Wireless Testing Market Size, Share & Trends Analysis Report, By Offering (Equipment & Services), By Technology (Wi-Fi, Bluetooth, 2G/3G, 4G/LTE, 5G), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-341-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Wireless Testing Market Size & Trends

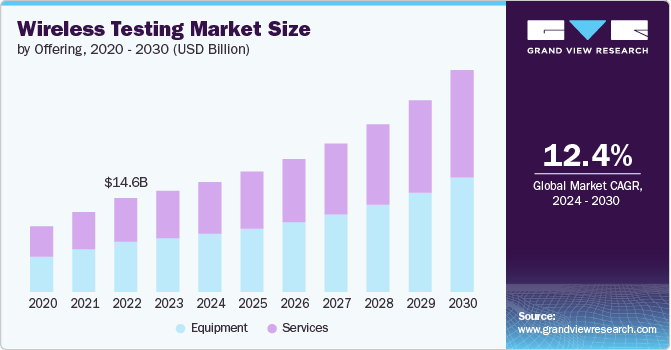

The global wireless testing market size was estimated at USD 14.55 billion in 2023 and is expected to grow at a CAGR of 12.4% from 2024 to 2030. The wireless testing market is experiencing robust growth, driven by a confluence of technological advancements and expanding applications across diverse industries. As wireless connectivity becomes increasingly ubiquitous, the demand for reliable, efficient, and secure wireless systems has surged, necessitating more sophisticated and comprehensive testing solutions.

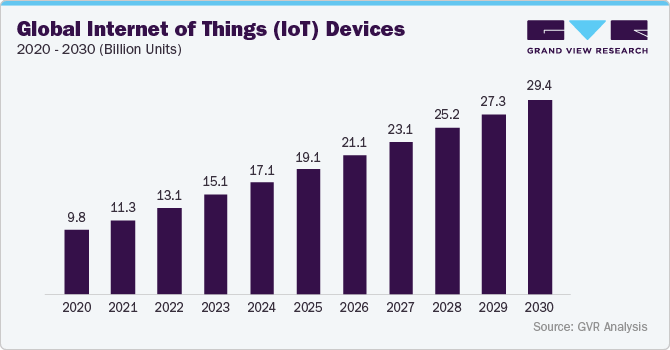

The rapid proliferation of wireless devices underpins this market expansion, the evolution of wireless standards such as 5G, and the integration of wireless technologies into critical infrastructure and everyday applications. From smartphones and IoT devices to industrial automation and smart city initiatives, the pervasive nature of wireless technology has created a complex ecosystem that requires rigorous testing to ensure functionality, interoperability, and compliance with evolving regulatory standards. As organizations and industries continue to leverage wireless capabilities to drive innovation and improve operational efficiency, the wireless testing market is poised for continued growth, playing a crucial role in maintaining the integrity and performance of our increasingly connected world.

Another major factor contributing to the expansion of the wireless testing market is the increasing complexity of wireless technologies and the growing emphasis on quality and reliability across diverse industries. As wireless systems become more intricate and are integrated into critical applications like autonomous vehicles, healthcare devices, and industrial automation, the need for thorough and accurate testing becomes paramount. This complexity is evident in the rising number of wireless protocols and frequency bands that devices must support. For instance, a modern smartphone typically incorporates multiple wireless technologies such as 5G, Wi-Fi 6, Bluetooth 5.0, NFC, and GPS, each requiring specific testing procedures.

This growth is further fueled by stringent regulatory requirements in sectors such as automotive, aerospace, and telecommunications, which mandate rigorous testing protocols to ensure product safety and performance. For example, in the automotive industry, the implementation of wireless systems for vehicle-to-everything (V2X) communication necessitates compliance with standards like DSRC (Dedicated Short-Range Communications) and C-V2X (Cellular Vehicle-to-Everything). Similarly, in aerospace, the DO-160 standard sets strict requirements for avionics equipment, including wireless systems.

The telecommunications sector faces ongoing challenges with the rollout of 5G networks, requiring extensive testing for spectrum efficiency, network slicing capabilities, and ultra-reliable low-latency communication (URLLC). The increasing adoption of wireless technologies in these high-stakes environments underscores the critical role of wireless testing in maintaining product integrity and public safety. Moreover, the emergence of Industry 4.0 and smart manufacturing concepts has led to a surge in industrial IoT devices, each requiring robust wireless testing to ensure seamless operation in challenging factory environments.

Offering Insights

Based on the offering, the wireless testing market is segmented into equipment and services. The equipment segment dominated the market in terms of market revenue share in 2023. The rapid advancement of wireless technologies, particularly 5G and IoT, has necessitated more sophisticated testing equipment to evaluate performance, reliability, and compliance. The increasing complexity of wireless systems, incorporating multiple radio frequencies and protocols, demands high-precision, multi-functional testing solutions.

Stringent regulatory requirements across industries like telecommunications, automotive, and aerospace further fuel the need for advanced testing tools to ensure adherence to evolving standards. The trend toward automation in testing processes has also boosted the adoption of advanced equipment, offering higher accuracy, repeatability, and efficiency. Additionally, the relatively high costs and long lifecycle of testing instruments contribute to sustained investment in this segment. These factors collectively reinforce the equipment segment's crucial role and dominant position in the wireless testing market.

Technology Insights

The 4G LTE segment accounted for the dominant market revenue share in 2023 and is likely to remain dominant from 2024-2030. Based on technology, the market is segmented into Wi-Fi, Bluetooth, 2G/3G, 4G/LTE, and 5G. The 4G/LTE segment's dominance in the wireless testing market can be attributed to several key factors. Primarily, the widespread global adoption and continued expansion of 4G/LTE networks have driven sustained demand for testing solutions. Despite the emergence of 5G, 4G/LTE remains the backbone of mobile communications in many regions, necessitating ongoing testing and optimization. The maturity of 4G/LTE technology has led to a well-established ecosystem of devices and infrastructure, requiring comprehensive testing to ensure interoperability and performance across diverse implementations.

Additionally, the evolution of LTE-Advanced and LTE-Advanced Pro has introduced new complexities, such as carrier aggregation and higher-order MIMO, which demand sophisticated testing methodologies. The integration of 4G/LTE in critical applications like public safety networks and IoT deployments has further emphasized the need for rigorous testing to ensure reliability and coverage. Moreover, as operators continue to densify their 4G networks to handle increasing data traffic, there is a persistent need for testing solutions to optimize network performance and capacity. The coexistence of 4G with emerging 5G networks also requires specialized testing to ensure seamless interworking and handover between the two technologies.

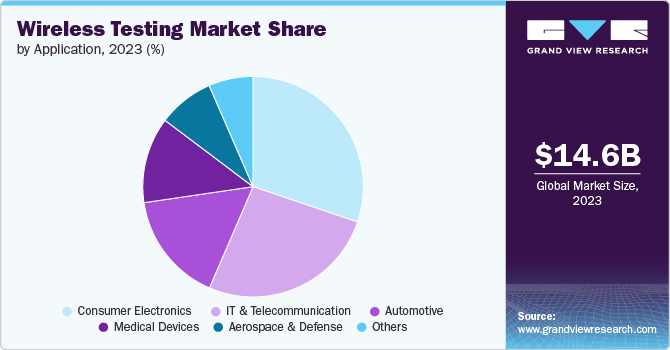

Application Insights

Based on application, the market is segmented into consumer electronics, IT & telecommunication, automotive, medical devices, aerospace & defense, and others. The consumer electronics segment accounted for the largest market revenue share in 2023. The proliferation of wireless-enabled devices, including smartphones, tablets, smartwatches, and smart home appliances, has created a vast and rapidly growing market for testing solutions. The frequent release cycles and high production volumes of consumer electronics necessitate extensive and efficient testing processes to ensure quality and compliance.

Additionally, the increasing integration of multiple wireless technologies (e.g., Wi-Fi, Bluetooth, NFC, cellular) within single devices has amplified the complexity of testing requirements. Consumer expectations for seamless connectivity and performance across various environments and use cases have raised the bar for wireless testing standards. The competitive nature of the consumer electronics market also drives manufacturers to prioritize rigorous testing to maintain product quality and brand reputation.

Regulatory compliance across different global markets further necessitates comprehensive testing protocols. The trend towards Internet of Things (IoT) devices in the consumer sector has expanded the scope of wireless testing, encompassing a wider range of products and connectivity scenarios. Moreover, the rapid adoption of new wireless standards in consumer products, such as Wi-Fi 6 and Bluetooth 5.0, continually drives demand for advanced testing capabilities.

Regional Insights

North America wireless testing market accounted for the largest revenue share in the global wireless testing market in 2023 and is expected to retain its dominance from 2024-2030. The region is at the forefront of wireless technology adoption and innovation, particularly in 5G deployment and IoT integration. This leadership position necessitates advanced testing solutions to ensure the reliability and performance of cutting-edge wireless systems. The presence of major telecommunications companies, technology giants, and wireless device manufacturers in North America drives significant investment in research and development, including testing infrastructure. The region's robust regulatory framework, enforced by bodies like the Federal Communications Commission (FCC), mandates rigorous testing for compliance and certification of wireless devices and systems.

Additionally, North America's strong focus on sectors such as automotive (with the development of connected and autonomous vehicles), aerospace, and defense contributes to the high demand for sophisticated wireless testing solutions. The region's advanced industrial sector, embracing Industry 4.0 concepts, further fuels the need for comprehensive wireless testing in manufacturing and automation applications. Moreover, the high consumer adoption rate of smart devices and home automation systems in North America creates a substantial market for consumer electronics testing.

U.S. Wireless Testing Market Trends

The wireless testing market of the U.S. is experiencing significant growth, driven by the country's leadership in 5G deployment, high smartphone penetration, and expanding IoT ecosystem. Key factors include the automotive industry's shift towards connected vehicles, government emphasis on cybersecurity, and the presence of major technology companies fostering innovation. Strict FCC regulations necessitate thorough compliance testing. The adoption of Industry 4.0 in manufacturing and increasing smart city initiatives are expanding wireless testing applications.

Asia Pacific Wireless Testing Market Trends

Asia Pacific wireless testing market is expected to showcase the fastest CAGR of 13.1% from 2024-2030. Rapid urbanization and digital transformation initiatives across countries like China, India, Japan, and South Korea are driving significant demand for wireless technologies and testing solutions. The region's large population and growing middle class are fueling a surge in smartphone adoption and IoT device penetration, necessitating robust testing infrastructure. Aggressive 5G rollout strategies, particularly in China and South Korea, are boosting the need for advanced wireless testing equipment and services.

The region's dominance in electronics manufacturing creates a substantial market for testing solutions in production and quality assurance processes. Emerging economies in Southeast Asia are investing heavily in telecommunications infrastructure, further driving demand. The automotive sector's growth, focusing on electric and connected vehicles, is another key driver. Government initiatives promoting smart cities, industrial automation, and digital connectivity are catalyzing IoT and M2M technology adoption, each requiring comprehensive testing. The increasing focus on local manufacturing and technological self-reliance in countries like India and China is spurring domestic innovation in wireless technologies. Additionally, the region's diverse regulatory landscape and the need to comply with various international standards contribute to the growing complexity and demand for wireless testing solutions.

Europe Wireless Testing Market Trends

The wireless testing market of Europe recorded a significant CAGR of 12.7%in the target market from 2024-2030. The region's concerted efforts to accelerate 5G rollout and digital transformation initiatives across member states have intensified the need for advanced wireless testing solutions. The European Union's stringent regulatory standards, particularly in areas of electromagnetic compatibility (EMC) and radio equipment directive (RED), necessitate comprehensive testing protocols for wireless devices and systems. Europe's strong automotive industry, with its focus on connected and electric vehicles, is a major driver for wireless testing demand, especially in areas like vehicle-to-everything (V2X) communication.

The region's emphasis on sustainable and smart city initiatives has led to increased deployment of IoT devices and sensors, further boosting the wireless testing market. Europe's diverse market, with varying levels of wireless infrastructure development across countries, creates unique testing challenges and opportunities. The continent's focus on privacy and data security, exemplified by regulations like GDPR, adds another layer of complexity to wireless testing requirements, particularly for IoT and mobile devices. Furthermore, Europe's investments in emerging technologies such as edge computing and network function virtualization (NFV) in telecom networks drive demand for specialized testing solutions.

Key Wireless Testing Company Insights

Some of the key companies operating in the market include Deere & Company, and GGS Group., among others.

-

Bureau Veritas offers inspection, laboratory testing, and certification services. The company offers independent inspection services to verify the conformity, integrity, and safety of assets, equipment, and facilities, serving industries such as oil & gas, power generation, construction, transportation, and mining. Bureau Veritas also conducts thorough tests to evaluate product quality, safety, and compliance across diverse sectors, such as consumer goods, industrial equipment, materials, and electrical and electronic devices.

EXFO Inc.and Intertek Group plc are some of the emerging market companies in the target market.

-

The Intertek Group plc delivers innovative and customized assurance, testing, inspection, and certification services to its valued customers. It helps its customers mitigate risks, optimize performance, and enhance overall operational efficiency through cutting-edge technologies and in-depth industry knowledge. The company’s service offerings cover various areas, including product testing, safety certifications, quality inspections, supply chain audits, sustainability assessments, regulatory compliance evaluations, and tailored solutions designed to meet specific industry requirements.

Key Wireless Testing Companies:

The following are the leading companies in the wireless testing market. These companies collectively hold the largest market share and dictate industry trends.

- GGS Group

- Bureau Veritas

- Intertek Group PLC

- DEKRA com

- Anritsun

- Alifecom Technology

- Keysight Technologies

- Rohde & Schwarz

- Viavi Solutions Inc

- TUV Nord Group

- EXFO Inc.

- Applus+

Recent Developments

-

In March 2024, Bureau Veritas acquired ONETECH CORP., KOSTEC Co., Ltd, and Hi Physix Laboratory India Pvt. to strengthen its testing and certification services for electrical and electronic consumer products in South and North-East Asia. This move enhanced their market presence in Korea and India, adding a combined revenue of around USD 21.5 million in 2023.

-

In May 2024, Intertek Group PLC entered into a Master Services Agreement (MSA) with Korea Testing & Research Institute (KTR) to enhance global market access for manufacturers of electrical and electronic products. This partnership enables the company customers to use CB test reports for Korea Certification and allows Korean manufacturers to obtain the company’s S Mark Certification, ensuring compliance with European safety standards.

Wireless Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 15.80 billion |

|

Revenue forecast in 2030 |

USD 31.91 billion |

|

Growth rate |

CAGR of 12.4 % from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

GGS Group; Bureau Veritas; Intertek Group PLC; DEKRA com; Anritsun; Alifecom Technology; Keysight Technologies; Rohde & Schwarz; Viavi Solutions Inc; TUV Nord Group; EXFO Inc.; Applus+. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Wireless Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global wireless testing market report based on offering, technology, application, and region.

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Equipment

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

WiFi

-

Bluetooth

-

2G/3G

-

4G/LTE

-

5G

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer Electronics

-

IT & Telecommunication

-

Automotive

-

Medical Devices

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wireless testing market size was estimated at USD 14.55 billion in 2023 and is expected to reach USD 15.80 billion in 2024.

b. The global wireless testing market is expected to grow at a compound annual growth rate of 12.4% from 2024 to 2030 to reach USD 31.91 billion by 2030.

b. North America dominated the wireless testing market with a share of over 32.1% in 2023. This is attributable to the high consumer electronics demand in the region.

b. Some key players operating in the wireless testing market include GGS Group, Bureau Veritas, Intertek Group PLC, DEKRA com, Anritsun, Alifecom Technology, Keysight Technologies, Rohde & Schwarz, Viavi Solutions Inc, TUV Nord Group, EXFO Inc., and Applus+.

b. Key factors driving market growth include the growing adoption of smart devices, increased regulatory requirements, expansion of automotive electronic, and healthcare industry growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."