- Home

- »

- Renewable Energy

- »

-

Wind Turbine Rotor Blade Market Size & Share Report, 2030GVR Report cover

![Wind Turbine Rotor Blade Market Size, Share & Trends Report]()

Wind Turbine Rotor Blade Market Size, Share & Trends Analysis Report By Material (Glass Fiber, Carbon Composite), By Application (Onshore, Offshore), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-388-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

“2030 wind turbine rotor blade market value to reach USD 19.56 billion.”

Wind Turbine Rotor Blade Market Trends

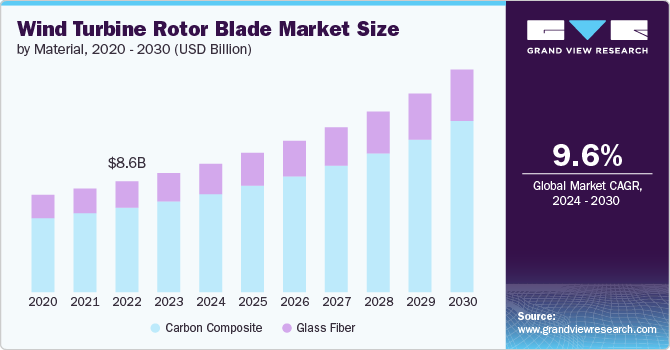

The global wind turbine rotor blade market size was estimated at USD 10.46 billion in 2023 and is estimated to grow at a CAGR of 9.6% from 2024 to 2030. Global shift towards renewable energy on account of limited conventional energy resources and growing emissions is expected to benefit the market growth. As countries aim to reduce carbon emissions and combat climate change, wind energy is expected to emerge as promising source of energy. The increasing investments in wind power projects by governments and private entities alike further propels the demand for advanced, efficient rotor blades.

For instance, in July 2024, India Offshore Wind Working Group and Global Wind Energy Council announced approval for Viability Gap Fund for offshore wind energy projects in India. The government of India has announced investment of USD 890 million for installation of 1 GW wind energy projects in Gujarat and Tamil Nadu in India.

Technological advancements in rotor blade design and materials is expected to remain a key contributing factor for the market growth over the coming years. Innovations such as carbon fiber and other composite materials have significantly improved blade strength and durability while reducing weight. This enhances the efficiency of wind turbines, making wind energy a more competitive alternative to traditional fossil fuels.

High initial investment i.e. capital required for wind energy projects is expected to act as a restraining factor for the market expansion. The capital involves cost of manufacturing and installing high-quality rotor blades. In addition, the maintenance and repair of large rotor blades present logistical challenges and additional costs, potentially impacting the market growth.

Increasing demand for offshore wind energy projects represents an opportunity for market participants. Offshore wind farms, with their larger turbine sizes and stronger wind speeds, require specially designed rotor blades, opening up a new revenue stream for manufacturers. Stronger and more consistent wind speeds from offshore projects is expected to result in higher and more reliable energy production.

Material Insights

“Carbon composite material segment held the largest revenue share of over 76% in 2023.”

In initial period, the high cost of carbon composite materials limited their use to high-end applications. However, as the manufacturing processes have improved and costs have begun to decrease, these materials are increasingly becoming the standard for new rotor blade designs. Their superior strength-to-weight ratio significantly enhances the performance and durability of wind turbines, thereby supporting the growth of the wind energy sector.

Glass fiber materials have become an important in the development and optimization of wind turbine rotor blades, significantly influencing the wind energy sector. Advantages of glass fibers such as strength-to-weight ratio, durability, and cost-effectiveness, have enabled the design of longer, more resilient blades, essential for enhancing the efficiency and energy output of wind turbines.

Application Insights

“Offshore application held the largest revenue share of over 68% in 2023.”

Onshore application segment is expected to benefit from its cost-effectiveness in terms of installation and maintenance compared with its offshore counterparts. This is further expected to fuel by well-established infrastructure and technological base that supports onshore wind energy, being a suitable choice for investment across both developed and developing countries. The lower financial barriers and proven reliability of onshore wind farms is expected to benefit rising adoption.

The growth of the onshore segment is attributed to the lower installation and maintenance costs compared to offshore wind farms. The established infrastructure and technology for onshore wind energy make it a reliable investment for both developed and developing nations. Countries such as India and China are increasingly investing in wind energy applications and thus expected to benefit the market growth.

Regional Insights

“North America held over 24% revenue share of the overall wind turbine rotor blade market.”

North American market is expected to witness a steady growth, driven by supportive government policies and initiatives aimed at diversifying the energy mix. The U.S. in particular, continues to invest heavily in wind energy, with several state-level mandates promoting the expansion of wind farms both onshore and offshore. This highlights the country's commitment to renewable energy and positions it as a significant player in the global market.

U.S. Wind Turbine Rotor Blade Market Trends

U.S. manufacturers and energy producers are expected to focus on sustainability practices, including recycling and reusing old blades, contributing to a more sustainable lifecycle for wind turbines. As the industry continues to evolve, the U.S. is expected to emerge as a leader in wind energy innovation, harnessing wind power to meet a growing demand of its energy needs sustainably.

Europe Wind Turbine Rotor Blade Market Trends

Europe is expected to grow on account of promising efforts for wind energy installations and stringent regulations on carbon emissions. Countries such as Germany, UK, and Denmark are leading countries in wind energy innovation, with significant investments in both onshore and offshore wind farms. The European industry is anticipated to benefit from a highly developed infrastructure, skilled workforce, and technological leadership in wind turbine design and manufacturing.

Asia Pacific Wind Turbine Rotor Blade Market Trends

Asia Pacific is likely to observe rapid growth in the wind turbine rotor blade market, fueled by the rapid expansion of wind energy projects in countries such as China and India. These countries have set ambitious goals for wind energy capacity, to meet rising energy demands for growing population.

Key Wind Turbine Rotor Blade Company Insights

Some of key players operating in market include Suzlon Energy Limited, Siemens AG, and Vestas Wind Systems

-

Suzlon Energy Limited is India-based wind turbine manufacturer. The company has contributed in renewable energy sector, focusing on the development and maintenance of wind turbine generators and components.

-

Siemens AG, a multinational company headquartered in Munich, Germany, operates through various sectors including energy, healthcare, and infrastructure. Siemens focused on innovative wind power solutions, with its commitment to provide eco-friendly energy sources.

Key Wind Turbine Rotor Blade Companies:

The following are the leading companies in the wind turbine rotor blade market. These companies collectively hold the largest market share and dictate industry trends.

- Acciona S.A.

- Aeris Energy

- EnBW

- Enercon GmbH

- Gamesa Corporation Technology

- Hitachi Power Solutions

- MFG Wind

- Siemens AG

- Suzlon Energy Limited

- Vestas Wind Systems AS

Recent Developments

-

In May 2024, Siemens Energy AG announced its plan to sell turbine unit of Indian subsidiary Siemens Gamesa Renewable Energy. The company plans to focus on European and U.S. market despite challenges. However, in India the company remains obligated to provide services.

-

In March 2023, EnBW secured loan of nearly USD 650 million from the European Investment Bank for its wind farm in North Sea. With this project, the company has plans to provide green electricity to 1.1 million household.

Wind Turbine Rotor Blade Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.28 billion

Revenue forecast in 2030

USD 19.56 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; China; India; Japan; South Korea; Brazil; GCC; South Africa

Key companies profiled

Acciona S.A.; Aeris Energy; EnBW; Enercon GmbH; Gamesa Corporation Technology; Hitachi Power Solutions; MFG Wind; Siemens AG; Suzlon Energy Limited; Vestas Wind Systems AS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wind Turbine Rotor Blade Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wind turbine rotor blade market report on the basis of material, application, and region:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Glass Fiber

-

Carbon Composite

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wind turbine rotor blade market size was estimated at USD 10.46 billion in 2023 and is expected to reach USD 11.28 billion in 2024.

b. The global wind turbine rotor blade market is expected to grow at a compound annual growth rate of 9.6% from 2024 to 2030 to reach USD 19.56 billion by 2030.

b. By application, offshore dominated the market with a revenue share of over 68.0% in 2023.

b. Some of the key vendors of the global wind turbine rotor blade market are Acciona S.A., Aeris Energy, EnBW, Enercon GmbH, Gamesa Corporation Technology, Hitachi Power Solutions, MFG Wind, Siemens AG, Suzlon Energy Limited and Vestas Wind Systems AS

b. The key factor driving the growth of the global wind turbine rotor blade market is rising capacity for wind energy installations around the world

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."