- Home

- »

- Automotive & Transportation

- »

-

Yacht Charter Market Size & Share, Industry Report, 2030GVR Report cover

![Yacht Charter Market Size, Share & Trends Report]()

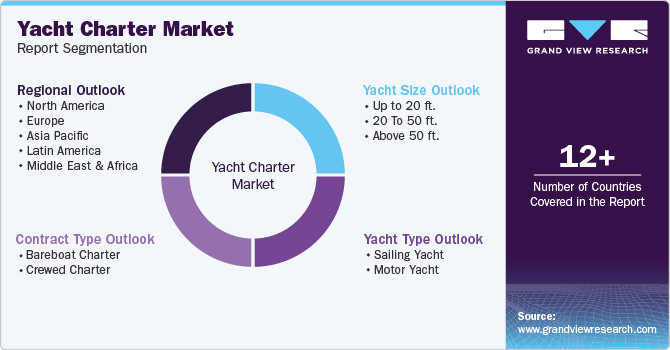

Yacht Charter Market (2025 - 2030) Size, Share & Trends Analysis Report By Yacht Size (Up To 20 Ft., 20 To 50 Ft.), By Yacht Type (Sailing, Motor), By Contract Type (Bareboat Charter, Crewed Charter), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-228-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Yacht Charter Market Summary

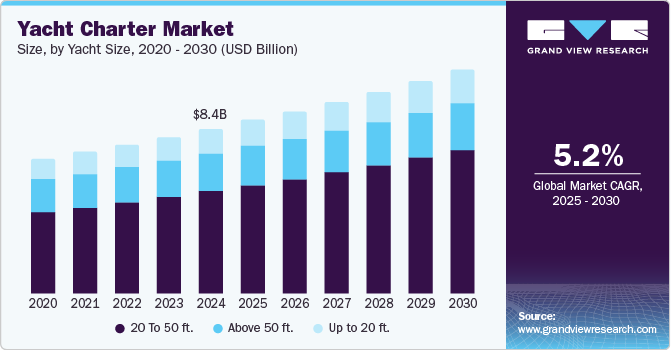

The global yacht charter market size was valued at USD 8.35 billion in 2024 and is projected to reach USD 11.34 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. This growth is attributed to the increasing disposable incomes and a rising interest in luxury marine tourism are encouraging more individuals to seek unique travel experiences.

Key Market Trends & Insights

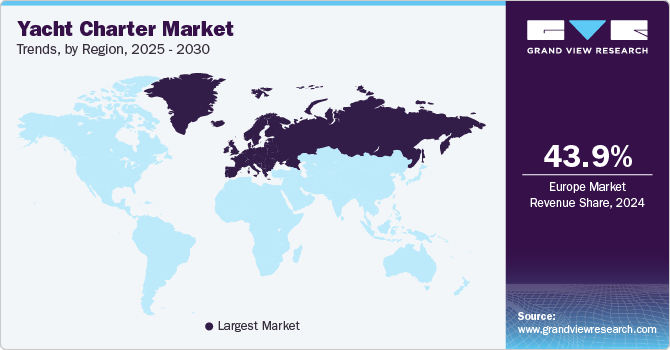

- Europe yacht charter market dominated the global market and accounted for the largest revenue share of 43.9% in 2024.

- The Asia Pacific yacht charter market is expected to grow at a CAGR of 6.6% over the forecast period.

- By yacht size, the 20 to 50-ft yacht segment held the dominant position in the market with the largest revenue share of 62.3% in 2024.

- By contract type, the bareboat charter segment is expected to grow at a CAGR of 4.2% over the forecast period.

- By yacht type, the motor yacht led the market and accounted for the largest revenue share of 87.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.35 Billion

- 2030 Projected Market Size: USD 11.34 Billion

- CAGR (2025-2030): 5.2%

- Europe: Largest market in 2024

In addition, the growing popularity of recreational boating activities and personalized services is enhancing demand. Furthermore, technological advancements in yacht design and operations and the expansion of yachting infrastructure further support this growth. A yacht charter refers to the rental of a yacht for leisure purposes, allowing individuals to explore various destinations while enjoying luxurious amenities on board. The yacht charter market is increasingly influenced by the rise of digital platforms and mobile applications, which simplify the booking process for clients. These technologies provide a user-friendly experience, enabling customers to easily browse available yachts, compare prices, and make reservations with minimal effort. The convenience of real-time availability and online reservations reduces the need for extensive offline communication.

The growing trend of luxury travel is fueling demand for yacht charters among affluent individuals seeking unique experiences. As more travelers prioritize personalized and exclusive leisure activities, yacht charters offer an appealing option for exploring beautiful coastal regions and secluded destinations. In addition, technological advancements in yacht design and onboard amenities also attract clients who value comfort and luxury.

Furthermore, Innovations such as eco-friendly propulsion systems cater to environmentally conscious travelers, enhancing the appeal of yacht charters. As the industry evolves, companies are expanding their offerings to include diverse yacht sizes and features that meet varying consumer preferences. Moreover, the integration of advanced technologies improves the booking experience and enhances customer satisfaction by providing detailed information about each vessel. This transparency fosters informed decision-making among potential clients.

Yacht Size Insights

The 20 to 50-ft yacht segment held the dominant position in the market with the largest revenue share of 62.3% in 2024. This growth is attributed to its versatility, offering a balance of comfort and affordability, making it ideal for small groups and families. In addition, the availability of yachts with wind sailing capabilities enhances fuel efficiency, while their shallow draft allows access to various anchorages. Furthermore, the trend towards renewable energy sources in developed economies further supports this segment's appeal, aligning with consumer preferences for sustainable travel options.

The up-to-20-foot yacht segment is expected to grow at a CAGR of 5.1% over the forecast period, primarily driven by its accessibility and lower operating costs. These smaller vessels are perfect for personal use and exploring coastal areas, attracting individuals and small groups seeking affordable marine experiences. In addition, their agility enables navigation in shallow waters, making them popular for casual outings. Furthermore, the increasing demand for personalized and easily accessible yacht charter options reflects a broader trend towards more intimate and budget-friendly leisure activities.

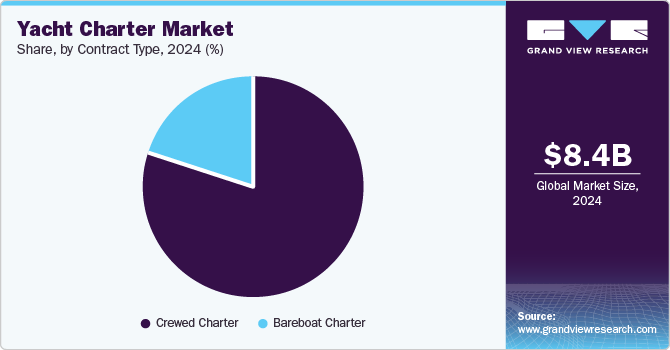

Contract Type Insights

The crewed charter segment dominated the market and accounted for the largest revenue share of 80.2% in 2024, driven by the increasing demand for luxurious and personalized experiences. In addition, clients prefer crewed charters for the high level of service provided, including gourmet meals and tailored itineraries that cater to individual preferences. This segment appeals particularly to those seeking a hassle-free vacation, allowing them to relax while the crew manages all aspects of the journey. Furthermore, the trend towards experiential tourism further boosts the appeal of crewed charters as unique travel options.

The bareboat charter segment is expected to grow at a CAGR of 4.2% over the forecast period, owing to its affordability and flexibility to attract a diverse clientele, including experienced sailors and adventure seekers. This option allows charterers to operate the yacht themselves, offering a sense of independence and control over their itinerary. In addition, the rise in recreational boating activities and increased interest in sailing as a leisure pursuit contribute to this growth. Furthermore, advancements in technology have made it easier for individuals to navigate and manage bareboat charters, enhancing their overall appeal.

Yacht Type Insights

The motor yacht led the market and accounted for the largest revenue share of 87.3% in 2024, due to its speed and efficiency, allowing for quicker travel between destinations. This appeals to charter clients who prioritize maximizing their exploration time. Furthermore, the rising popularity of marine tourism and recreational boating activities contributes to increased demand for motor yachts, as they are well-suited for both leisure and competitive events. Moreover, the segment is expected to maintain its leading market position due to these advantages and ongoing growth in luxury marine tourism.

The sailing yacht is expected to grow at a CAGR of 4.0% from 2025 to 2030, owing to a growing interest in eco-friendly travel options and its unique experience. Sailing yachts provide a more immersive connection with nature, attracting environmentally conscious consumers. In addition, the rise in recreational sailing activities and events also fuels demand as people seek personalized experiences on the water. Furthermore, advancements in sailing technology enhance performance and comfort, making this segment increasingly appealing to a diverse clientele looking for leisurely exploration.

Regional Insights

Europe yacht charter market dominated the global market and accounted for the largest revenue share of 43.9% in 2024, primarily driven by its rich maritime culture and diverse coastal landscapes. In addition, the Mediterranean and Adriatic regions attract numerous tourists with their picturesque destinations and well-established yachting infrastructure. Furthermore, the increasing disposable income of consumers and a growing inclination towards marine tourism contribute to this trend. Moreover, the popularity of luxury experiences and recreational boating activities further enhances the appeal of yacht charters, making Europe a leading market in this sector.

France Yacht Charter Market Trends

The yacht charter market in France led the European market and accounted for the largest revenue share in 2024. This growth is attributed to its renowned coastal regions, including the French Riviera, famous for luxury yachting. The country's vibrant tourism sector attracts affluent clients seeking unique experiences on the water. Furthermore, France's strong maritime heritage and well-developed marina facilities support the growth of yacht charters. Moreover, the increasing interest in sailing events and regattas drives demand, as locals and tourists engage in competitive and leisure boating activities along its stunning coastlines.

Asia Pacific Yacht Charter Market Trends

The Asia Pacific yacht charter market is expected to grow at a CAGR of 6.6% over the forecast period, owing to rising disposable incomes and a growing interest in recreational boating activities. Countries such as Australia, Thailand, and Indonesia are becoming popular charter destinations due to their beautiful coastlines and favorable sailing conditions. In addition, the increasing number of promotional programs and yacht service providers enhances accessibility for potential clients. Furthermore, the trend towards experiential travel among younger consumers is propelling the demand for unique marine experiences in this dynamic region.

The yacht charter market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024 due to increasing wealth among the middle class and a growing interest in luxury leisure activities. The government’s efforts to promote marine tourism and develop yachting infrastructure are also significant contributors to this growth. In addition, coastal cities such as Shanghai and Sanya are emerging as key hubs for yacht charters, attracting both domestic and international tourists. Furthermore, the rise of water sports culture among Chinese consumers is further driving demand for yacht rentals and charters.

North America Yacht Charter Market Trends

The North America yacht charter market is expected to witness substantial growth over the forecast period, primarily driven by a strong culture of recreational boating. The appeal of coastal destinations such as Florida and California draws both domestic and international tourists seeking luxurious experiences on the water. In addition, the increasing availability of charter options and rising disposable incomes support this trend. Furthermore, promotional programs targeting younger demographics are encouraging first-time boaters to explore chartering as an exciting vacation option.

The growth of the yacht charter market in the U.S. is expected to be driven by a well-established infrastructure that supports various types of charters, including crewed and bareboat options. In addition, the popularity of events such as boat shows and regattas fosters interest in yachting among consumers. Furthermore, consumers prioritize comfort and unique experiences over performance, leading to increased demand for luxury charters. Moreover, seasonal variations also play a role; with peak chartering seasons from May to October, many clients seek out discounted offers during these months to enhance their boating experiences.

Key Yacht Charter Company Insights

Key companies in the global yacht charter industry include Sunseeker International Ltd. The Moorings Limited, Camper & Nicholsons International Ltd., and others. These companies adopt various strategies to enhance their competitive edge. These include leveraging advanced technology for seamless booking experiences, offering personalized services to cater to diverse customer preferences, and expanding their fleet with modern, eco-friendly yachts. Furthermore, companies focus on strategic partnerships and collaborations to enhance market reach and visibility.

Sunseeker International Ltd. manufactures luxury performance motor yachts known for their innovative designs and high-quality craftsmanship. The company operates in the yacht manufacturing segment, offering a diverse portfolio that includes various yacht ranges such as the Manhattan, Predator, and Ocean models. The company's yachts are designed for both leisure and performance, catering to affluent clients seeking exceptional experiences on the water.

Boat International Media Ltd. specializes in providing information and resources for the luxury yacht industry, focusing on yacht sales, charters, and lifestyle content. The company operates within the marine media segment, offering publications and digital platforms that cater to yacht owners, buyers, and enthusiasts. Boat International Media produces high-quality magazines and online content that highlight luxury yachts, charter destinations, and industry trends.

Key Yacht Charter Companies:

The following are the leading companies in the yacht charter market. These companies collectively hold the largest market share and dictate industry trends.

- Beneteau S.A

- Sunseeker International Ltd.

- The Moorings Limited

- Camper & Nicholsons International Ltd.

- Sunsail Worldwide Sailing Ltd.

- IYC

- Argo Nautical Limited

- Burgess Yacht

- Kiriacoulis Mediterranean Cruises Shipping S.A.

- Boat International Media Ltd.

- Yachtico Inc.

- Fraser Yachts Florida Inc.

Recent Developments

-

In December 2024, Burgess Yacht unveiled six stunning yachts that will be available for charter in 2025, enhancing the luxury yacht charter market. Notable entries include the lavish 112m RENAISSANCE, accommodating up to 36 guests, and the elegant 49.9m ASANI, featuring luxurious amenities and spacious outdoor areas. Each yacht offers unique experiences tailored to charterers' desires, from adventure to relaxation.

-

In September 2023, IYC announced the opening of a new office in Dubai, enhancing its luxury yacht charter market presence. This strategic move aims to cater to the region's growing demand for yacht charters, providing clients with personalized services and access to a diverse fleet. The Dubai office will serve as a hub for both local and international clients seeking premium yacht charter experiences.

Yacht Charter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.79 billion

Revenue forecast in 2030

USD 11.34 billion

Growth Rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Yacht size, yacht type, contract type, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa.

Country scope

U.S.; Canada; Mexico; China; India; Japan; Indonesia; Germany; UK; France; Italy; Spain; Brazil; Argentina

Key companies profiled

Beneteau S.A; Sunseeker International Ltd.; The Moorings Limited; Camper & Nicholsons International Ltd.; Sunsail Worldwide Sailing Ltd.; IYC; Argo Nautical Limited; Burgess Yacht; Kiriacoulis Mediterranean Cruises Shipping S.A.; Boat International Media Ltd.; Yachtico Inc.; Fraser Yachts Florida Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Yacht Charter Market Report Scope Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global yacht charter market report based on yacht size, yacht type, contract type, and region:

-

Yacht Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 20 ft.

-

20 To 50 ft.

-

Above 50 ft.

-

-

Yacht Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sailing Yacht

-

Motor Yacht

-

-

Contract Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bareboat Charter

-

Crewed Charter

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Singapore

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

Saudi Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.