Wireless Audio Devices Market Size, Share, & Trends Analysis Report By Product (Earphone, Headphone), By Functionality, By Technology, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-117-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

The global wireless audio devices market size was evaluated at USD 94.96 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 15.5% from 2023 to 2030. Advances in technology coupled with the proliferation of smartphones, tablets, and other portable devices; evolving consumer lifestyles; and changing consumer requirements are some of the factors that are prompting market players to introduce new, innovative wireless audio devices capable of providing seamless connectivity and better mobility, thereby driving the growth of the market. Furthermore, the COVID-19 pandemic increased the demand for consumer electronics, specifically wearable electronics, as people were concerned about their physical health. In addition, the travel restrictions imposed by governments at the time of the pandemic also increased the demand for consumer electronics, as people were mandated to stay indoors. Due to this, people opted to connect with their family and friends digitally, which contributed to the growth of the market for wireless audio devices.

The integration of advanced technologies such as AI and machine learning into consumer electronics, enabling the devices to offer enhanced functionality, has also contributed to the growth of the consumer electronics market. Moreover, companies in the consumer electronics market have been introducing AI-integrated devices, thereby driving market growth. For instance, in April 2023, Sensory announced the integration of ChatGPT and other AI into its consumer devices to drive conversational voice responses. The AI and Machine Learning (ML) technology is expected to be integrated into in-ear voice assistants, smartphones, smartwatches, and automotive infotainment systems, among others. Go, NVIDIA Triton, gRPC, and AWS Global Accelerator power SensoryCloud’s voice assistant solution. These advancements would further drive the market during the forecast period.

The growing popularity of streaming platforms, such as Spotify and Apple Music, has reshaped the way people consume audio content. With abundant on-demand content available, consumers are seeking devices that can reproduce this content with immense clarity and depth. At this juncture, wireless headphones and earbuds can particularly allow individuals to access high-quality audio as per their respective preferences. For instance, in April 2023, Sony Corporation launched WF-C700N, a true wireless earbuds designed for comfort and stability. The earbuds featured the noise-cancellation feature while still allowing them to stay connected to the surroundings. The earbuds also featured Adaptive Sound Control (ASC), allowing users to adjust sound settings depending on the activity the user is indulging in. These developments and initiatives would further drive the growth of the market during the forecast period.

Artificial Intelligence (AI) is being used in the latest models to enhance users’ experience of listening to music. AI-enabled earbuds allow users to recognize essential sounds and block the sounds that disrupt their audio experience. For instance, Mobi TWS earbuds combine AI algorithms with hybrid Active Noise Cancellation (ANC) technology for comprehensive and smart noise cancellation. The next-generation hybrid ANC includes a feedforward microphone that mixes three mics per earbud. This innovation replaced the ordinary hybrid ANC program with an AI algorithm that captures the difference between over 6,000 sounds. However, smart audio devices utilize AI-driven adaptation to modify the noise cancellation or transparency mode settings automatically based on real-time sound analysis. It ensures improved performance in all locations, and the adaptation of AI-based solutions has become mandatory to cope with the surrounding environment. These developments would further drive the growth of the market during the forecast period.

The use of premium digital music subscriptions is gaining traction among consumers. The growing popularity of music and exercise subscriptions and fitness equipment is anticipated to contribute to the market growth. Moreover, post the pandemic, people are into learning new things and are engaged in entertainment through a plethora of internet-based content. The globalization and proliferation of Over-the-top (OTT) platforms such as Amazon Prime, Netflix, and Hotstar have introduced Millennials and Gen Z to a diverse spectrum of cultures and musical genres. In addition, post-pandemic, the global average frequency of time spent on online videos has been one hour per day. Thus, to enhance sound quality and audio experience, people started to invest in high-quality earbuds connected to portable devices. For instance, a high latency R1 Chip powers the Realme Buds Air using a Google fast pair, which automatically connects to the phone. It also offers auto-play and pause, which is convenient. The dual-channel transmission, gaming mode, Multi-function Buttons (MFB), solo-bud usage, ambient noise reduction during conversations, and other features of Realme earbuds have led to increased sales among the Gen Z audience. These factors would drive the growth of the market during the forecast period.

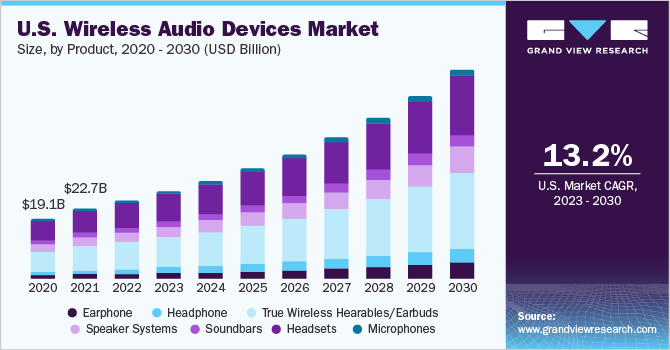

Product Insights

The true wireless hearables/earbuds segment accounted for the largest market share of over 30% in 2022. The trendy design, simplicity, and comfort offered by TWS earbuds are anticipated to increase their adoption among the Gen Z population. In addition, they are more stylish, athletic, and sleek compared to wired headphones, which adds to people's appearance. For instance, Sennheiser introduced a new TWS earbuds sport for fitness followers and athletes. It provides the user with a feature that provides open and close ear adapters and adjusts EQ sound settings for the custom training sound according to the athlete's requirement, thus enhancing the listening experience of their sport. Furthermore, the compatibility of earphones with tablets, laptops, desktops, cell phones, and other mobile devices helps boost the worldwide earbud industry's growth. Millennials are three times as likely as baby boomers to view videos on their mobile devices. Thus, millennials invest in quality earbuds that work with smartphones and portable mobile devices such as iPods, MP3 players, and MP4 players. As a result, shifting lifestyles toward online mediums are expected to propel the true wireless wearables/earbuds market growth over the forecast period.

The earphones segment is anticipated to grow at a CAGR of 17.5% during the forecast period. Technological developments in wireless connectivity, audio quality, and downsizing have converted earphones into sophisticated electronics. Wireless earbuds' freedom from the limits of traditional wired equivalents has completely appealed to customers, particularly those who lead busy lifestyles. This transition has been accelerated by the widespread availability of smartphones and music streaming services, which enabled seamless and on-the-go audio consumption. True wireless earbuds, distinguished by their separate earpieces, have appealed to consumers who value freedom of movement and increased aesthetics, fueling the growth of the market. As customer attitudes shift toward sustainability, various wireless earphone manufacturers include eco-friendly materials and manufacturing techniques to appeal to environmentally aware shoppers.

Technology Insights

The bluetooth segment accounted for the largest market share of over 25% in 2022. The development of Bluetooth technology in the wireless audio devices market represents a combination of innovation, convenience, and connectivity. The constant development in Bluetooth technology, from a simple wireless data transmission tool to a cornerstone of seamless audio experiences, lies at the core of this surge. Bluetooth Low Energy (BLE) has reduced battery consumption, allowing devices to function for a longer time. In addition, improved audio codecs such as aptX and AAC have enhanced sound quality to unprecedented levels, eliminating the distinction between wired and wireless audio.

The bluetooth + wi-fi segment is anticipated to grow at a CAGR of 16.1% during the forecast period. The development of Bluetooth technology in the market represents a combination of innovation, convenience, and connectivity. The constant development in Bluetooth technology, from a simple wireless data transmission tool to a cornerstone of seamless audio experiences, lies at the core of this surge. Bluetooth Low Energy (BLE) has reduced battery consumption, allowing devices to function for a longer time. In addition, improved audio codecs such as aptX and AAC have enhanced sound quality to unprecedented levels, eliminating the distinction between wired and wireless audio.

Functionality Insights

The smart devices segment accounted for the largest market share of over 55% in 2022. The complex interplay of technical progress, customer need for convenience, and the rising range of integrated experiences increase the need for converting traditional audio devices into multipurpose hubs that effortlessly merge audio entertainment, connectivity, and smart functionality. These characteristics combine to convert traditional audio devices into multipurpose hubs that effortlessly merge audio entertainment, connectivity, and smart functionality. Voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri are examples of the evolution of smart technology. These factors and developments would drive the growth of the segment during the forecast period.

The non-smart devices segment is anticipated to grow at a CAGR of 14.3% during the forecast period. The adoption of non-smart devices in the wireless audio industry is driven by a confluence of factors emphasizing the ongoing attraction of simplicity, dependability, and different customer demands. These non-smart devices serve consumers seeking easy audio solutions without the complications of integrated features in a world dominated by sophisticated technologies. This simplicity appeals to purists, audiophiles who respect pristine sound quality, and those looking for low-cost choices. As the industry grows, e-commerce platforms provide an easy way for customers to learn about various non-smart wireless audio devices, supporting competition, innovation, and long-term acceptance of these purpose-driven offers.

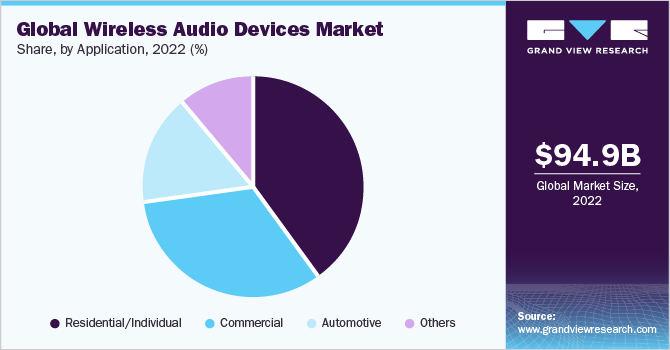

Application Insights

The residential/individual segment accounted for the largest market share of over 35% in 2022. Varying consumer preferences, technical improvements, and changing lifestyles drive the expansion of residential and individual applications in the market. Wireless audio devices act as transformational solutions as homes become networked hubs and customized audio experiences become more important. These products appeal to unique preferences and household demands, from wireless headphones for private aural delight to smart speakers for enhancing the home atmosphere.

The automotive segment is anticipated to grow at a CAGR of 17.1% during the forecast period. The growth of the automotive segment in the market is driven by a convergence of factors that redefine in-car entertainment and connectivity. With the increasing number of connected vehicles, wireless audio devices provide a seamless way to elevate the driving experience. Bluetooth, Wi-Fi, and other wireless technologies enable users to stream music, podcasts, and navigation instructions directly to their vehicles' audio systems.

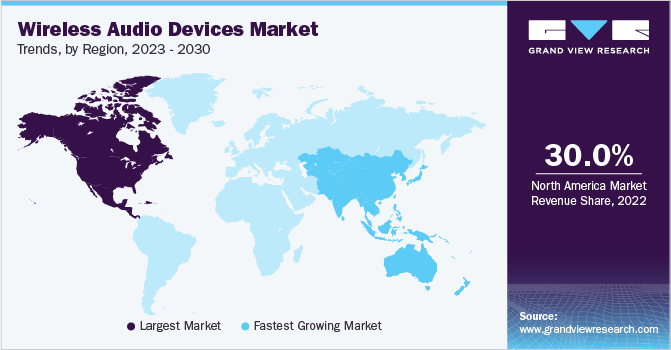

Regional Insights

North America held the major share of over 30.0% of the market in 2022. The growth of the North American market can be attributed to factors such as the region's technological innovation, consumer desire for quality audio experiences, and altering lifestyle choices. As a hub for tech titans and entrepreneurs, North America constantly pioneers breakthroughs in wireless communication, influencing the adoption of cutting-edge technologies such as Bluetooth, Wi-Fi, and proprietary protocols in audio products. The region's high disposable income and tech-savvy population fuel the demand for wireless audio solutions that can interact seamlessly with smart homes, delivering convenience and boosting entertainment ecosystems.

Asia Pacific is anticipated to emerge as the fastest-growing region over the forecast period at a CAGR of 17.1%. The growth of the Asia Pacific market is driven by technological advancements and the introduction of laws related to e-waste management recycling, among others. Owing to the region's large population and expanding middle-class population, modern audio solutions such as wireless headphones, earbuds, and speakers are in high demand. Further, the rising adoption of smartphones and other smart gadgets that function as audio sources contributes to this rising demand. Furthermore, legislative activities that aim at standardizing frequency bands for wireless communication between nations are fostering the development of wireless audio systems.

Key Companies & Market Share Insights

The key players operating in the market are broadening their product offerings, and utilizing a variety of inorganic growth tactics, such as regular mergers acquisitions, and partnerships. In January 2023, Harman Luxury Audio Group, a part of Harman International Industries, launched a new JBL series of MP350 Classic streaming media players, CD350 Classic CD player, SA550 Classic integrated amplifier, and TT350 Classic turntable. Users can stream music services and personal libraries from their tablets and smartphones using the MP350 Classic music player and SA550 Classic integrated amplifier. Furthermore, CD350 Classic supports CD-RW, CD, and CD-R playback, as well as MP3, WAV, and FLAC file formats, among others. It also features a robust loading mechanism and USB-A interface with modern high-resolution digital technology. Prominent players dominating the global wireless audio devices market include:

-

Apple Inc.

-

Bose Corporation

-

GN Store Nord A/S (Jabra)

-

HARMAN International

-

Logitech (Jaybird)

-

SAMSUNG

-

Skullcandy.com

-

Sennheiser electronic GmbH& Co. KG

-

Sony Corporation

-

Xiaomi

-

Sonos, Inc.

-

Panasonic Corporation

-

Shure Incorporated

-

Imagine Marketing Limited (Boat)

-

Plantronics, Inc.

Wireless Audio Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 107.92 billion |

|

Revenue forecast in 2030 |

USD 296.55 billion |

|

Growth Rate |

CAGR of 15.5% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, functionality, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Middle East & Africa; Latin America |

|

Country scope |

U.S., Canada, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, U.A.E., Saudi Arabia, South Africa |

|

Key companies profiled |

Apple Inc.; Bose Corporation; GN Store Nord A/S (Jabra); HARMAN International; Logitech (Jaybird); SAMSUNG; Skullcandy.com; Sennheiser electronic GmBH Co. KG; Sony Corporation; Xiaomi; Sonos, Inc.; Panasonic Corporation; Shure Incorporated; Imagine Marketing Limited (Boat); Plantronics, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Wireless Audio Devices Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wireless audio devices market report based on product, technology, functionality, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Earphone

-

Headphone

-

True Wireless Hearables/Earbuds

-

Speaker Systems

-

Soundbars

-

Headsets

-

Microphones

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bluetooth

-

Wi-Fi

-

Bluetooth + Wi-Fi

-

Airplay

-

Others

-

-

Functionality Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Devices

-

Non-smart Devices

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential/Individual

-

Commercial

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wireless audio devices market size was estimated at 94.96 billion in 2022 and is expected to reach USD 107.92 billion in 2023.

b. The global wireless audio devices market is expected to grow at a compound annual growth rate of 15.5% from 2023 to 2030 to reach USD 296.55 billion by 2030.

b. The true wireless hearables/earbuds segment accounted for the largest market share of over 30% in 2022 in the wireless audio devices market. The trendy design, simplicity, and comfort offered by TWS earbuds are anticipated to increase their adoption among the Gen Z population. In addition, they are more stylish, athletic, and sleek compared to wired headphones, which adds to people's appearance.

b. Key players in the wireless audio devices industry include Apple Inc., Bose Corporation, GN Store Nord A/S (Jabra), HARMAN International, Logitech (Jaybird), SAMSUNG, Skullcandy.com, Sennheiser electronic GmbH& Co. KG, Sony Corporation, Xiaomi, Sonos, Inc., Panasonic Corporation, Shure Incorporated, Imagine Marketing Limited (Boat), and Plantronics, Inc. are some key vendors in the market.

b. Advances in technology coupled with the proliferation of smartphones, tablets, and other portable devices; evolving consumer lifestyles and changing consumer requirements are some of the factors that are prompting market players to introduce new, innovative wireless audio devices capable of providing seamless connectivity and better mobility, thereby driving the growth of the wireless audio devices market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."