- Home

- »

- Advanced Interior Materials

- »

-

X-ray Inspection Machines Market Size & Share Report, 2030GVR Report cover

![X-ray Inspection Machines Market Size, Share & Trends Report]()

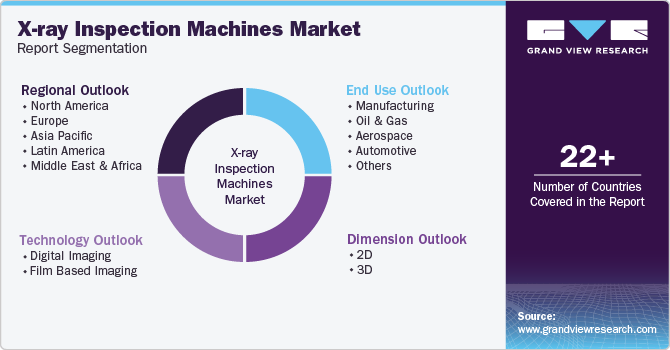

X-ray Inspection Machines Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Digital Imaging, Film Based Imaging), By Dimension (2D, 3D), By End Use (Aerospace, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-475-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

X-ray Inspection Machines Market Summary

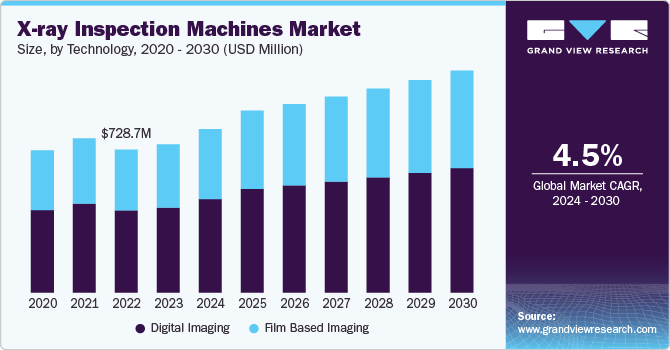

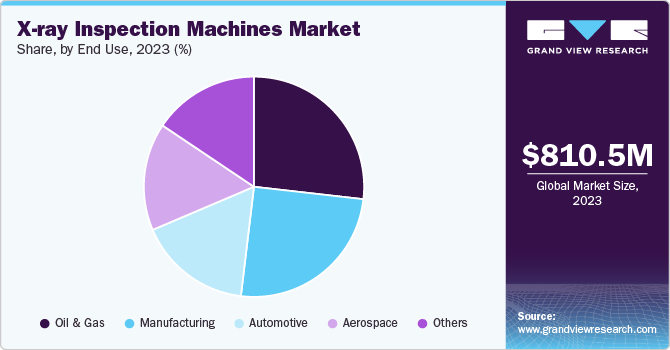

The global x-ray inspection machines market size was estimated at USD 810.5 million in 2023 and is expected to reach USD 1,094.0 million by 2030, growing at a CAGR of 4.5% from 2024 to 2030. The market is primarily driven by increasing security concerns and the need for efficient screening processes in various sectors.

Key Market Trends & Insights

- The Asia Pacific x-ray inspection machines market is one of the fastest-growing markets.

- India to witness market growth at 6.1% CAGR.

- Based on technology, the digital imaging technology segment led the market in 2023 and accounted for 57.1% of the global revenue share.

- Based on dimension, the 3D dimension segment led the market in 2023, accounting for 55.7% of the global revenue share.

- Based on end-use, the passenger cars segment accounted for 26.8% of the global revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 810.5 Million

- 2030 Projected Market Size: USD 1,094.0 Million

- CAGR (2024-2030): 4.5%

- Asia Pacific: Largest market in 2023

With rising global threats related to terrorism and smuggling, the airports, transportation hubs, and critical infrastructure facilities are investing heavily in advanced x-ray technologies to enhance their security measures. These machines provide rapid and non-invasive scanning capabilities, allowing for quick detection of prohibited items, thus ensuring the safety of both personnel and the public. In addition, regulatory compliance in industries such as manufacturing, pharmaceuticals, and food safety mandates the use of x-ray systems to ensure product integrity and safety, further propelling market growth.

Another significant driving factor is technological advancement in x-ray inspection systems. Innovations such as automated detection algorithms, high-resolution imaging, and the integration of artificial intelligence are transforming the efficiency and accuracy of x-ray inspections. These advancements not only reduce the time required for inspections but also improve the detection rates of contraband and hazardous materials. Moreover, the growing adoption of x-ray machines in non-security applications, such as quality control in manufacturing and medical diagnostics, expands their market potential. As industries increasingly recognize the benefits of these sophisticated inspection solutions, the demand for x-ray machines is expected to continue rising.

Drivers, Opportunities & Restraints

The market is significantly driven by heightened security needs across various sectors, including aviation, border security, and public safety. With the rise in global threats, organizations are investing in advanced x-ray technologies to bolster their security infrastructure. These machines provide rapid, non-invasive scanning, allowing for efficient detection of prohibited items such as weapons and explosives. In addition, regulatory requirements in industries such as food safety and pharmaceuticals mandate strict inspection protocols, further fueling the demand for x-ray systems to ensure compliance and product safety.

Emerging markets present substantial growth opportunities for the x-ray inspection machines sector. As developing countries invest in enhancing their security measures and infrastructure, there is a rising demand for advanced inspection technologies. Furthermore, the integration of artificial intelligence and machine learning in x-ray systems offers the potential for improved detection capabilities and operational efficiency. This technological evolution can lead to the development of more sophisticated systems that not only enhance security but also expand into applications like industrial quality control and medical diagnostics, creating new avenues for growth.

Despite the positive outlook, the market faces several challenges. High initial investment costs and maintenance expenses can deter smaller businesses and organizations from adopting these technologies. In addition, concerns regarding radiation exposure, even at minimal levels, may lead to regulatory scrutiny and public apprehension, affecting the market’s growth. Lastly, the rapid pace of technological change necessitates continuous updates and training, which can strain resources for companies that struggle to keep pace with advancements in x-ray inspection technologies.

Technology Insights

“The film-based imaging technology segment is expected to grow at a CAGR of 4.9% from 2024 to 2030 in terms of revenue.”

The digital imaging technology segment led the market in 2023 and accounted for 57.1% of the global revenue share. The demand for digital imaging x-ray inspection machines has surged due to their numerous advantages over traditional film-based systems. Digital imaging offers superior image quality, allowing for enhanced clarity and detail in inspections. This capability enables faster and more accurate detection of anomalies, making it especially valuable in high-stakes environments such as airports, border control, and industrial applications. Moreover, digital systems streamline the workflow by eliminating the need for film processing, thus reducing operational costs and turnaround times. The growing adoption of digital technologies across industries has further bolstered the demand for these modern x-ray inspection solutions.

Moreover, film-based imaging still holds a niche market, particularly in specific sectors where traditional methods are entrenched. Some users prefer film due to its familiarity and the perceived reliability it offers, especially in applications where digital technology may not yet be fully trusted. In addition, film-based systems are often less expensive in terms of initial investment, making them appealing to smaller organizations with budget constraints. However, as industries increasingly prioritize efficiency, accuracy, and the ability to integrate with advanced technologies, the trend is leaning toward digital imaging solutions, suggesting a gradual decline in demand for film-based x-ray inspection machines in the long term.

Dimension Insights

“The 3D dimension segment is expected to grow at a significant CAGR of 4.8% from 2024 to 2030 in terms of revenue.”

The 3D dimension segment led the market in 2023, accounting for 55.7% of the global revenue share. 3D x-ray inspection machines are rapidly gaining traction due to their advanced capabilities and superior imaging technology. By generating three-dimensional images, these machines offer a more comprehensive view of an object, enabling inspectors to identify internal defects and structural issues that may not be visible in 2D images. This enhanced functionality is particularly valuable in industries such as aerospace, automotive, and medical device manufacturing, where precision is crucial. The growing emphasis on quality assurance and the increasing complexity of products are driving demand for 3D x-ray systems, making them a key player in the evolution of x-ray inspection technology. As industries seek to optimize their inspection processes, the shift towards 3D solutions is expected to continue, shaping the future of the market.

The 2D x-ray inspection machines have long been the standard in various industries, offering a reliable method for detecting flaws, cracks, and other defects in materials. Their simplicity and cost-effectiveness make them particularly appealing for applications in security screening, quality control, and non-destructive testing. In sectors like manufacturing and aviation, 2D x-ray systems provide essential insights into product integrity, helping companies ensure compliance with safety standards. However, while effective, 2D imaging can sometimes fall short in providing depth perception, which may limit its effectiveness in complex inspections.

End use Insights

“The manufacturing end use segment is expected to grow at a significant CAGR of 4.7% from 2024 to 2030 in terms of revenue”

The passenger cars segment accounted for 26.8% of the global revenue share in 2023. In the oil & gas industry, the demand for x-ray inspection machines is largely driven by the critical need for equipment reliability and safety in high-risk environments. With pipelines, drilling rigs, and other infrastructure subjected to extreme conditions, regular inspection is essential to prevent failures that could result in catastrophic accidents and environmental damage. X-ray inspection technology is employed to examine welds, pipes, and pressure vessels for defects, ensuring compliance with industry standards and regulations. As the sector continues to focus on operational efficiency and safety, the reliance on advanced x-ray inspection machines is expected to grow, reflecting the industry's commitment to maintaining the highest safety standards and mitigating risks associated with oil and gas extraction and transportation.

The demand for x-ray inspection machines in the manufacturing sector is driven by the need for stringent quality control and assurance processes. As manufacturers face increasing pressure to ensure product integrity and safety, x-ray systems play a crucial role in detecting internal flaws, cracks, and inconsistencies in materials and components. This is especially important in industries such as aerospace, automotive, and electronics, where even minor defects can lead to significant safety hazards and costly recalls. The ability of x-ray machines to provide non-destructive testing (NDT) allows manufacturers to maintain high standards without compromising the integrity of their products, making these systems indispensable in modern manufacturing environments.

Regional Insights

The North American x-ray inspection machines market is witnessing steady growth, primarily driven by advancements in technology and increasing security concerns. The region's robust aerospace, automotive, and healthcare sectors necessitate high-quality inspection solutions to ensure compliance with safety regulations and maintain product standards. In addition, the rising prevalence of sophisticated threats has led to heightened investments in security screening technologies at airports and other transportation hubs. Furthermore, the integration of artificial intelligence and machine learning into x-ray inspection systems is enhancing their capabilities, offering significant advantages in terms of efficiency and accuracy. As a result, North America is expected to remain a key player in the market, characterized by innovation and a commitment to safety.

Asia Pacific X-ray Inspection Machines Market Trends

The Asia Pacific x-ray inspection machines market is one of the fastest-growing markets for x-ray inspection machines, driven by rapid urbanization and industrial growth. Countries like China, Japan, and South Korea are at the forefront of adopting advanced inspection technologies across various sectors, including manufacturing, healthcare, and security. The increasing need for efficient inspection systems in food safety and pharmaceuticals is further bolstering market demand. Furthermore, government initiatives aimed at enhancing border security and counter-terrorism measures are leading to increased investments in x-ray inspection solutions. As a result, the Asia Pacific region is set to witness sustained growth in the market, supported by technological advancements and rising consumer awareness.

“India to witness market growth at 6.1% CAGR”

The India x-ray inspection machines market is experiencing robust growth driven by increasing industrialization and the government's focus on enhancing security infrastructure. The rise of manufacturing sectors, particularly in automotive and pharmaceuticals, is pushing demand for advanced inspection technologies to ensure product safety and compliance with international standards. In addition, the expanding aviation and transportation sectors are investing heavily in security measures, leading to a surge in the adoption of x-ray machines for baggage screening and cargo inspections. With ongoing infrastructural developments and a growing emphasis on quality control, the Indian market for x-ray inspection machines is poised for significant expansion in the coming years.

Europe X-ray Inspection Machines Market Trends

The Europe x-ray inspection machines market is characterized by a strong focus on regulatory compliance and safety standards across industries. The stringent regulations in sectors such as food and pharmaceuticals drive the need for effective inspection systems to ensure product integrity and consumer safety. Moreover, the growing adoption of automated and digital technologies is reshaping the market, with manufacturers increasingly investing in advanced x-ray solutions that offer enhanced imaging capabilities and efficiency. The ongoing transition towards Industry 4.0 also highlights the demand for integrated inspection systems that can provide real-time data analysis, further propelling the growth of the market in Europe.

Key X-ray Inspection Machines Company Insights

Some of the key players operating in the market include Nikon Metrology, Inc. and Nordson Corporation, among others.

-

Nikon Metrology, Inc. is a leading provider of advanced measurement and inspection solutions, specializing in non-destructive testing and 3D metrology. A subsidiary of the renowned Nikon Corporation, the company leverages cutting-edge technology to deliver high-precision imaging systems, x-ray inspection machines, and coordinate measuring machines (CMMs) across various industries, including aerospace, automotive, and electronics. With a strong commitment to innovation and quality, Nikon Metrology focuses on enhancing productivity and accuracy in manufacturing processes, helping clients ensure the integrity of their products while adhering to stringent regulatory standards.

-

Nordson Corporation is a global leader in precision dispensing, coating, and curing technologies, providing a broad range of products and services that enhance manufacturing processes across various industries. Founded in 1954, the company operates in key sectors such as packaging, electronics, and medical devices, offering solutions that include x-ray inspection systems for quality assurance and process control. Nordson is known for its commitment to innovation and customer satisfaction, continuously investing in research and development to stay at the forefront of technology. With a strong emphasis on sustainability and efficiency, Nordson's solutions help manufacturers optimize their operations while ensuring product quality and compliance with industry standards.

Key X-ray Inspection Machines Companies:

The following are the leading companies in the X-ray inspection machines market. These companies collectively hold the largest market share and dictate industry trends.

- North Star Imaging Inc.

- Nikon Metrology, Inc.

- Nordson Corporation

- YXLON International GmbH

- VJ Group, Inc.

- Mettler Toledo International Inc.

- Ametek, Inc.

- Viscom AG

- ViTrox Corporation Berhad

- Test Research, Inc.

Recent Developments

-

In February 2024, Rad Source launched the NDT 1000 X-ray Inspection System, capable of handling materials up to 0.5 inches thick, including steel, with exceptional precision, speed, and versatility. The system features a high-resolution digitizing panel and monitors, providing crystal-clear imaging for accurate evaluations.

X-ray Inspection Machines Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 840.5 million

Revenue forecast in 2030

USD 1,094.0 million

Growth Rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, dimension, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

North Star Imaging Inc.; Nikon Metrology, Inc.; Nordson Corporation; YXLON International GmbH; VJ Group, Inc.; Mettler Toledo International Inc.; Ametek, Inc.; Viscom AG; ViTrox Corporation Berhad; Test Research, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

X-ray Inspection Machines Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global x-ray inspection machines market report based on technology, dimension, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Imaging

-

Film Based Imaging

-

-

Dimension Outlook (Revenue, USD Million, 2018 - 2030)

-

2D

-

3D

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Oil & Gas

-

Aerospace

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global x-ray inspection machines market size was estimated at USD 810.5 million in 2023 and is expected to reach USD 840.5 million in 2024.

b. The global x-ray inspection machines market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 1,094.0 million by 2030.

b. The 3D dimension segment led the market, accounting for 55.7% of the global market revenue share in 2023. 3D x-ray inspection machines are rapidly gaining traction due to their advanced capabilities and superior imaging technology.

b. Some of the key players operating in the x-ray inspection machines market include North Star Imaging Inc., Nikon Metrology, Inc., Nordson Corporation, YXLON International GmbH, VJ Group, Inc., Mettler Toledo International Inc., Ametek, Inc., Viscom AG, ViTrox Corporation Berhad, Test Research, Inc.

b. The x-ray inspection machines market is primarily driven by increasing security concerns and the need for efficient screening processes in various sectors. With rising global threats related to terrorism and smuggling, airports, transportation hubs, and critical infrastructure facilities are investing heavily in advanced x-ray technologies to enhance their security measures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.