- Home

- »

- Medical Devices

- »

-

Wound Closure Strips Market Size & Share Report, 2030GVR Report cover

![Wound Closure Strips Market Size, Share & Trends Report]()

Wound Closure Strips Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Flexible, Reinforced), By Product Sterility (Sterile, Non-Sterile), By Indication, By End Use, Distribution Channel And Region Forecasts

- Report ID: GVR-4-68040-398-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wound Closure Strips Market Size & Trends

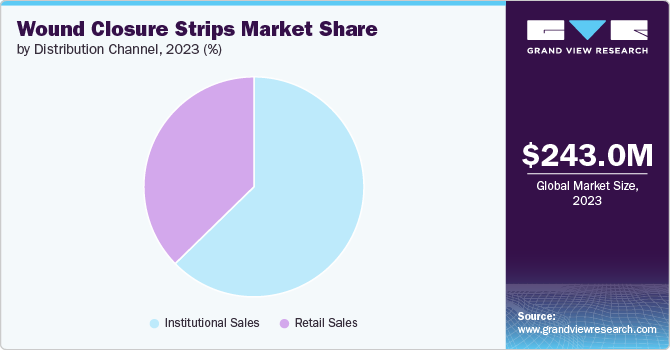

The global wound closure strips market size was estimated at USD 243 million in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The growth can be attributed to the growing number of surgical procedures and the increasing prevalence of injuries and wounds. According to the data published by the National Safety Council in April 2024, approximately 63 million individuals - around 1 in 5 - sought medical attention for an injury. Thus, the large number of patient population is anticipated to boost the demand for wound closure strips in the coming years.

The increasing prevalence of acute wounds such as cuts, lacerations, and abrasions is expected to boost the need for wound closure strips. Many individuals experience preventable acute injuries. For example, based on data published by TRADEBASE OR ITS AFFILIATES in February 2023, approximately 30% of all workplace injuries involve cuts or lacerations. Furthermore, the Bureau of Labor Statistics reported 89,730 instances of lacerations, cuts, or punctures in private industries, with 15,380 occurring in manufacturing firms alone in 2020. Wound closure strips are commonly used to treat acute injuries such as cuts, lacerations, and abrasions. As a result, the high number of acute wound cases is expected to increase the demand for wound closure strips.

Furthermore, the increasing number of road accidents and the rising incidence of injuries are expected to drive the demand for wound closure strips in the upcoming years. According to data published in the Annual Report on Road Accidents in India-2022, a total of 461,312 road accidents were recorded by States and Union Territories (UTs) in 2022, resulting in injuries to 443,366 individuals. This indicates a 15.3% increase in injuries and an 11.9% rise in accidents compared to the previous year. Wound closure strips can effectively treat minor lacerations and cut wounds sustained during road accidents. As a result, the surge in road accidents is expected to lead to a significant increase in injuries, consequently boosting the demand for wound closure strips.

Moreover, the benefits of wound closure strips are expected to drive their demand over the forecast period. Some advantages of wound closure strips include high patient comfort, excellent cosmetic results, ease of application, faster healing, reduced risk of infection and damage caused by stitches, and the absence of the need for local anesthetic.

Moreover, an increasing number of surgical procedures is anticipated to drive market growth as wound closure strips are utilized in post-surgical care and to treat surgical incisions. According to the data published by the National Library of Medicine in September 2020, approximately 310 million major surgeries are conducted annually across the globe. Of these, around 40 to 50 million surgical procedures are performed in the U.S. and 20 million in Europe. Thus, the large number of surgical procedures conducted worldwide is expected to drive the demand for wound closure strips, resulting in market growth in the coming years.

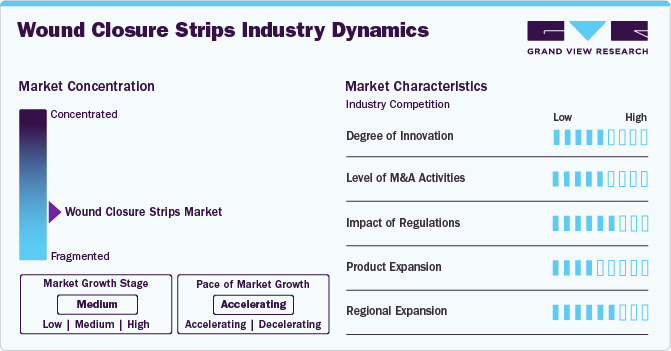

Market Concentration and Characteristics

The market growth stage is moderate, and the pace is accelerating. The wound closure strips market is characterized by a high degree of growth owing to the rising number of surgical procedures, the growing number of wounds & injuries, and the advancements in wound closure strips.

The market is fragmented. This fragmentation can be attributed to the presence of numerous small, medium, and large firms offering various product types of wound closure strips. For instance, Aspen Surgical Products, Inc., a key industry participant, offers different types of wound closure strips, such as flexible skin closures and filament-reinforced skin closures. The players operating in the market often compete based on product differentiation, price, material quality, and end uses.

Manufacturers in the market are advancing by developing sterile, reinforced, and flexible wound closure strips. Industry participants are also focusing on innovative products, such as micro anchor skin closure products. Numerous products are being made using materials such as nylon and polyamide. In addition, innovations in sizes, such as 1/8" x3", 1/4" x3", 1/2" x4", 1/4" x 4", and 1" x 4" are being offered to meet diverse patient needs.

Regulatory bodies such as the Food and Drug Administration (FDA), Health Canada, the European Union, and other agencies set quality and safety standards for medical equipment, including wound closure strips. The regulatory bodies categorize medical devices like wound closure strips into different categories according to the risk associated with these products. The wound care products are subject to scrutiny depending on their risk classes. For instance, as per the FDA, 3M STERI-STRIP skin closure is classified under tape and bandage adhesive regulations, and it is considered a low-risk medical device.

Product expansion in the wound closure strips market involves introducing new products or enhancing existing ones to meet evolving patient needs and advancements in product materials. Industry participants offer products with diverse materials and features. For instance, Dukal, LLC, a key industry player, offers sterile and non-sterile wound closure strips in different sizes such as 1" x 4", 1/2" x 4", 1/4" x 1-1/2", and 1/4" x 3, among others.

Manufacturers and companies operating in the industry focus on expanding their presence in numerous countries. Industry players are forming distribution partnerships to increase the reach of their wound care products in numerous markets. For instance, in April 2020, Medline, a major industry player, formed an exclusive distribution partnership with BandGrip to expand the market reach of BandGrip's patented micro-anchor skin closure products. Such distribution agreements are anticipated to propel market growth in the coming years.

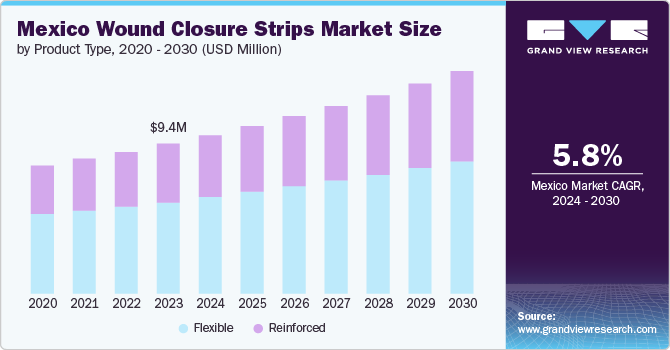

Product Type Insights

The flexible wound closure strips segment dominated the market in 2023. This dominance can be attributed to several benefits associated with it. Some of the benefits of flexible wound closure strips include easy application, breathable fabric, and pain-free wound closure. These strips enhance the patient’s comfort as their flexible material can stretch with body movement. Some of the key players offering flexible wound closure strips include 3M, Essity, and DermaRite Industries, LLC, among others.

The reinforced wound closure strips segment is expected to register fastest growth with a CAGR of 6.0% during the forecast period. These reinforced strips enhance the tensile strength of the wound and provide support. Strips reinforced with polymer filaments assist with a reliable and strong closure of skin lacerations and incisions. Furthermore, companies like Dynarex Corporation offer wound closure strips reinforced with polypropylene fibers for enhanced durability. The availability of such reinforced wound closure strips, which can enhance durability and provide reliable skin closure, is expected to support the growth of this segment in the coming years.

Product Sterility Insights

The sterile segment dominated the market in 2023. The dominance of the segment can be attributed to the growing focus on reducing surgical and wound site infection and the availability of sterile products from major industry participants such as Dynarex Corporation, Dukal, LLC, and Medline Industries, LP, among others. Moreover, around 75% of wound closure strips manufactured by Dukal LLC are sterile. Thus, the availability of several products in the sterile category is anticipated to drive the segment growth in the coming years. In addition, the sterile wound closure strips segment is anticipated to grow fastest with a CAGR of 5.4% in the coming years.

The non-sterile segment is expected to register significant growth during the forecast period. The growth of the segment can be attributed to the presence of several non-sterile products, such as non-sterile wound closure strips from Dukal, LLC, and SavDerm wound closure strip kit from Oriental Resources Development Limited. These strips can be used on surgical incisions and closure of lacerations. The growing number of injuries and wound incidences is anticipated to support the segment's growth in the coming years.

Indication Insights

The surgical wounds segment dominated the market in 2023. It is also anticipated to grow fastest with a CAGR of 5.4% in the coming years. Surgical wounds include incisions related to surgeries and post-surgical care. Wound closure strips are widely used to treat surgical incisions. The increasing number of surgeries globally is anticipated to support the segment growth over the forecast period. According to the data published by the American College of Surgeons in July 2023, around 15 million Americans undergo surgery every year. Thus, the large patient population is expected to propel the surgical wounds segment in the coming years.

The lacerations & minor cuts segment is expected to grow significantly from 2024 to 2030. Wound closure strips help secure and close minor cuts. The increasing number of lacerations, minor cuts, and injuries is anticipated to support the segment's growth. According to the data published by MARTOR USA in July 2023, 83% of workplace hand injuries were caused by cuts, lacerations, and punctures in 2021. Furthermore, per the OSHA’s Safety Pays Program calculator, most firms should anticipate spending more than USD 45 million per laceration in direct and indirect costs. Thus, the growing spending on laceration treatments and the increasing number of injuries is anticipated to fuel the segment growth in the coming years.

End use Insights

The hospital segment dominated the market with a revenue share of 41.6% in 2023. Wound closure strips are important in hospitals across various departments such as labor & delivery, operating room-surgery, emergency, intensive care unit, medical-surgical, orthopedics, pediatrics, urgent care, wound care, and critical care, among others. The availability of skilled staff, resources, and specialized equipment in hospital settings is expected to drive the growth of the hospital segment in the coming years. Moreover, the increasing number of hospitals can also contribute to the segment's growth.

The home healthcare segment is anticipated to register the fastest CAGR from 2024 to 2030. A growing shift towards patient-centric care is anticipated to boost the other segments' growth. In addition, the rising aging population, advancements in wound closure products, and the cost-effectiveness of wound closure strips are expected to support the segment's growth over the forecast period.

Distribution Channel Insights

The institutional sales segment dominated the market in 2023. This involves direct interactions with major healthcare institutions such as hospitals. Manufacturers of wound care products can also directly market their products to healthcare providers, including clinics, hospitals, and patients, through direct-to-consumer marketing. This approach offers more control over the distribution process and enables manufacturers to foster customer relationships.

The retail sales segment is expected to grow fastest with a CAGR of 5.6% during the forecast period. Wound closure strips help secure and close minor cuts. Retail sales mainly comprise e-commerce and retail pharmacy stores. Large pharmacies benefit customers by offering various delivery options and usually providing good service. E-commerce sales platforms and pharmacy stores can provide information about product features and help improve the customer's knowledge. The growing shift toward e-commerce medical buying and ease of access associated with retail sales is anticipated to support the segment growth in the coming years.

Regional Insights

The North America wound closure strips market held the largest revenue share of 44.62% in 2023, due to the rising incidence of injuries and wounds and favorable government initiatives. Moreover, the large number of surgical procedures performed in the region is anticipated to support the market growth. In addition, the growing healthcare expenditures in the U.S. and Canada are anticipated to propel the market growth. According to the Canadian Medical Association, Canada’s total health spending was anticipated to reach USD 249.90 billion in 2023.

U.S. Wound Closure Strips Market Trends

The wound closure strips market in the U.S. is expected to dominate the North American market from 2024 to 2030. The presence of key players such as 3M, DeRoyal Industries, Inc., DermaRite Industries, LLC, Dukal, LLC, and Medline Industries, LP is anticipated to support the country’s market growth. Moreover, the growing number of road accidents and injuries across the country is anticipated to fuel the country's market in the coming years.

Europe Wound Closure Strips Market Trends

Europe's wound closure strips market is anticipated to grow significantly in the coming years. This growth can be attributed to the rising number of individuals suffering from chronic conditions and growing advancements in wound closure strips. Moreover, the availability of domestic and international companies offering wound closure strips for managing surgical wounds and minor cuts is anticipated to boost the market growth. For instance, Smith+Nephew. is a UK-based company that produces and manufactures LEUKOSTRIP, a skin closure product that can be used in primary and secondary closure of skin wounds.

The wound closure strips market in the UK is expected to grow moderately over the forecast period. The growing number of wound incidents due to the growing number of road accidents and sports injuries is anticipated to support market growth in the coming years. According to the data published by Dr. Naveen Bhadauria in June 2023, approximately 2 million individuals in the UK end up in Emergency & Accident departments each year due to sports injuries. Sports injuries often result in acute wounds and cuts, thus boosting the demand for wound closure strips.

France wound closure strips market is expected to grow over the forecast period owing to the increasing prevalence of wounds and high healthcare expenditures. Rising awareness about wound care management is also anticipated to support the country's market growth over the forecast period.

The wound closure strips market in Germany is experiencing steady growth due to the increasing prevalence of the senior population, which is more susceptible to chronic diseases and injuries. In addition, the growing number of injuries across the country is expected to drive the market in the coming years. According to data published by the Statistisches Bundesamt (Destatis) in April 2023, around 366,557 individuals were injured in Germany due to traffic accidents in 2023.

Asia Pacific Wound Closure Strips Market Trends

Asia Pacific region is anticipated to grow significantly over the forecast period. The wound closure strips market in the Asia Pacific region has been experiencing significant growth, driven by several key factors, such as the increasing number of road accidents, the growing number of surgical procedures, and the rising prevalence of the geriatric population.

The wound closure strips market in China is expected to grow over the forecast period owing to the growing demand for wound closure strips, the increasing burden of injuries, and the increasing prevalence of older people. Furthermore, the rising focus of domestic and international players on wound care is anticipated to support the country's market growth.

Japan wound closure strips market is projected to expand from 2024 to 2030 due to several key factors, including an increasing number of surgeries throughout the country and a growing elderly population. According to data from the BBC, it is expected that in Japan, individuals over 65 will make up 34.8% of the population by 2040.

Middle East and Africa Wound Closure Strips Market Trends

The wound closure strips market in the Middle East and Africa is expected to witness significant growth in the coming years due to the growing healthcare expenditure, increasing number of surgical procedures, rising traffic accidents, and growing senior population.

Saudi Arabia wound closure strips market is expected to grow over the forecast period. The growing number of surgical procedures and rising health expenditures can boost market growth in the coming years.

The wound closure strip market in Kuwait is expected to grow over the forecast period due to rising healthcare expenditures, the increasing prevalence of the senior population, and the growing number of surgical procedures nationwide. According to the data published by the EHS in August 2022, Kuwait Hospital performed 939 surgeries in the first half of 2022, up from the 573 surgeries reported during the same period in the previous year.

Key Wound Closure Strips Company Insights

Companies operating in the industry are seeking approvals for their novel products and expanding their manufacturing and production capacities to bolster their presence in the market. In addition, manufacturers are acquiring smaller players and emphasizing supplying their products globally.

Key Wound Closure Strips Companies:

The following are the leading companies in the wound closure strips market. These companies collectively hold the largest market share and dictate industry trends.

- DeRoyal Industries, Inc.

- DermaRite Industries, LLC.

- 3M

- Medline Industries, LP

- Gentell

- Dynarex Corporation

- Smith+Nephew

- Dukal, LLC

- Aspen Surgical Products, Inc.

- Essity

- Aero Healthcare

Recent Developments

-

In July 2024, Vernacare Ltd (H.I.G. Capital, LLC), a manufacturer of wound closure strips, transferred USD 4.54 million in surgical tool operations from China to the UK. This plan would allow the company to extend its manufacturing capacity at Worksop, Newtown, Wales, and England establishments and save about USD 324.60 million.

-

In January 2024, 3M Health Care's Medical Solutions Division was awarded a USD 34.2 million contract by the U.S. Army to research and develop innovative products for infection prevention, wound management, and healing. It is expected to support the market growth of the wound closure strips market.

-

In January 2022, Convatec Group made a strategic acquisition of Triad Life Sciences Inc. to enter the wound biologics market. By combining Triad's product offerings with Convatec's existing strengths in Advanced Wound Care, the company aims to enhance its market position in the U.S. significantly.

Wound Closure Strips Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 255.9 million

Revenue forecast in 2030

USD 349.8 million

Growth rate

CAGR of 5.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product type, product sterility, indication, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

DeRoyal Industries, Inc.; DermaRite Industries, LLC.; 3M; Medline Industries, LP; Gentell, Dynarex Corporation; Smith+Nephew; Dukal, LLC; Aspen Surgical Products, Inc.; Essity; Aero Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Closure Strips Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wound closure strips market report based on product type, product sterility, indication, end use, distribution channel, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible

-

Reinforced

-

-

Product Sterility Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterile

-

Non-Sterile

-

-

Indications Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Wounds

-

Lacerations & Minor Cuts

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wound closure strips market size was estimated at USD 243.0 million in 2023 and is expected to reach USD 255.9 million in 2024.

b. The global incontinence and ostomy care products market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 349.8 million by 2030.

b. The flexible segment dominated the market for wound closure strips. The segment is expected to expand at the significant CAGR of 4.9% from 2024 to 2030.

b. North America dominated the wound closure strips market in 2023 with the largest revenue share of around 44.62%. Due to the rising incidence of injuries and wounds and favorable government initiatives. Moreover, the large number of surgical procedures performed in the region is anticipated to support the market growth.

b. Some key players operating in the wound closure strips market include DeRoyal Industries, Inc., DermaRite Industries, LLC., 3M, Medline Industries, LP, Gentell, Dynarex Corporation, Smith+Nephew, Dukal, LLC, Aspen Surgical Products, Inc., Essity, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.