- Home

- »

- Medical Devices

- »

-

Wound Cleanser Products Market Size & Share Report, 2030GVR Report cover

![Wound Cleanser Products Market Size, Share & Trends Report]()

Wound Cleanser Products Market Size, Share & Trends Analysis Report By Product (Wetting Agents, Antiseptic), By Form (Sprays, Solutions), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-307-4

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Wound Cleanser Products Market Trends

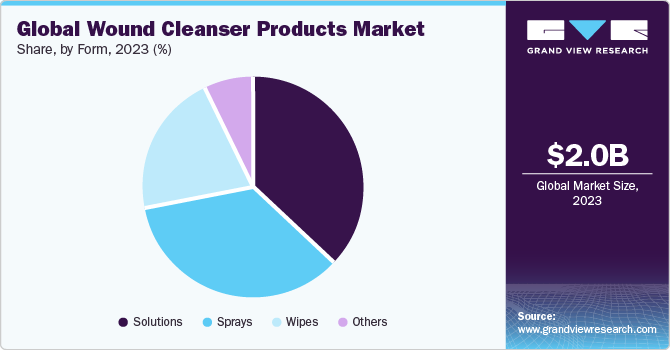

The global wound cleanser products market size was estimated at USD 2.04 billion in 2023 and is projected to grow at a CAGR of 4.69% from 2024 to 2030. The market growth is driven by numerous factors such as increasing prevalence of chronic diseases, technological advancements coupled with increasing number of ambulatory surgical centers. The increasing the number of clinical trials is also anticipated to boost market growth in the near future.

Chronic conditions such as diabetes, vascular diseases, obesity, and autoimmune diseases can impede the body's natural healing process, leading to the development of chronic, nonhealing wounds or ulcers. This creates a substantial demand for effective wound management solutions, including wound cleansers. For instance, according to the National Association of Chronic Disease Directors, in April 2022, nearly 60% of adult U.S. citizens had at least one chronic disease. Additionally, as per data published by the Institute for Health Metrics and Evaluation in June 2023, global diabetes cases are expected to grow to 1.3 billion by 2050 from 529 million. Thus, the increasing prevalence of chronic diseases globally is a key factor driving the market growth.

Ambulatory Surgery Centers (ASCs) offer a variety of services, such as surgical care, diagnostics, and preventive procedures. Surgeries for pain management; urology; orthopedics; restorative, reconstructive, or alternative plastic surgeries; and gastrointestinal surgeries are also performed in ASCs. Earlier, ASCs were only capable of performing GI-related minor surgeries; however, with an increase in the number of minimally invasive surgical procedures, services offered by ASCs have expanded and grown exponentially. According to the Ambulatory Surgery Center Association (ASCA), in 2022, there are approximately 6,200 active ASCs in the U.S. The number of ASCs in each state, as reported by ASCA. Additionally, there are 848 ASCs in California, 56 in Massachusetts, and 160 in New York among others. As the number of ASCs and surgeries performed in these centers increases, so does the demand for advanced wound cleanser products, boosting the market growth.

Moreover, various authorities and organizations operating in the country are conducting studies to review wound cleansing products. For instance, in June 2023, the CADTH Health Technology Review for Antimicrobial or Antiseptic Cleansers for Wounds was published by the Canadian Journal of Health Technologies. This document reviewed the antimicrobial or antiseptic wound cleansers versus saline for managing wounds. Such review documents can help improve the knowledge and awareness about wound cleansers among Canadian healthcare decision-makers, health systems leaders, healthcare professionals, and policymakers. Thus, the increasing awareness about wound cleanser products among industry stakeholders is anticipated to drive market growth over the forecast period.

Market Concentration & Characteristics

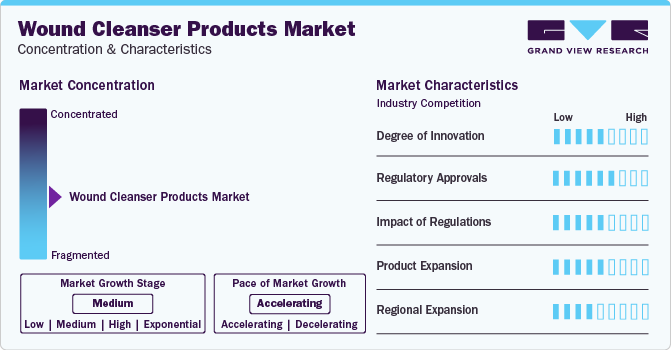

The market growth stage is medium, and the pace of growth is accelerating. The market is characterized by increasing cases of chronic diseases, a rising number of Ambulatory Surgery Centers (ASCs) coupled with increasing regulatory approval for novel product launches.

Key strategies implemented by players and government entities are increasing clinical studies for assessments for product launch, expansion, acquisitions, partnerships, collaboration, and other strategies. For instance, in August 2022, Heraeus Medical GmbH introduced the palaJet, a battery-operated, single-use pulse lavage system designed for efficient and effective bone bed cleaning. Particularly in arthroplasty procedures, this crucial step contributes to improved long-term outcomes by thoroughly removing fat residues, bone debris, marrow, and blood from cement-receiving surfaces.

The market for wound cleansing products is characterized by an ongoing increase in technological advances. Novel procedures, smart packaging, and effective application devices are a few examples of advancements that have improved the efficiency and usability of wound-cleansing products.

The major regulatory authority overseeing medical devices in the U.S. is FDA and the European Medicines Agency (EMA) in Europe. Before wound cleanser products can be marketed and sold, it is required to undergo a thorough review process to demonstrate their safety and effectiveness. This process typically involves preclinical testing, clinical trials, and submission of extensive documentation to the regulatory authorities for review.

Regulations often set standards for safety and efficacy, driving manufacturers to invest in R&D to meet these requirements. Companies focus on developing innovative features or improving existing technologies to comply with regulations while enhancing patient outcomes.

Market players are focusing on expanding their product portfolios to cater to a broader range of patient needs. This involves the development of wound cleanser products with the integration of antimicrobial agents, the use of biocompatible materials, and the incorporation of smart technologies for real-time monitoring.

Within the wound cleanser products market, many companies focus on addressing several patient demographics or meeting specific therapeutic requirements. Due to an emphasis of companies on developing customized solutions for certain specializations in the market, this specialization contributes to market fragmentation.

Forming strategic partnerships or collaborations with local distributors, healthcare providers, and key opinion leaders can facilitate market entry and accelerate adoption. Collaborating with established entities can provide valuable insights into regional market nuances, regulatory requirements, and customer preferences.

Product Insights

The wetting agents segment dominated the market in 2023. Wetting agents play a crucial role in wound cleanser solutions due to their ability to help the cleanser penetrate wounds more efficiently by dissolving and removing debris. Sprays, foams, and gels are the various wound cleanser products available. Many of these solutions have wetting agents as an essential component, which enhances their effectiveness and ensures that wounds are completely washed & disinfected. The increasing prevalence of chronic wounds and advancements in wetting agents are expected to drive the segment’s growth.

As per a research article published in November 2023 by ResearchGate, approximately 50% of people who wear Contact Lenses (CL) use reusable ones that require proper care. CL-related microbial keratitis, lens contamination, and Acanthamoeba keratitis may result from improper CL care and insufficient cleaning. Japan developed a CL solution that includes Hyaluronic Acid Derivatives (HADs) as wetting agents that adhere to the lens surface over time to increase its wettability. HAD may also be included in other solutions, such as cleanser products. Thus, such advances in wetting agents are expected to boost market growth.

The pulsed lavage systems segment is expected to register the fastest CAGR of 7.82% during the forecast period. Pulsed lavage systems are advanced wound-cleaning devices that use suction and mechanical irrigation to completely clean wounds. These techniques are especially helpful for complex wounds, where traditional approaches, such as severe injuries, surgical wounds, and persistent ulcers, might not be sufficient for proper washing.

There is increasing demand for pulsed lavage systems due to their ability to effectively remove bacteria and debris from wounds, lower the risk of infection, and speed up the healing process. The development of portable and user-friendly systems is anticipated to propel market expansion. In addition to hospitals and specialty clinics, the demand for pulsed lavage systems is rising in home care settings as patients seek convenient and efficient wound injury solutions.

Form Insights

The solutions segment dominated the market in 2023. Saline solutions, antiseptic solutions (such as povidone-iodine and chlorhexidine), hypochlorous acid solutions, and enzymatic solutions are some types of wound cleansing solutions. Various medical facilities use wound cleanser solutions, such as clinics, hospitals, long-term care homes, and home care settings. The market for wound cleansing solutions is anticipated to develop due to innovation, an increase in applications, and rising awareness of advanced wound treatment methods due to changing healthcare demands and technological advancements.

Industry key players are involved in novel product launches, further boosting the segment. For instance, in September 2023, to help physicians with all stages of wound healing, HR Pharmaceuticals, Inc. developed Renovar, an advanced skin & wound solution that is readily available and non-sensitizing. Using a super oxidized solution called HOClean Technology, Renovar speeds the healing process by 33% by increasing the oxygen flow to the wound bed. It cleans the wound, reduces inflammation, and lowers the risk of infection.

The wipes segment is expected to register the fastest CAGR of 5.15% during the forecast period. Premoistened and individually packaged wound cleansing wipes are suitable for various applications in clinics, hospitals, & home care facilities. Antiseptic solutions, such as benzalkonium chloride or povidone-iodine, are used in wound cleaning wipes to clean the wound site and reduce the risk of infection.

Since they come in separate packaging, wound cleansing wipes are suitable for one-time usage. They eliminate the need for additional supplies, such as cotton balls, water, or soap. Certain wound cleansing wipes include moisturizing ingredients such as glycerin or aloe vera, which can keep the wound area moisturized & enhance healing. Moreover, the increasing prevalence of surgical & chronic wounds and demand for wound cleanser products is expected to drive the segment in the near future.

Application Insights

The acute wounds segment dominated the market in 2023. Acute wounds include abrasions, burns, and cuts, as well as surgical & traumatic wounds. These wounds should be properly cleaned to promote healing and prevent infection. During the early phases of healing, acute wounds are especially prone to infection. By effectively cleaning the wound surface with antimicrobial wound cleansers, the microbial infection within the wound is reduced, thus decreasing the risk of infection and complications.

For instance, as per reports published by WHO in October 2023, approximately 180,000 fatalities occur from burn injuries every year. The majority of these deaths occur in low- and middle-income nations. Every year, over 1 million individuals in India suffer from moderate to severe burns. The demand for advanced wound cleansing solutions that efficiently clean and disinfect wounds while reducing patient discomfort has increased due to the rising prevalence of acute wounds.

The chronic wounds segment is expected to register the fastest CAGR of 5.15% during the forecast period. The market for wound cleanser products is anticipated to grow due to the increasing prevalence of chronic wounds, including pressure ulcers, venous leg ulcers, and diabetic foot ulcers. The prevalence of diabetic foot ulcers is anticipated to increase due to the rise in the prevalence of diabetes. According to a WHO report, 422 million people worldwide had diabetes in 2023; most of these people lived in low- and middle-income countries. Diabetes is the primary cause of 1.5 million deaths per year.Hence, with the increasing prevalence of diabetes, the risk of diabetic foot ulcers is predicted to surge, propelling segment growth.

End-use Insights

The hospitals segment dominated the market in 2023 and is expected to register the fastest CAGR of 5.05% during the forecast period. Hospitals serve as the primary centers for diagnosing, managing, and treating various types of wound injuries. Hospitals are crucial in the healthcare sector due to their advanced technologies, specialist medical knowledge, and extensive infrastructure for managing this condition. Moreover, hospitals focus on delivering brief medical interventions for severe injuries or illnesses, urgent medical needs, or postsurgical recovery. They provide various services, including emergency care, surgical procedures, intensive care, and specialized medical treatments.

For instance, Definitive Healthcare, LLC’s assessment estimated 3,876 acute care hospitals in the U.S. in 2023. In an inpatient setting, patients receive nonurgent or short-term emergency medical care for a disease, injury, or other conditions. Moreover, as per the same report, there were about 389 long-term acute care hospitals in the U.S. in 2023. These hospitals serve individuals with severe medical challenges that surpass the capabilities of regular acute care hospitals or skilled nursing facilities.

Regional Insights

North America accounted for 37.68% of the global revenue share in 2023 and is expected to continue its dominance over the forecast period. The demand for wound cleanser products across the region is anticipated to be driven by the rising prevalence of diabetes, increasing number of surgeries, and growing approvals for wound cleanser products from numerous regulatory authorities such as the FDA. In addition, supportive policies and increasing funding from government authorities for wound care & surgeries are expected to propel the regional market growth over the forecast period.

The companies operating in the market are undertaking several strategies such as collaborations, partnerships, and product launches & approvals to strengthen their presence in the U.S. market. For instance, in May 2023, VeriCyn Wound Wash from Armis Biopharma obtained 510(k) clearance from the FDA for removing debris from wounds. This product is useful for diabetic ulcers, pressure ulcers, burns, surgical wounds, and grafted/donor sites. Thus, such approvals for wound cleansing products are anticipated to fuel the competition in the market.

U.S. Wound Cleanser Products Market Trends

The wound cleanser products market in the U.S. is expected to grow over the forecast period. The main factors propelling the expansion of the wound cleanser products market in the U.S. are the rising prevalence of diabetes, novel product launches, and the presence of industry key players in this region.

Europe Wound Cleanser Products Market Trends

The wound cleanser products market in Europe is expected to grow over the forecast period owing to the rising number of older individuals and surgical procedures in countries such as France, Italy, and Denmark, among others.

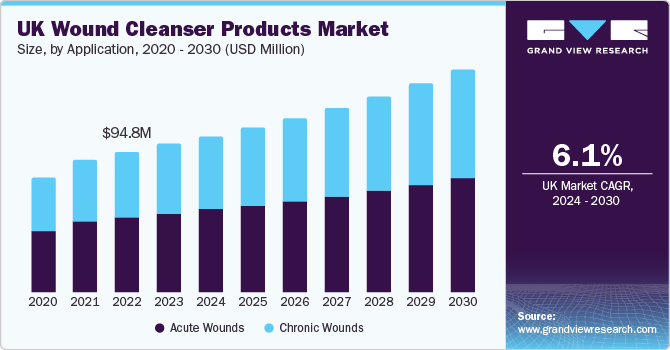

The wound cleanser products market in the UK is expected to grow over the forecast period due to the presence of major market players such as Coloplast Corp, Smith + Nephew, 3M, and ConvaTec. These players offer several innovative wound-cleaning products in the market.

The France wound cleanser products market is expected to grow over the forecast period owing to the increasing number of surgical procedures performed nationwide. For instance, according to the statistics published by the OECD, around 97,790 total knee replacement surgical procedures were performed in France in 2020, which increased to 113,628 in 2022 . Thus, the rising number of surgical procedures is anticipated to propel the demand for wound cleanser products.

The wound cleanser products market in Germany is witnessing a steady growth due to the rapid launch of novel wound cleanser products nationwide. Manufacturers and companies operating in Germany are developing various wound cleanser products.

Asia Pacific Wound Cleanser Products Market Trends

Asia Pacific wound cleanser market is anticipated to grow at the fastest CAGR over the forecast period. Several factors, including the increasing prevalence of chronic disorders and rising medical tourism, are driving market growth in this region. The rising healthcare expenditure in the Asia Pacific region can be attributed to rapid economic development & urbanization and rising healthcare awareness are driving the demand for advanced wound care products, such as wound cleansers. Continuous advancements in technology in wound care products, such as the creation of novel compositions of wound cleansers & delivery methods, are expected to propel the market expansion in the near future.

The wound cleanser products market in China is expected to grow over the forecast perioddue to industry key players focusing on expanding their market presence by enhancing their product portfolios and widening their distribution channels nationwide. In addition, collaborations and partnerships with healthcare providers & hospitals are helping players strengthen their market position.

The India wound cleanser products market has been making significant investments. The evolving Indian healthcare landscape, along with government initiatives to improve healthcare access & quality, significantly influence competitive dynamics in the market.

The wound cleanser products market in Japan is expected to grow over the forecast period owing to the increasing cases of acute and chronic wounds in this region.

Middle East And Africa Wound Cleanser Products Market Trends

Middle East and Africa wound cleanser products market is expected to witness significant growth in the coming years. Advancements in the healthcare system are expected to boost the development of wound care products in these countries. Growing health insurance penetration, increasing privatization, and rising regional disease burden are among the factors expected to drive regional market growth.

The Saudi Arabia wound cleanser products market is expected to grow over the forecast period. The market is driven by the rising geriatric population and the increasing incidence of chronic wounds.

The wound cleanser products market in Kuwait is expected to grow over the forecast period.The key industry players are involved in the launch of novel products, mergers & acquisitions, and geographic expansion. This is expected to increase the demand for treatments for wound cleanser products, which is expected to drive market growth in the near future.

Key Wound Cleanser Products Company Insights

AROA BIOSURGERY LIMITED, and NovaBay Pharmaceuticals, Inc. are some of the emerging players in the market. There are significant trends in the wound cleanser product industry that are altering the landscape of wound care. One notable development is the rise of chronic wounds, including pressure ulcers and diabetic ulcers, which is driving up the demand for advanced wound washing products. Consequently, emerging market players are intensifying their efforts to benefit from this development.

These emerging companies are using technology developments to create innovative wound cleaner solutions that have better antibacterial qualities and are more effective in accelerating wound healing. They are providing innovative formulations and delivery systems that cater to the changing needs of patients and healthcare professionals by concentrating on research and development. Moreover, the growing emphasis on sustainability and eco-friendliness is influencing the development of biodegradable wound cleanser products, aligning with the broader environmental concerns across industries. Emerging players are integrating sustainability principles into their product design and manufacturing processes to appeal to environmentally conscious consumers and healthcare facilities.

Competitive Insights: Smith+Nephew Implemented Sustainability Strategy With “Less Waste, More Care”

The company optimized the size of ALLEVYN Dressing packaging, starting with the bordered dressings, through the "Less waste + more care" campaign. This eliminated unnecessary air and resulted in a 20% reduction in the size of their cartons, pouches, and cases.

The initiative includes:

-

Every year, save 2.7 million square meters of packing material.

-

Reducing 92 tons of CO2 is approximately the same as driving a car 13 times around the globe.

Increased strategic partnerships deals for wound care solutions

Companies involved in strategic partnerships for advancing wound therapy portfolio drives the market growth in near future.

November 2022- The formation of SI Wound Care, LLC ("SI Wound Care"), a joint venture between InfuSystem Holdings, Inc. and Sanara MedTech Inc., was aimed at providing an integrated wound management solution with the goals of enhancing patient outcomes, reducing medical expenses, and raising both provider and patient satisfaction. Through the collaboratively operated business, InfuSystem intended to be able to provide innovative offerings to new clients, such as Sanara's innovative wound care line of products and Cork Medical LLC's ("Cork") NPWT (negative pressure wound therapy) devices and supplies.

Insight from Industry expert:

“Over the past few years, we have built our NPWT business as a turnkey solution with a focus on offering high quality options to patients and providers. We believe the wound care market represents a significant opportunity to drive revenue growth for our Integrated Therapy Services (“ITS”) platform by treating both chronic and acute wounds. Partnering with Sanara enables us to better serve patients and care providers nationally by offering a complete line of advanced wound care products.”

- InfuSystem’s CEO, Richard DiIorio

Increasing number of Clinical Studies for the treatment of Acute Wound

For instance, in December 2023, ClinicalTrials.gov revealed the proposed study held by Rochal Industries LLC in collaboration with Brooke Army Medical Center, University of Texas Health Science Center at San Antonio and MicroGenDXthat. The study will be a prospective trial of management of acute traumatic wounds (less than 24 hours from injury and without previous intervention aside from a dressing for coverage).

BIAKOS Antimicrobial Wound Cleanser and BIAKOS Antimicrobial Wound Gel: Providing Biofilm Prevention and Treatment Through Continuum of Care- The study design involves a prospective single arm, 35 subject study that analyzes the effect of the subsequent application of a novel wound cleanser and wound gel on subjects' acute traumatic wounds and the respective microbial loads over a 28-day study duration.

The market for wound cleanser products may benefit from the growing number of clinical research in the field of wound treatment with a greater focus on innovation, market expansion, regulatory compliance, competitive advantages, and training programs.

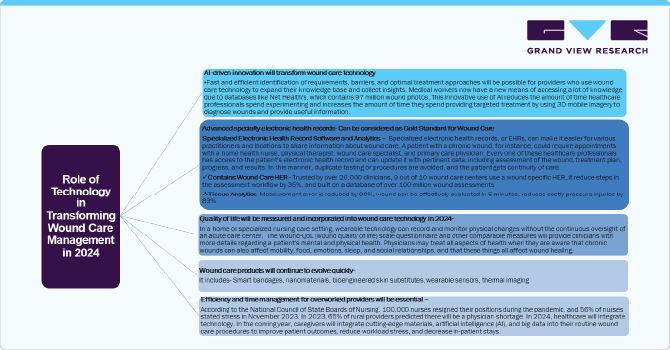

Advances In Wound Care Management Industry Insights

Advanced wound healing techniques are becoming increasingly important since the population ages and the number of people with chronic illnesses rises steadily. Companies that advance in medical technology can introduce artificial intelligence and large amounts of data into waiting rooms, thereby enhancing patient outcomes for millions.

Key Wound Cleanser Products Companies:

The following are the leading companies in the wound cleanser products market. These companies collectively hold the largest market share and dictate industry trends

- Stryker

- Coloplast Corp

- Smith + Nephew

- B. Braun SE

- Johnson & Johnson Services Inc.

- 3M

- Medline Industries, Inc.

- ConvaTec

- Cardinal Health

- Integra LifeSciences

- Molnlycke Healthcare

- Stryker

- Zimmer Biomet

- Heraeus Holding

- Judd Medical Limited

Recent Developments

-

In September 2023, to help physicians with all stages of wound healing, HR Pharmaceuticals, Inc. developed Renovar, an advanced skin & wound solution that is readily available and non-sensitizing. Using a super oxidized solution called HOClean Technology, Renovar speeds the healing process by 33% by increasing the oxygen flow to the wound bed. It cleans the wound, reduces inflammation, and lowers the risk of infection.

-

In June 2023, HR HealthCare launched CliniClean Chlorhexidine Gluconate (CHG) 4%, a potent antiseptic solution designed to offer extensive protection for the skin against a variety of microorganisms by minimizing the risk of contracting healthcare-associated infections or Surgical Site Infections (SSI). This antiseptic/antimicrobial compound is effective for preoperative patient preparation, surgical hand cleansing, healthcare personnel hand hygiene, and general skin & wound sanitation.

-

In May 2023, VeriCyn Wound Wash from Armis Biopharma obtained 510(k) clearance from the FDA for removing debris from wounds. This product is useful for diabetic ulcers, pressure ulcers, burns, surgical wounds, and grafted/donor sites.

-

In April 2023, Gunze Medical, a full-service medical device manufacturer that oversees all aspects from sales to research of the company, expanded its wound care sales network in Japan. Furthermore, Gunze Medical has begun selling its products through a robust distribution network in China, the U.S., and Japan. Such initiatives are expected to propel industry growth.

-

In August 2022, Heraeus Medical GmbH introduced the palaJet, a battery-operated, single-use pulse lavage system designed for efficient and effective bone bed cleaning. Particularly in arthroplasty procedures, this crucial step contributes to improved long-term outcomes by thoroughly removing fat residues, bone debris, marrow, and blood from cement-receiving surfaces.

Wound Cleanser Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.12 billion

Revenue forecast in 2030

USD 2.79 billion

Growth Rate

CAGR of 4.69% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, form, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Coloplast Corp; Smith + Nephew; B. Braun SE; Johnson & Johnson Services Inc.; 3M; Medline Industries, Inc.; ConvaTec; Cardinal Health; Integra LifeSciences; Molnlycke Healthcare; Stryker; Zimmer Biomet; Heraeus Holding; Judd Medical Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Cleanser Products Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wound cleanser products market report based on product, form, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wetting Agents

-

Antiseptic

-

Moisturizers

-

Pulsed Lavage Systems

-

Disposable

-

Reusable

-

Semi Disposable

-

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Sprays

-

Solutions

-

Wipes

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Care

-

Ambulatory Surgery Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wound cleanser products market size was estimated at USD 2.04 billion in 2023 and is expected to reach USD 2.12 billion in 2024.

b. The global wound cleanser products market is expected to grow at a compound annual growth rate of 4.69% from 2024 to 2030 to reach USD 2.79 billion by 2030.

b. The wetting agents segment dominated the global wound cleanser products market with a share of 32.70% in 2023. Wetting agents, such as sterile & portable water, saline, and others, are primarily used for cleansing fatal lesions.

b. Some key players operating in the global wound cleanser products market include Coloplast Corp, Smith + Nephew, B. Braun SE, Johnson & Johnson Services Inc., 3M, Medline Industries, Inc., ConvaTec, Cardinal Health, Integra LifeSciences, Molnlycke Healthcare, Stryker, Zimmer Biomet, Heraeus Holding, Judd Medical Limited

b. Key factors that are driving the market growth include growing prevalence of chronic diseases and rising number of surgeries worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."