- Home

- »

- Plastics, Polymers & Resins

- »

-

Wood Pallets Market Size, Share And Trends Report, 2030GVR Report cover

![Wood Pallets Market Size, Share & Trends Report]()

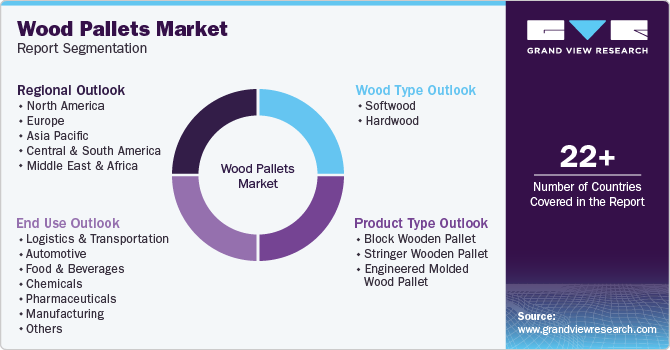

Wood Pallets Market (2024 - 2030) Size, Share & Trends Analysis Report By Wood Type (Softwood, Hardwood), By Product Type (Block Wooden Pallet, Stringer Wooden Pallet), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-137-6

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wood Pallets Market Summary

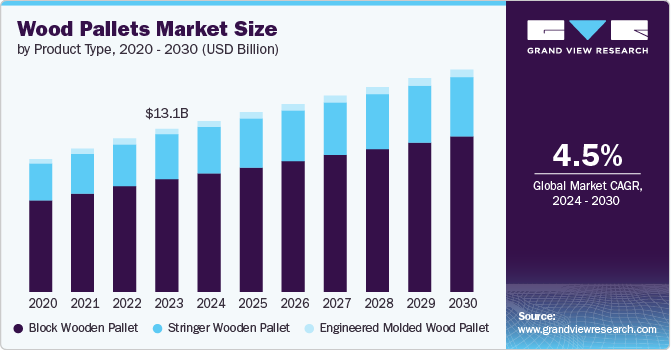

The global wood pellets market size was estimated at USD 13.1 billion in 2023 and is projected to reach USD 17.8 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. The growth in global trade influences the demand for wooden pallets used in logistics & transportation.

Key Market Trends & Insights

- Asia Pacific dominated wood pallets regional segment and accounted for a revenue share of over 39.0% in 2023.

- China wood pallets market hold dominant position in Asia Pacific region.

- Based on wood type, the softwood segment dominated and accounted for a revenue share of over 59.0% share in 2023.

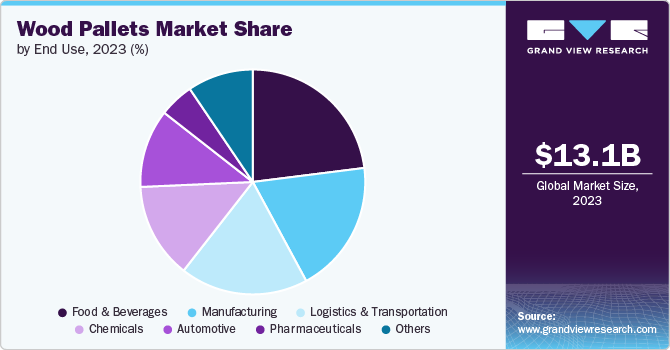

- Based on end use, the food & beverage segment dominated and accounted for a revenue share of over 22.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 13.1 Billion

- 2030 Projected Market Size: USD 17.8 Billion

- CAGR (2024-2030): 4.5%

- Asia Pacific: Largest market in 2023

According to World Trade Organization the demand for traded goods is expected to grow in 2024 and 2025 compared to previous contraction in 2023, resulting in growth in global merchandise trade volume by 2.6% and 3.3% respectively. Wooden pallets helps facilitate the movement and storage of goods across borders in the supply chain sector. The global trade positive growth indication presents growth opportunity for wood pallets market.

Wood pallets, renowned for their strength and durability, are essential for supporting heavy loads during transportation and handling. Moreover, their cost-effectiveness compared to plastic pallets, and ability to be customized contributes to their demand in various End use industries. Moreover, the ease of repair and increasing preference for reusable packaging components are anticipated to fuel global market growth for wood pallets.

The food and beverage industry has witnessed sustained growth periodically. Global travel and cultural exchange have introduced consumers to a diverse range of cuisines, from Filipino and Korean to African, stimulating curiosity and demand for new flavors. Simultaneously, a growing emphasis on health and wellness has led to a surge in demand for vegetarian, vegan, low-fat, low-calorie, and gluten-free options. This shift in consumer preferences, both at home and away, has significantly contributed to the expansion of the food and beverage market.

The increasing diversity and sophistication of the food and beverage industry directly impacts the demand for packaging solutions, including wood pallets. As consumers seek a wider variety of products and prioritize convenience, the need for efficient and reliable packaging becomes paramount bringing wood pallets into the picture. Wood pallets, with their versatility, durability, and sustainability, remain a preferred choice for transporting food and beverage items across the supply chain.

According to the American Chemistry Council (ACC), the global chemical industry is thriving, with global production increasing by 0.3% in 2023 and projected to grow by 2.9% in 2024. This growth directly benefits the demand for wood pallets, which are essential for transporting and storing chemicals efficiently. Wood pallets' durability, versatility, and compatibility with handling equipment make them indispensable for chemical businesses.

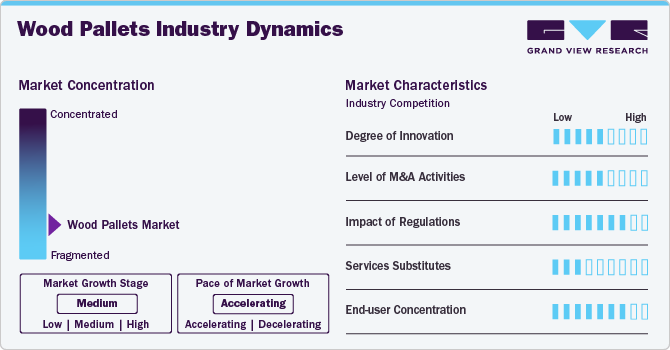

Industry Dynamics

The wood pallet market is generally fragmented. While there are a few large, multinational players, the majority of the market is composed of smaller, regional or local manufacturers. The impact of service substitutes is generally less for wood pallets as there are limited viable substitutes that can fully replicate their function, such as plastic or metal pallets. Since wood pallets are typically more cost-effective than many alternative materials, especially in large-scale operations. This makes it difficult for substitutes to compete on price.

In wood pallets market, the market players are actively launching new products, mergers & acquisitions, and investment in capacity expansion to meet customer demand. For instance, in July 2023, South Carolina-based EP Group acquired MORGAN WOOD PRODUCTS, an Ohio-based wood pallet manufacturer.

In June 2024, PalletOne announced launch of its automated pallet assembly machine redeployment program. This strategic move aims to expand the company's ability to offer comprehensive pallet and packaging solutions across North America.

Wood Type Insights

Based on wood type, wood pallets market is segmented into softwood and hardwood. Among these softwood dominated wood type segment and accounted for a revenue share of over 59.0% share in 2023. Softwood, sourced from needle-bearing coniferous trees, particularly pine, is a prevalent material for wood pallet production. Its wider availability and lower cost compared to hardwood have fueled its market growth. Softwood pallets' lightweight nature offers transportation efficiency. While their durability may be slightly less than hardwood pallets, softwood boards can compensate by using thicker dimensions. Furthermore, the block wooden pallets which are majorly used in Europe, Asia Pacific, Central & South America, and Middle East Africa are manufactured from softwood which further strengthens its market dominant position.

Hardwood pallets, crafted from trees such as walnut, hickory, beech, maple, and oak, are renowned for their superior load-bearing capabilities and command premium prices. While commonly utilized in furniture manufacturing, hardwood's penetration in the pallet market is relatively lower compared to softwood. In certain instances, a combination of hardwood and softwood is employed to construct wood pallets.

End Use Insights

Based on end use wood pallets market is segmented into logistics & transportation, automotive, food & beverages, chemicals, pharmaceuticals, and manufacturing among others. Among these food & beverage dominated the end use segment and accounted for a revenue share of over 22.0% in 2023. The food and beverage industry is one of the largest sectors in terms of product volume and frequency of shipments. This high volume of goods necessitates a reliable and efficient packaging solution such as wood pallets.

The logistics & transportation is expected to progress with fastest CAGR of 5.4% in terms of revenue over the forecast period. Wood pallets form a critical part of the supply chain of any business and are vital equipment in the logistics & transportation industry. The increasing globalization of trade and the expansion of international supply chains have driven the need for efficient and reliable transportation solutions, such as wood pallets.

Product Type Insights

Based on product type, market is segmented into block wooden pallets, stringer wooden pallets, and. Block wooden pallets dominated product type segment and accounted for over a revenue share of over 69.0% in 2023. Block wooden pallets market dominance is largely due to their superior features, such as uniform load distribution, ease of cleaning, and efficient handling compared to stringer wood pallets

Stringer wood pallets use vertical supports, known as stringers, to reinforce the load-bearing structure. These stringers are positioned between the top and bottom decks. Typically constructed from hardwood, stringer pallets often incur higher material costs compared to block wood pallets. In addition, stringer pallets are commonly referred to as two-way pallets due to their accessibility from both sides using a pallet jack.

Regional Insights

North America's abundant supply of tree species, including western hemlock, southern yellow pine, eastern white pine, and Douglas fir, provides a convenient source of raw materials for wood pallet manufacturers. The region's increasing focus on sustainable packaging solutions further benefits the wood pallet market, as these products are often perceived as more environmentally friendly alternatives to plastic pallets due to their biodegradability and recyclability.

U.S. Wood Pallets Market Trends

Wood pallets market in the U.S. is poised for growth, driven by the expansion of warehousing, logistics, food and beverage, and manufacturing sectors. The e-commerce boom has fueled a surge in warehouse construction, while other industries, such as renewable energy, are also contributing to this trend. For example, Orion Energy, a prominent U.S. renewable energy company, announced plans in August 2023 to invest USD 750 million in a new warehouse facility. As an essential component of warehouse operations, the growing demand for warehouses is expected to positively impact the wood pallet market.

Asia Pacific Wood Pallets Market Trends

Asia Pacific dominated wood pallets regional segment and accounted for a revenue share of over 39.0% in 2023. This region is also expected to be fastest growing market over forecast period. This growth can be attributed to the expansion of manufacturing, logistics, and e-commerce sectors. Countries such as China, India, Japan, and South Korea are major contributors to this market, driven by the increasing demand for efficient and cost-effective material handling solutions. The rise in cross-border trade within the region has also fueled the need for standardized pallets that comply with international shipping regulations.

China wood pallets market hold dominant position in Asia Pacific region and has experienced significant growth in recent years, registering a market share of 28.80% in 2023. This positive outlook is due to the country's booming manufacturing and logistics sectors. As the world's largest exporter of goods, China relies heavily on pallets for storing, handling, and transporting products across its vast supply chain network. The market is characterized by a mix of domestic manufacturers, ranging from small family-owned businesses to large-scale industrial producers, as well as international companies looking to capitalize on the growing demand for pallets.

Europe Wood Pallets Market Trends

The wood pallets market in Europe held a revenue share of over 25.0% in 2023. Food & beverage sector is a significant end user of wood pallets across the region, driven by the need for safe and hygienic transportation of perishable goods. European regulations and standards, such as those set by the European Pallet Association (EPAL), ensure that pallets used in this industry meet stringent hygiene and safety requirements. Companies such as Nestlé and Unilever rely heavily on certified wood pallets to maintain the integrity of their products during transit, highlighting the importance of quality and compliance in this sector.

The Germany wood pallets market is expected to grow during the forecast period. Germany, being one of Europe's largest economies and a major manufacturing hub, relies heavily on efficient transportation and storage solutions, making wood pallets an essential component of its supply chain infrastructure. The market is driven by the expansion of e-commerce, increased industrial production, and a growing emphasis on sustainable packaging solutions.

Central & South America Wood Pallets Market Trends

Wood pallets market in Central & South America is experiencing steady growth, driven by factors such as increasing industrialization, expanding logistics networks, and growing e-commerce sectors. The region's abundant timber resources and relatively lower labor costs have made it an attractive market for wood pallet manufacturers.

The wood pallets market in Brazil is driven by growing logistics & transportation industry. Brazil's economy relies heavily on the efficient transportation of goods between regions. Key industries, including manufacturing, construction, and agriculture, rely primarily on trucks to distribute their products across the country. The expansion of the logistics and transportation industry is directly correlated with an increased demand for wood pallets, which are essential for efficiently transporting heavy loads across various modes of transportation.

Middle East & Africa Wood Pallets Market Trends

The Middle East and Africa's robust oil and gas sector drives demand for lubricants and other chemicals used in automotive and various industries. As a major producer of Group III and API Group II base oils, the region exports these products to Western Europe, North America, and India. These chemicals are often transported in barrels placed on wood pallets for efficient handling. The increasing demand for lubricants and greases is expected to fuel the market for wood pallets in the region.

South Africa wood pallets market plays a crucial role in the country's logistics and supply chain industries. As a major exporter of fruits, wines, and other agricultural products, South Africa heavily relies on wooden pallets for storage and transportation. The market is characterized by a mix of local manufacturers, importers, and recyclers who cater to various sectors, including agriculture, manufacturing, and retail.

Key Wood Pallets Company Insights

The market exhibits presence of large number of players, most of which operate through North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa. In an attempt to augment their revenue and increase their market share companies engage in mergers & acquisitions and capacity as well as geographical expansion.

-

In May 2024, James Jones & Sons Ltd expanded its Australian pallet manufacturing operations through the acquisition of Express Pallets and Crates by its subsidiary, Hyne Timber Pty Ltd. This follows the recent acquisition of Rodpak in Melbourne, aligning with the company's strategy to expand and diversify its business. The combination of these acquisitions will strengthen James Jones & Sons' presence in the East Coast market, enabling them to leverage their existing sawn timber product portfolio.

-

In May 2024, the owners of Loscam, a leading Asian pallet pooling provider, are exploring the possibility of selling the company. China Merchants Group (CMG), Citic Capital, and Fountainvest Partners, the current shareholders, are reportedly in talks with potential buyers, including infrastructure funds, to finalize a deal valued at over USD 2.0 billion.

Key Wood Pallets Companies:

The following are the leading companies in the wood pallets market. These companies collectively hold the largest market share and dictate industry trends.

- CHEP

- Kronus LTD

- Kamps Inc.

- UFP Industries, Inc.

- TREYER PALETTEN GMBH

- Mid Cork Pallets & Packaging

- Hazelhill Timber Products

- SAS GROUP

- The Nelson Company

- PECO Pallet

- Hi-Tech Innovations

- M/s JAY WOOD INDUSTRY

- NEFAB GROUP

- LEAP

- Palette Deutschland

- Hangzhou Penno Packtech Co., Ltd.

- Renqiu Hongfei Wood Industry Co., Ltd

- SATO CAMPANY

- PalettenWerk

- Archimbaud group

Wood Pallets Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.77 billion

Revenue forecast in 2030

USD 17.88 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million units, revenue in usd million and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments Covered

Wood, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Saudi Arabia; South Africa

Key companies profiled

Kronus LTD; Kamps Inc.; UFP Industries, Inc.; TREYER PALETTEN GMBH; CHEP; Mid Cork Pallets & Packaging; Hazelhill Timber Products; SAS GROUP; The Nelson Company; PECO Pallet; Hi-Tech Innovations; M/s JAY WOOD INDUSTRY; NEFAB GROUP; LEAP; Palette Deutschland; Hangzhou Penno Packtech Co., Ltd.; Renqiu Hongfei Wood Industry Co., Ltd; SATO CAMPANY; PalettenWerk; Archimbaud group

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Wood Pallets Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the wood pallets market on the basis of wood type, product type, end use, and region:

-

Wood Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Softwood

-

Hardwood

-

-

Product Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Block Wooden Pallet

-

Stringer Wooden Pallet

-

Engineered Molded Wood Pallet

-

-

End Use Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Logistics & Transportation

-

Automotive

-

Food & Beverages

-

Chemicals

-

Pharmaceuticals

-

Manufacturing

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wood pallets market was valued at USD 13.12 billion in the year 2023 and is expected to reach USD 13.77 billion in 2024.

b. The global wood pallets market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 17.88 billion by 2030.

b. Block wooden pallets under the product type segment accounted for the largest market share of over 69.0% of the wood pallets market for the base year 2023. This is attributed to the features exhibited by the block wood pallets which include offering uniform support for loads, easy to clean, and easy to pick up compared to stringer wood pallets.

b. Some of the key players operating in the wooded pallets market include Kronus LTD, Kamps Inc., UFP Industries, Inc., TREYER PALETTEN GMBH, CHEP, Mid Cork Pallets & Packaging, Hazelhill Timber Products, and SAS GROUP

b. The growth of global trade and the rise in consumerism of food & beverage products are expected to drive the wood pallets market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.