Workforce Analytics Market Size, Share & Trends Analysis Report By Component, By Deployment (Cloud, On-premise), By Enterprise Size (SMEs, Large Enterprises), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-947-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Workforce Analytics Market Size & Trends

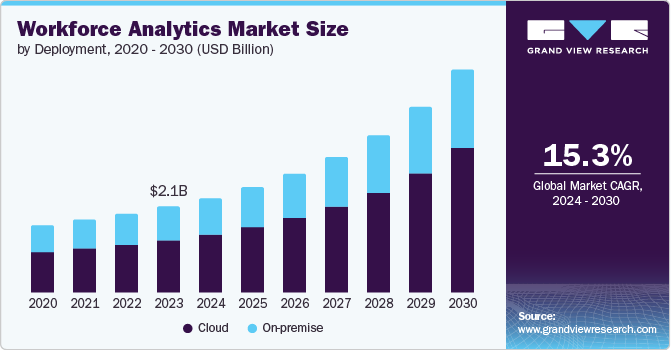

The global workforce analytics market size was valued at USD 2.14 billion in 2023 and is projected to grow at a CAGR of 15.3% from 2024 to 2030. Organizations seeking to enhance their operational efficiency are turning to advanced analytics to gain insights into their workforce dynamics. Companies leverage data to optimize hiring processes, improve employee retention, and enhance productivity. Workforce analytics provides valuable metrics such as employee performance, engagement levels, and the effectiveness of HR policies.

As businesses face a highly competitive labor market, they require sophisticated tools to attract, develop, and retain top talent. Workforce analytics offers insights into talent acquisition strategies, skill gaps, and employee career development. By utilizing these insights, organizations can implement targeted training programs, streamline recruitment efforts, and foster a positive work environment that supports employee growth and satisfaction. The demand for effective talent management solutions is escalating as companies recognize that their workforce is a critical asset that directly impacts their success and growth.

Technological advancements are accelerating the growth of the workforce analytics market by making sophisticated analytics tools more accessible and affordable. Innovations such as artificial intelligence (AI), machine learning, and advanced data visualization techniques have enhanced the capabilities of workforce analytics platforms. These technologies enable organizations to process vast amounts of data quickly and extract more precise, actionable insights. The development of cloud-based solutions has also contributed to market growth by providing scalable and flexible analytics tools tailored to the specific needs of businesses of all sizes. As technology continues to evolve, the capabilities of workforce analytics tools are expected to expand, driving further market growth.

Component Insights

The solutions segment dominated the market and accounted for a share of 69.1% in 2023. Organizations seek comprehensive solutions that effectively integrate data from multiple sources, such as HR systems, performance evaluations, and employee feedback. These solutions give businesses a holistic view of their workforce, leading to informed decision-making and strategic workforce planning.

The service segment is expected to register the fastest CAGR of 17.5% during the forecast period. Organizations, especially those without in-house expertise, rely on service providers for essential advice. This involves offering advisory services to establish their objectives for workforce analytics, assisting with seamless integration, and providing continuous support to extract the most value from the data for optimizing their talent management strategies.

Deployment Insights

Cloud accounted for the largest market revenue share in 2023. Cloud platforms enable organizations to scale their workforce analytics capabilities up or down based on their changing needs. This flexibility allows businesses to add or remove features, adjust the number of users, and manage data storage without significant upfront investment or infrastructure changes. As organizations expand or contract, cloud solutions can adapt to these shifts efficiently, providing a cost-effective and agile approach to workforce management.

The on-premise segment is anticipated to grow significantly over the forecast period. On-premise solutions give organizations complete control over their analytics infrastructure, allowing extensive customization to meet specific business needs. Companies can tailor the software to their unique requirements, from configuring features and interfaces to integrating with existing systems.

End-use Insights

The healthcare sector accounted for the largest market revenue share in 2023. Workforce analytics solutions provide healthcare administrators with tools to optimize staffing levels, manage labor costs, and improve scheduling practices. By analyzing data on staffing needs, shift patterns, and overtime expenses, these solutions help healthcare providers reduce inefficiencies and operational costs.

The manufacturing sector is expected to register the fastest CAGR over the forecast period. Manufacturing organizations increasingly focus on optimizing production processes to enhance output, reduce waste, and minimize downtime. Workforce analytics solutions provide manufacturers with tools to track and analyze workforce performance, identify bottlenecks, and optimize labor allocation. Manufacturers can implement strategies to streamline operations, boost performance, and achieve better production outcomes by leveraging data on production efficiency, employee productivity, and equipment usage.

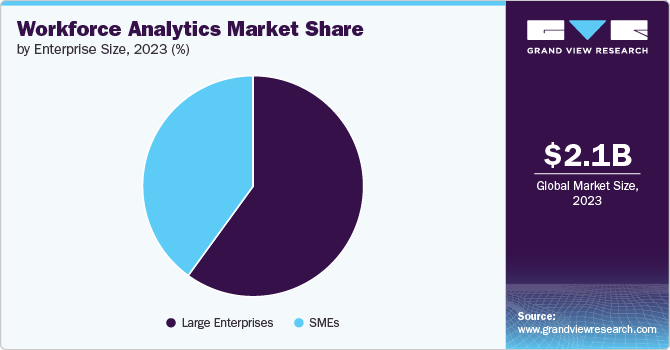

Enterprise Size Insights

Large enterprises accounted for the largest market revenue share in 2023. Large enterprises' complex workforce management drives the demand for sophisticated workforce analytics solutions. Managing thousands of employees across various departments, regions, and functions requires advanced tools for effective oversight and strategic planning. Workforce analytics solutions offer detailed performance tracking, comprehensive employee engagement surveys, and in-depth workforce planning tools that cater to these complex needs.

Small and medium-sized enterprises (SMEs) is anticipated to register the fastest CAGR over the forecast period. Workforce analytics solutions enable SMEs to gather and analyze data on various aspects of their workforce, such as employee performance, engagement, and productivity. By leveraging these insights, SMEs can make informed hiring, training, and employee development decisions. This shift towards data-driven strategies helps SMEs optimize their HR practices, align their workforce with business goals, and improve organizational performance.

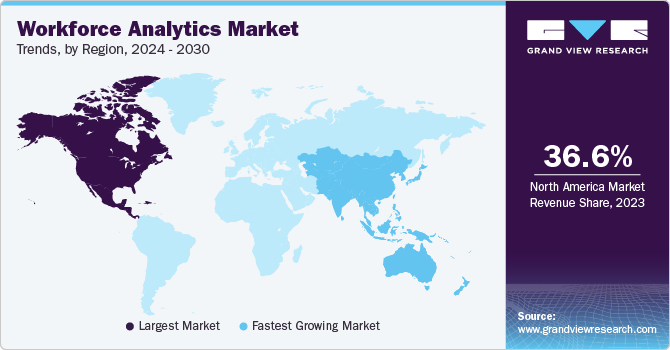

Regional Insights

The North America workforce analytics market accounted for the largest market revenue share of 36.6% in 2023. The developed IT infrastructure and multiple market players in North America have resulted in the widespread use of workforce analytics tools in industries such as healthcare, IT and telecommunication, BFSI, etc. The rising emphasis on enhancing employee engagement, retention, and productivity also fuels the request for workforce analytics solutions.

U.S. Workforce Analytics Market Trends

The U.S. workforce analytics market dominated the North America market. The U.S. is a major player in the IT industry, with Silicon Valley and many tech hubs located within its borders. As American businesses face a highly competitive labor market, there is a growing emphasis on optimizing talent acquisition, development, and retention strategies. Workforce analytics solutions offer advanced tools that help organizations align their human resources with long-term business objectives.

Europe Workforce Analytics Market Trends

The workforce analytics market in Europe was identified as a lucrative region in 2023. European governments are implementing regulations and initiatives that require organizations to maintain accurate and transparent workforce data. The General Data Protection Regulation (GDPR) requires organizations to maintain accurate and transparent employee data. As a result, organizations are investing in workforce analytics solutions to comply with these regulations, driving the market's growth in the region.

The UK workforce analytics market is expected to grow rapidly in the coming years. The UK labor market is governed by various complex regulations and legal requirements related to employment practices, including those set by the Employment Rights Act, the Equality Act, and GDPR for data protection. Workforce analytics solutions offer features that help UK organizations manage these compliance obligations through tools for tracking regulatory adherence, managing risk, and preparing for audits.

Asia Pacific Workforce Analytics Market Trends

The workforce analytics market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. As economies across APAC continue to expand, there is a growing demand for sophisticated workforce management solutions to help organizations keep up with rapid changes in the labor market. Workforce analytics tools offer capabilities for optimizing talent acquisition, enhancing employee performance, and improving operational efficiency.

The India workforce analytics market is expected to grow rapidly in the coming years. The digital revolution is reshaping business operations in India, with companies investing heavily in new technologies to enhance efficiency and drive innovation. Workforce analytics solutions play a crucial role in this digital transformation by providing data collection, analysis, and reporting tools. These solutions help Indian businesses modernize their HR functions, integrate data across different HR processes, and harness insights to inform decision-making.

Key Workforce Analytics Company Insights

Some of the key companies in the workforce analytics market include McAfee, LLC, Trend Micro Inc., AlienVault, Inc., TrustWave Holdings, Inc., and Qualys, Inc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Trend Micro Inc. is a cybersecurity service provider offering internet and computer content security and threat management solutions. The company's product portfolio includes security software, network and web security, mobile device security, and anti-spam products. Trend Micro has a strong presence in the cybersecurity market, focusing on providing layered security for data centers, cloud environments, networks, and endpoints.

-

Qualys, Inc. workforce analytics offerings are designed to enhance organizational security and compliance through advanced data analysis and reporting tools. Qualys’ approach to workforce analytics involves leveraging data to provide insights into security practices, manage user access, and assess the effectiveness of security policies.

Key Workforce Analytics Companies:

The following are the leading companies in the workforce analytics market. These companies collectively hold the largest market share and dictate industry trends.

- ADP, Inc.

- Cornerstone

- International Business Machines Corporation

- UKG

- Ascender HCM

- SAP SE

- Willis Towers Watson

- Visier, Inc.

- Workday, Inc.

- Oracle Corporation

- TABLEAU SOFTWARE, LLC (Salesforce, Inc.)

- SAS Institute Inc.

- Paycom Payroll LLC

- Anaplan, Inc.

Recent Developments

-

In June 2023, Sapience Analytics partnered with QuantumWork Advisory to transform the method of managing external labor expenditure through data analytics and strategic workforce planning. This collaboration offers organizations insight into real work time, facilitating the validation of purchase orders, goods receipts, and invoices. Additionally, it assists leaders in identifying specific labor requirements and enhances user experience by implementing improved processes and technology.

Workforce Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.35 billion |

|

Revenue forecast in 2030 |

USD 5.53 billion |

|

Growth rate |

CAGR of 15.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa |

|

Key companies profiled |

ADP, Inc., Cornerstone, International Business Machines Corporation, UKG, Ascender HCM, SAP SE, Willis Towers Watson, Visier, Inc., Workday, Inc., Oracle Corporation, TABLEAU SOFTWARE, LLC(Salesforce, Inc.), SAS Institute Inc., Paycom Payroll LLC, Anaplan, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Workforce Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global workforce analytics market report based on component, deployment, enterprise size, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

IT & Telecommunication

-

BFSI

-

Manufacturing

-

Retail

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."