Wound Care Market Size, Share & Trends Analysis Report By Product (Advanced Wound Dressing, Surgical Wound Care), By Application (Chronic, Acute), By End-use, By Mode Of Purchase, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-300-3

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Wound Care Market Size & Trends

The global wound care market size was valued at USD 23.15 billion in 2024 and is projected to grow at a CAGR of 4.19% from 2025 to 2030. The demand for wound care products is rising owing to the growing number of surgical cases and the increasing prevalence of chronic disorders across the globe. Moreover, the rising incidence of diabetes due to an inactive lifestyle is one of the significant factors contributing to market growth. For instance, a new report published by Diabetes UK in May 2024 demonstrated an almost 40% increase in 5 years, i.e., from 2016-17 to 2022-23, in the number of individuals diagnosed with type 2 diabetes in the UK who were younger than 40 years.

Wound care products are crucial in treating diabetic foot ulcers (DFUs), which are common among individuals with diabetes. A study published in JAMA Network in November 2023 reports that approximately 33.33% of individuals with diabetes will develop a foot ulcer during their lifetime. DFUs affect an estimated 18.6 million individuals globally and 1.6 million people annually in the U.S. Products like hydrocolloid dressings are particularly effective in promoting wound healing by retaining moisture, facilitating internal and external healing, and aiding in the absorption of necrotic tissue. These benefits are also valuable in treating surgical site infections. As a result, healthcare professionals increasingly rely on these products, which are expected to drive growth in the wound care market in the coming years.

Moreover, the increasing incidence of burn injuries is another crucial factor boosting the growth of the wound care market. For instance, as per the WHO report published in October 2023, an estimated 180,000 morbidities occur each year across the globe due to burn injuries. In addition, according to the study published by the National Library of Medicine in May 2023, nearly 450,000 individuals receive treatment for burns annually, and around 30,000 require specialized care at burn centers.

Wound care products such as ointments, moisturizers, and advanced dressings play a crucial role in managing burn wounds by promoting healing, preventing infection, and improving recovery outcomes. As the number of burn cases continues to rise, the demand for these products is expected to grow, driving the overall expansion of the wound care market, particularly for burn treatment solutions in clinical and home care settings.

Furthermore, the increasing number of traumatic injuries across the world is anticipated to drive the industry. For instance, according to a WHO report (published in December 2023), around 1.19 million individuals die every year as a result of road traffic accidents. Moreover, in February 2024, BPS-Statistics Indonesia reported approximately 139,258 traffic accidents, with 139,258 resulting in severe injuries and 160,449 causing slight injuries. These accidents usually lead to severe blood loss and other injuries. Thus, such cases are expected to increase the demand for wound care products.

The industry is continuously evolving, driven by technological innovations and advancements. New developments in wound care technologies, such as bioengineered tissues, smart dressings, and digital wound monitoring, are providing more effective and advanced wound management solutions. For example, in January 2023, investigators at the University of Arizona College of Medicine designed a smart bandage that integrates advanced electronics to accelerate tissue repair. This bandage uses electrical stimulation and biosensors to improve blood flow to the wounded area, promote faster healing, and reduce scar formation. These breakthroughs represent significant developments in wound care, offering enhanced treatment options for patients.

There is a growing focus on developing more environmentally sustainable wound care solutions, driven by concerns over the environmental impact of medical waste and the rising cost of traditional wound care products. To address these issues, biodegradable materials are being incorporated into interactive wound dressings, reducing environmental harm while enhancing sustainability. As a result, the wound care market is expected to see continued collaborations, research initiatives, and the introduction of innovative therapies and products designed to improve wound healing and promote patient well-being. This trend highlights the industry’s shift toward more eco-friendly and cost-effective solutions.

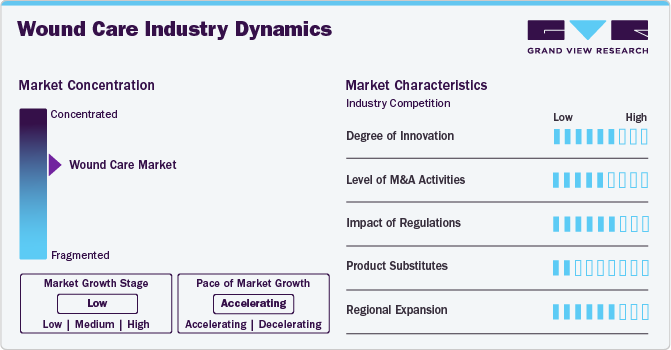

Market Concentration & Characteristics

The market is characterized by growth owing to the rising number of surgical procedures and accidental injuries, along with the increasing prevalence of chronic wounds. Players in the industry and researchers are focusing on developing patient-centered and advanced wound care products

For instance, in September 2023, in response to constant feedback from end users regarding the demand for a larger device with touchscreen capacities and an IV pole attachment, Cork Medical expanded its innovative negative pressure wound therapy (NPWT) line with the introduction of the Nisus Touch. This groundbreaking new device offers unique features specifically designed for the acute inpatient care setting. It provides both partners and clinicians with two NPWT solutions, allowing them to select the most suitable option to address their specific wound care requirements.

Regulatory agencies such as the Food and Drug Administration (FDA), Health Canada, the European Union, and other bodies establish quality and safety standards for medical devices, including wound care products. These devices are classified into different categories based on the associated risk levels, with regulatory scrutiny varying accordingly. For instance, in November 2023, the FDA proposed reclassifying solid wound dressings, wound dressings in gel, cream, or ointment form, and liquid wound washes containing antimicrobials or other chemicals into either Class II or Class III. This classification would require either 510(k) clearance or PMA approval, depending on the specific type and nature of the antimicrobial agents used in the products.

Companies are actively acquiring development-stage firms to broaden their service portfolios, catering to a larger patient base. Major companies may acquire smaller firms to strengthen their market position, expand product portfolios, or gain access to new technologies. For instance, in July 2023, Coloplast revealed the agreement to acquire an Icelandic wound care company, Kerecis for upto USD 1.3 billion to expand its wound care offerings.

The market is highly fragmented. This fragmentation can be attributed to the presence of numerous small, medium, and large firms offering various types of wound care products, such as dressings, wound cleansers, bandages, and devices, among others. For instance, 3M offers adhesive first aid & island dressings, antimicrobial IV dressings, antimicrobial wound dressings, collagen dressings, elastic bandages & tapes, foam dressings, securement dressings & devices, wound contact layers and transparent film dressings under its wound care product lines.

Players in the wound care industry are strategically focusing on provincial expansion to capitalize on emerging prospects and broaden their market presence. In June 2022, Smith+Nephew, a global player in medical technology, announced its decision to invest over USD 100 million in the construction of a new Research & Development (R&D) and manufacturing facility on the outskirts of Hull, UK. This strategic move is part of the company’s broader plan for regional expansion within its advanced wound management portfolio.

Product Insights

The advanced wound dressing segment dominated the market with a revenue share of over 34.96% in 2024 and is expected to register the highest CAGR during the forecast period. Advanced wound dressing is mainly used to treat chronic and non-healing wounds. Thus, increasing the number of chronic wounds, such as diabetic foot ulcers, is expected to help the wound care market propel. For instance, as per NCBI, in August 2023, the incidence of diabetic foot ulcers globally was between 9.1 million and 26.1 million. In addition, about 15% to 25% of patients with diabetes may develop DFUs during their lifetime. Therefore, due to the abovementioned factors, the segment growth is expected to propel during the forecast period.

The surgical wound care segment is anticipated to grow at a considerable growth rate during the forecast period. This can be attributed to rising surgical cases and surgical site infections worldwide. For instance, as per a report by NIH published in January 2023, around 0.5% to 3% of patients undergoing surgery may experience surgical site infection.

Application Insights

The chronic wounds segment held the largest share of 59.84% in 2024. An increasing number of geriatric populations, along with the rising prevalence of diabetic foot ulcers, venous pressure ulcers, and other chronic wounds, is expected to drive the segment's growth. For instance, as per a United Health Foundation report (published in May 2023), more than 55.8 million adults aged 65 and older lived in the U.S., accounting for about 16.8% of the nation's population in 2021.

The acute wound segment is expected to grow at the fastest CAGR of 4.30% during the forecast period. The increasing number of cases of different traumatic wounds and burns is the major factor driving the segment's growth. The multiple benefits of acute wound products include reduced surgical site infections, improved results and patient satisfaction, and reduced hospital stays. There is also an increase in the number of burn wounds across the globe. Since acute wound products are used mainly for treating acute wounds such as traumatic wounds, the use of wound care products is expected to help surge the segment growth.

End-use Insights

The hospital segment held the largest share of 36.30% in 2024. The growth of this segment can be attributed to an increase in surgical procedures across the world because of an inactive lifestyle and rising bariatric surgeries, which require the use of wound care products to contain surgical site infections. Furthermore, surgical wound care dressings and NPWT are especially suitable for hospital use and are not feasible for home care. In addition, hospital institutions are considered large buyers of wound care, having long-term contracts with suppliers. Hence, owing to the aforementioned factors, the segment is anticipated to propel during the forecast period.

The home healthcare segment is anticipated to grow at the fastest CAGR of 5.40% from 2025 to 2030. The demand for home healthcare wound care products surged during the pandemic. Wound care in home settings is primarily driven by the introduction of single-use NPWT systems, which are lightweight, portable, canister-free, and user-friendly. In addition, the cost-effectiveness of these therapies makes home care a preferred option over hospital stays.

Mode Of Purchase Insights

The prescribed segment is anticipated to dominate the market and is projected to grow at the fastest CAGR of 4.95% over the forecast period. The prescribed wound care products depend on the type of product and the severity of the wound. For mild to moderate wounds, over-the-counter wound care products such as bandages, gauze, and antiseptic creams can be purchased at pharmacies, drug stores, or online retailers. For more severe wounds, prescription wound care products such as wound dressings, wound cleansers, and topical antibiotics may be required. These products can only be obtained with a prescription from a healthcare provider and can be purchased at a pharmacy.

The Non-prescribed (OTC) segment is expected to witness considerable growth due to increasing numbers of acute wounds and injuries. Moreover, industry players are also launching non-prescribed wound care products. For instance, in April 2024, a bioelectric bandage, PowerHeal, cleared by the FDA for over-the-counter use for wound management, was made available by Vomaris. Such approvals and launches for non-prescribed wound care products are anticipated to support the segment's growth.

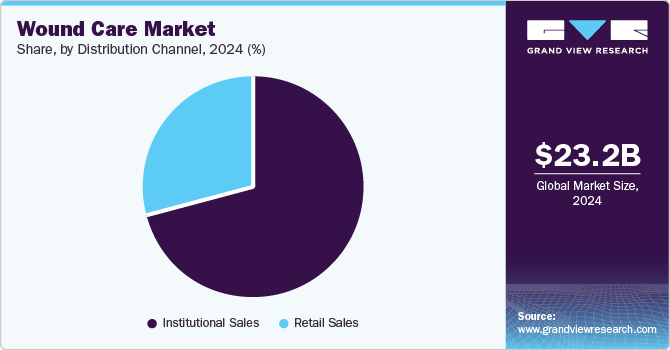

Distribution Channel Insights

The institutional sales segment dominated the market in 2024. Manufacturers usually sell products directly to healthcare providers, such as hospitals and clinics, or to patients through direct-to-consumer marketing. This strategy offers manufacturers greater control over distribution and helps build customer relationships. Institutional sales primarily involve direct distributors and manufacturers, with hospitals, wound care centers, clinics, nursing homes, long-term care facilities, diagnostic labs, and birth centers typically having long-term contracts with distributors and manufacturers. Key players are using these long-term agreements as a strategy to expand their market reach and strengthen their position.

The retail sales segment is expected to experience the fastest growth during the forecast period, with a CAGR of 4.62%. This segment includes retail pharmacies, e-commerce, and other outlets. Pharmacies offer numerous benefits to customers, such as a wide range of delivery options and excellent service. Customers typically purchase both prescription and over-the-counter wound care products, including dressings, ointments, and bandages, from retail pharmacies and specialty stores, which may also provide wound care advice. The e-commerce demand is anticipated to grow due to the convenience, affordability, and accessibility of online stores and mail-order services. The growing availability of wound care products through e-commerce, including the rise of eHealth services, is expected to further boost segment growth.

Regional Insights

North America wound care market held the largest revenue share of more than 45.47% in 2024. The key drivers of growth in the region include a large population base and an increasing patient pool, particularly in the U.S. In addition, the rising geriatric population, which is more prone to wounds, will further boost demand for wound care products. According to Statistics Canada, the proportion of individuals aged 65 and older in the total population is projected to grow from 18.9% in 2023 to between 21.9% (slow-aging scenario) and 32.3% (fast-aging scenario) by 2073.

U.S. Wound Care Market Trends

The wound care market in the U.S. is expected to dominate the North American region over the forecast period due to the presence of key players and the increasing launches of products. For instance, in January 2023, Convatec introduced the ConvaFoam, a family of advanced foam dressings in the U.S. market.

Europe Wound Care Market Trends

The wound care market in Europe is projected to experience significant growth in the coming years, driven by an increase in surgical procedures and greater awareness of wound care management. In addition, rising investments and funding for companies in the wound care industry are expected to further propel market growth. For instance, in April 2023, SolasCure, the developer of Aurase Wound Gel, secured USD 12.67 million in funding. This hydrogel, currently in development, is anticipated to enhance wound debridement processes.

UK wound care market is expected to grow moderately over the forecast period. This growth can be attributed to an aging population, rising chronic conditions like diabetes, and advancements in wound care technologies. Increased healthcare investments, government initiatives, and growing awareness of advanced treatments further boost demand for innovative solutions.

The wound care market in France is projected to grow during the forecast period, driven by the increasing prevalence of chronic conditions, the introduction of innovative products, and significant healthcare spending. For example, in January 2022, Accel-Heal, a wearable electrical stimulation wound management device, was launched in France. This single-use, easy-to-use device helps reduce pain and accelerate the healing of chronic wounds.

Germany wound care market is witnessing steady growth due to various factors, such as the increasing prevalence of chronic diseases, an aging population, and advancements in wound care technologies. Rising healthcare spending and the demand for advanced wound care solutions further support market growth.

Asia Pacific Wound Care Market Trends

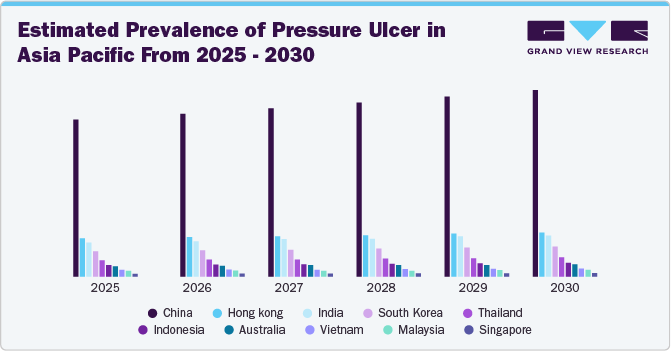

The wound care market in Asia Pacific is expected to register the highest CAGR during the forecast period, driven by significant growth in the wound care industry. Key factors include rising demand for wound care products in Southeast Asian countries such as Indonesia, Malaysia, and Singapore. In addition, increasing healthcare expenditure in Singapore and Malaysia is expected to further boost market growth in the region. Moreover, the large patient population in countries such as India, China and Japan can further propel the market growth over the forecast period.

China wound care market is expected to grow throughout the forecast period, driven by increasing demand for solutions to address the increasing incidence of chronic wounds such as diabetic foot ulcers. According to the study published by the Frontiers in August 2024, the incidence of DFUs ranges from 17.03% to 42.84% (19-22) in China, which is significantly higher than in other nations. Furthermore, the same study also reported a high incidence of amputation among Chinese individuals with DFUs. Thus, such a high incidence of DFUs and amputation is anticipated to boost the demand for wound management products.

The wound care market in Japan is expected to experience substantial growth during the forecast period, driven by several key factors. These include a rising number of surgical procedures across the country, which increases the demand for effective wound care solutions. In addition, Japan's rapidly aging population is a significant driver, as elderly individuals are more prone to chronic wounds, pressure ulcers, and surgical complications.

Middle East & Africa Wound Care Market Trends

The wound care market in the Middle East and Africa is expected to witness significant growth in the coming years due to the rising awareness about wound management, increasing prevalence of chronic diseases, and growing healthcare expenditure. For instance, the UAE Government reserves a substantial share of the federal budget for the healthcare sector every year. As per Federal budget data published in June 2024, around USD 1.33 billion was allocated for 2023, which increased to 1.36 billion in 2024.

Saudi Arabia wound care market is anticipated to grow over the forecast period. The country market is driven by the rising prevalence of chronic conditions like diabetes, an aging population, and growing healthcare investments. Government initiatives to improve healthcare infrastructure, along with increasing awareness of advanced wound care technologies, are further supporting market growth.

The wound care market in Kuwait is expected to grow over the forecast period due to the growing incidence of chronic diseases, particularly diabetes, leading to a rise in diabetic ulcers and other wound-related conditions. Moreover, growing healthcare expenditure propels country market growth.

The increasing prevalence of chronic wounds such as pressure ulcers is anticipated to drive the demand for wound care products. The prevalence of pressure ulcers in China is estimated to increase by around 22.95% from 2024 to 2030. Wound management products such as superabsorbent dressings and antibacterial dressings containing silver are used for treating pressure ulcers. Several major industry players, such as Convatec Group Plc and Mölnlycke Health Care AB, offer dressings for treating pressure ulcers under various brands, such as ConvaMax and Mepilex. Thus, the increasing prevalence of pressure ulcers in numerous countries such as China, India, and South Korea, among others, is anticipated to support the market growth over the forecast period.

Growing Demand For Negative Pressure Wound Therapy (NPWT) Systems

The demand for NPWT is anticipated to increase significantly in the coming years due to the rising incidence of chronic and acute wounds and the increasing launches of NPWT systems. Several major companies operating in the wound care industry have witnessed growth in their revenue due to increasing demand for NPWT systems.

-

For instance, Smith+Nephew reported a growth of 17.0% in the revenue of its Advanced Wound Devices segment in 2023. This growth was driven by both the RENASYS NPWT System and the single-use PICO NPWT System

-

Furthermore, the company also reported continuous demand for its NPWT portfolio in the second quarter (Q2) of 2024. As per the Second Quarter and First Half 2024 Results published by Smith+Nephew, Advanced Wound Devices revenue increased by 8.0% (6.6% reported) due to the robust growth from single-use PICO NPWT System, VERSAJET Hydrosurgery System, and LEAF Patient Monitoring System

“We are pleased with our 2023 performance, led by our Negative Pressure Wound Therapy portfolio where we focused on accelerating growth, delivering on the 12-Point Plan.”Rohit Kashyap,President Advanced Wound Management & Global Commercial Operations Smith+Nephew.

Key Wound Care Company Insights

Smith+Nephew, Convatec Group PLC, Mölnlycke Health Care AB, Baxter, DeRoyal Industries, Inc, Coloplast Corp, Medtronic, 3M, MIMEDX Group, Inc., INTEGRA LIFESCIENCES, Medline Industries, LP, Johnson & Johnson Services, Inc., B. Braun SE, Cardinal Health, and Organogenesis Inc. are some of the major players in the wound care market. Companies are expanding their portfolios of wound care devices, such as NPWT, to gain a competitive advantage in the coming years. Moreover, industry players are also launching antimicrobial wound dressings incorporating silver to meet the growing demand for silver dressings.

Key Wound Care Companies:

The following are the leading companies in the wound care market. These companies collectively hold the largest market share and dictate industry trends.

- Smith+Nephew

- Convatec Group PLC

- Mölnlycke Health Care AB

- Baxter

- DeRoyal Industries, Inc

- Coloplast Corp

- Medtronic

- 3M

- INTEGRA LIFESCIENCES

- Medline Industries, LP

- Johnson & Johnson Services, Inc.

- B. Braun SE

- MIMEDX Group, Inc.

- Cardinal Health

- Organogenesis Inc

- URGO MEDICAL

View a comprehensive list of companies in the Wound Care Market

Recent Developments

-

In September 2024, Solventum launched a new product called the V.A.C. Peel and Place Dressing, which combines both dressing and drape into one integrated solution. This all-in-one dressing can be used for up to seven days and can be applied in under two minutes. In addition, it features a built-in, non-adherent,perforated layer that minimizes tissue ingrowth, making the dressing removal process less painful.

-

In April 2024, Mölnlycke AB agreed to acquire the Austrian manufacturer of Granudacyn wound cleansing and moisturizing solutions, P.G.F. Industry Solutions GmbH. This acquisition will help the company to strengthen its wound cleansing and moisturizing portfolio.

-

In April 2024, Smith+Nephew, a major company operating in the wound care industry, introduced a lightweight and compact NPWT system named the RENASYS EDGE Negative Pressure Wound Therapy (NPWT) System. This system was launched in the U.S. market for treating chronic wounds.

Wound Care Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 24.08 billion |

|

Revenue forecast in 2030 |

USD 29.57 billion |

|

Growth rate |

CAGR of 4.19% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, mode of purchase, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE and Kuwait |

|

Key companies profiled |

Smith+Nephew, Convatec Group PLC, Mölnlycke Health Care AB, Baxter, DeRoyal Industries, Inc, Coloplast Corp, Medtronic, 3M, INTEGRA LIFESCIENCES, MIMEDX Group, Inc., Medline Industries, LP, Johnson & Johnson Services, Inc., B. Braun SE, Cardinal Health, Organogenesis Inc, URGO MEDICAL |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Wound Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wound care market report on the basis of product, application, end-use, mode of purchase, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Wound Dressing

-

Foam Dressings

-

Hydrocolloid Dressings

-

Film Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Other Advanced Dressings

-

-

Surgical Wound Care

-

Sutures & staples

-

Tissue adhesive and sealants

-

Anti-infective dressing

-

-

Traditional Wound Care

-

Medical Tapes

-

Cotton

-

Bandages

-

Gauzes

-

Sponges

-

Cleansing Agents

-

-

Wound Therapy Devices

-

Negative pressure wound therapy

-

Oxygen and hyperbaric oxygen equipment

-

Electric stimulation devices

-

Pressure relief devices

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic foot ulcers

-

Pressure ulcers

-

Venous leg ulcers

-

Other chronic wounds

-

-

Acute Wounds

-

Surgical & traumatic wounds

-

Burns

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Physician’s Office

-

Nursing Homes

-

Others

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescribed

-

Non-prescribed (OTC)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wound care market size was estimated at USD 23.15 billion in 2024 and is expected to reach USD 24.08 billion in 2025.

b. The global wound care market is expected to grow at a compound annual growth rate of 4.19% from 2025 to 2030 to reach USD 29.57 billion by 2030.

b. Advanced wound dressing dominated the wound care market in 2024 with a market share of 34.96% and is expected to witness the fastest growth over the forecast period due to an increase in technological advancement, rising cases of chronic diseases, and an increase in sports-related injuries.

b. Some key players operating in the wound care market include Smith+Nephew, Convatec Group PLC, Mölnlycke Health Care AB, Baxter, DeRoyal Industries, Inc, Coloplast Corp, Medtronic, 3M, INTEGRA LIFESCIENCES, MIMEDX Group, Inc., Medline Industries, LP, Johnson & Johnson Services, Inc., B. Braun SE, Cardinal Health, URGO MEDICAL, and Organogenesis Inc

b. An aging population drives the wound care market, increasing the incidence of chronic diseases such as diabetes, the prevalence of pressure ulcers and venous leg ulcers, and the demand for advanced wound care products and therapies. Technological advancements in wound care products, awareness about wound care management, and favorable reimbursement policies contribute to market growth.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.3. Information Procurement

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Wound Care Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing prevalence of chronic diseases and conditions affecting wound healing capabilities

3.2.1.2. Rising incidence of burn injuries

3.2.1.3. Introduction of innovative and advanced wound products

3.2.1.4. Rising geriatric population

3.2.1.5. Increasing number of road accidents and trauma injuries

3.2.2. Market restraint analysis

3.2.2.1. High cost of advanced wound care products and chronic wound treatments

3.2.2.2. Delayed diagnosis and lower treatment rates in emerging nations

3.2.3. Market opportunity analysis

3.2.3.1. Improvements in public and private hospital infrastructure

3.2.3.2. Growth potential in emerging economies in wound care market

3.2.3.3. Rising number of clinical trials

3.2.4. Market challenge analysis

3.2.4.1. Growing number of product recalls

3.2.4.2. Lack of awareness about proper wound care practices and available treatment options

3.3. Wound Care Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of suppliers

3.3.1.2. Bargaining power of buyers

3.3.1.3. Threat of substitutes

3.3.1.4. Threat of new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political & Legal Landscape

3.3.2.2. Economic and Social Landscape

3.3.2.3. Technological landscape

Chapter 4. Wound Care Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Global Wound Care Market Movement Analysis

4.3. Global Wound Care Market Size & Trend Analysis, by Product, 2018 to 2030 (USD Million)

4.4. Advanced wound dressing

4.4.1. Advanced wound dressing market estimates and forecast 2018 to 2030 (USD Million)

4.4.2. Foam dressings

4.4.2.1. Foam dressings market estimates and forecast 2018 to 2030 (USD Million)

4.4.3. Hydrocolloid dressings

4.4.3.1. Hydrocolloid dressings market estimates and forecast 2018 to 2030 (USD Million)

4.4.4. Film dressings

4.4.4.1. Film dressings market estimates and forecast 2018 to 2030 (USD Million)

4.4.5. Alginate dressings

4.4.5.1. Alginate dressings market estimates and forecast 2018 to 2030 (USD Million)

4.4.6. Hydrogel dressings

4.4.6.1. Hydrogel dressings market estimates and forecast 2018 to 2030 (USD Million)

4.4.7. Collagen dressings

4.4.7.1. Collagen dressings market estimates and forecast 2018 to 2030 (USD Million)

4.4.8. Other advanced dressings

4.4.8.1. Other advanced dressings market estimates and forecast 2018 to 2030 (USD Million)

4.5. Surgical wound care

4.5.1. Surgical wound care market estimates and forecast 2018 to 2030 (USD Million)

4.5.2. Sutures & staples

4.5.2.1. Sutures & staples market estimates and forecast 2018 to 2030 (USD Million)

4.5.3. Tissue adhesives & sealants

4.5.3.1. Tissue adhesives & sealants market estimates and forecast 2018 to 2030 (USD Million)

4.5.4. Anti-infective dressing

4.5.4.1. Anti-infective dressing market estimates and forecast 2018 to 2030 (USD Million)

4.6. Traditional wound care

4.6.1. Traditional wound care market estimates and forecast 2018 to 2030 (USD Million)

4.6.2. Medical tapes

4.6.2.1. Medical tapes market estimates and forecast 2018 to 2030 (USD Million)

4.6.3. Cotton

4.6.3.1. Cotton market estimates and forecast 2018 to 2030 (USD Million)

4.6.4. Bandages

4.6.4.1. Bandages market estimates and forecast 2018 to 2030 (USD Million)

4.6.5. Gauzes

4.6.5.1. Gauzes market estimates and forecast 2018 to 2030 (USD Million)

4.6.6. Sponges

4.6.6.1. Sponges market estimates and forecast 2018 to 2030 (USD Million)

4.6.7. Cleansing agents

4.6.7.1. Cleansing agents market estimates and forecast 2018 to 2030 (USD Million)

4.7. Wound therapy devices

4.7.1. Wound therapy devices market estimates and forecast 2018 to 2030s (USD Million)

4.7.2. Negative pressure wound therapy

4.7.2.1. Negative pressure wound therapy market estimates and forecast 2018 to 2030 (USD Million)

4.7.3. Oxygen and hyperbaric oxygen equipment

4.7.3.1. Oxygen and hyperbaric oxygen equipment market estimates and forecast 2018 to 2030 (USD Million)

4.7.4. Electric stimulation devices

4.7.4.1. Electric stimulation devices market estimates and forecast 2018 to 2030 (USD Million)

4.7.5. Pressure relief devices

4.7.5.1. Pressure relief devices market estimates and forecast 2018 to 2030 (USD Million)

4.7.6. Others

4.7.6.1. Others market estimates and forecast 2018 to 2030 (USD Million)

Chapter 5. Wound Care Market: Application Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Global Wound Care Market Movement Analysis

5.3. Global Wound Care Market Size & Trend Analysis, by Application, 2018 to 2030 (USD Million)

5.4. Acute Wounds

5.4.1. Acute wounds market estimates and forecast 2018 to 2030 (USD Million)

5.4.2. Surgical & traumatic wounds

5.4.2.1. Surgical & traumatic wounds market estimates and forecast 2018 to 2030 (USD Million)

5.4.3. Burns

5.4.3.1. Burns market estimates and forecast 2018 to 2030 (USD Million)

5.5. Chronic Wounds

5.5.1. Chronic wounds market estimates and forecast 2018 to 2030 (USD Million)

5.5.2. Diabetic foot ulcers

5.5.2.1. Diabetic foot ulcers market estimates and forecast 2018 to 2030 (USD Million)

5.5.3. Pressure ulcers

5.5.3.1. Pressure ulcers market estimates and forecast 2018 to 2030 (USD Million)

5.5.4. Venous leg ulcers

5.5.4.1. Venous leg ulcers market estimates and forecast 2018 to 2030 (USD Million)

5.5.5. Others chronic wounds

5.5.5.1. Others chronic wounds market estimates and forecast 2018 to 2030 (USD Million)

Chapter 6. Wound Care Devices: End Use Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Global Wound Care Market Movement Analysis

6.3. Global Wound Care Market Size & Trend Analysis, by End Use, 2018 to 2030 (USD Million)

6.4. Hospitals

6.4.1. Hospitals market estimates and forecast 2018 to 2030 (USD Million)

6.5. Specialty clinics

6.5.1. Specialty clinics centers market estimates and forecast 2018 to 2030 (USD Million)

6.6. Home healthcare

6.6.1. Home healthcare market estimates and forecast 2018 to 2030 (USD Million)

6.7. Physician’s office

6.7.1. Physician’s office market estimates and forecast 2018 to 2030 (USD Million)

6.8. Nursing Homes

6.8.1. Nursing homes market estimates and forecast 2018 to 2030 (USD Million)

6.9. Others

6.9.1. Others market estimates and forecast 2018 to 2030 (USD Million)

Chapter 7. Wound Care Market: Mode of Purchase Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Global Wound Care Market Movement Analysis

7.3. Global Wound Care Market Size & Trend Analysis, by Mode Of Purchase, 2018 to 2030 (USD Million)

7.4. Prescribed

7.4.1. Prescribed market estimates and forecast 2018 to 2030 (USD Million)

7.5. Non-prescribed (OTC)

7.5.1. Non-prescribed (OTC) market estimates and forecast 2018 to 2030 (USD Million)

Chapter 8. Wound Care Market: Distribution Channel Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Global Wound Care Market Movement Analysis

8.3. Global Wound Care Market Size & Trend Analysis, by Distribution Channel, 2018 to 2030 (USD Million)

8.4. Institutional sales

8.4.1. Institutional sales market estimates and forecast 2018 to 2030 (USD Million)

8.5. Retail sales

8.5.1. Retail sales market estimates and forecast 2018 to 2030 (USD Million)

Chapter 9. Wound Care Market: Regional Estimates & Trend Analysis

9.1. Regional Dashboard

9.2. Market Size & Forecasts and Trend Analysis, 2018 to 2030

9.3. North America

9.3.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Million)

9.3.2. U.S.

9.3.2.1. Key country dynamics

9.3.2.2. Competitive scenario

9.3.2.3. Regulatory framework

9.3.2.4. Reimbursement scenario

9.3.2.5. U.S. market estimates and forecasts, 2018 - 2030

9.3.3. Canada

9.3.3.1. Key country dynamics

9.3.3.2. Competitive scenario

9.3.3.3. Regulatory framework

9.3.3.4. Reimbursement scenario

9.3.3.5. Canada market estimates and forecasts, 2018 - 2030

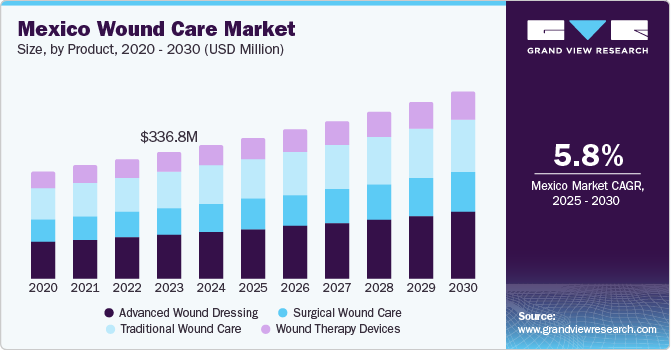

9.3.4. Mexico

9.3.4.1. Key country dynamics

9.3.4.2. Competitive scenario

9.3.4.3. Regulatory framework

9.3.4.4. Reimbursement scenario

9.3.4.5. Mexico market estimates and forecasts, 2018 - 2030

9.4. Europe

9.4.1. UK

9.4.1.1. Key country dynamics

9.4.1.2. Competitive scenario

9.4.1.3. Regulatory framework

9.4.1.4. Reimbursement scenario

9.4.1.5. UK market estimates and forecasts, 2018 - 2030

9.4.2. Germany

9.4.2.1. Key country dynamics

9.4.2.2. Competitive scenario

9.4.2.3. Regulatory framework

9.4.2.4. Reimbursement scenario

9.4.2.5. Germany market estimates and forecasts, 2018 - 2030

9.4.3. France

9.4.3.1. Key country dynamics

9.4.3.2. Competitive scenario

9.4.3.3. Regulatory framework

9.4.3.4. Reimbursement scenario

9.4.3.5. France market estimates and forecasts, 2018 - 2030

9.4.4. Italy

9.4.4.1. Key country dynamics

9.4.4.2. Competitive scenario

9.4.4.3. Regulatory framework

9.4.4.4. Reimbursement scenario

9.4.4.5. Italy market estimates and forecasts, 2018 - 2030

9.4.5. Spain

9.4.5.1. Key country dynamics

9.4.5.2. Competitive scenario

9.4.5.3. Regulatory framework

9.4.5.4. Reimbursement scenario

9.4.5.5. Spain market estimates and forecasts, 2018 - 2030

9.4.6. Denmark

9.4.6.1. Key country dynamics

9.4.6.2. Competitive scenario

9.4.6.3. Regulatory framework

9.4.6.4. Reimbursement scenario

9.4.6.5. Denmark market estimates and forecasts, 2018 - 2030

9.4.7. Sweden

9.4.7.1. Key country dynamics

9.4.7.2. Competitive scenario

9.4.7.3. Regulatory framework

9.4.7.4. Reimbursement scenario

9.4.7.5. Sweden market estimates and forecasts, 2018 - 2030

9.4.8. Norway

9.4.8.1. Key country dynamics

9.4.8.2. Competitive scenario

9.4.8.3. Regulatory framework

9.4.8.4. Reimbursement scenario

9.4.8.5. Norway market estimates and forecasts, 2018 - 2030

9.5. Asia Pacific

9.5.1. Japan

9.5.1.1. Key country dynamics

9.5.1.2. Competitive scenario

9.5.1.3. Regulatory framework

9.5.1.4. Reimbursement scenario

9.5.1.5. Japan market estimates and forecasts, 2018 - 2030

9.5.2. India

9.5.2.1. Key country dynamics

9.5.2.2. Competitive scenario

9.5.2.3. Regulatory framework

9.5.2.4. Reimbursement scenario

9.5.2.5. India market estimates and forecasts, 2018 - 2030

9.5.3. China

9.5.3.1. Key country dynamics

9.5.3.2. Competitive scenario

9.5.3.3. Regulatory framework

9.5.3.4. Reimbursement scenario

9.5.3.5. China market estimates and forecasts, 2018 - 2030

9.5.4. South Korea

9.5.4.1. Key country dynamics

9.5.4.2. Competitive scenario

9.5.4.3. Regulatory framework

9.5.4.4. Reimbursement scenario

9.5.4.5. South Korea market estimates and forecasts, 2018 - 2030

9.5.5. Australia

9.5.5.1. Key country dynamics

9.5.5.2. Competitive scenario

9.5.5.3. Regulatory framework

9.5.5.4. Reimbursement scenario

9.5.5.5. Australia market estimates and forecasts, 2018 - 2030

9.5.6. Thailand

9.5.6.1. Key country dynamics

9.5.6.2. Competitive scenario

9.5.6.3. Regulatory framework

9.5.6.4. Reimbursement scenario

9.5.6.5. Thailand market estimates and forecasts, 2018 - 2030

9.6. Latin America

9.6.1. Brazil

9.6.1.1. Key country dynamics

9.6.1.2. Competitive scenario

9.6.1.3. Regulatory framework

9.6.1.4. Reimbursement scenario

9.6.1.5. Brazil market estimates and forecasts, 2018 - 2030

9.6.2. Argentina

9.6.2.1. Key country dynamics

9.6.2.2. Competitive scenario

9.6.2.3. Regulatory framework

9.6.2.4. Reimbursement scenario

9.6.2.5. Argentina market estimates and forecasts, 2018 - 2030

9.7. MEA

9.7.1. South Africa

9.7.1.1. Key country dynamics

9.7.1.2. Competitive scenario

9.7.1.3. Regulatory framework

9.7.1.4. Reimbursement scenario

9.7.1.5. South Africa market estimates and forecasts, 2018 - 2030

9.7.2. Saudi Arabia

9.7.2.1. Key country dynamics

9.7.2.2. Competitive scenario

9.7.2.3. Regulatory framework

9.7.2.4. Reimbursement scenario

9.7.2.5. Saudi Arabia market estimates and forecasts, 2018 - 2030

9.7.3. UAE

9.7.3.1. Key country dynamics

9.7.3.2. Competitive scenario

9.7.3.3. Regulatory framework

9.7.3.4. Reimbursement scenario

9.7.3.5. UAE market estimates and forecasts, 2018 - 2030

9.7.4. Kuwait

9.7.4.1. Key country dynamics

9.7.4.2. Competitive scenario

9.7.4.3. Regulatory framework

9.7.4.4. Reimbursement scenario

9.7.4.5. Kuwait market estimates and forecasts, 2018 - 2030

Chapter 10. Competitive Landscape

10.1. Market Participant Categorization

10.2. Key Company Profiles

10.2.1. Smith+Nephew

10.2.1.1. Company overview

10.2.1.2. Financial performance

10.2.1.3. Product benchmarking

10.2.1.4. Strategic initiatives

10.2.2. Convatec Group PLC,

10.2.2.1. Company overview

10.2.2.2. Financial performance

10.2.2.3. Product benchmarking

10.2.2.4. Strategic initiatives

10.2.3. Mölnlycke Health Care AB

10.2.3.1. Company overview

10.2.3.2. Financial performance

10.2.3.3. Product benchmarking

10.2.3.4. Strategic initiatives

10.2.4. Baxter

10.2.4.1. Company overview

10.2.4.2. Financial performance

10.2.4.3. Product benchmarking

10.2.4.4. Strategic initiatives

10.2.5. DeRoyal Industries, Inc

10.2.5.1. Company overview

10.2.5.2. Financial performance

10.2.5.3. Product benchmarking

10.2.5.4. Strategic initiatives

10.2.6. Coloplast Corp.

10.2.6.1. Company overview

10.2.6.2. Financial performance

10.2.6.3. Product benchmarking

10.2.6.4. Strategic initiatives

10.2.7. Medtronic

10.2.7.1. Company overview

10.2.7.2. Financial performance

10.2.7.3. Product benchmarking

10.2.7.4. Strategic initiatives

10.2.8. 3M

10.2.8.1. Company overview

10.2.8.2. Financial performance

10.2.8.3. Product benchmarking

10.2.8.4. Strategic initiatives

10.2.9. INTEGRA LIFESCIENCES

10.2.9.1. Company overview

10.2.9.2. Financial performance

10.2.9.3. Product benchmarking

10.2.9.4. Strategic initiatives

10.2.10. Medline Industries, LP

10.2.10.1. Company overview

10.2.10.2. Financial performance

10.2.10.3. Product benchmarking

10.2.10.4. Strategic initiatives

10.2.11. Johnson & Johnson Services, Inc.

10.2.11.1. Company overview

10.2.11.2. Financial performance

10.2.11.3. Product benchmarking

10.2.11.4. Strategic initiatives

10.2.12. B. Braun SE

10.2.12.1. Company overview

10.2.12.2. Financial performance

10.2.12.3. Product benchmarking

10.2.12.4. Strategic initiatives

10.2.13. Cardinal Health

10.2.13.1. Company overview

10.2.13.2. Financial performance

10.2.13.3. Product benchmarking

10.2.13.4. Strategic initiatives

10.2.14. Organogenesis Inc

10.2.14.1. Company overview

10.2.14.2. Financial performance

10.2.14.3. Product benchmarking

10.2.14.4. Strategic initiatives

10.2.15. MIMEDX Group, Inc.

10.2.15.1. Company overview

10.2.15.2. Financial performance

10.2.15.3. Product benchmarking

10.2.15.4. Strategic initiatives

10.2.16. URGO MEDICAL

10.2.16.1. Company overview

10.2.16.2. Financial performance

10.2.16.3. Product benchmarking

10.2.16.4. Strategic initiatives

10.3. Heat Map Analysis/ Company Market Position Analysis

10.4. Estimated Company Market Share Analysis, 2024

10.5. List of Other Key Market Players

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviation

Table 3 North America wound care market, by country, 2018 - 2030 (USD Million)

Table 4 North America wound care market, by product, 2018 - 2030 (USD Million)

Table 5 North America wound care market, by application, 2018 - 2030 (USD Million)

Table 6 North America wound care market, by end use, 2018 - 2030 (USD Million)

Table 7 North America wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 8 North America wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 9 U.S. wound care market, by product, 2018 - 2030 (USD Million)

Table 10 U.S. wound care market, by application, 2018 - 2030 (USD Million)

Table 11 U.S. wound care market, by end use, 2018 - 2030 (USD Million)

Table 12 U.S. wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 13 U.S. wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 14 Canada wound care market, by product, 2018 - 2030 (USD Million)

Table 15 Canada wound care market, by application, 2018 - 2030 (USD Million)

Table 16 Canada wound care market, by end use, 2018 - 2030 (USD Million)

Table 17 Canada wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 18 Canada wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 19 Mexico wound care market, by product, 2018 - 2030 (USD Million)

Table 20 Mexico wound care market, by application, 2018 - 2030 (USD Million)

Table 21 Mexico wound care market, by end use, 2018 - 2030 (USD Million)

Table 22 Mexico wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 23 Mexico wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 24 Europe wound care market, by country, 2018 - 2030 (USD Million)

Table 25 Europe wound care market, by product, 2018 - 2030 (USD Million)

Table 26 Europe wound care market, by application, 2018 - 2030 (USD Million)

Table 27 Europe wound care market, by end use, 2018 - 2030 (USD Million)

Table 28 Europe wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 29 Europe wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 30 UK wound care market, by product, 2018 - 2030 (USD Million)

Table 31 UK wound care market, by application, 2018 - 2030 (USD Million)

Table 32 UK wound care market, by end use, 2018 - 2030 (USD Million)

Table 33 UK wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 34 UK wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 35 Germany wound care market, by product, 2018 - 2030 (USD Million)

Table 36 Germany wound care market, by application, 2018 - 2030 (USD Million)

Table 37 Germany wound care market, by end use, 2018 - 2030 (USD Million)

Table 38 Germany wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 39 Germany wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 40 France wound care market, by product, 2018 - 2030 (USD Million)

Table 41 France wound care market, by application, 2018 - 2030 (USD Million)

Table 42 France wound care market, by end use, 2018 - 2030 (USD Million)

Table 43 France wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 44 France wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 45 Italy wound care market, by product, 2018 - 2030 (USD Million)

Table 46 Italy wound care market, by application, 2018 - 2030 (USD Million)

Table 47 Italy wound care market, by end use, 2018 - 2030 (USD Million)

Table 48 Italy wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 49 Italy wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 50 Spain wound care market, by product, 2018 - 2030 (USD Million)

Table 51 Spain wound care market, by application, 2018 - 2030 (USD Million)

Table 52 Spain wound care market, by end use, 2018 - 2030 (USD Million)

Table 53 Spain wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 54 Spain wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 55 Denmark wound care market, by product, 2018 - 2030 (USD Million)

Table 56 Denmark wound care market, by application, 2018 - 2030 (USD Million)

Table 57 Denmark wound care market, by end use, 2018 - 2030 (USD Million)

Table 58 Denmark wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 59 Denmark wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 60 Sweden wound care market, by product, 2018 - 2030 (USD Million)

Table 61 Sweden wound care market, by application, 2018 - 2030 (USD Million)

Table 62 Sweden wound care market, by end use, 2018 - 2030 (USD Million)

Table 63 Sweden wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 64 Sweden wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 65 Norway wound care market, by product, 2018 - 2030 (USD Million)

Table 66 Norway wound care market, by application, 2018 - 2030 (USD Million)

Table 67 Norway wound care market, by end use, 2018 - 2030 (USD Million)

Table 68 Norway wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 69 Norway wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 70 Asia Pacific wound care market, by country, 2018 - 2030 (USD Million)

Table 71 Asia Pacific wound care market, by product, 2018 - 2030 (USD Million)

Table 72 Asia Pacific wound care market, by application, 2018 - 2030 (USD Million)

Table 73 Asia Pacific wound care market, by end use, 2018 - 2030 (USD Million)

Table 74 Asia Pacific wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 75 Asia Pacific wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 76 China wound care market, by product, 2018 - 2030 (USD Million)

Table 77 China wound care market, by application, 2018 - 2030 (USD Million)

Table 78 China wound care market, by end use, 2018 - 2030 (USD Million)

Table 79 China wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 80 China wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 81 Japan wound care market, by product, 2018 - 2030 (USD Million)

Table 82 Japan wound care market, by application, 2018 - 2030 (USD Million)

Table 83 Japan wound care market, by end use, 2018 - 2030 (USD Million)

Table 84 Japan wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 85 Japan wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 86 India wound care market, by product, 2018 - 2030 (USD Million)

Table 87 India wound care market, by application, 2018 - 2030 (USD Million)

Table 88 India wound care market, by end use, 2018 - 2030 (USD Million)

Table 89 India wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 90 India wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 91 South Korea wound care market, by product, 2018 - 2030 (USD Million)

Table 92 South Korea wound care market, by application, 2018 - 2030 (USD Million)

Table 93 South Korea wound care market, by end use, 2018 - 2030 (USD Million)

Table 94 South Korea wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 95 South Korea wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 96 Australia wound care market, by product, 2018 - 2030 (USD Million)

Table 97 Australia wound care market, by application, 2018 - 2030 (USD Million)

Table 98 Australia wound care market, by end use, 2018 - 2030 (USD Million)

Table 99 Australia wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 100 Australia wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 101 Thailand wound care market, by product, 2018 - 2030 (USD Million)

Table 102 Thailand wound care market, by application, 2018 - 2030 (USD Million)

Table 103 Thailand wound care market, by end use, 2018 - 2030 (USD Million)

Table 104 Thailand wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 105 Thailand wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 106 Latin America wound care market, by country, 2018 - 2030 (USD Million)

Table 107 Latin America wound care market, by product, 2018 - 2030 (USD Million)

Table 108 Latin America wound care market, by application, 2018 - 2030 (USD Million)

Table 109 Latin America wound care market, by end use, 2018 - 2030 (USD Million)

Table 110 Latin America wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 111 Latin America wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 112 Brazil wound care market, by product, 2018 - 2030 (USD Million)

Table 113 Brazil wound care market, by application, 2018 - 2030 (USD Million)

Table 114 Brazil wound care market, by end use, 2018 - 2030 (USD Million)

Table 115 Brazil wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 116 Brazil wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 117 Mexico wound care market, by product, 2018 - 2030 (USD Million)

Table 118 Mexico wound care market, by application, 2018 - 2030 (USD Million)

Table 119 Mexico wound care market, by end use, 2018 - 2030 (USD Million)

Table 120 Mexico wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 121 Mexico wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 122 Argentina wound care market, by product, 2018 - 2030 (USD Million)

Table 123 Argentina wound care market, by application, 2018 - 2030 (USD Million)

Table 124 Argentina wound care market, by end use, 2018 - 2030 (USD Million)

Table 125 Argentina wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 126 Argentina wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 127 Middle East & Africa wound care market, by country, 2018 - 2030 (USD Million)

Table 128 Middle East & Africa wound care market, by product, 2018 - 2030 (USD Million)

Table 129 Middle East & Africa wound care market, by application, 2018 - 2030 (USD Million)

Table 130 Middle East & Africa wound care market, by end use, 2018 - 2030 (USD Million)

Table 131 Middle East & Africa wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 132 Middle East & Africa wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 133 South Africa wound care market, by product, 2018 - 2030 (USD Million)

Table 134 South Africa wound care market, by application, 2018 - 2030 (USD Million)

Table 135 South Africa wound care market, by end use, 2018 - 2030 (USD Million)

Table 136 South Africa wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 137 South Africa wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 138 Saudi Arabia wound care market, by product, 2018 - 2030 (USD Million)

Table 139 Saudi Arabia wound care market, by application, 2018 - 2030 (USD Million)

Table 140 Saudi Arabia wound care market, by end use, 2018 - 2030 (USD Million)

Table 141 Saudi Arabia wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 142 Saudi Arabia wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 143 UAE wound care market, by product, 2018 - 2030 (USD Million)

Table 144 UAE wound care market, by application, 2018 - 2030 (USD Million)

Table 145 UAE wound care market, by end use, 2018 - 2030 (USD Million)

Table 146 UAE wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 147 UAE wound care market, by distribution channel, 2018 - 2030 (USD Million)

Table 148 Kuwait wound care market, by product, 2018 - 2030 (USD Million)

Table 149 Kuwait wound care market, by application, 2018 - 2030 (USD Million)

Table 150 Kuwait wound care market, by end use, 2018 - 2030 (USD Million)

Table 151 Kuwait wound care market, by mode of purchase, 2018 - 2030 (USD Million)

Table 152 Kuwait wound care market, by distribution channel, 2018 - 2030 (USD Million

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Wound Care Market, Market Segmentation

Fig. 7 Market Driver Analysis (Current & Future Impact)

Fig. 8 Market Restraint Analysis (Current & Future Impact)

Fig. 9 Market Opportunity Analysis (Current & Future Impact)

Fig. 10 Market Challenge Analysis (Current & Future Impact)

Fig. 11 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 12 Porter’s Five Forces Analysis

Fig. 13 Regional Marketplace: Key Takeaways

Fig. 14 Global Wound Care Market, for Product, 2018 - 2030 (USD Million)

Fig. 15 Global Wound Care Market, for Advanced Wound Dressing, 2018 - 2030 (USD Million)

Fig. 16 Global Wound Care Market, for Foam Dressings, 2018 - 2030 (USD Million)

Fig. 17 Global Wound Care Market, for Hydrocolloid Dressings, 2018 - 2030 (USD Million)

Fig. 18 Global Wound Care Market, for Film Dressings, 2018 - 2030 (USD Million)

Fig. 19 Global Wound Care Market, for Alginate Dressings, 2018 - 2030 (USD Million)

Fig. 20 Global Wound Care Market, for Hydrogel Dressings, 2018 - 2030 (USD Million)

Fig. 21 Global Wound Care Market, for Collagen Dressings, 2018 - 2030 (USD Million)

Fig. 22 Global Wound Care Market, for Other Advanced Dressings, 2018 - 2030 (USD Million)

Fig. 23 Global Wound Care Market, for Surgical Wound Care, 2018 - 2030 (USD Million)

Fig. 24 Global Wound Care Market, for Sutures & Staples, 2018 - 2030 (USD Million)

Fig. 25 Global Wound Care Market, for Tissue Adhesives and Sealants, 2018 - 2030 (USD Million)

Fig. 26 Global Wound Care Market, for Anti-infective Dressing, 2018 - 2030 (USD Million)

Fig. 27 Global Wound Care Market, for Traditional Wound Care, 2018 - 2030 (USD Million)

Fig. 28 Global Wound Care Market, for Medical Tapes, 2018 - 2030 (USD Million)

Fig. 29 Global Wound Care Market, for Cotton, 2018 - 2030 (USD Million)

Fig. 30 Global Wound Care Market, for Bandages, 2018 - 2030 (USD Million)

Fig. 31 Global Wound Care Market, for Gauzes, 2018 - 2030 (USD Million)

Fig. 32 Global Wound Care Market, for Sponges, 2018 - 2030 (USD Million)

Fig. 33 Global Wound Care Market, for Cleansing Agents, 2018 - 2030 (USD Million)

Fig. 34 Global Wound Care Market, for Wound Therapy Devices, 2018 - 2030 (USD Million)

Fig. 35 Global Wound Care Market, for Negative Pressure Wound Therapy, 2018 - 2030 (USD Million)

Fig. 36 Global Wound Care Market, for Oxygen and Hyperbaric Oxygen Equipment, 2018 - 2030 (USD Million)

Fig. 37 Global Wound Care Market, for Electric Stimulation Devices, 2018 - 2030 (USD Million)

Fig. 38 Global Wound Care Market, for Pressure Relief Devices, 2018 - 2030 (USD Million)

Fig. 39 Global Wound Care Market, for Others, 2018 - 2030 (USD Million)

Fig. 40 Global Wound Care Market, for Application, 2018 - 2030 (USD Million)

Fig. 41 Global Wound Care Market, for Acute Wound, 2018 - 2030 (USD Million)

Fig. 42 Global Wound Care Market, for Surgical & Traumatic Wounds, 2018 - 2030 (USD Million)

Fig. 43 Global Wound Care Market, for Burns, 2018 - 2030 (USD Million)

Fig. 44 Global Wound Care Market, for Chronic Wound, 2018 - 2030 (USD Million)

Fig. 45 Global Wound Care Market, for Diabetic Foot Ulcers, 2018 - 2030 (USD Million)

Fig. 46 Global Wound Care Market, for Pressure Ulcers, 2018 - 2030 (USD Million)

Fig. 47 Global Wound Care Market, for Venous Leg Ulcers, 2018 - 2030 (USD Million)

Fig. 48 Global Wound Care Market, for Others Chronic Wounds, 2018 - 2030 (USD Million)

Fig. 49 Global Wound Care Market, for End Use, 2018 - 2030 (USD Million)

Fig. 50 Global Wound Care Market, for Hospitals, 2018 - 2030 (USD Million)

Fig. 51 Global Wound Care Market, for Specialty Clinics, 2018 - 2030 (USD Million)

Fig. 52 Global Wound Care Market, for Home Healthcare, 2018 - 2030 (USD Million)

Fig. 53 Global Wound Care Market, for Physician’s Office, 2018 - 2030 (USD Million)

Fig. 54 Global Wound Care Market, for Nursing Homes, 2018 - 2030 (USD Million)

Fig. 55 Global Wound Care Market, for Others, 2018 - 2030 (USD Million)

Fig. 56 Global Wound Care Market, for Distribution Channel, 2018 - 2030 (USD Million)

Fig. 57 Global Wound Care Market, for Institutional Sales, 2018 - 2030 (USD Million)

Fig. 58 Global Wound Care Market, for Retail Sales, 2018 - 2030 (USD Million)

Fig. 59 Global Wound Care Market, for Mode of Purchase, 2018 - 2030 (USD Million)

Fig. 60 Global Wound Care Market, for Prescribed, 2018 - 2030 (USD Million)

Fig. 61 Global Wound Care Market, for Non-prescribed (OTC), 2018 - 2030 (USD Million)

Fig. 62 Regional Outlook, 2024 & 2030

Fig. 63 North America Wound Care Market, 2018 - 2030 (USD Million)

Fig. 64 U.S. Wound Care Market, 2018 - 2030 (USD Million)

Fig. 65 Canada Wound Care Market, 2018 - 2030 (USD Million)

Fig. 66 Mexico Wound Care Market, 2018 - 2030 (USD Million)

Fig. 67 Europe Wound Care Market, 2018 - 2030 (USD Million)

Fig. 68 Germany Wound Care Market, 2018 - 2030 (USD Million)

Fig. 69 UK Wound Care Market, 2018 - 2030 (USD Million)

Fig. 70 France Wound Care Market, 2018 - 2030 (USD Million)

Fig. 71 Italy Wound Care Market, 2018 - 2030 (USD Million)

Fig. 72 Spain Wound Care Market, 2018 - 2030 (USD Million)

Fig. 73 Denmark Wound Care Market, 2018 - 2030 (USD Million)

Fig. 74 Sweden Wound Care Market, 2018 - 2030 (USD Million)

Fig. 75 Norway Wound Care Market, 2018 - 2030 (USD Million)

Fig. 76 Asia Pacific Wound Care Market, 2018 - 2030 (USD Million)

Fig. 77 Japan Wound Care Market, 2018 - 2030 (USD Million)

Fig. 78 China Wound Care Market, 2018 - 2030 (USD Million)

Fig. 79 India Wound Care Market, 2018 - 2030 (USD Million)

Fig. 80 Australia Wound Care Market, 2018 - 2030 (USD Million)

Fig. 81 South Korea Wound Care Market, 2018 - 2030 (USD Million)

Fig. 82 Thailand Wound Care Market, 2018 - 2030 (USD Million)

Fig. 83 Latin America Wound Care Market, 2018 - 2030 (USD Million)

Fig. 84 Brazil Wound Care Market, 2018 - 2030 (USD Million)

Fig. 85 Argentina Wound Care Market, 2018 - 2030 (USD Million)

Fig. 86 Middle East and Africa Wound Care Market, 2018 - 2030 (USD Million)

Fig. 87 South Africa Wound Care Market, 2018 - 2030 (USD Million)

Fig. 88 Saudi Arabia Wound Care Market, 2018 - 2030 (USD Million)

Fig. 89 UAE Wound Care Market, 2018 - 2030 (USD Million)

Fig. 90 Kuwait Wound Care Market, 2018 - 2030 (USD Million)

Market Segmentation

- Wound Care Product Outlook (Revenue, USD Million, 2018 - 2030)

- Advanced Wound Dressing

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

- Surgical Wound Care

- Sutures & Staples

- Tissue Adhesives and Sealants

- Anti-infective Dressing

- Traditional Wound Care

- Medical Tapes

- Cotton

- Bandages

- Gauzes

- Sponges

- Cleansing Agents

- Wound Therapy Devices

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Electric Stimulation Devices

- Pressure Relief Devices

- Others

- Advanced Wound Dressing

- Wound Care Application Outlook (Revenue, USD Million, 2018 - 2030)

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

- Chronic Wounds

- Wound Care End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Specialty Clinics

- Home healthcare

- Physician’s Office

- Nursing Homes

- Others

- Wound Care Mode of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

- Prescribed

- Non-prescribed (OTC)

- Wound Care Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Institutional Sales

- Retail Sales

- Wound Care Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Wound Care Market, by Product

- Advanced Wound Dressing

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

- Surgical Wound Care

- Sutures & Staples

- Tissue Adhesives and Sealants

- Anti-infective Dressing

- Traditional Wound Care

- Medical Tapes

- Cotton

- Bandages

- Gauzes

- Sponges

- Cleansing Agents

- Wound Therapy Devices

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Electric Stimulation Devices

- Pressure Relief Devices

- Others

- Advanced Wound Dressing

- North America Wound Care Market, by Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

- North America Wound Care Market, by End Use

- Hospitals

- Outpatient Facilities

- Home Care

- Research & Manufacturing

- North America Wound Care Market, by Mode of Purchase

- Prescribed

- Non-prescribed (OTC)

- North America Wound Care Market, by Distribution Channel

- Institutional Sales

- Retail Sales

- U.S.

- U.S. Wound Care Market, by Product

- Advanced Wound Dressing

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

- Surgical Wound Care

- Sutures & Staples

- Tissue Adhesives and Sealants

- Anti-infective Dressing

- Traditional Wound Care

- Medical Tapes

- Cotton

- Bandages

- Gauzes

- Sponges

- Cleansing Agents

- Wound Therapy Devices

- Medical Tapes

- Cotton

- Bandages

- Gauzes

- Sponges

- Cleansing Agents

- Advanced Wound Dressing

- U.S. Wound Care Market, by Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

- Chronic Wounds

- U.S. Wound Care Market, by End Use

- Hospitals

- Specialty Clinics

- Home healthcare

- Physician’s Office

- Nursing Homes

- Others

- U.S. Wound Care Market, by Mode of Purchase

- Prescribed

- Non-prescribed (OTC)

- U.S. Wound Care Market, by Distribution Channel

- Institutional Sales

- Retail Sales

- U.S. Wound Care Market, by Product

- Canada

- Canada Wound Care Market, by Product

- Advanced Wound Dressing

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

- Surgical Wound Care

- Sutures & Staples

- Tissue Adhesives and Sealants

- Anti-infective Dressing

- Traditional Wound Care

- Medical Tapes

- Cotton

- Bandages

- Gauzes

- Sponges

- Cleansing Agents

- Wound Therapy Devices

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Electric Stimulation Devices

- Pressure Relief Devices

- Others

- Advanced Wound Dressing

- Canada Wound Care Market, by Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

- Chronic Wounds

- Canada Wound Care Market, by End Use

- Hospitals

- Specialty Clinics

- Home healthcare

- Physician’s Office

- Nursing Homes

- Others

- Canada Wound Care Market, by Mode of Purchase

- Prescribed

- Non-prescribed (OTC)

- Canada Wound Care Market, by Distribution Channel

- Institutional Sales

- Retail Sales

- Canada Wound Care Market, by Product

- Mexico

- Mexico Wound Care Market, by Product

- Advanced Wound Dressing

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

- Surgical Wound Care

- Sutures & Staples

- Tissue Adhesives and Sealants

- Anti-infective Dressing

- Traditional Wound Care

- Medical Tapes

- Cotton

- Bandages

- Gauzes

- Sponges

- Cleansing Agents

- Wound Therapy Devices

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Electric Stimulation Devices

- Pressure Relief Devices

- Others

- Advanced Wound Dressing

- Mexico Wound Care Market, by Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

- Chronic Wounds

- Mexico Wound Care Market, by End Use

- Hospitals

- Specialty Clinics

- Home healthcare

- Physician’s Office

- Nursing Homes

- Others

- Mexico Wound Care Market, by Mode of Purchase

- Prescribed

- Non-prescribed (OTC)

- Mexico Wound Care Market, by Distribution Channel

- Institutional Sales

- Retail Sales

- Mexico Wound Care Market, by Product

- North America Wound Care Market, by Product

- Europe

- Europe Wound Care Market, by Product

- Advanced Wound Dressing

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

- Surgical Wound Care

- Sutures & Staples

- Tissue Adhesives and Sealants

- Anti-infective Dressing

- Traditional Wound Care

- Medical Tapes

- Cotton

- Bandages

- Gauzes

- Sponges

- Cleansing Agents

- Wound Therapy Devices

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Electric Stimulation Devices

- Pressure Relief Devices

- Others

- Advanced Wound Dressing

- Europe Wound Care Market, by Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

- Chronic Wounds

- Europe Wound Care Market, by End Use

- Hospitals

- Specialty Clinics

- Home healthcare

- Physician’s Office

- Nursing Homes

- Others

- Europe Wound Care Market, by Mode of Purchase

- Prescribed

- Non-prescribed (OTC)

- Europe Wound Care Market, by Distribution Channel

- Institutional Sales

- Retail Sales

- UK

- UK Wound Care Market, by Product

- Advanced Wound Dressing

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

- Surgical Wound Care

- Sutures & Staples

- Tissue Adhesives and Sealants

- Anti-infective Dressing

- Traditional Wound Care

- Medical Tapes

- Cotton

- Bandages

- Gauzes

- Sponges

- Cleansing Agents

- Wound Therapy Devices

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Electric Stimulation Devices

- Pressure Relief Devices

- Others

- Advanced Wound Dressing

- UK Wound Care Market, by Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

- Chronic Wounds

- UK Wound Care Market, by End Use

- Hospitals

- Specialty Clinics

- Home healthcare

- Physician’s Office

- Nursing Homes

- Others

- UK Wound Care Market, by Mode of Purchase

- Prescribed

- Non-prescribed (OTC)

- UK Wound Care Market, by Distribution Channel

- Institutional Sales

- Retail Sales

- UK Wound Care Market, by Product

- Germany.

- Germany Wound Care Market, by Product

- Advanced Wound Dressing

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

- Surgical Wound Care

- Sutures & Staples

- Tissue Adhesives and Sealants

- Anti-infective Dressing

- Traditional Wound Care

- Medical Tapes

- Cotton

- Bandages

- Gauzes

- Sponges

- Cleansing Agents

- Wound Therapy Devices

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Electric Stimulation Devices

- Pressure Relief Devices

- Others

- Advanced Wound Dressing

- Germany Wound Care Market, by Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

- Chronic Wounds

- Germany Wound Care Market, by End Use

- Hospitals

- Specialty Clinics

- Home healthcare

- Physician’s Office

- Nursing Homes

- Others

- Germany Wound Care Market, by Mode of Purchase

- Prescribed

- Non-prescribed (OTC)