- Home

- »

- Advanced Interior Materials

- »

-

Wood Fencing Market Size & Trends Analysis Report, 2030GVR Report cover

![Wood Fencing Market Size & Trends Report]()

Wood Fencing Market Size & Trends Analysis Report By Product (Picket, Vertical Boards) By Species (Cedar, Redwood), By Installation, By Coatings, By Application (Residential, Agricultural), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-065-8

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Wood Fencing Market Size & Trends

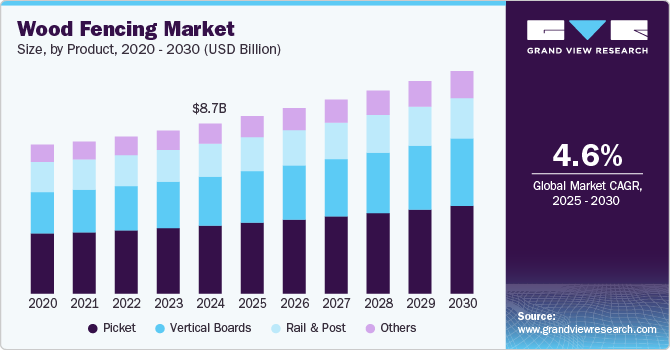

The global wood fencing market size was estimated at USD 8.71 billion in 2024 and is expected to grow at a CAGR of 4.6% from 2025 to 2030. The growth is attributed to its increasing use in residential and agricultural applications for protecting property by enclosing a given area. Fencing is available in different thickness ranges and made of wood materials such as cedar, Douglas fir, redwood, and whitewood. Cedar is the largest used material owing to its durability, strength, and visually appealing designs.

In addition, wood fencing is utilized in the agricultural industry to confine animals and protect farms from intruders. It also aids in increasing durability and in enabling lower maintenance requirements as compared to alarms and security control systems. According to the U.S. Department of Agriculture, U.S. agricultural exports are expected to be USD 196.0 billion in 2022, an increase of USD 5.00 billion more than in 2021 owing to higher commodity prices. Moreover, the agricultural industry across the world is a prominent user of fencing products thus, increasing the fencing demand.

The U.S. market accounted for the highest revenue share of the North America region with 83.8% in 2024 owing to its wide use in construction properties and buildings to improve the aesthetics of the infrastructure; thereby driving the market growth. In addition, the high number of remodeling projects and real estate developments in the U.S. are expected to propel the demand for wood fencing over the forecast period.

Wood is the primary raw material utilized for manufacturing wood fencing. Engineered wood products, oriented-strand board, fiber strand, or laminated strand lumber are used in the production of fence panels or pickets. Each fence blank in an engineered wood panel is of the same size. Each fence blank is then subject to edge profiling on the top and bottom edges, top feature milling to create fence top features, finishing, texturing, printing, paper overlay, and combinations.

The wood fencing market has been continuously witnessing expansion and is characterized by partnerships between major players to ensure competitiveness and profitability in the company. For instance, Hudson Fence Supply, Inc. and associated firms Hudson have been purchased by Eastern Wholesale Fence, LLC. Through this acquisition, the company is expected to continue to offer a comprehensive portfolio of premium fencing products and be a crucial partner to fence contractors, fabricators, distributors, retailers, landscapers, and municipalities.

Product Insights

The picket fence held the largest revenue share of 40.0% in 2024 owing to its high usage of safeguarding swimming pools or garden ponds. The imposition of rules across the globe that require the deployment of fences at poolsides for safety reasons is boosting product demand. Moreover, the rise in residential construction activities and the surge in institutional construction expenditures are expected to fuel the growth of picket wood fencing over the forecast period.

The vertical boards segment is expected to grow at the fastest growing segment at a CAGR of 5.6% over the forecast period. Vertical board fences offer privacy and noise absorption if the property is too close to neighbors or in a busy area. They are primarily adopted by users owning livestock comprising horses and cows. Different types of wood such as pine and hardwood are used for developing vertical board fencing. Users can paint or apply sealants to keep these fences shielded from the weather, depending on the aesthetic value of the wood.

The rail & post segment of the market is projected to grow at a CAGR of 3.5% in terms of revenue during the forecast period. The segment’s growth can be attributed to the increased adoption of rail & post fences in agricultural fields. In addition, these fences are strong and extremely resistant to decaying and warping caused by moisture. The easy availability of wood is also surging the demand for wooden rail & post fences.

Species Insights

Cedar dominated with the highest revenue share of 41.6% in 2024 as it has been used as a fencing material for many years, due to its high endurance. Cedar fences typically survive longer than those made of softer timbers, like pine, in addition to withstanding the elements well. In addition, the natural oils in cedar wood protect it from rotting and insect damage.

The redwood segment is anticipated to be the fastest growing segment with a CAGR of 5.6% in terms of revenue over the forecast year. The redwood is available in garden grades and architectural grades which can be adopted for fencing based on end-use application. Garden grades are thorny, hardy, and affordable, while, architectural grades are more appropriate for ornamental fences and find application in architectural fence panels. These panels may also be painted to provide a decorative look and increase durability.

Whitewood species of wood are available in a range of sizes, grades, and accents that can be added to create a distinctive design. They can also be painted or stained. Whitewoods are fitted as panels or as individual parts (board, back rail, post). When used for decorative purposes or as screening in a private location, it proves to be an economical fence.

Douglas fir is expected to grow at a CAGR of 3.5% in terms of revenue due to the high quality of its wood, its portability, and excellent nail and screw gripping capabilities. Douglas fir wood is a preferable choice for DIY projects because it is easy to cut and does not pose any other problems. In addition, these species, which are extracted from the heartwood, have shown to be better in performance than cedar in the market.

Installation Insights

The contractor & installers segment led the market and accounted for USD 5.61 billion in 2024. The increasing disposable income, growing population, and low levels of unemployment are expected to drive the demand for residential construction. This is anticipated to propel the growth of wood fencing, with contract installation gaining popularity.

The DIY segment is expected to grow at a significant rate of 6.1% from 2025 to 2030. The DIY trend was encouraged by factors such as a rise in house sales and the emergence of home remodeling videos on social media.There are several DIY fence kits present in the marketplace. However, since installation is time-consuming, many consumers choose to use professional services; this is anticipated to negatively impact the market growth.

Coatings Insights

The stained coating segment held the largest revenue of USD 7.03 billion in 2024 and is expected to grow at the fastest CAGR from 2025 to 2030. Fence stains help to reduce surface oxidation, preserving the wood's color for a longer period. The stain can be rolled, brushed, or sprayed onto the fence. The fence can be repaired to its original finish and then stained to make it look appealing even if it has weathered and is covered in mold and grey oxidation. This is anticipated to augment the demand for stained fencing.

The non-stained coatings market is expected to grow at a CAGR of 3.2% in terms of revenue over the forecast period. The demand for non-stained wood is comparatively less in comparison to stained wood, as it cannot be treated to increase durability, it cannot be designed according to the building structure, color, or requirement.

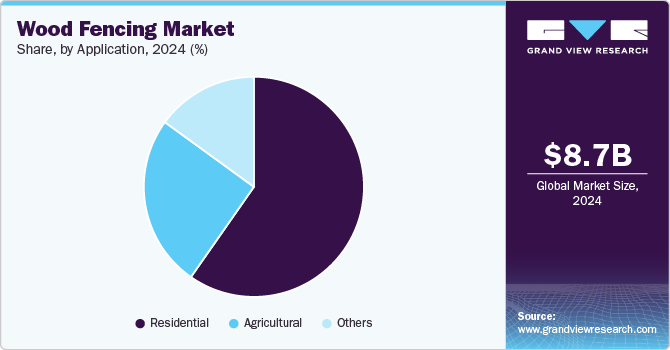

Application Insights

Wood fencing found its major application in residential buildings with revenue of USD 5.20 billion in 2024. It includes homeowners that emphasize privacy and security along with the comfort of their homes. The work-from-home or stay-in-place trends have resulted in a positive effect on the repair and remodeling of residential buildings. This is expected to have a positive impact on the wood fencing market growth.

The agricultural segment accounted for a 25.3% revenue share in 2024. For agricultural applications, fencing is designed and manufactured according to consumer requirements by using better-quality raw material, which are sourced from reliable vendors in the market. These fences find applications in farms, where they are used to keep stray animals away from grazing the fields.

The other application segment is expected to grow at a significant CAGR of 3.6% in 2024. There are various types of fencing available in a wide range of materials such as cedar, Douglas fir, redwood, and whitewood to secure commercial premises. Installation of the fence with either horizontal or vertical alignment offers a safeguard against intruders.

Regional Insights

The North America wood fencing market is expected to witness a significant growth of 3.2% CAGR over the forecast period due to the increasing construction of residential and commercial buildings in the region. The market is witnessing a rapid shift toward improving the aesthetics of the infrastructure; thereby driving the growth of the wood fencing.

U.S. Wood Fencing Market Trends

The wood fencing market in the U.S. has a longstanding cultural appeal, symbolizing privacy, security, and the classic “American dream” of homeownership. Many American homeowners prefer wood fencing for its traditional aesthetic and versatility, which can complement a variety of architectural styles. Wood fences can be customized in style, height, and finish, making them adaptable to different design preferences, from classic white picket fences to more rustic wooden boundaries.

Asia Pacific Wood Fencing Market Trends

The Asia Pacific wood fencing market dominated the global market and is expected to grow at the fastest CAGR of 5.6% over the forecast period. This is due to the rapidly growing population thus leading to higher demand for residential spaces. In addition, the growing service sector and development of industrial clusters in the emerging economies of the region such as India is further expected to bolster the demand for wood fencing over the forecast period.

The wood fencing market in China is driven by the rising demand for wood fencing due to increased urbanization, the growth of residential communities, and a shift toward more natural-looking landscaping options. As more people move to suburban and rural areas, there’s a growing interest in defining property boundaries and enhancing privacy with aesthetically pleasing fencing options. Wood fencing is valued for its natural, rustic appearance, which contrasts with China’s modern urban architecture and appeals to consumers seeking a connection to nature.

Europe Wood Fencing Market Trends

The Europe wood fencing market accounting for a leading share of 31.2% in 2024 and is driven by the increasing demand for the renovation of dwellings and is anticipated to create numerous opportunities for wood fencing vendors. As per the European Parliament report, over 90% of the buildings were built before 1990 and over 40% before 1960 in Europe. Thus, several buildings require renovation and reconstruction. Wood offers eco-friendly and sustainable fencing options to customers thus, increasing its demand in Europe. Burgeoning demand for energy-efficient green buildings to improve workplace health, cut construction & operating costs, and improve productivity is expected to create growth opportunities in the market. As a result, the need for wood fencing is expected to increase. In addition, wood fencing protects residents while having an attractive appearance and a sustainable design.

Key Wood Fencing Company Insights

Some key players operating in the market include Mendocino Forest Products Company, LLC (MFP) and Jacksons Fencing:

-

Mendocino Forest Products Company, LLC, based in California, USA, is a leading producer of redwood and Douglas fir lumber. Known for its commitment to sustainable forestry practices, MFP has built a strong reputation for responsibly sourced wood products, which include fencing materials, decking, and other outdoor wood applications. MFP operates as part of the Mendocino and Humboldt Redwood companies, which manage forests in northern California, ensuring a reliable, high-quality supply of timber for various uses.

-

Jacksons Fencing, based in the UK, is a prominent fencing manufacturer with over 75 years of experience. The company specializes in high-quality wood fencing solutions for residential, commercial, and agricultural use. Known for its craftsmanship and durability, Jacksons Fencing offers a broad range of fencing options, including traditional wooden fences, acoustic barriers, and security fencing solutions.

Treeway Fencing Ltd is one of the emerging market participants.

-

Treeway Fencing Ltd is a UK-based company specializing in the supply of wood fencing and related products for both residential and commercial applications. Founded more recently than its major counterparts, Treeway has positioned itself as a cost-effective supplier of reliable, high-quality fencing materials. The company’s range includes traditional wooden panels, post-and-rail fencing, and garden accessories, appealing to homeowners and landscaping professionals alike.

Key Wood Fencing Companies:

The following are the leading companies in the wood fencing market. These companies collectively hold the largest market share and dictate industry trends.

- Jacksons Fencing

- Treeway Fencing Ltd

- Wilfirs

- Travis Perkins

- Bekaert

- Seven Trust

- Sierra Pacific Industries

- Mendocino Forest Products Company, LLC (MFP)

- Redwood Empire Sawmill

- Pine River Group Home, Inc.

- L.L. Johnson Lumber Mfg. Co. & Johnson’s Workbench

- BarretteWood

- SPEC Wood Inc.

- Cedarline Industries

Wood Fencing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.10 billion

Revenue forecast in 2030

USD 11.41 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, species, coating, installation, application, country

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Belgium; Poland; China; India; Japan; Brazil; Saudi Arabia; UAE

Key companies profiled

Jacksons Fencing; Treeway Fencing Ltd; Wilfirs; Travis Perkins; Bekaert; Seven Trust; Sierra Pacific Industries; Mendocino Forest Products Company, LLC (MFP); Redwood Empire Sawmill; Pine River Group Home, Inc.; L.L. Johnson Lumber Mfg. Co. & Johnson’s Workbench; BarretteWood; SPEC Wood Inc.; Cedarline Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wood Fencing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wood fencing market based on product, species, coatings, installation, application, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Picket

-

Rail & Post

-

Vertical Board

-

Others

-

-

Species Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cedar

-

Douglas fir

-

Redwood

-

Whitewood

-

Others

-

-

Installation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Contractor & Installer

-

Do-It-Yourself

-

-

Coating Outlook (Revenue, USD Billion, 2018 - 2030)

-

Stained

-

Non-Stained

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Agricultural

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Belgium

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wood fencing market size was estimated at USD 8.71 billion in 2024 and is expected to reach USD 9.10 billion in 2025.

b. The global wood fencing market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030, reaching USD 11.41 billion by 2030.

b. Picket fences dominated the wood fencing market with a 40.0% revenue share in 2024, owing to its rising usage in gardens and pools primarily for security purposes.

b. Some of the key players operating in the wood fencing market include Jacksons Fencing, Treeway Fencing Ltd, Wilfirs, Travis Perkins, Bekaert, Seven Trust, Sierra Pacific Industries, and Mendocino Forest Products Company, LLC (MFP).

b. The key factors driving the wood fencing market include its increasing application in residential and agricultural areas and rising environmental awareness among the masses.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."