Workwear Market Size, Share & Trends Analysis Report By Demography (Men, Women), By Product (Work Apparel, Work Footwear), By Application (Construction, Chemical, Food And Beverage, Biological/Healthcare), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-186-3

- Number of Report Pages: 121

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Workwear Market Size & Trends

The global workwear market size was estimated at USD 17.72 billion in 2023 and is expected to grow at a CAGR of 4.5% from 2024 to 2030. Technological advancements in the textile industry and rising employment rates across various sectors have driven the market growth. In the second quarter of 2023, the Organisation for Economic Co-operation and Development (OECD) recorded employment and labor force participation rates at 70.1% and 73.7%, respectively-the highest since 2005 and 2008. Around 19 out of 38 OECD countries, including France, Germany, Italy, and Japan, reported record highs in both indicators.

Workwear finds greater significance in the construction industry due to the risk of severe injuries in the absence of adequate safety measures. Increased employment in this sector has fueled the need for appropriate workwear. In December 2023, the construction industry saw an addition of 17,000 jobs, according to the Associated Builders and Contractors analysis of data released by the U.S. Bureau of Labor Statistics. Industry employment also increased by 197,000 jobs year-over-year, marking a 2.5% growth. Companies are prioritizing the safety of construction workers through appropriate workwear and protective gear, as failure to use them can lead to severe consequences for both organizations and employees.

The market is also driven by product innovations and advanced technologies. Noticing a high demand for innovative workwear, prominent market players have been upgrading their technologies over the years. For instance, in June 2023, Alexandra Workwear introduced its Eco range, featuring innovative garment technologies and fibers. Initially targeting healthcare professionals, the line was extended to those in the beauty, dentistry, and veterinary sectors. The garments are constructed from a blend of Tencel and polyester and are lightweight and breathable. Tencel fibers efficiently absorb moisture to create a less favorable environment for bacterial growth, enhancing hygiene in clinical settings and keeping the wearer cooler.

Advancements in workwear material technology have transformed numerous sectors by offering workers durable and high-performance clothing, boosting their effectiveness, and guaranteeing their safety at work. By incorporating innovative technologies like functional fabrics and durable materials, workers can remain efficient and protected in challenging environments. Safety is the top priority across industries like biotechnology, construction, and chemicals, where flame-resistant materials play a crucial role. These advanced fabrics are designed to withstand flames, protecting workers from risks like sparks and open flames.

Market Concentration & Characteristics

The market demonstrates a high degree of innovation. Players are integrating advanced materials, such as moisture-wicking fabrics, flame-resistant materials, and high-performance textiles, to enhance comfort, durability, and safety. At the same time, the availability and affordability of substitutes, like casual clothing or alternative forms of personal protective equipment (PPE), could impact the workwear market’s attractiveness. The threat of substitutes considers the extent to which alternative products could fulfill the same needs as workwear.

The workwear market navigates a complex regulatory landscape, including safety standards, environmental regulations, and labor laws. Adhering to safety regulations is paramount, particularly in high-risk environments where workwear must meet stringent requirements such as flame resistance or high-visibility ratings. Moreover, environmental regulations are prompting the industry to embrace sustainability, necessitating shifts in material sourcing, manufacturing methods, and waste management practices.

Product Insights

The work apparel market accounted for a revenue share of 75.0% in 2023. Workers are often exposed to extreme working conditions that can cause heat-related health concerns, such as fainting, heat strokes, and dehydration. This has forced workwear brands to develop innovative fabric and apparel technologies to control heat and create a safer environment for workers. Technological advancements in fabric and design enable manufacturers to produce more protective, comfortable, and durable workwear, enhancing worker compliance with safety gear. For instance, AS Color has pledged to encourage sustainable cotton production through the Better Cotton Initiative.

The work footwear market is expected to grow at a CAGR of 5.2% from 2024 to 2030. This growth can be attributed to a combination of trends and factors, primarily the increasing focus on and presence of workplace safety regulations spanning diverse industries. The mandate on using protective footwear to safeguard against potential hazards and accidents drives segment growth. This is particularly true for industries such as construction, manufacturing, and mining, where protective gear is essential.

Demography Insights

Men’s workwear accounted for a revenue share of 87.3% in 2023. The growing popularity of fashionable and comfortable workwear that can withstand daily wear and tear has encouraged manufacturers to widen their product lines to include different products, such as painters’ clothing, mechanic uniforms, and hospital uniforms. Moreover, there is a growing trend of merging fashion with functionality, where workwear is designed to be both practical for the workplace and stylish for casual wear, thus attracting a broader customer base.

Women’s workwear is projected to grow at a CAGR of 4.8% from 2024 to 2030. The increasing demand for comfortable and durable workwear among working women has encouraged manufacturers to offer a wide range of products. For instance, Carhartt offers a comprehensive range of durable women's work apparel and footwear; Red Wing Shoes is known for its high-quality, safety-standard-compliant work boots designed for women; and Patagonia Workwear emphasizes durability, functionality, and sustainable production in its work apparel. These developments underscore a broader industry shift toward inclusivity, sustainability, and innovation, catering to the evolving needs and preferences of the female workforce.

Application Insights

Construction workwear accounted for a revenue share of 23.9% in 2023. Construction sites are inherently hazardous environments, leading to a heightened emphasis on safety measures. Work footwear and apparel are designed to protect against potential hazards such as falls, impacts, and electrical shocks, making them essential for workers' safety. For instance, modern workwear might incorporate moisture-wicking fabrics that help keep workers dry or UV-protective materials for outdoor work. In addition, the integration of smart technology into workwear, such as GPS trackers for real-time location monitoring or sensors that monitor health indicators, is a notable trend in enhancing worker safety and efficiency.

Biological/healthcare workwear is expected to grow at a CAGR of 5.4% from 2024 to 2030. In the healthcare sector, the demand for specialized footwear and apparel is on the rise, primarily due to the increased emphasis on infection control and hygiene protocols within facilities. This drives the need for protective clothing that can effectively mitigate the spread of pathogens and contaminants. As healthcare workers routinely encounter various hazards, such as biological fluids, chemicals, and infectious agents, the importance of appropriate workwear cannot be overstated.

Regional Insights

The North America workwear market is expected to grow at a CAGR of 3.9% from 2024 to 2030. Workwear is a significant segment within North America's apparel and footwear industry, catering to various sectors such as manufacturing, construction, healthcare, and hospitality. Carhartt, Inc.; Berne Apparel; Camber Sportswear, Inc.; and ExtremeGuard, Inc. are among the prominent players in North America. The region has stringent safety regulations and standards for workplaces across different industries and this governs trends and practices in the market. Depending on the industry, employers must provide appropriate workwear, including protective clothing, high-visibility garments, flame-resistant apparel, and other specialized workwear for safety purposes.

U.S. Workwear Market Trends

The workwear market in the U.S. is expected to grow at a CAGR of 3.8% from 2024 to 2030. The U.S. has stringent occupational safety regulations enforced by agencies such as the Occupational Safety and Health Administration (OSHA). In line with these regulations, there is a high demand for specialized workwear to protect workers from workplace hazards such as falls, impacts, and chemical exposure. In January 2024, the U.S. Department of Labor initiated a multi-year program to reduce worker fatalities and injuries within the tree and landscape services sectors across New Jersey, New York, Puerto Rico, and the U.S. Virgin Islands. This program, administered by OSHA, focuses on enhancing safety measures for workers and employers in these regions. Such initiatives are likely to boost awareness among employers to prioritize employee safety and injury prevention, subsequently driving the market growth.

Europe Workwear Market Trends

The workwear market in Europe is expected to grow at a CAGR of 3.5% from 2024 to 2030. The increasing inclination of consumers across all age demographics toward professional attire that prioritizes comfort propels the demand for workwear in Europe. Moreover, the rising trend of incorporating workwear into casual outfits in Europe is expected to stimulate demand in the foreseeable future. The presence of stylish workwear options in developed nations like Germany, the UK, and France, alongside an upsurge in consumer expenditure, is projected to drive market growth.

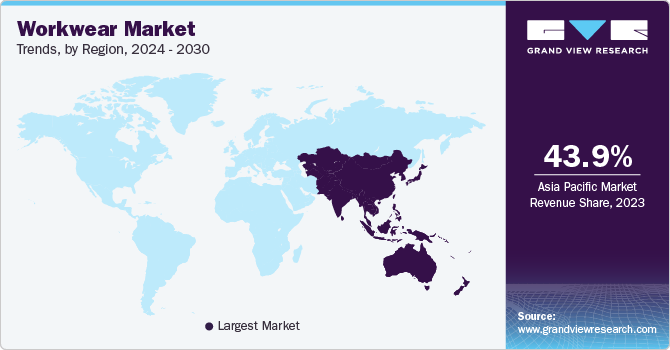

Asia Pacific Workwear Market Trends

The workwear market in Asia Pacific accounted for a revenue share of over 43.9% in 2023. Rapid industrialization and infrastructure development in countries like China, India, and across Southeast Asia have fueled the demand for workwear and safety clothing. In Malaysia, the New Industrial Master Plan 2030 aims to build more competitive industries and promote the advancement of economic complexity. Similarly, South Korea and Japan have customized their industrial policies to nurture their semiconductor sectors, aiming to bolster their competitiveness with China and the U.S. As construction, manufacturing, and other industries expand, there is a greater emphasis on worker safety and compliance with regulations, driving the need for specialized clothing.

Key Workwear Company Insights

-

Honeywell International, Inc.; Carhartt, Inc.; 3M; Ansell Ltd.; and Kimberly-Clark Corporation are some of the dominant market players.

-

Honeywell has a global presence in 70 countries across Asia Pacific, Latin America, North America, Europe, and the Middle East & Africa.

-

Carhartt, Inc.’s production takes place in company-owned factories in the U.S. and Mexico, as well as in supplier and licensee factories globally.

-

3M has a presence in more than 65 countries and has a market reach in about 200 countries. Over 60,000 innovative 3M products are used in residential and commercial settings.

-

Kimberly-Clark Corporation sells its products in more than 175 countries across various regions like North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Key Workwear Companies:

The following are the leading companies in the workwear market. These companies collectively hold the largest market share and dictate industry trends.

- Carhartt, Inc.

- Aramark (Vestis)

- Alsico Group

- Alexandra

- A. Lafont SAS

- Hard Yakka

- 3M

- Ansell Ltd.

- Honeywell International, Inc.

- Kimberly-Clark Corporation

Recent Developments

-

In February 2024, the company opened a new company store at Park City Center in Pennsylvania, U.S. The store is likely to be opened in October 2024. The company runs 36 of its own corporate stores in addition to selling its goods through a range of retailers. In Pennsylvania, the only other Carhartt company store is located close to Pittsburgh.

-

In October 2023, Vestis successfully concluded its previously disclosed spin-off from Aramark. From October 2023, Vestis commenced trading on the New York Stock Exchange using the ticker symbol "VSTS," with trading commencing at the market opening.

-

In October 2023, the company implemented a policy allowing users to return Alsico workwear and protective clothing they no longer need. These garments were collected at the Valorisation Hub in Ronse, Belgium, where they were assessed for potential reuse or repair. Items suitable for reuse were offered through the Worked Wear program, while those only fit for recycling were processed separately and sent to preferred partners for valorization. Potential applications included acoustic or thermal insulation in new products or conversion into new fibers.

Workwear Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 18.42 billion |

|

Revenue forecast in 2030 |

USD 24.05 billion |

|

Growth rate |

CAGR of 4.5% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, demography, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; Colombia; South Africa |

|

Key companies profiled |

Carhartt, Inc.; Aramark (Vestis); Alsico Group; Alexandra; A. Lafont SAS; Hard Yakka; 3M; Ansell Ltd.; Honeywell International, Inc.; and Kimberly-Clark Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Workwear Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global workwear market report based on product, demography, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Work Apparel

-

General Apparel

-

Protective Apparel

-

-

Work Footwear

-

General Footwear

-

Protective Footwear

-

-

-

Demography Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Chemical

-

Power

-

Food and Beverage

-

Biological/Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global market is driven by product innovations backed by the furtherance of technology. Advancements in workwear material technology have transformed numerous sectors by offering workers durable and high-performance clothing, boosting their effectiveness and guaranteeing their safety at work.

b. The global workwear market size was estimated at USD 17.72 billion in 2023 and is expected to reach USD 18.42 billion in 2024.

b. The global workwear market is expected to grow at a compounded growth rate of 4.5% from 2024 to 2030 to reach USD 24.05 billion by 2030.

b. Work apparel dominated the workwear market with a share of 75.0% in 2023. . The work apparel market is growing significantly due to increasing focus on workplace safety and functionality.

b. Some key players operating in workwear market include Carhartt, Inc.; Aramark (Vestis); Alsico Group; Alexandra; A. Lafont SAS; Hard Yakka; 3M; Ansell Ltd.; Honeywell International, Inc.; and Kimberly-Clark Corporation

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."