (FDI) policies. The high demand for recreational activities further fuels regional market growth. Countries such as Singapore, Thailand, China, and Australia are witnessing a surge in participation in marine leisure pursuits. This trend is expected to drive investments in coastal infrastructure and a wider range of water-based activities. Beyond established favorites such as scuba diving, free diving, and snorkeling, the market will likely see increased investment in fishing, sail training adventures, white-water rafting, kayaking, and one-day boating excursions. Additionally, the growing number of trade shows hosted by manufacturers and recreational boating events is serving as a catalyst for market expansion within the region.

The Indonesian yacht industry is expected to grow rapidly in the coming years, fueled by its vast archipelagic landscape and growing allure as a luxury travel destination. Boasting over 17,000 islands, Indonesia presents unparalleled cruising grounds, from the iconic Raja Ampat to untouched waters in the Moluccas and Sulawesi. This, coupled with rising disposable income among its elite and increasing interest from international yacht owners and charterers, fuels market expansion. Furthermore, infrastructure investments in new and improved marinas are underway to better serve the yachting community. Regulatory reforms aimed at streamlining yacht entry and operations further enhance the market's appeal. However, bureaucratic complexities, inconsistent enforcement, and a lack of skilled marine service providers remain hurdles. Despite these challenges, Indonesia's yacht market is positioned for significant growth, offering unique yachting experiences that are attracting global attention.

Key Yacht Companies Insights

Some of the key companies in the yacht market include Alexander Marine International (AMI) Co., Ltd., Azimut Benetti Group, Damen Shipyards Group, Feadship, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Ferretti S.p.A is an Italian company that designs, builds, and sells prestigious vessels under renowned brands like Riva and Pershing. Their offerings cater to diverse preferences, encompassing a range of luxury composite yachts, fully customizable superyachts, and motor/sail configurations, all supported by comprehensive ancillary services. Operating across six Italian shipyards, Ferretti seamlessly blends efficient production with the meticulous Italian craftsmanship that defines their brand. Unwavering commitment to exceptional quality, innovative technology, timeless design, and superior performance is evident in every yacht. Ferretti aspires to be the ultimate expression of Italian elegance and design genius in yachting, continuously innovating, expanding production capacity, and upgrading facilities.

-

Azimut Benetti Group is a builder of luxury motor yachts and megayachts. The Group encompasses renowned brands such as Azimut Yachts and Benetti. They operate across six shipyards, with a workforce exceeding 2,000, and boast a vast network for sales and service. Their focus lies in constant innovation, delivering unique experiences that blend heritage with innovative design. Sustainability is a priority, with the Group striving to become the world's most sustainable shipbuilder through its commitment to circularity and zero-emission goals.

Key Yacht Companies:

The following are the leading companies in the yacht market. These companies collectively hold the largest market share and dictate industry trends.

- Alexander Marine International (AMI) Co., Ltd.

- Azimut Benetti Group

- Damen Shipyards Group

- Feadship

- Ferretti SpA

- Flensburger Schiffbau Gesellschaft GmbH (FSG)

- Heesen Group

- Princess Yachts Limited

- Sanlorenzo SpA

- Sunseeker International

Recent Developments

-

In October 2025, Fountaine Pajot Yachts, a catamaran manufacturer, partnered with Fraser Yachts to launch the FPY 110, a 110-foot luxury yacht project in the design phase following the success of its Thira 80 and Power 80 models. This collaboration leverages Fraser's global sales, marketing, and expertise to provide comprehensive support for buyers, from customized design and build oversight to delivery and management, ensuring a seamless, high-end experience. The initiative underscores Fountaine Pajot's expansion into large yachts, emphasizing innovation, quality, discreet luxury, and personalized service for an international clientele seeking enduring excellence in the yachting industry.

-

In March 2025, Nautor Swan, under parent company Sanlorenzo, launched a strategic partnership with brokerage firm Edmiston to introduce a new range of high-performance alloy sailing yachts, debuting at the 2025 Palm Beach International Boat Show with an initial model designed by Malcolm McKeon Yacht Design. This venture expands Swan's legacy from composite yachts into durable aluminum construction for maxi yachts, emphasizing strength, long-range capability, sustainability features such as hydrogeneration and advanced propulsion, while preserving racing performance, timeless aesthetics, and luxury for discerning owners.

Yacht Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 10.87 billion

Revenue forecast in 2033

USD 15.52 billion

Growth rate

CAGR of 5.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report length

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, length, propulsion, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Indonesia; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Alexander Marine International (AMI) Co., Ltd.; Azimut Benetti Group; Damen Shipyards Group; Feadship; Ferretti SpA; Flensburger Schiffbau Gesellschaft GmbH (FSG); Heesen Group; Princess Yachts Limited; Sanlorenzo SpA; Sunseeker International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Yacht Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global yacht market report based on type, length, propulsion, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Yacht

-

Sport Yacht

-

Flybridge Yacht

-

Long Range Yacht

-

Others

-

-

Length Outlook (Revenue, USD Million, 2021 - 2033)

-

Upto 20 m

-

20 to 50 m

-

Above 50 m

-

-

Propulsion Outlook (Revenue, USD Million, 2021 - 2033)

-

Motor Yacht

-

Sailing Yacht

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global yacht market size was estimated at USD 10.34 billion in 2025 and is expected to reach USD 10.87 billion in 2026.

b. The global yacht market is expected to grow at a compound annual growth rate of 5.2% from 2026 to 2033, reaching USD 15.52 billion by 2033.

b. The super yacht segment dominated the global market with a revenue share of more than 31% in 2025. This is due to their high popularity among UHNWIs who desire luxury and exclusivity.

b. The 20-to-50-meter length segment dominated the yacht market in 2025, with a revenue share of over 57%. Furthermore, it is expected to remain dominant over the forecast period due to lower maintenance costs, wind sailing capabilities, and shallower draft requirements.

b. The motor yacht segment held the largest revenue share of more than 81% in 2025 in the yacht market. The high share can be attributed to the benefits offered by these yachts, including the high speed and power, and large distance coverage, among others.

b. Some prominent players in the yacht market include Alexander Marine International (AMI) Co., Ltd.; Azimut Benetti Group; Damen Shipyards Group; Feadship; Ferretti SpA; Flensburger Schiffbau Gesellschaft GmbH (FSG); Heesen Group; Princess Yachts Limited; Sanlorenzo SpA; Sunseeker International.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.