- Home

- »

- Advanced Interior Materials

- »

-

Wood Plastic Composites Market Size, Industry Report, 2033GVR Report cover

![Wood Plastic Composites Market Size, Share & Trends Report]()

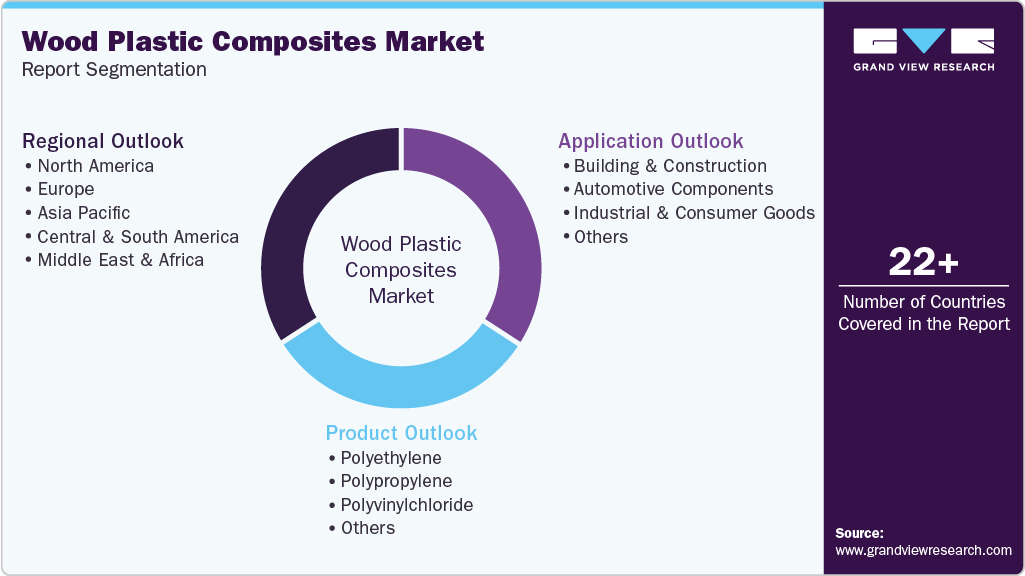

Wood Plastic Composites Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Polyethylene, Polypropylene, Polyvinylchloride), By Application (Automotive Components, Building & Construction), By Region, And Segment Forecasts

- Report ID: 978-1-68038-849-7

- Number of Report Pages: 198

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wood Plastic Composites Market Summary

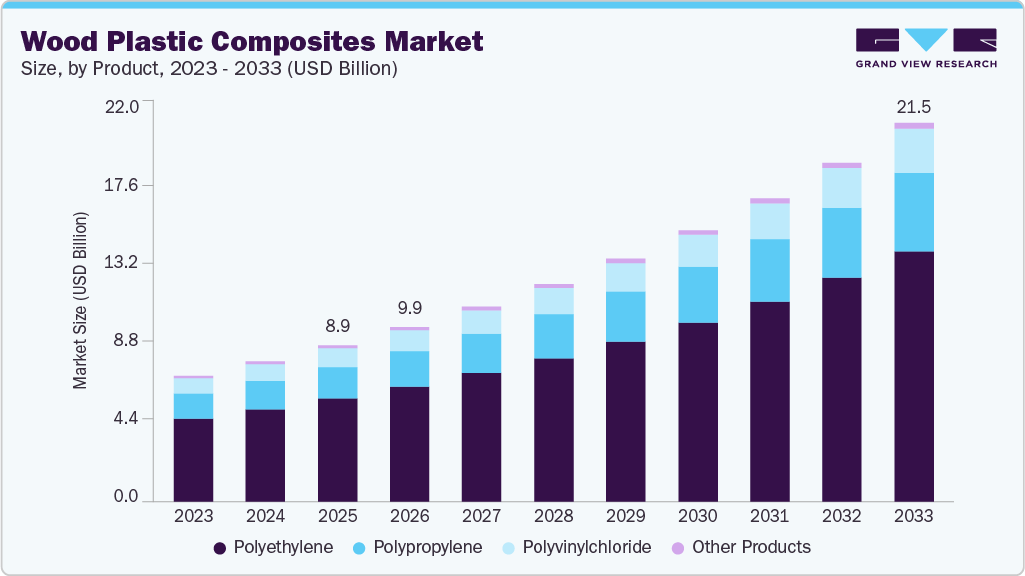

The global wood plastic composites market size was estimated at USD 8.89 billion in 2025 and projected to reach USD 21.51 billion by 2033, growing at a CAGR of 11.7% from 2026 to 2033. The market is driven by the rising demand for sustainable construction materials, as well as an increase in renovation and repair activities in the residential sector worldwide.

Key Market Trends & Insights

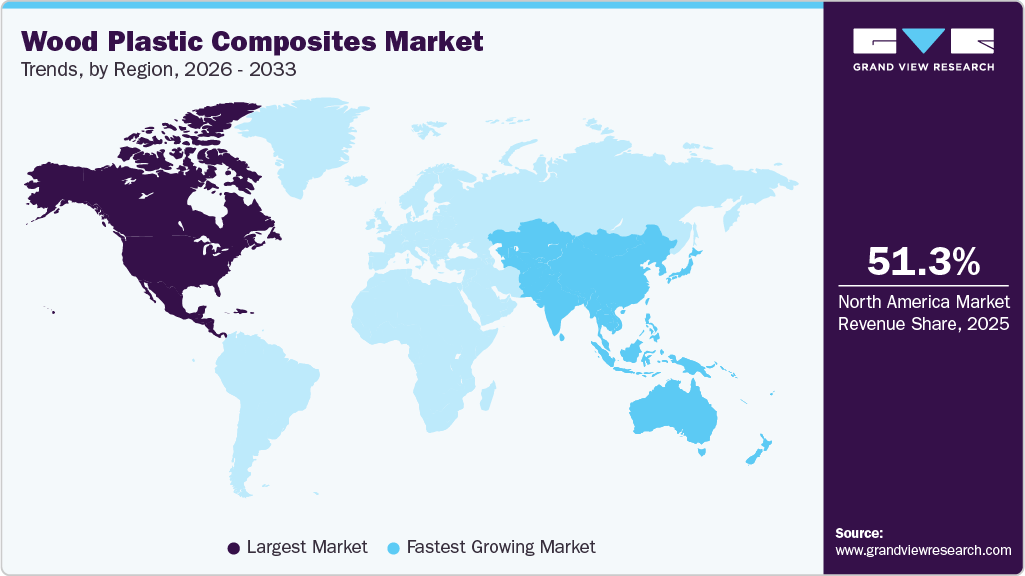

- North America dominated the global wood plastics composites market with the largest revenue share of 51.3% in 2025.

- The wood plastics composites industry is anticipated to grow at the fastest CAGR during the forecast period.

- By product, the polyethylene segment led the market with the largest revenue share of 66.0% in 2025.

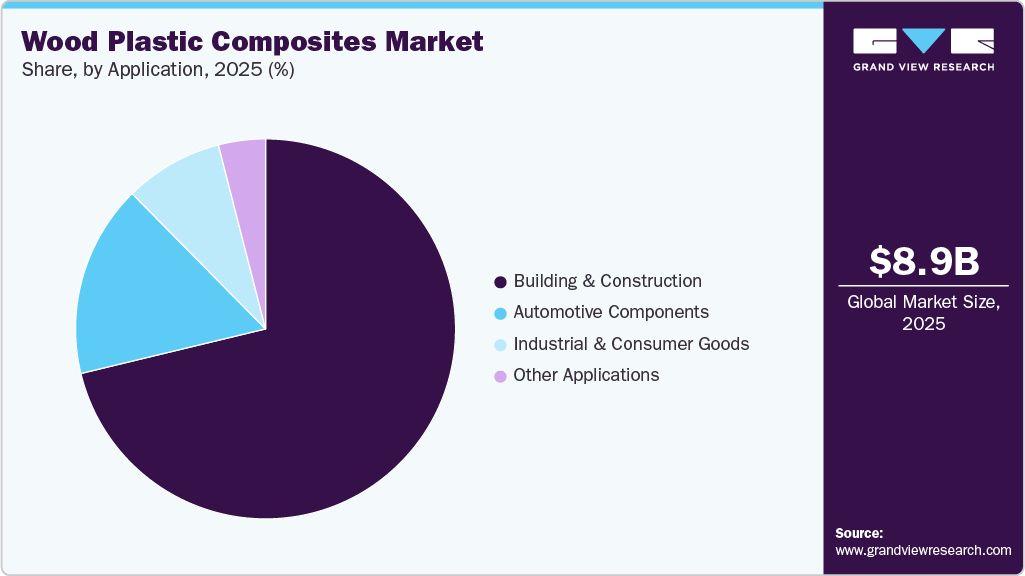

- By application, the building and construction segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 8.89 Billion

- 2033 Projected Market Size: USD 21.51 Billion

- CAGR (2026-2033): 11.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest market share

Wood plastic composites are increasingly being used in construction applications. Wood plastic composites are being employed in roofing applications as well as in the manufacturing of glass windows.Wood plastic composites are increasingly being used in construction applications. Wood plastic composites are being employed in roofing applications as well as in the manufacturing of glass windows. In developing countries, wood-plastic composites are replacing standard wood in roofing applications due to their high strength. This is due to its tendency to break into larger pieces compared to standard wood, which prevents sharp shards upon breakage and can lead to serious human injuries in the event of an accident.

Furthermore, wood-plastic composite has a lower melting temperature compared to conventional wood products, which lowers the energy cost for end-users and also reduces the environmental impact of the product. Wood-plastic composite can be worked with the same tools used for wood products. This factor eliminates the investments the manufacturers must make and the risks associated with recouping the same.

Biggest tech companies such as IBM, Microsoft, and Cisco are investing in megaprojects to build smart, sustainable cities across the globe. Investments in these cities are expected to reach USD 135.00 trillion in the next two years. In addition to these cities, international megaprojects such as Hudson Yards and Masdar City have created opportunities for interior construction manufacturers, resulting in a surge in wood plastic composite demand over the coming years.

Wood flour is hygroscopic in nature and must be properly wetted with the use of a thermoplastic matrix; otherwise, it can absorb moisture, leading to weak mechanical properties, unwanted odors, and microbial attacks. The technique requires complex machine arrangements and skilled laborers, resulting in increasing the overall cost of the products. This, in turn, can restrict the market growth over the projected years.

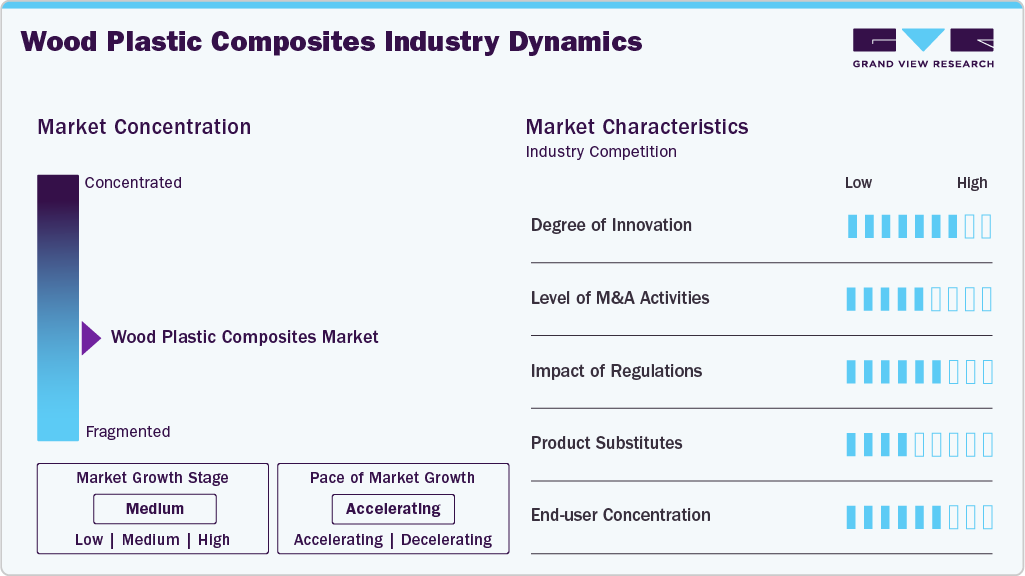

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The major key players in the market are utilizing their in-house technology and manufacturing processes for wood-plastic composite products. In addition, various software is used by the key players to build a 3D model for residential and commercial building & construction projects, leading to a moderate degree of innovation.

The industry participants are implementing strategies, including mergers and acquisitions, to strengthen their foothold in the market. For instance, in May 2022, UFP Industries, Inc. announced the acquisition of Cedar Poly LLC for USD 17.0 million. This helped UFP Industries, Inc. vertically integrate the sourcing of recycled polymers and increase the use of post-industrial waste materials in their products without compromising the quality of the overall products.

Regulations and standards moderately impact the wood plastic composites industry by ensuring product quality, safety, and environmental sustainability. Standards related to mechanical properties, durability, and performance help maintain consistency and reliability in wood plastic composite products, boosting consumer confidence and market acceptance.

The product is prone to staining and color fading due to the presence of wood particles. In addition, the presence of mineral-based composite products and pure plastic base products serves as an alternative to the WPC products. However, WPC products exhibit the lowest price point; the level of substitution threat is expected to be moderate over the forecast period.

Product Insights

The polyethylene product segment led the market with the largest revenue share of 66.0% in 2025. The high demand for polyethylene is primarily driven by the manufacturing of furniture for homes, offices, restaurants, resorts, and hospitals. Moreover, the rising demand for polyethylene in the automotive industry, owing to its low cost, high stiffness, and biodegradability, is expected to further propel the market growth over the coming years. Low cost, high stiffness, abundant raw material availability, and biodegradability offered by polyethylene-based wood plastic composite products are likely to open new avenues for market growth.

The polypropylene segment is anticipated to grow at the fastest CAGR of 12.0% over the forecast period. This higher share is attributed to its heavy use in the niche application segments, such as water-resistant coatings on furniture and high-temperature controllable wooden units. As well as the polyvinylchloride segment is projected to register a significant CAGR of 11.5% in terms of volume over the forecast period.

Growing demand for polyvinylchloride thermoplastics in automotive applications for manufacturing door panels, seat cushions, cabin linings, backrests, and dashboards on account of its excellent insulation properties is expected to have a positive impact on the market growth over the forecast period. Polyvinyl chloride thermoplastics possess insulation properties and are therefore used in the manufacture of insulating products for applications in the electrical and automotive industries.

The rising demand for polystyrene and acrylonitrile butadiene styrene composites in a wide range of applications, such as kitchen furniture, shower receptors, bathtubs, window sills, and whirlpool baths, due to their high durability and environmentally friendly characteristics, is expected to boost market growth over the next eight years.

Application Insights

The building and construction segment led the market with the largest revenue share of 71.3% in 2025. Increasing infrastructural development activities in the emerging economies such as China, India, Thailand, and Brazil, coupled with the growing demand for aesthetically appealing furniture and flooring solutions across the globe, have surged the demand for wood plastic composite in the construction industry. The rising demand for various wood-plastic-based products in construction applications, particularly for decking, is expected to drive market growth.

The use of recyclable or biodegradable wood-plastic composite-based parts in automobiles is expected to improve mechanical strength and acoustic performance. In addition, it also reduces material weight and fuel consumption, lowers manufacturing costs, improves passenger safety and shatterproof performance. These factors are forecasted to boost the market at the fastest CAGR of 12.4% from 2026 to 2033.

Wood-filled PVC is gaining popularity because of its balance of thermal stability, moisture resistance, stiffness, and strength, although it is more expensive than unfilled PVC. Wood-plastic composites are utilized in various sectors worldwide, although their applications differ. For longevity, they extrude wood-filled PVC with an unfilled PVC cap stock, while others extrude a PVC core with a paintable wood-filled PVC surface.

Increasing demand for wood plastic composite in manufacturing noise barriers for street construction, sheet pilings for landscaping, and garden furniture is expected to surge the product demand over the forecast period. In addition, the rising demand for wood plastic composite in manufacturing consumer goods, including toys and showpieces, is anticipated to further propel the market growth over the coming years.

Regional Insights

North America dominated the global wood plastic composites market with the largest revenue share of 51.5% in 2025, supported by rising demand for durable, low-maintenance building materials across residential, commercial, and outdoor applications. Increasing renovation activities reinforce growth, a shift toward sustainable construction materials, and technological advancements that enhance product performance and aesthetic appeal. The U.S. remains the largest contributor owing to strong infrastructure spending and widespread decking and fencing installations, while Canada’s market benefits from green construction standards and energy-efficient building codes. In addition, the Mexico market is emerging as a key growth pocket due to expanding construction activities, improving manufacturing capabilities, and rising adoption of eco-friendly materials in outdoor and industrial applications, collectively strengthening North America’s regional demand outlook.

U.S. Wood Plastic Composites Market Trends

The wood plastic composites market in the U.S. is experiencing strong growth driven by rising home renovation trends, expanding outdoor living spaces, and increasing consumer preference for durable, low-maintenance alternatives to traditional wood. Manufacturers are investing in advanced extrusion technologies and integrating recycled plastics, aligning with sustainability goals and evolving building codes. Demand is further supported by the rapid adoption of WPC decking, fencing, railing, and siding in both residential and commercial settings. In addition, strong distribution networks, product innovation, and the presence of leading WPC producers continue to position the U.S. as the dominant contributor to the regional market.

Europe Wood Plastic Composites Market Trends

The wood plastic composites market in Europe is growing at a rapid pace. The growth of the automotive industry in the region, which uses the product to manufacture interior & exterior trims, is anticipated to propel the demand for the product over the forecast period. However, the region has reached the stage of maturity, thereby expected to grow at a sluggish rate over the forecast period.

Asia Pacific Wood Plastic Composites Market Trends

The wood plastic composites market in Asia Pacific is expected to progress at the fastest CAGR of 12.4% over the forecast period. Increasing population in countries including India, China, Bangladesh, and Pakistan, coupled with changing consumer lifestyle, has resulted in the growth of the construction and consumer goods industry in the region, which in turn is expected to have a positive impact on the market growth over the forecast period.

The India wood-plastic composites market is expected to witness at a significant CAGR during the forecast period, due to the rising expansion of the capital market, the presence of small- & large-scale industries, and increasing foreign exchange reserves. The government’s ‘Make in India’ initiative is further expected to boost the consumer goods application segment.

Central & South America Wood Plastic Composites Market Trends

The wood plastic composites market in Central & South America is expected to progress at the substantial CAGR over the forecast period. Construction activities in the Central and South American economies have grown substantially owing to the rising income levels and shifting consumer preferences towards green buildings. The expanding commercial construction sector, coupled with government initiatives to create awareness about green buildings among the public, is expected to stimulate growth in the global market over the forecast period.

Key Wood Plastics Composites Company Insights

Some of the key players operating in the market include CertainTeed, LLC., JELU-WERK J. Ehrler GmbH & Co. KG, RENOLIT SE, Trex Company, Inc., and Oakio Plastic Wood Building Materials Co. Ltd.

-

CertainTeed, LLC. has segregated its business into two divisions, which include exterior building and interior building. The product portfolio under exterior building products encompasses roofing, siding, trim, sheathing, fencing, decking, railing, foundations, windows, and fiber-cement siding. Moreover, the company has a wide geographical presence, offering its products in over 100 countries.

-

JELU-WERK J. Ehrler GmbH & Co. KG is engaged in the production of wood plastic composite compounds, lignocellulose, and cellulose using plant fibers. The wood-plastic composite brands of the company operating in the market are Jelucel, Jeluvet, and Jeluxyl. The company distributes its products across all the five major regions across the globe.

Beologic, Fiberon, FKuR, Guangzhou Kindwood Co., Ltd., and UFP Industries, Inc. are among the emerging market participants in the industry.

-

UFP Industries, Inc. is engaged in the manufacturing and distribution of wood and wood-based alternative products. The company has three reportable segments, including retail, construction, and industrial. The company operates over 170 facilities in more than 100 countries, including the U.S., Canada, Mexico, India, Japan, the UK, and Australia, which supply tens of thousands of products to its three business segments.

-

Fiberon manufactures and distributes wood plastic composite products, which include composite decking, railings, and cladding. Its North Carolina production facility includes 400,000 square feet of manufacturing space and 175,000 square feet of assembly and warehouse space.

Key Wood Plastic Composites Companies:

The following are the leading companies in the wood plastic composites market. These companies collectively hold the largest Market share and dictate industry trends.

- Beologic

- Fiberon

- FKuR

- Guangzhou Kindwood Co. Ltd.

- JELU-WERK J. Ehrler GmbH & Co. KG

- PolyPlank AB

- RENOLIT SE

- TAMKO Building Products LLC

- The AZEK Company Inc. (TimberTech)

- Trex Company, Inc.

- UFP Industries, Inc.

- Hardy Smith Designs Private Limited.

- Oakio Plastic Wood Building Materials Co. Ltd.

Recent Developments

-

In June 2024, Oakio Plastic Wood Building Materials Co. Ltd., Inc. introduced Proshield WPC Cladding. This advanced cladding solution offers durability, sustainability, and aesthetic versatility for exterior building materials. Proshield WPC Cladding is engineered with a unique blend of wood fibers and high-density polyethylene, encased in a robust polymer shield.

-

In January 2023, UFP Industries, Inc. announced that it would feature new and innovative products from two leading brands, Deckorators and UFP-Edge. These distinctive products enable both DIYers and builders to bring their personal creativity to outdoor living, thereby helping the company gain a competitive edge.

Wood Plastic Composites Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 9.91 billion

Revenue forecast in 2033

USD 21.51 billion

Growth rate

CAGR of 11.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Mexico; Canada; UK; Germany; France; Spain; Italy; Russia; Netherland; Switzerland; China; Japan; India; South Korea; Australia; Indonesia; Thailand; Singapore; New Zealand; Philippines; Brazil; Argentina; Chile; Saudi Arabia; South Africa; UAE; Egypt; Iran

Key companies profiled

CertainTeed, LLC.; Beologic; Fiberon; FKuR; Guangzhou Kindwood Co. Ltd.; JELU-WERK J. Ehrler GmbH & Co. KG; PolyPlank AB; RENOLIT SE; TAMKO Building Products LLC; The AZEK Company Inc. (TimberTech); Trex Company, Inc.; UFP Industries, Inc.; Hardy Smith Designs Private Limited.; Oakio Plastic Wood Building Materials Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wood Plastic Composites Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global wood plastic composites market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene

-

Polypropylene

-

Polyvinylchloride

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building and Construction

-

Automotive Components

-

Industrial and Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Russia

-

Netherlands

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

Singapore

-

New Zealand

-

Philippines

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East

-

Saudi Arabia

-

South Africa

-

United Arab Emirates (UAE)

-

Egypt

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global wood plastic composites market size was estimated at USD 8.89 billion in 2025 and is expected to reach USD 9.91 billion in 2026.

b. The global wood plastic composites market is expected to grow at a compound annual growth rate of 11.7% from 2025 to 2033 to reach USD 21.51 billion by 2033.

b. The polyethylene product segment dominated the market, accounting for more than 66.0% of the global revenue in 2025. The market is driven by the rising demand for sustainable construction materials, along with an increase in renovation and repair activities in the residential sector worldwide.

b. The polyethylene product segment dominated the market, accounting for more than 66.0% of the global revenue in 2025. The market is driven by the rising demand for sustainable construction materials, along with an increase in renovation and repair activities in the residential sector worldwide.

b. The key factors driving the wood-plastic composites market include the increasing use of these products in various residential, industrial, and commercial sectors. Moreover, increasing consumer preferences for green buildings is projected to boost the demand for wood plastic composite in the construction industry over the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.