- Home

- »

- Specialty Polymers

- »

-

Wood Repair Epoxy Market Size And Share Report, 2030GVR Report cover

![Wood Repair Epoxy Market Size, Share & Trend Report]()

Wood Repair Epoxy Market Size, Share & Trend Analysis Report, By Product (Structural, Non-Structural), By Application (Residential, Commercial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-374-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

“2030 wood repair epoxy market value to reach USD 531.1 million.”

Wood Repair Epoxy Market Size & Trends

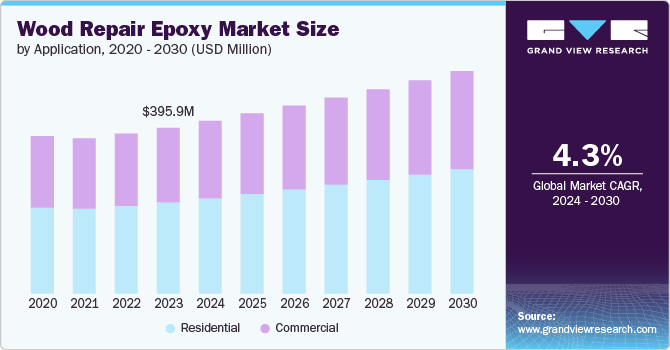

The global wood repair epoxy market size was estimated at USD 395.9 million in 2023 and is projected to reach USD 531.1 million by 2030, at a CAGR of 4.3% from 2024 to 2030. Increasing awareness among consumers about the benefits of wood repair epoxy fillers, such as their ability to extend the lifespan of wooden structures and reduce the need for their replacement, presents a significant opportunity for market growth in the coming years.

Wood repair epoxy is used as adhesive or filler into repairing damaged or decaying wood by rectifying the imperfections through filling of holes and cracks. It is extensively used in professional woodworking, construction applications, and DIY activities in order to enhance the appearance and strength of damaged wood.

Drivers, Opportunities & Restraints

The developments in construction industry is one of the key growth drivers for the market owing to the surging number of residential projects and office spaces worldwide. Growth in the residential sector paves the way for more demand for furniture and wood architecture on account of its aesthetics and appeal, thus driving demand for wood repair epoxy.

For instance, in April 2023, Hiranandani Group announced an investment of USD 120.7 million (INR 1,000.0 crore) in a new housing project in Mumbai, India. The company plans to create a residential space of 1 million square feet under this project that will have approximately 700 housing units. The size of the apartments may vary, ranging from 490 square feet to 1,150 square feet of carpet area.

Fluctuation in prices of epoxy resins impact the production costs for wood repair epoxy, which restrains market growth. For instance, in November 2023, the prices of epoxy resins dropped in the U.S. and Asia, as opposed to Europe. The price decline in the U.S. was attributed to the reduced price of the major feedstock Epichlorohydrin, whereas the price rise in Europe was owing to the supply chain disruptions.

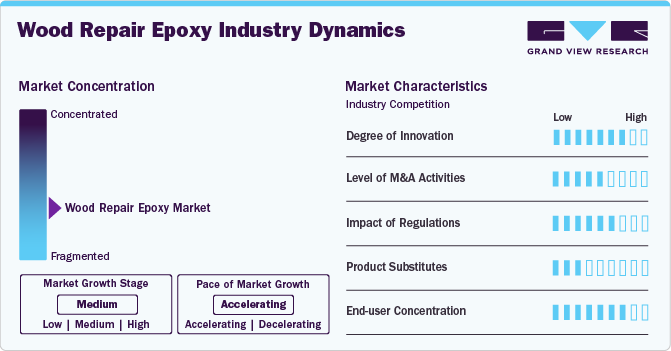

Industry Dynamics

The global wood repair epoxy market is fragmented, with numerous players worldwide. Key players opt for strategies such as mergers & acquisitions, product expansion, and vertical integrations across the value chain. These initiatives give the market players a competitive edge, thus increasing their market share in the industry.

The impact of regulations is moderately high for the market, as the standards and compliances related to health, safety, and environmental factors apply to epoxy resins. For instance, the U.S. EPA had brought forward the final rule for epoxy resins production and non-nylon polyamides under National Emission Standards for Hazardous Air Pollutants. The rule is to reduce emissions of hazardous air pollutants, mainly epichlorohydrin, by approximately 105 tons per year.

Product Type Insights

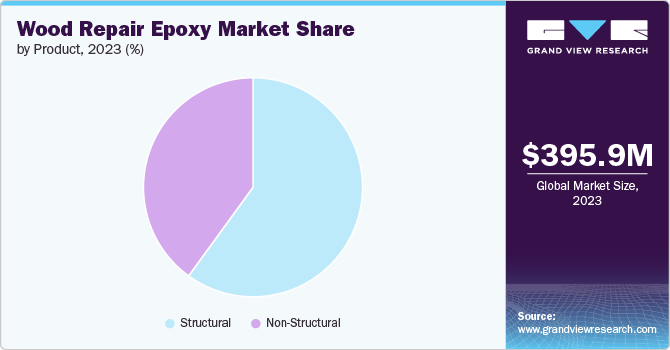

“Structural held a revenue share of over 60% in 2023 of the global market.”

Structural wood repair epoxy is known for its high strength and durability. Its excellent adhesion properties allow it to bond effectively with wood surfaces. This epoxy is resistant to moisture, rot, and insect damage, making it suitable for interior and exterior applications. It is primarily used to restore the strength and integrity of damaged wooden structures.

Non-structural wood repair epoxy has some characteristics similar to structural epoxy, including good adhesion and moisture resistance. However, it may have lower strength and durability than structural epoxy. It is often used for cosmetic repairs and filling small voids or cracks in wood surfaces instead of its use in load-bearing or structural applications.

Non-structural wood repair epoxy is commonly used to repair minor damages in wooden furniture, cabinets, doors, and other decorative wooden items. It can fill small cracks, chips, or holes in the wood, improving its appearance and preventing further damage. This type of epoxy is also suitable for art and craft projects involving wood.

Application Insights

“Residential held a revenue share of 55% in 2023 of the global market.”

Wood repair epoxy is widely used in residential settings for various purposes. It can bond strongly with wood surfaces, thereby leading to structural stability and durability. This epoxy can fill cracks, holes, and gaps in wood to restore its strength and integrity. It finds applications in repairing damaged furniture, cabinets, doors, and windows. It can also fix rotted or decayed wood in structural elements such as beams, joints, and posts.

Its ease of usage is increasingly propelling its demand. Homeowners are adopting it as a cost-effective solution for repairing and restoring damaged wood. The reasons behind this phenomenon include the desire to preserve the original character of old homes, the requirement for quick and efficient repairs, and the availability of high-quality wood repair epoxy products in the market.

The commercial segment is also witnessing growth amidst rising investments in the manufacturing sector and expansion of warehouse spaces. For instance, in June 2023, Seefried Industrial Properties and Affinius Capital completed the construction of a 14,900-square-meter wood-paneled warehousing facility in Dallas. The companies also have plans to construct similar facilities, such as a 23,200-square-foot wood-framed warehouse in the city of Toronto, Canada.

Regional Insights

“U.S. held a share of over 71% of the North America wood repair epoxy market.”

The wood repair epoxy market in North America has witnessed significant growth in recent years. The region is characterized by a high demand for wood repair products owing to the prevalence of wooden residential and commercial structures. The market's growth is driven by the increasing focus on sustainable construction practices and the rising popularity of DIY home improvement projects.

U.S. Wood Repair Epoxy Market Trends

The growth of wood repair epoxy market in the U.S. is driven by rising construction of wood-based buildings. According to the U.S. National Association of Home Builders, about 94% of the homes built in 2022 included wooden frames in their construction, as well as furniture, flooring, and other applications.

Europe Wood Repair Epoxy Market Trends

The Growing trend of prefab houses in region is boosting the growth of wood repair epoxy market in Europe. For instance, in April 2023, Zurich studio Appels Architekten prepared a wooden house in Southeast Germany from a cross-laminated structure and black-stained cladding.

Asia Pacific Wood Repair Epoxy Market Trends

The market for wood repair epoxy in Asia Pacific benefits from the demand for wooden furniture and architecture in the region. This growth can be attributed to the rising disposable income of the upper and middle-class population, followed by the booming real estate industry coupled with government-initiated housing projects.

Key Wood Repair Epoxy Company Insights

Some of the key players operating in the market include 3M, Henkel, and Sika.

-

3M was established in 1902 and is headquartered in Minnesota, U.S. It is a diversified technology company that manufactures various products, such as abrasives, adhesives and tapes, personal protective equipment, building materials, electronic components, labels, lubricants, films and sheeting, and compounds and polishes.

-

Henkel AG & Co. KGaA was founded in 1876 and is headquartered in Düsseldorf, Germany. It has a diversified and well-balanced portfolio and operates through three global business units in both consumer and industrial businesses.

-

Sika AG was established in 1910 and is headquartered in Baar, Switzerland. It is a manufacturer and supplier of specialty chemicals. The company manufactures products targeting to markets including concrete, waterproofing, roofing, flooring, sealing & bonding, refurbishment, and industrial.

Key Wood Repair Epoxy Companies:

The following are the leading companies in the wood repair epoxy market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Abatron Inc

- Elmer’s Product Inc. (Newell Brands Inc.)

- Gorilla Glue Inc.

- Henkel AG & Co. KGaA

- J-B Weld Company

- Mapei

- Parker Hannifin Corp

- Sika AG

- System Three Resins, Inc.

Recent Developments

-

In March 2024, Grasim Industries Limited announced expansion of its epoxy resin production capacity to 246 kilotons per annum. The expansion is part of its plans to expand its business footprint and cater to the rising demand for epoxy resin applications in the domestic and international markets.

-

In February 2024, DCM Shriram announced an expansion of its Epichlorohydrin (ECH) plant in Jhagadia, Gujarat, India, with an investment of INR 1000 crore (~USD 119.7 million) over the next few years as part of its greenfield investment to set up an epoxy resin manufacturing plant. This vertical integration positions DCM Shriram to enter the epoxy and value-added products market strategically.

Wood Repair Epoxy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 412.6 million

Revenue forecast in 2030

USD 531.1 million

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil

Key companies profiled

3M; Sika; Henkel; Mapei; Parker Hannifin Corporation; Gorilla Glue Inc.; Abatron Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wood Repair Epoxy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wood repair epoxy market report based on product, application, and region

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Structural

-

Non-Structural

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global wood repair epoxy market was valued at USD 395.9 million in 2023 and is expected to reach USD 412.6 million in 2024

b. The global wood repair epoxy market is anticipated to grow at a compound annual growth rate (CAGR) of 4.3% from 2024 to reach USD 531.1 million by 2030.

b. The growth of wood repair epoxy market in the U.S. is driven by rising construction of wood-based buildings. According to the U.S. National Association of Home Builders, about 94% of the homes built in 2022 included wooden frames in their construction, as well as furniture, flooring, and other applications.

b. Some of the key players operating in the market include 3M, Henkel, and Sika, Mapei, Parker Hannifin Corp, and Gorilla Glue In.

b. Increasing awareness among consumers about the benefits of wood repair epoxy fillers, such as their ability to extend the lifespan of wooden structures and reduce the need for their replacement, presents a significant opportunity for market growth in the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."