- Home

- »

- Organic Chemicals

- »

-

Wood Preservatives Market Size, Share, Growth Report 2030GVR Report cover

![Wood Preservatives Market Size, Share & Trends Report]()

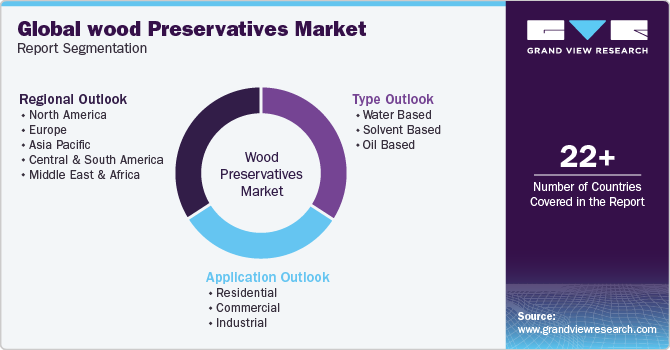

Wood Preservatives Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Water Based, Solvent Based, Oil Based), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-163-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wood Preservatives Market Size & Trends

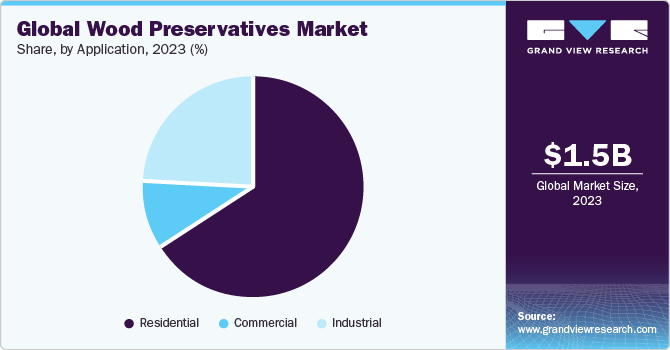

The global wood preservatives market size was valued at USD 1.50 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.0% from 2024 to 2030. The growth of this market across the world can be attributed to a significant surge in residential, commercial, and industrial construction activities. Wood is used in many applications such as furniture, doors, cabinets, roofs, staircases, and beams. The products are majorly used to protect them from decay, insects, and other environmental threats. The most commonly used product types include oil-based preservatives, water-based preservatives, and chemical treatment lumbar. Different chemicals used in products include creosote oils, copper-based chemicals, and borates.

There are three types of heavy-duty products as per the classification done by the United States Environment Protection (USEPA). This includes chromated arsenicals, pentachlorophenol, and creosote. In 2008, the US EPA determined all three heavy-duty products to remain in use as long as certain mitigations are identified by the Reregistration Eligibility Decision Documents. Furthermore, in 2019, the EPA found the threat of these substances in its draft risk assessment. Therefore, in 2021, the EPA issued the proposed interim decision to determine these chemicals as a threat to human health and environment.

Creosote is a traditional product type that has been used for hundreds of years. However, the negative effects of creosote have limited its use over the past few years owing to its negative effect on environment and human health. Moreover, the use of creosote for engine use and fencing products for agricultural use has been restricted in Europe, effective from April 2023. Moreover, the consumer use of creosote for treating domestic wood such as fence panels has been banned in Europe since 2003.

Alternative methods for wood preservation post the restrictions imposed in creosote include heat and pressure treating in order to change the wood properties. Furthermore, applying physical barriers to the wood. Providing physical barriers is not an effective alternative for creosote as it does not provide protection against fungi and insects. However, the hot oil-based copper treatment provides an effective solution for the fungi and insect problems.

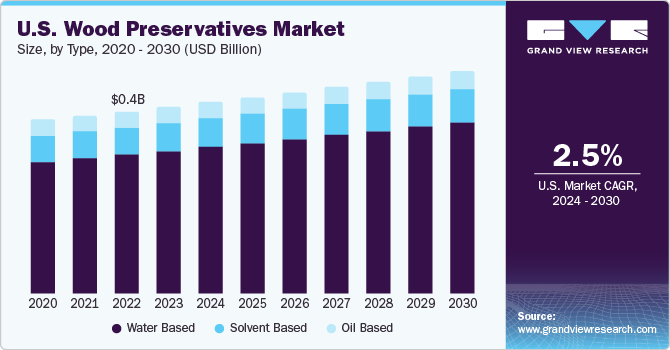

Type Insights

The water based product segment dominated the market with a revenue share of 73.2% in 2023 owing to their non-hazardous nature and no risk of fire or explosion. Moreover, the water-based product leaves the wood surface clean and paintable. This product type includes various metallic salts and other compounds. The most commonly used compounds include chromium, copper, fluoride, and arsenic. Water based product types are increasingly being used for plywood, lumber, and fence posts.

The water-based product type is formulated using water as a primary solvent instead of traditional organic solvents. This product type often contains fungicide and insecticide to protect against decay and insect damage. Moreover, these types of preservatives are safe for both the user and the environment owing to strict regulations on the VOCs. In addition, their stainable, paintable, odor-free, and clean nature makes them suitable for outdoor structures.

Solvent-based product type are used to protect the wood from degradation from degradation due to sap stains, fungal rot, molds, or wood-destroying insects. They are commonly used for outdoor applications such as seasoned building materials, utility poles, and fence posts among others. Solvent based product type is known for its ability to penetrate deep into wood providing long-lasting protection. Moreover, they are protective against a wide range of wood-destroying organisms.

Oil type preservatives are generally classified into two main groups including creosote solutions and creosote. Creosote includes creosote-coal tar, creosote, and creosote-petroleum formulations. The composition of oil-borne preservatives consists of preservative chemicals dissolved in a nonaqueous solvent. Some of the common types of oil-based products include motor oil, tung oil and linseed oil. Linseed oil is a natural wood preservative that penetrates deep in the porous fibers of wood, protecting it from moisture and rot. Tung oil is another natural wood preservative that provides a protective finish to the wood.

Application Insights

The residential application segment dominated the market with a revenue share of 65.8% in 2023. In residential application the product is used in doors, staircases, roofs, cabinets, columns, and beams. The shift of people from rural to urban areas globally is further driving the demand for construction activities which is further increasing the consumption of wood and the product. As per the Government of India, approximately 600 million people are expected to live in urban areas in India till 2030 creating a demand for about 25 million additional household units. This is one of the drivers and an opportunity for the product market in the country.

The other construction applications of the product include straight beams, glue-laminated beams, lintels, purlins, trusses, and tied rafters among others. The increasing demand for residential project in countries like China, India, Japan, the U.S., and the U.K. is further expected to boost the product demand in the respective countries.

The commercial construction industry is increasing using wood, particularly mass timer for various applications due to its sustainability, aesthetic appeal and cost competitiveness. The mass timber construction is energy efficient alternative to high rise and commercial buildings, with lighter carbon footprint than steel or concrete. Moreover, the traditional wood frame construction is also considered to be a cost-effective option for shopping malls, restaurants and big box stores. The product plays a crucial role in commercial construction activities as they help to protect the wood from degradation.

Wood is used in various industrial construction activities including warehouses, manufacturing facilities and distribution centers. Moreover, wooden cribbing is also used as a temporary structure for overseas shipping and to support heavy objects. Apart from this, it is also used in corbels and pilings. The developing industrial sector globally is increasing the demand for wood which is further expected to boost the global consumption of the product.

Regional Insights

North America region dominated the market with a revenue share of more than 35.6% in 2023. There were more than 919,000 constructions in the U.S. in the first quarter of 2023 as per the Associated General Contractors (AGC) of America. The rapidly developing construction activities in the region are driving the demand for products in the region. Moreover, the construction industry in Canada is a vital sector contributing significantly to the country’s economy. It includes a broad range of activities like residential, commercial, and infrastructure development.

Asia Pacific is also a potential market for products owing to rapidly developing construction industry in countries like China, India, Japan, and South Korea. According to the report published by Oxford Economics in May 2023, the construction industry in India is expected to witness the fastest growth in the world by 2030. It is projected to add USD 1 trillion to the growth of the global construction industry by 2030. Favorable policies by the government of India to strengthen the urban infrastructure in the country and meet the demands of the rapidly growing urbanizing population are contributing to the growth of the construction industry in the country. Thus, the rapidly growing construction activities globally are considered to be the major driving factor for the product market.

Key Companies & Market Share Insights

The global product market is fragmented with many players occupying an insignificant share. A few of market players include Troy Corporation, LANXESS, Koppers Performance Chemicals, and Wolman Wood and Fire Protection GmBH. The market players are involved in different strategies like joint ventures to cater to the sustainable market need. For instance, in January 2022, a joint venture was established between LANXESS and Matrica to produce sustainable biocide preservatives form renewable raw materials. The prices of wood extracts in 2023 and upcoming years are expected to rise owing to its increasing demand.

Key Wood Preservatives Companies:

- Jubilant

- Dolphin Bay

- Rio Tinto

- LANXESS

- Viance

- Nisus Corporation

- BERKEM

- Troy Corporation

- Impra Wood Protection Ltd.

- Wykamol Group Ltd

- Lonza Specialty Ingredients

- Koppers Performance Chemicals

Wood Preservatives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.56 billion

Revenue forecast in 2030

USD 2.11 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia & South Africa

Market Players

Jubilant; Dolphin Bay; Rio Tinto; LANXESS; Viance; Nisus Corporation; BERKEM; Troy Corporation; Impra Wood Protection Ltd.; Wykamol Group Ltd; Lonza Specialty Ingredients; Koppers Performance Chemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Wood Preservatives Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wood preservatives market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

Water Based

-

Solvent Based

-

Oil Based

-

-

Application Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Itay

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wood preservatives market size was estimated at USD 1.50 billion in 2023 and is expected to reach USD 1.56 billion in 2024

b. The global wood preservatives market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 2.11 billion by 2030.

b. North America dominated the wood preservatives market with a share of 35.6% in 2023. This is attributable to the rapidly developing wood-based construction activities in the region

b. Some key players operating in the wood preservatives market include Jubilant, Dolphin Bay, Rio Tinto, LANXESS, Viance, Nisus Corporation, BERKEM, Troy Corporation, Impra Wood Protection Ltd., Wykamol Group Ltd, Lonza Specialty Ingredients, Koppers Performance Chemicals

b. Key factors that are driving the market growth include significant surge in residential, commercial, and industrial construction activities globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.