Wood Pellets Market Size, Share & Trends Analysis Report By Application (Heating, Power Generation), By End-use (Residential, Industrial, Commercial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-745-2

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Wood Pellets Market Size & Trends

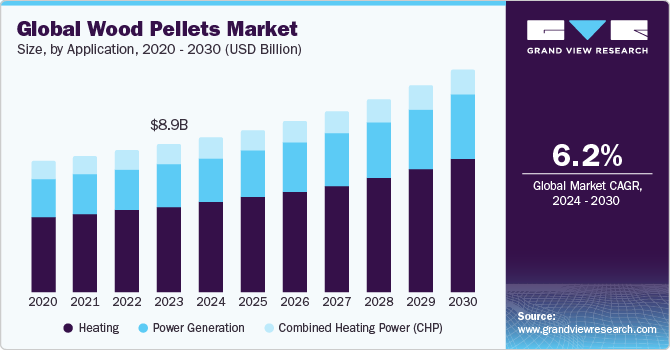

The global wood pellets market size was estimated at USD 8.91 billion in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2030. The demand for wood pellets is expected to witness significant growth as they can replace fossil fuels due to their eco-friendly, sustainable, and carbon-neutral attributes. Wood pellets are used as a substitute for fossil fuels owing to the major advantage of reduced greenhouse gas and carbon dioxide emissions, which majorly contributes to their application in heating, fuel, and power generation.

The harmful effects caused by burning fossil fuels, including greenhouse gas emissions and global warming, have led to the search for new, renewable, and clean alternatives for power generation. Moreover, the combustion of fossil fuels results in the transfer of geological carbon into the atmosphere, which is the primary factor contributing to global warming. Thus, these factors have increased the global demand for these pellets. These pellets are among the major sources of power generation owing to the consideration that they are manufactured using residues or waste from sawmills, wood processing units, and other timber-related industries.

Raw materials used for manufacturing these pellets include sawdust from sawmills and wood residues from timber processing companies. These materials are obtained at a low cost by the wood pellet manufacturers. In addition, urban wood waste, such as wood chips obtained by recycling residues and disposed of wooden pallets, is considered feedstock for manufacturing wood pellets. These raw materials are procured by manufacturers and transported to the production facilities using trucks.

Companies involved in manufacturing pellets include Drax Biomass, Georgia Biomass, LLC, Energex, Vermont Wood Pellet Co., Singpellet Pte. Ltd., and Pinnacle Renewable Energy, Inc. Majority of the aforementioned companies have vertically integrated supply chains, wherein they are involved in harvesting raw materials, manufacturing wood pellets, and supplying them to power plants or residential applications.

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The wood pellets market is highly competitive in nature with the presence of several major players. Many manufacturers are integrated across the three stages of the value chain from manufacturing raw materials to distribution of these pellets. Furthermore, companies have vast distribution channels spread across the globe with numerous distribution channels.

External substitution in the industry is high, as wood briquettes are perfect substitutes for wood pellets, offering high tolerance and involving the usage of a variety of raw materials. Furthermore, the product itself is a substitute for coal and other fossil fuels used in electricity generation in power plants.

The market is regulated by various bodies, such as the European Standards (EN) and the International Organization for Standardization (ISO), which lay down regulations and standards that govern the production, testing, and application of wood pellets. The bodies define required technical specifications such as moisture content, pellet size, and calorific value.

Buyers of these pellets include retailers and commercial buyers or importers. The buying power of resellers or retailers is low, as they rely on local suppliers and provide wood pellets for residential applications. Furthermore, the buying power of importers is moderate, as they can negotiate the prices owing to bulk demand.

Application Insights

The heating applications dominated the market accounting for a revenue share of 58.3% in 2023. The use of wood pellets for heating federal or municipal buildings, office buildings, educational facilities, and other commercial buildings in European and North American countries is increasing at a rapid pace on account of the availability of bulk fuel supply and advanced technology such as pellet stoves. In addition, the adoption of these pellets as a clean-burning renewable fuel source coupled with their sustainable production from sawdust and forest residues is projected to have a positive impact on their market growth over the forecast period.

The power generation application is expected to grow at a CAGR of 6.4% from 2024 to 2030. Wood pellets are used to generate electricity in coal-based power plants, where they are co-fired with coal to reduce greenhouse gas emissions. The easy adaptability of these pellets with automated combustion systems in coal-fired power plants is expected to drive their demand in power generation applications.

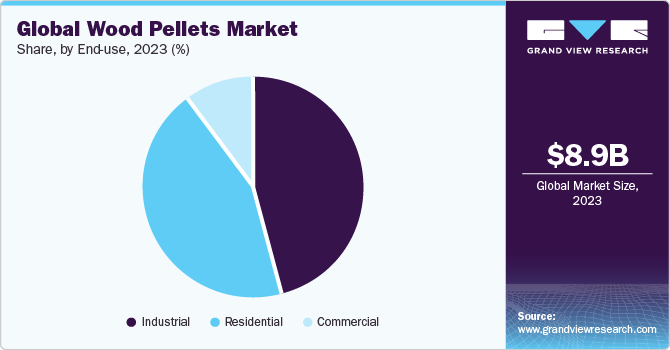

End-use Insights

The industrial end-use dominated the market with a revenue share of 45.8% in 2023 and is further expected to grow at the fastest CAGR from 2024 to 2030. The product finds application in various industrial processes, such as food processing, drying process, and manufacturing, as a renewable energy source.

They can be used in industrial dryers, thermal equipment, and boilers to provide energy for particular processes and help reduce reliance on fossil fuels. Furthermore, the ability of wood pellets to offer consistent quality because of their size and properties and reliable performance for industrial heating systems is driving segment growth.

The residential end-use is anticipated to register a growth of 6.2% from 2024 to 2030 owing to the rising use of wood pellets for heating via pellet boilers and pellet stoves in homes. These pellets are becoming increasingly popular among household users due to attributes like green, cleansing, sustainability, etc. They are commonly used for cooking and heating in households, but they can also be used as cat litter and horse bedding.

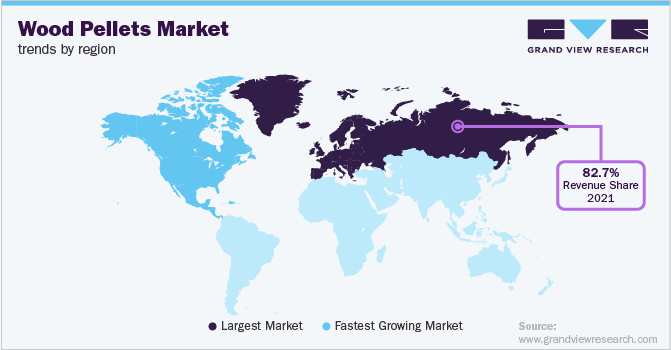

Regional Insights

The wood pellets market in North America accounted for a significant revenue share in 2023. The major factors driving the demand for wood pellets in North America include the regional price competitiveness with propane and residential heating oil and the increasing replacement of traditional burners for improving automatic feed-in and comfort. The favorable climatic conditions for heating in residential and commercial buildings are further expected to complement market growth.

U.S. Wood Pellets Market Trends

The U.S. wood pellets market dominated the market with highest revenue share in 2023. The production of wood pellets in the U.S. is concentrated in the Northeast and Northwest regions, where residues from sawmills are used as raw materials, and the end products are supplied to the residential sector for heating applications. However, rising demand for these pellets from the global market is a key driver for their increasing production in the country.

Europe Wood Pellets Market Trends

The wood pellets market in Europe dominated the market with a revenue share of 82.2% in 2023. This growth is characterized by economies, such as the UK, Sweden, Denmark, Belgium, Germany, Austria, and France. The Feed-in Tariffs (FiTs) program by various EU member states, including the Netherlands, the Czech Republic, Denmark, and Germany, provides financial support for using renewable energy in the generation of electricity, which is expected to drive the demand for these pellets in power plants.

The Germany wood pellets market is expected to grow at the fastest CAGR from 2024 to 2003. The country is the third-largest producer of these pellets worldwide after the U.S. and Canada. The presence of a strong wood processing industry coupled with extensive forest areas is expected to maintain a substantial supply of raw materials for manufacturing wood pellets. In addition, the high heating potential of the product is expected to propel their demand over the forecast period.

Asia Pacific Wood Pellets Market Trends

The wood pellets market in Asia Pacific is driven by the increasing demand for the product in Japan, South Korea, and China. The major suppliers of these pellets in the region include Vietnam, China, Indonesia, Malaysia, Thailand, and Canada. These pellets in the region have applications for electricity generation in coal-fired power plants. Furthermore, the governments of various countries in the region are promoting renewable energy sources of energy, which has resulted in the formulation of policies responsible for driving the demand for these pallets in Asia Pacific over the years.

The China wood pellets market accounted for the largest revenue share in the Asia Pacific for the year in 2023. The demand for products to fuel the power plants for electricity generation is projected to witness significant growth, owing to the rising number of power plants in the country. China has banned the use of coal-fired boilers in the east and Guangdong provinces.

The Wood pellets market in India showed significant a revenue share in 2023. These pellets are used in India for heating and cooking with pellet stoves in residential and commercial applications. A combination of micro-gasification stoves or devices using these pellet fuels is also used in residential and commercial applications in the country. Furthermore, the country’s focus on renewable energy and reducing carbon emissions is expected to propel the demand for wood pellets over the years.

Middle East & Africa Wood Pellets Market Trends

The countries that contribute to the demand for wood pellets in the Middle East & Africa are Kuwait, Oman, Qatar, UAE, Saudi Arabia, South Africa, and Egypt. Major applications of these pellets in the region are as an electricity source and fuel for replacing wood fuel and paraffin for heating, lighting, and cooking purposes in non-electrified residential buildings.

The Wood Pellets Market in South Africa is considered one of the largest pellet manufacturers in Africa as the country consists of a large wood processing industry and forest resources. Moreover, the implementation of policies that support sustainable and clean energy generation in the country is also contributing to the use of these pellets for meeting energy requirements and reducing dependency on traditional fuels.

Central & South America Wood Pellets Market Trends

The demand for wood pellets in Central & South America is primarily derived from their use in residential and commercial applications, which account for over 80% of the overall demand for these pellets in the region.

The Wood pellets market in Brazil dominated the market with highest revenue share in 2023. The favorable climatic and soil conditions, coupled with future policies of the government of the country for reducing GHG emissions, are expected to have a positive impact on the growth of the wood pellet market in Brazil in the coming years.

Key Wood Pellets Company Insights

Some key players operating in the market include Enviva LP, Drax Group Plc, and Pinnacle Renewable Energy Inc.

-

Pinnacle Renewable Energy Inc. Company along with its subsidiaries, focuses on the manufacturing, distribution, and sale of industrial wood pellets in Europe, North America, and Asia. It has seven manufacturing facilities located in western Canada, where the supply of wood fiber is abundant, aiding the manufacture of wood pellets. These plants are located near rails or ports for ease of transportation of pellets.

-

Drax Group Plc is focused mainly on the generation and distribution of electricity in the UK. Its operations are conducted through an integrated value chain across the three key areas including sustainable wood pellet production, electricity generation, and energy sales & services to customers.

I.C.S. (Lacroix) Lumber Inc., Wood Pellet Energy (UK) Ltd., and Premium Pellet Ltd. are some emerging market participants in the market.

-

Premium Pellet Ltd. is engaged in manufacturing wood pellets from chip fines or white wood waste, planer shavings, and sawmill sawdust. It is a subsidiary of Nechako Lumber Co., Ltd. The company provides wood pellets in bags for retail distribution; as well as in bulk quantities in larger containers, rail carloads, truckloads, and ship hold loads for the offshore market.

-

I.C.S. (Lacroix) Lumber Inc. is a family-owned company located in Northern Ontario, Canada. The company is engaged in the production and distribution of wood pellets for institutional, commercial, and residential heating in Canada. Its customers include retailers in areas of Quebec, Ontario, Eastern U.S., and Europe.

Key Wood Pellets Companies:

The following are the leading companies in the wood pellets market. These companies collectively hold the largest market share and dictate industry trends.

- Drax Group Plc

- SINGPELLET Pte. Ltd.

- Enviva LP

- Georgia Biomass, LLC

- The Westervelt Company, Inc.

- Pinnacle Renewable Energy Inc.

- Energex

- Wood Pellet Energy (UK) Ltd.

- United Company

- Groupe Savoie Inc.

- Vermont Wood Pellet Co.

- Pacific BioEnergy

- Premium Pellet Ltd.

- I.C.S. (Lacroix) Lumber Inc.

- Lauzon Recycled Wood Energy

Recent Developments

-

In June 2023, TotalEnergies started packaging its premium wood pellets in high-performance polyethylene bags which incorporate 50% PCR (post-consumer recycled_ materials. The packaging delivers the same thickness and properties as compared to fossil-based alternatives, but at the same time reduces the environmental footprint. Furthermore, the initiative was taken to execute a circular economy in plastic use by the company.

-

In August 2022, Drax Group Plc agreed to acquire the pellet production plant of Princeton Standard Pellet Corporation (PSPC) situated in British Columbia, Canada. The plant has a production capacity of 90,000 tons of wood pellets per year. This acquisition will help Drax Group Plc to achieve its target of reaching 8 million tons production capacity of wood pellets per year by 2030.

Wood Pellets Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.32 billion |

|

Revenue forecast in 2030 |

USD 13.38 billion |

|

Growth rate |

CAGR of 6.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

June 2024 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil; South Africa |

|

Key companies profiled |

Drax Group Plc; SINGPELLET Pte. Ltd.; Enviva LP; Georgia Biomass, LLC; The Westervelt Company; Inc., Pinnacle Renewable Energy Inc.; Energex, Wood Pellet Energy (UK) Ltd.; United Company; Groupe Savoie Inc.; Vermont Wood Pellet Co.; Pacific BioEnergy; Premium Pellet Ltd.; I.C.S. (Lacroix) Lumber Inc.; Lauzon Recycled Wood Energy |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

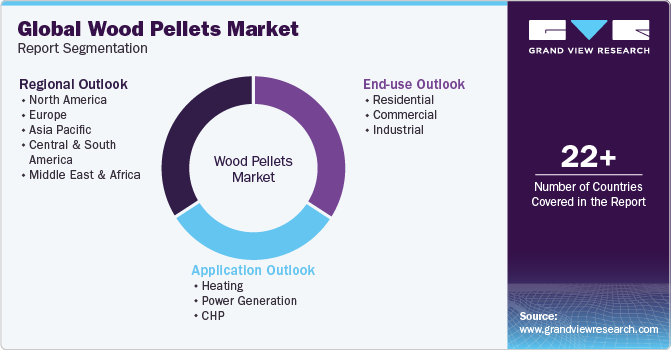

Global Wood Pellets Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wood pellets market report based on application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Heating

-

Power Generation

-

CHP

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wood pellets market size was estimated at USD 8.91 billion in 2023 and is expected to reach USD 9.32 billion in 2024.

b. The wood pellets market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 13.38 billion by 2030.

b. Industrial end use accounted for the largest revenue share of 45.8% in 2023 and is expected to dominate the market over the forecast period, owing to the increasing demand of renewable source of energy across the globe.

b. The key players operating in the global wood pellets market include Drax Group Plc, SINGPELLET Pte. Ltd., Enviva LP, Georgia Biomass, LLC, The Westervelt Company, Inc., Pinnacle Renewable Energy Inc., Energex, Wood Pellet Energy (UK) Ltd., United Company, and Groupe Savoie Inc.

b. The wood pellets market is anticipated to be driven by growing residential consumption and encouraging government policies to use renewable source of energy, which will consequently drive the market growth. In addition, rising awareness regarding the environmental degradation by harmful emissions by other fuels is also expected to aid the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."