- Home

- »

- Medical Devices

- »

-

Women’s Health Rehabilitation Products Market Report, 2030GVR Report cover

![Women’s Health Rehabilitation Products Market Size, Share & Trends Report]()

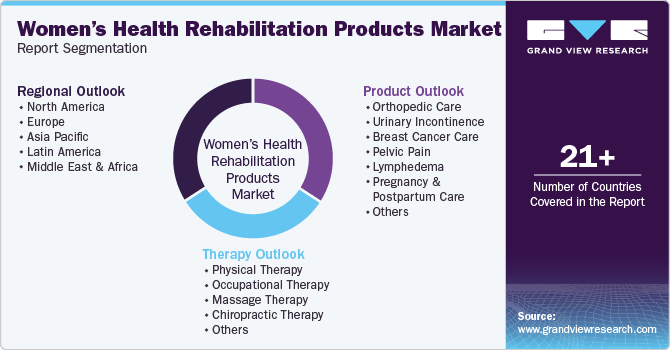

Women’s Health Rehabilitation Products Market Size, Share & Trends Analysis Report By Product (Orthopedic Care, Urinary Incontinence, Pregnancy & Postpartum Care), By Therapy, By Region And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-773-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

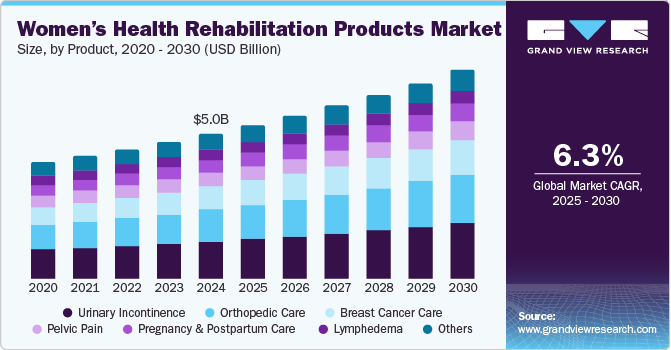

The global women’s health rehabilitation products market size was valued at USD 5.03 billion in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. This growth is driven by the increasing incidence of health conditions such as cardiovascular diseases, cancer, and disabilities among women. Additionally, the rising elderly women population and higher obesity rates due to sedentary lifestyles contribute significantly to the demand for these products. Moreover, advancements in medical research and technology, along with increased investments in R&D activities, are leading to the development of innovative rehabilitation products.

The increasing prevalence of rheumatoid arthritis, neurological disorders, and other disabilities among women worldwide (majorly in the U.S.) is expected to propel the growth of rehabilitation products. Bone health assessment X-ray machines, rollators and walkers or sticks, braces, belts, traction kits, wheelchairs, tens machines, and other bone support devices are likely to gain demand over the forecast period.

The large global base of females over 60 who have lower immunity levels is prone to chronic diseases such as arthritis, osteoporosis, cardiovascular conditions, atherosclerosis, neurological disorders, and age-related deformities. This is a high-impact driver for the growth of the women’s health rehabilitation products market for the next nine years.

Moreover, organizations such as the World Health Organization (WHO) advocate gender-sensitive health policies, encouraging countries to prioritize women's health in their healthcare systems. These efforts are complemented by increased public awareness campaigns that educate women on health risks and the importance of rehabilitation, thereby driving demand for specialized products.

Product Insights

The urinary incontinence segment held the largest share, 26.2%, in the global women's health rehabilitation products market in 2024. This can be attributed to the high prevalence of urinary incontinence among women, especially as they age. Products in this segment include absorbent pads, adult diapers, catheters, and electrical stimulation devices. These products' increasing awareness and social acceptance have also contributed to their widespread use. Additionally, technological advancements have led to the development of more effective and discreet solutions, further driving market growth.

On the other hand, the orthopedic care segment is expected to grow at a CAGR of 7.5% during the forecast period. This growth is driven by the rising incidence of musculoskeletal conditions among women, such as osteoporosis and arthritis. The segment includes products like braces, supports, and physical therapy equipment designed to aid in the recovery and management of orthopedic conditions. The increasing focus on preventive care and rehabilitation, along with the aging female population, is expected to fuel the demand for orthopedic care products. Furthermore, integrating advanced materials and designs in orthopedic products enhances their effectiveness and comfort, making them more appealing to consumers.

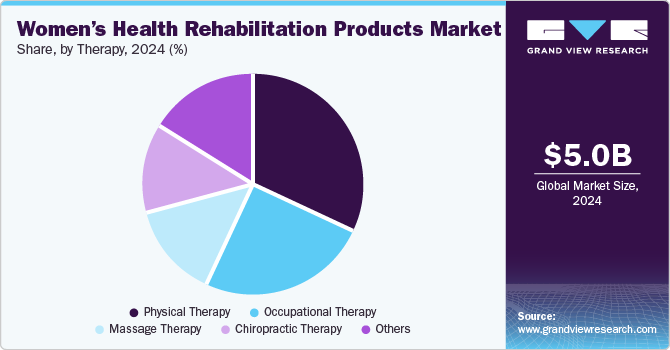

Therapy Insights

The physical therapy segment dominated the women's health rehabilitation market in 2024. This can be attributed to the widespread recognition of physical therapy as a crucial component in the recovery and management of various women's health conditions, such as postpartum recovery, pelvic floor dysfunction, and musculoskeletal injuries. Physical therapy offers non-invasive treatment options that help improve mobility, strength, and overall well-being. The increasing number of specialized physical therapy clinics and the integration of advanced therapeutic techniques have further contributed to the segment's dominance.

The chiropractic therapy segment is projected to grow at the fastest CAGR of 7.1% over the forecast period. Chiropractic therapy focuses on diagnosing and treating musculoskeletal disorders, specifically disorders related to the spine. The growing awareness of the benefits of chiropractic care, such as pain relief and improved posture, has led to increased demand for these services. Additionally, the aging female population and the rising prevalence of conditions like osteoporosis and arthritis are driving the need for non-surgical, drug-free treatment options. The segment's growth is also supported by the expanding number of chiropractic practitioners and the integration of chiropractic care into mainstream healthcare practices.

Regional Insights

The North American market held the largest share in 2024, driven by high awareness levels, advanced healthcare infrastructure, and the significant presence of major market players. The growing emphasis on women's health and wellness, coupled with robust government support, has further boosted the market in this region.

U.S. Women’s Health Rehabilitation Products Market Trends

The U.S. dominated the North American market in 2024, owing to its highly developed healthcare system and extensive R&D activities. The strong focus on addressing chronic conditions and the availability of advanced rehabilitation products have played a crucial role in maintaining the U.S. market's leadership. The Affordable Care Act (ACA) has also significantly expanded access to healthcare services, including rehabilitation products for women.

Europe Women’s Health Rehabilitation Products Market Trends

Europe accounted for the second-largest revenue share in 2024, with countries like Germany, France, and the UK leading the charge. The region's well-established healthcare infrastructure and increasing investment in women's health initiatives have driven market growth.

Asia Pacific Women’s Health Rehabilitation Products Market Trends

The Asia Pacific region is anticipated to grow the fastest during the forecast period, fueled by rising healthcare awareness, improving economic conditions, and a growing focus on women's health. Countries like China, India, and Japan are expected to contribute to this rapid market expansion.

Key Women’s Health Rehabilitation Products Company Insights

Some of the key companies in the women’s health rehabilitation products market include GE HealthCare, Access Health, GPC Medical Ltd, Zynex, Inc., Win Health Medical Ltd, Meyer Physical Therapy, AliMed, and others.

-

Access Health is known for its comprehensive range of rehabilitation products and aids, including orthopedic supports, pelvic floor trainers, and postpartum recovery tools.

-

GPC Medical Ltd. is another leading manufacturer of rehabilitation products and aids, offering a diverse range of products such as finger splints, back braces, cervical supports, and walking aids.

Key Women’s Health Rehabilitation Products Companies:

The following are the leading companies in the women’s health rehabilitation products market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Access Health

- GPC Medical Ltd

- Zynex, Inc

- Win Health Medical Ltd

- Meyer Physical Therapy

- AliMed

- DeRoyal Industries, Inc.

- Essity Medical Solutions

- Accord Medical Products

Recent Developments

-

In September 2024, Hyivy Health successfully raised USD 1.5 million to accelerate the development of its advanced pelvic rehabilitation platform. The Hyivy system is poised to redefine treatment standards for pelvic pain, offering promising results for both therapeutic and diagnostic applications. With its potential to address over 51 conditions affecting women at all stages of life, Hyivy is at the forefront of revolutionizing pelvic health care.

-

In April 2024, Solis Mammography, a leading provider of advanced breast health services, and Northwest Healthcare formed a strategic partnership to enhance breast imaging capabilities within the Tucson market. Through this joint venture, both organizations aim to expand access to high-quality mammography services, thereby improving women's overall health and well-being in the Tucson area.

Women’s Health Rehabilitation Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.32 billion

Revenue forecast in 2030

USD 7.22 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, therapy, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, KSA, UAE, South Africa, Kuwait

Key companies profiled

GE HealthCare, Access Health, GPC Medical Ltd, Zynex, Inc, Win Health Medical Ltd, Meyer Physical Therapy, AliMed, DeRoyal Industries, Inc., Essity Medical Solutions, Accord Medical Products

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Women’s Health Rehabilitation Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global women’s health rehabilitation products market report based on product, therapy, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Orthopedic Care

-

Urinary Incontinence

-

Breast Cancer Care

-

Pelvic Pain

-

Lymphedema

-

Pregnancy and Postpartum Care

-

Others

-

-

Therapy Outlook (Revenue, USD Billion, 2018 - 2030)

-

Physical Therapy

-

Occupational Therapy

-

Massage Therapy

-

Chiropractic Therapy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."