- Home

- »

- Next Generation Technologies

- »

-

Wireless Charger Market Size, Share, Industry Report, 2030GVR Report cover

![Wireless Charger Market Size, Share & Trends Report]()

Wireless Charger Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Transmitters, Receivers), By Product, By Technology, By Power Output, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-272-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wireless Charger Market Summary

The global wireless charger market size was estimated at USD 5,346.5 million in 2024 and is projected to reach USD 19,029.2 million by 2030, growing at a CAGR of 22.9% from 2025 to 2030. The increasing adoption of Electric Vehicles (EVs) has heightened the demand for convenient charging solutions, driving the integration of wireless charging technologies in the automotive sector.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Mexico is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, transmitters accounted for a revenue of USD 4,522.8 million in 2024.

- Transmitters is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5,346.5 Million

- 2030 Projected Market Size: USD 19,029.2 Million

- CAGR (2025-2030): 22.9%

- Asia Pacific: Largest market in 2024

In consumer electronics, the proliferation of smartphones, tablets, laptops, and wearables has created a substantial need for efficient and user-friendly charging options, further fueling wireless charger industry expansion.

The adoption of wireless charging technology is accelerating across multiple industries, driven by the demand for convenience, improved user experience, and the elimination of cable clutter. Consumer electronics, particularly smartphones, tablets, wearables, and laptops, continue to dominate the market as major brands integrate Qi wireless charging as a standard feature. Advancements in fast wireless charging and multi-device charging solutions further enhance the appeal, making it a preferred choice for users seeking effortless power solutions, which further boosts the wireless charger industry expansion.

Moreover, the automotive sector is witnessing rapid growth in wireless charging solutions, particularly in Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). Automakers are integrating wireless vehicle charging pads to improve charging convenience, reduce mechanical wear, and support autonomous charging infrastructure. Furthermore, in-car wireless charging pads for consumer devices have become a standard feature in modern vehicles, enabling seamless power transfer for smartphones and other portable electronics, thereby driving the wireless charger industry's growth.

The market is also witnessing significant advancements in long-distance and over-the-air (OTA) wireless charging, driven by developments in resonant and radio frequency (RF) charging technologies. These innovations can potentially enable true wireless charging environments, where devices can charge without being placed on a fixed charging pad. As regulatory approvals and efficiency improvements progress, OTA wireless charging could transform how electronic devices and electric vehicles receive power, further expanding the wireless charger industry’s potential.

Another factor contributing to this growth is the continuous innovation in wireless charging technology, which has led to improved efficiency and faster charging speeds. The introduction of standards such as Qi (for smartphones) and the enhancement of power transfer capabilities have expanded the range of devices supported by wireless chargers, offering quicker charging times. As charging speeds improve and energy efficiency rises, wireless charging is gaining more traction, thereby fueling the wireless charger industry's growth.

Component Insights

The transmitters segment dominated the market with a revenue share of over 66% in 2024. Transmitters are gaining momentum owing to the increasing demand for faster, more efficient charging solutions. The key drivers for the transmitter market include the rapid adoption of smartphones, wearables, and electric vehicles (EVs), all of which are increasingly integrating wireless charging capabilities. In addition, advancements in transmitter technology, such as improved power output and wider compatibility with various devices, are propelling growth. Reducing device clutter and enhancing user convenience also fuels demand for high-quality transmitters.

The receivers segment is expected to witness a significant CAGR of over 21% from 2025 to 2030, owing to the advancement in receiver chip technology that enables faster and more efficient charging. Key drivers include the increasing integration of wireless charging in consumer electronics like smartphones, tablets, and wearables, along with the growing popularity of wireless EV chargers. Furthermore, the push for energy efficiency and the demand for universally compatible receivers are shaping this segment's growth. Consumer preferences for convenience and the desire for fewer cables contribute to receivers' rapid adoption across multiple industries.

Product Insights

The charging pad segment accounted for the largest market share in 2024, owing to its simple design, affordability, and versatility. The key driver behind the growth of charging pads is the increasing adoption of smartphones and other portable electronic devices. As more devices support wireless charging, consumers prefer charging pads as a convenient and easy-to-use solution. Trends also show that charging pads are becoming more compact, energy-efficient, and faster, offering a significant competitive market edge. Moreover, the increasing presence of multi-device charging pads, which allow simultaneous charging, is fueling market growth.

Charging vehicle mount is expected to witness the highest CAGR from 2025 to 2030. Charging vehicle mounts are increasingly in demand as electric vehicle (EV) adoption rises globally. The growing trend of integrating wireless charging technology into EVs is a key driver for this segment. Consumers prefer wireless charging mounts for EVs due to the convenience of not needing to plug in cables, especially as more cities and regions develop wireless charging infrastructure for vehicles. The trend towards cleaner energy and advancements in wireless charging for vehicles is pushing the market forward, with increasing demand for compatible amounts in both consumer and commercial automotive markets.

Application Insights

The consumer electronics segment accounted for the largest market share in 2024. The segmental growth is fueled by the increasing number of devices like smartphones, wearables, tablets, and wireless earbuds that require convenient and efficient charging solutions. Consumers are seeking more streamlined, cable-free charging experiences, particularly as the number of personal devices grows. Trends in this segment include the widespread adoption of wireless charging for smartphones and other gadgets, with manufacturers integrating Qi wireless charging technology into more devices. There is also a push for faster wireless charging capabilities, multi-device charging stations, and the development of sleek, aesthetically pleasing charging pads that can blend seamlessly into home and office environments, reflecting the growing trend of convenience and minimalism in consumer technology.

Mobility is expected to witness the highest CAGR from 2025 to 2030. The increasing demand for convenient, cable-free charging solutions for vehicles, electric scooters, and other portable transportation devices drives segmental growth. As electric vehicles (EVs) and shared mobility solutions become more mainstream, the need for efficient, user-friendly charging options is rising. Wireless charging eliminates the hassle of plugging in and provides seamless integration into charging infrastructure.

Power Output Insights

The up to 5W segment accounted for the largest market share in 2024, primarily driven by the widespread adoption of low-power devices, such as smartphones, smartwatches, and small gadgets. This segment is in high demand, owing to its affordability and convenience, offering a low-cost solution for basic wireless charging needs. As most entry-level devices support wireless charging, especially in the consumer electronics sector, the up-to-5W range remains a dominant segment. This segment's growth is further driven by its simplicity and suitability for personal devices that require minimal charging power, contributing to a steady and consistent market presence.

Above 1kW power output is expected to witness the highest CAGR from 2025 to 2030. This segment is the most advanced power output for wireless charging solutions, primarily catering to specialized applications such as electric vehicle charging, high-power industrial equipment, and large-scale commercial systems. This segment is experiencing substantial growth owing to the increasing demand for ultra-fast charging capabilities for electric vehicles and high-demand industries such as robotics, aerospace, and large-scale IoT applications.

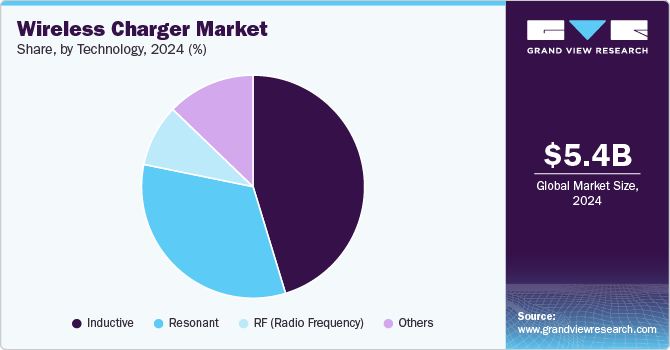

Technology Insights

The inductive segment accounted for the largest market share in 2024. Inductive charging technology is the market's most widely used and established method. Technology relies on magnetic fields to transfer energy between the transmitter and receiver. Key drivers include its wide compatibility with consumer electronics like smartphones, wearables, and other portable devices. The simplicity, reliability, and proven efficiency of inductive charging are major factors fueling its dominance. However, as the demand for faster charging increases, there is a trend toward improving power output and efficiency within inductive systems, which is expected to drive future growth.

Radio frequency (RF) is expected to witness the highest CAGR from 2025 to 2030. RF wireless charging is emerging as an innovative technology, particularly for applications that require charging over even longer distances. Key drivers for RF technology include its ability to provide wireless charging in various environments, from consumer electronics to IoT devices. As RF charging can work in the background without the need for close proximity to the charger, it opens up opportunities for new applications, such as in smart homes and connected devices. The trend towards highly integrated and efficient wireless charging solutions is expected to drive the growth of RF technology, particularly as demand for ultra-convenient charging grows.

Regional Insights

North America wireless charger market held a significant share of over 26% in 2024. The increasing adoption of advanced technologies and strong consumer demand for convenience and energy-efficient solutions drive the market. The growing use of smartphones, wearables, and electric vehicles (EVs) is leading to a surge in wireless charger demand. Moreover, the presence of major technology companies and the rise of smart home ecosystems are further propelling market growth. Consumers in North America also prefer sleek, clutter-free solutions, boosting the popularity of wireless charging pads and stands.

U.S. Wireless Charger Market Trends

The wireless charger market in U.S. is expected to grow at a CAGR of over 21% from 2025 to 2030, driven by the increasing adoption of smartphones, wearables, and other consumer electronics that support wireless charging technology. Furthermore, the growing shift towards smart home devices, the development of faster and more efficient wireless charging standards (such as Qi), the push for eco-friendly solutions, and technological advancements are fueling market growth.

Europe Wireless Charger Market Trends

Europe wireless charger is expected to grow at a CAGR of over 22% from 2025 to 2030, driven by stringent environmental regulations that encourage energy-efficient products. In addition, Europe’s tech-savvy population and the rapid adoption of smartphones, wearables, and electric vehicles fuel the demand for wireless charging devices.

The UK wireless charger market is expected to grow significantly in the coming years, driven by the increasing adoption of smartphones, wearables, and electric vehicles (EVs). Consumers are increasingly seeking convenience, and wireless charging offers a clutter-free solution. The UK's strong focus on sustainability is another key driver, as wireless chargers help reduce e-waste by eliminating the need for cables and adapters. Moreover, integrating wireless charging stations in public spaces, such as airports and offices, aligns with the country’s push toward smart cities and green technology, further boosting the market.

The wireless charger market in Germany is fueled by its strong tech industry, with a high adoption rate of consumer electronics and electric vehicles (EVs). As one of Europe's largest markets for technology, Germany is embracing wireless charging in smartphones, wearables, and automotive solutions. The government's focus on sustainability, energy efficiency, and green technologies further supports the growth of wireless charging, particularly in the EV sector.

Asia Pacific Wireless Charger Market Trends

The wireless charger market in Asia Pacific is dominated by the largest share of over 43% in 2024, driven by rapid urbanization, high smartphone penetration, and the growing popularity of smart devices in countries like China, Japan, and South Korea. Moreover, the automotive industry in the region is increasingly adopting wireless charging technology, especially for electric vehicles-the rise of consumer electronics and the expansion of retail networks further fuel demand. Moreover, the region's growing interest in eco-friendly solutions and the shift toward smart homes contribute to the increasing adoption of wireless chargers.

Japan wireless charger market is gaining traction as Japan is a technology hub with a highly advanced consumer electronics market. The country’s tech-savvy population is increasingly adopting wireless charging for devices like smartphones, wearables, and smart home products. Japan's strong focus on innovation and sustainability also fuels demand for energy-efficient charging solutions, including wireless chargers. Furthermore, as the country leads in electric vehicle adoption, the growing demand for wireless EV chargers is a major trend. The integration of wireless charging in public spaces, such as train stations and airports, is further pushing the market.

The wireless charger market in China is rapidly expanding, driven by the country's massive manufacturing base allows for cost-effective production of wireless chargers, making them more affordable to the average consumer. In addition, China’s push towards electric vehicles (EVs) is accelerating the demand for wireless EV chargers, while the integration of wireless charging infrastructure in public spaces, such as airports and offices, further boosts the market growth.

Key Wireless Charger Company Insights

Some key players operating in the market include Samsung Electronics Co., Ltd. and Apple, Inc.

-

Samsung Electronics Co.Ltd is a multinational electronics company specializing in consumer electronics, semiconductors, and telecommunications equipment. It is renowned for its innovative products, such as the Galaxy series of smartphones. The company offers a range of wireless charging solutions for its devices.

-

Apple Inc. is a multinational technology company renowned for its innovative consumer electronics, software, and services. Its products include iPhones, Macs, iPads, Apple Watches, and AirPods. The company offers a range of wireless charging solutions, including its proprietary MagSafe technology, which provides fast and reliable charging for compatible devices.

Ossia, Inc. and Energous Corporation are some of the emerging market participants.

-

Ossia, Inc. specializes in wireless power solutions, particularly through its patented Cota technology. This technology allows for the delivery of energy over the air to devices at a distance without the need for wires or charging pads. Ossia’s innovative approach enables continuous and uninterrupted power supply to various devices, including Internet of Things (IoT) sensors, scanners, and other electronic devices.

-

Energous Corporation is a pioneering technology company specializing in scalable, over-the-air wireless power networks (WPNs). The company develops WattUp wireless power technology, which enables radio frequency-based charging for Internet of Things (IoT) devices, including sensors, smart home devices, and medical equipment. The company focuses on innovative solutions that provide continuous access to wireless power, reduce the need for batteries, and enhance operational efficiency across the retail, logistics, and healthcare industries.

Key Wireless Charger Companies:

The following are the leading companies in the wireless charger market. These companies collectively hold the largest market share and dictate industry trends.

- Anker Innovations Technology Co., Ltd.

- Apple, Inc.

- Belkin International, Inc.

- Continental AG

- Electreon Wireless Ltd.

- Energous Corporation

- InductEV Inc.

- Ossia Inc.

- PLUGLESS POWER INC.

- Powercast Corporation

- Powermat Technologies Ltd.

- PULS Wireless (PULS GmbH)

- Renesas Electronics Corporation

- Resonant Link

- Samsung Electronics Co, Ltd

- Sony Group Corporation

- TESLA

- WiTricity Corporation

Recent Developments

-

In February 2025, Powercast Corporation and B&Plus formed a strategic partnership to introduce Powercast's RF wireless power solutions to Japan, supporting the country's net-zero emissions goals. This collaboration aims to reduce reliance on traditional batteries in various industries by integrating Powercast's technology into B&Plus's product designs, offering a battery-free alternative for enhanced efficiency and reduced waste. Powercast's solutions are now available for demonstration at B&Plus’s showroom in Saitama, Japan.

-

In January 2025, Samsung Electronics Co., Ltd. announced a new power management integrated chip (PMIC) called the S2MIW06, which supports wireless charging speeds of up to 50W. This chip aligns with the forthcoming Qi 2.2 standard and supports all major Qi profiles, including Baseline Power Profile (BPP), Extended Power Profile (EPP), and Magnetic Power Profile (MPP). The MPP uses magnets for precise alignment, reducing overheating and improving charging efficiency.

-

In September 2024, TESLA released a new Wireless Portable Charger in North America, priced at 95 US. Available in black, rose gold, and white, this charger is an upgrade from the Wireless Charging Pad 2.0 and is designed to fit in Tesla's wireless phone charging slot. It features a 5000mAh battery, can charge two Qi-enabled devices simultaneously, and includes an integrated USB-C cable for charging on the go.

Wireless Charger Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.78 billion

Revenue forecast in 2030

USD 19.03 billion

Growth rate

CAGR of 22.9% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, product, application, power output, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Anker Innovations Technology Co., Ltd.; Apple, Inc.; Belkin International, Inc.; Continental AG; Electreon Wireless Ltd.; Energous Corporation; InductEV Inc.; Ossia Inc.; PLUGLESS POWER INC.; Powercast Corporation; Powermat Technologies Ltd.; PULS Wireless (PULS GmbH); Renesas Electronics Corporation; Resonant Link; Samsung Electronics Co, Ltd; Sony Group Corporation; TESLA; WiTricity Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wireless Charger Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wireless charger market report based on component, technology, product, application, power output, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Transmitters

-

Receivers

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Inductive

-

Resonant

-

RF (Radio Frequency)

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Charging Pad

-

Power Mat

-

Charging Stand

-

Charging Vehicle Mount

-

Others

-

-

Power Output Outlook (Revenue, USD Million, 2018 - 2030)

-

Charging Pad

-

Power Mat

-

Charging Stand

-

Charging Vehicle Mount

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobility

-

Electric Vehicles (EVs)

-

BEV

-

HEV

-

PHEV

-

-

Electric Scooter

-

Others

-

-

Consumer Electronics

-

Smartphones & Tablets

-

Laptops

-

Wearables

-

Others

-

-

Drone

-

Healthcare

-

Handled Medical Devices

-

Wearable Health Monitors

-

Others

-

-

Industrial

-

Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wireless charger market size was estimated at USD 5.35 billion in 2024 and is expected to reach USD 6.78 billion in 2025.

b. The global wireless charger market is expected to grow at a compound annual growth rate of 22.9% from 2025 to 2030 to reach USD 19.03 billion by 2030.

b. Factors such as the growing demand for consumer electronics worldwide are driving the demand for wireless chargers.

b. The U.S. accounted for nearly 82% of the global wireless charger market share in 2024, due to the growing demand for power outputs higher than 1000W chargers. Government initiatives to promote the electric vehicle market significantly drive the demand for wireless chargers.

b. Some key players operating in the wireless charger market include Resonant Link, TESLA, PULS Wireless (PULS GmbH), Ossia Inc., SAMSUNG, Powermat, Anker (Anker Innovations Technology), Continental AG, Energous Corporation., Belkin International, Inc., PLUGLESS POWER INC., Powercast Corporation., Renesas Electronics Corporation., WiTricity Corporation, and InductEV Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.