- Home

- »

- Healthcare IT

- »

-

Wireless Health Market Size, Share & Growth Report, 2030GVR Report cover

![Wireless Health Market Size, Share & Trends Report]()

Wireless Health Market Size, Share & Trends Analysis Report By Product (WLAN/Wi-Fi, WPAN), By Component (Hardware, Software, Services), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-166-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Wireless Health Market Size & Trends

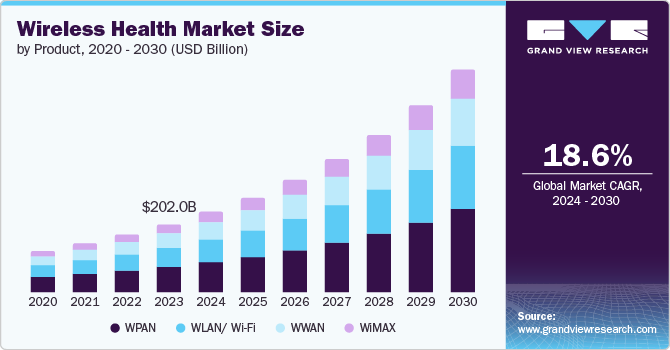

The global wireless health market size was valued at USD 202.0 billion in 2023 and is projected to grow at a CAGR of 18.6% from 2024 to 2030. The increasing adoption of wireless communication technologies, such as wearable devices, mobile health apps, and telemedicine, is one of the primary drivers. These technologies enable real-time patient monitoring, improve patient engagement, and reduce healthcare costs, making them attractive to both healthcare providers and patients. In addition, the growing prevalence of chronic diseases and the aging population are increasing the demand for remote patient monitoring services, further driving the market growth.

Government initiatives and investments in digital health also play a crucial role in promoting the use of wireless health technologies. The COVID-19 pandemic has also underscored the importance of remote healthcare services, accelerating the adoption of wireless health solutions. Wearable technologies, including fitness trackers and smartwatches, have emerged as significant market influencers. Their capacity to gather, process, and transmit health data in real-time has revolutionized patient care management, thereby propelling the growth of the wireless health market.

The integration of 5G in the healthcare sector facilitates seamless real-time data transmission, thereby improving remote patient monitoring, telehealth consultations, and hospital emergency management. The resultant surge in demand for products with 5G capabilities has further stimulated market growth.

Product Insights

Wireless Personal Area Networks (WPAN) technologies captured a 36.8% market share in 2023. This dominance can be attributed to cost-effective connectivity and WPAN solutions' leveraging of user-friendly technologies such as Bluetooth and RFID. These factors significantly enhance user adoption due to their inherent ease of use. Additionally, WPAN technologies address the critical concerns of data confidentiality and privacy, fostering trust among users in healthcare and other sensitive applications.

The Wireless Wide-Area Networks (WWAN) product segment is anticipated to grow a CAGR of 18.7% from 2024 to 2030. This upsurge is primarily attributed to the inherent advantages of WWAN technology, which facilitates long-range communication. This capability empowers advancements in critical applications such as remote monitoring, emergency response services, and telemedicine. Furthermore, recent advancements have augmented the interoperability of WWAN by enabling them to connect seamlessly with Internet of Things (IoT) devices.

Component Insights

Software components segment accounted for the largest market revenue share of 40.6% in 2023. The factors attributed to this significant growth are the modernization of healthcare organizations, which necessitates timely software updates, with better software. Robust software solutions are essential for ensuring compliance with the stringent regulations governing the healthcare sector. Secondly, advancements in artificial intelligence (AI) and machine learning (ML) are significantly enhancing healthcare operations and empowering the delivery of personalized care. These cumulative benefits are fueling the substantial growth trajectory of the software components segment.

The services components segment is expected to grow fastest at a CAGR of 19.0% from 2024 to 2030. This exceptional growth is primarily attributed to the healthcare sector's rising dependence on services to bolster technical support, strengthen data security, elevate user experience, and deliver high-quality customization. These factors are acting as key drivers for the segment's expansion.

End Use Insights

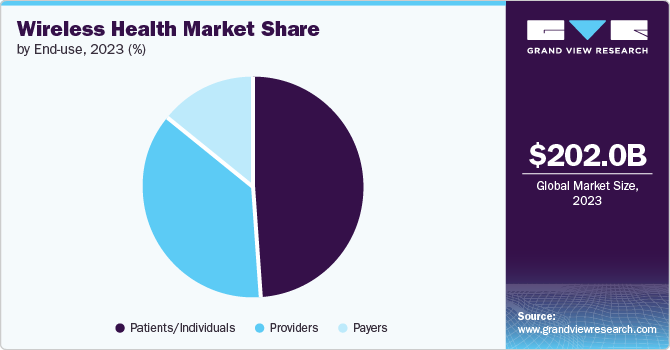

The patients/Individuals end use segment dominated the market in 2023. This segment's growth is attributed to factors such as advancements in personalized health tracking, increased adoption of remote patient monitoring, the rise of telehealth services, and improved chronic disease management solutions. These factors have fueled demand for self-use healthcare products, leading to significant segment expansion.

The providers' segment is projected to grow at a CAGR of 19.0% from 2024 to 2030. This surge is attributed to several factors, including advancements in telemedicine services, supportive regulatory environments, and improved communication channels between patients and healthcare providers. These developments are collectively driving significant demand for the product within this segment.

Application Insights

The patient-specific applications segment accounted for 55.1% of the market revenue in 2023. This growth is primarily fueled by technological advancements that empower patients to manage their individual healthcare needs. Wireless technologies have revolutionized remote patient monitoring by enabling healthcare providers to effectively track the vitals and health status of geographically dispersed patients. The integration of artificial intelligence, machine learning, and other cutting-edge technologies is poised to refine personalized treatment plans further and elevate remote patient monitoring capabilities in the coming years.

The provider/payer-specific applications segment is anticipated to witness the fastest growth, with a CAGR of 18.7% from 2024 to 2030. This surge is attributed to the segment's ability to directly address critical requirements of healthcare professionals and payers. These solutions empower value-based care management, facilitate telehealth service implementation, leverage data analytics for population health initiatives, and enable seamless integration with electronic health records (EHRs).

Regional Insights

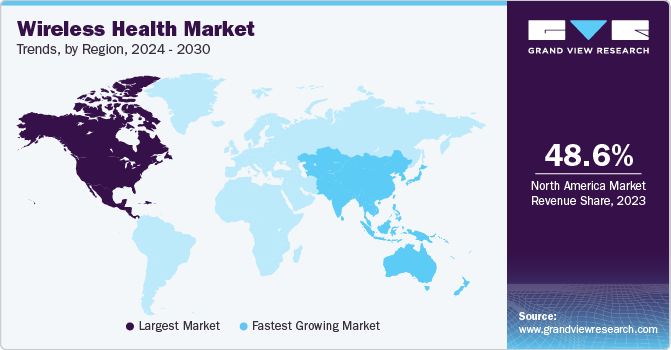

North America wireless health market dominated the market and accounted for a revenue share of 48.6% in 2023. This dominance is likely attributable to the convergence of two key factors: escalating healthcare costs necessitating cost-effective solutions and the accelerating digitization of the region's healthcare sector. These trends are driving significant demand for wireless health products, fueling market growth.

U.S. Wireless Health Market Trends

The U.S. wireless health market dominated the North American market with a share of 83.1% in 2023 due to a rising tech-savvy population, advanced IT infrastructure in healthcare organizations, and a surge in the demand for wearable technologies are the major driving forces of the market in the country.

Europe Wireless Health Market Trends

Europe wireless health market was identified as a lucrative region in 2023. The improved results and innovative technological advancements are the major driving forces of the market in the region

The UK wireless health market is expected to grow rapidly in the coming years, with promoting digital transformation and improving health care delivery efficiency being the major driving forces.

Asia Pacific Wireless Health Market Trends

The Asia Pacific wireless market is anticipated to witness significant growth due to the rising geriatric population and chronic disease cases. This leads to a surge in demand for personalized and remote healthcare management, which in turn leads to the rise of wireless technologies and the growth of the market significantly.

China's wireless health market held a substantial market share in 2023 owing to leading 5G deployment and improved IT infrastructure in healthcare organizations.

Key Wireless Health Company Insights

Some of the key companies in the Global wireless health market include IBM, Philips, Oracle and many more. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Wireless Health Companies:

The following are the leading companies in the wireless health market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Epic Systems Corporation

- Oracle

- OMRON Corporation

- Qualcomm Technologies, Inc

- Veradigm LLC

- Koninklijke Philips N.V.

- Stryker

- Alcatel-Lucent

Recent Developments

-

In April 2024, GE Healthcare introduced Caption AI, an artificial intelligence (AI) technology that empowers users of their wireless handheld ultrasound systems to acquire diagnostic-quality cardiac images.

-

In December 2023, GE Healthcare secured the exclusive U.S. distribution rights for AirStrip's cardiology and patient monitoring solutions.

Wireless Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 238.4 billion

Revenue forecast in 2030

USD 664.7 billion

Growth rate

CAGR of 18.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

IBM; Epic Systems Corporation; Oracle; OMRON Corporation; Qualcomm Technologies, Inc; Qualcomm Technologies, Inc; Veradigm LLC; Koninklijke Philips N.V.; Stryker; ALE International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wireless Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wireless health market report based on product, component, application, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

WLAN/ Wi-Fi

-

WPAN

-

WiMAX

-

WWAN

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Patient-specific

-

Physiological monitoring

-

Patient communication

-

-

Provider/Payer-specific

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Providers

-

Payers

-

Patients/Individuals

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."