- Home

- »

- Renewable Energy

- »

-

Wind Turbine Operations & Maintenance Market Report, 2030GVR Report cover

![Wind Turbine Operations And Maintenance Market Size, Share & Trends Report]()

Wind Turbine Operations And Maintenance Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Onshore and Offshore), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-1-68038-870-1

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wind Turbine Operations And Maintenance Market Summary

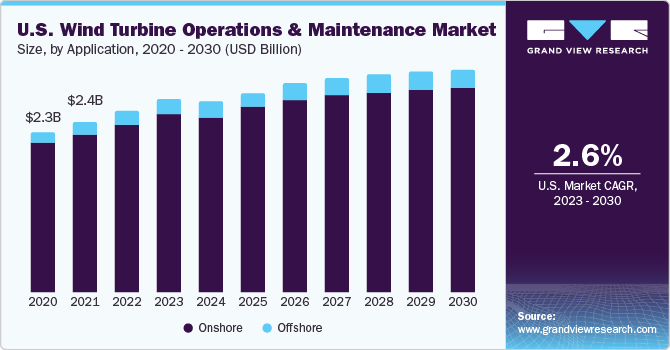

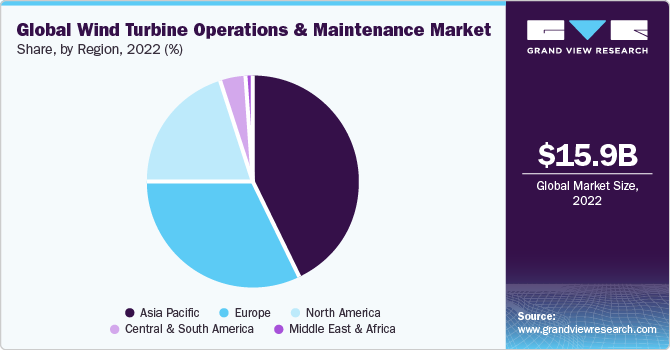

The global wind turbine operations and maintenance market size was estimated at USD 15.86 billion in 2022 and is anticipated to reach USD 27.24 billion by 2030, growing at a CAGR of 7.0% from 2023 to 2030. Repairing and maintenance of turbines is an integral part of the wind energy project. Efficient maintenance helps in reducing failure rate and thus avoids outage time at the time of event failure.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 42.6% in 2022.

- Central & South America is expected to grow at the fastest CAGR of 17.4% during the forecast period.

- By application, the onshore segment accounted for the largest revenue share of 91.2% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 15.86 Billion

- 2030 Projected Market Size: USD 27.24 Billion

- CAGR (2023-2030): 7.0%

- Asia Pacific: Largest market in 2022

Components including gears, control systems, electric systems, yaw systems, blades, pitch systems, rotors, generator, sensors, and hydraulics, are critical in nature and prone to failure. Unexpected breakdown of turbine components leads to high downtime and affects productivity, thereby increasing the need for effective monitoring and maintenance at regular intervals. Increase in capacity installations across the globe has accelerated the wind turbine operations and maintenance industry. Focus on reducing environmental impacts in the power generation industry was the key driver for exponential growth in annual installation over the past few years, leading to rapid growth in capacity installation in Asia Pacific, Europe, and North America.

Favorable government policies and attractive incentives were implemented to develop a zero emission power system, which in turn fueled annual installation capacity over the past few tears. Countries including China, Germany, India, Japan, and France are focusing to reduce their dependency on fossil fuel-based power source.

Developed countries within Europe have been focusing on market-based schemes such as competitive auctions and feed-in-premium tariffs. China has been supporting industry growth through the implementation of favorable plans and policies such as the mandatory purchase of renewable energy and Five Year Plan for Energy Transition.

These plans have boosted wind energy consumption in China to reach 20% by 2030 and consequently fueled the installation of new turbines. Furthermore, Japan and India have adopted the feed-in-tariff policy to encourage investments in renewable energy projects.

Supportive policies and initiatives to reduce environmental impact propelled the renewable energy market significantly and thus resulted in a prolific growth in the annual installation of turbines.

The market was largely driven by the unprecedented growth in turbine installation. However, stagnant growth in global electric consumption is expected to have a negative impact on the overall industry over the forecast period.

Technical innovation in this market led to the development of energy-efficient processes in various industries. As a result, electricity demand in the industrial sector has witnessed slow growth in developed countries including the U.S. Furthermore, the electricity demand in the residential sector grew at a slower rate than the expected rate.

The energy industry was subjected to high costs for operations & maintenance, owing to optimistic estimation of the reliability and lifetime of turbines. However, with robust growth in the wind energy market, industry players increased their focus on the optimization of maintenance costs, through efficient tracking of failure statistics and other strategies.

Industry players have been focusing on the improvement of operations & maintenance activities required at project sites. Emphasis on reliable and cost-effective condition monitoring techniques has increased over the past few years. Numerous companies have been implementing cutting-edge technology to resolve failure issues.

Advanced tools are being designed to estimate long-term annual average costs and downtime of turbines. Such tools aid in identifying components that are on the verge of dysfunction and preventive measures are taken in advance to avoid unexpected failure.

Application Insights

The global wind turbine operations and maintenance industry has been segmented into onshore and offshore. The onshore segment accounted for the largest revenue share of 91.2% in 2022. It is driven by advances in technology, regulatory frameworks & policies, initiatives for cost reduction, and environmental concerns. The worldwide rising awareness about climate change and the necessity to transition to sustainable and clean energy sources has led to a surge in wind energy installations, thereby propelling the market.

The offshore segment is expected to grow at the fastest CAGR of 9.9% during the forecast period. Offshore turbines offer higher efficiency than their onshore counterparts; however, they incur higher installation costs, and consequently, operating costs increase. The offshore sector faces various challenges owing to remote locations in the sea, with lower accessibility for repair and maintenance and high installation costs, thereby impacting the segment growth.

Major players such as the U.S., France, Spain, Portugal, Italy, and India focus on onshore projects for renewable energy generation, owing to the higher costs of offshore sites. Various countries in Central & South America, Asia Pacific, and Middle East & Africa solely depend on onshore projects to meet the demand.

Europe holds the predominant position in the offshore market. Prominent countries in the European offshore market include the UK, Germany, Belgium, the Netherlands, Sweden, Finland, Ireland, and Norway. Several countries have initiated efforts to enhance their offshore capacity due to higher yields. For example, they are deploying larger turbines to reduce overall costs.

The U.S. started its first commercial offshore project in 2015. In addition, China and Japan have been focusing on increasing their offshore capacity. Furthermore, European countries such as the UK, Germany, Denmark, Belgium, France, and the Netherlands have approved numerous offshore projects, therefore projecting significant growth of the offshore segment during the forecast period.

Regional insights

Asia Pacific dominated the market and accounted for the largest revenue share of 42.6% in 2022, owing to a significant increase in annual installations in China. China accounted for the highest annual installation of 23 GW across the globe. Furthermore, the country is expected to push its offshore capacity, thereby positively impacting the industry growth.

The market in Japan, South Korea, and Southeast Asian countries is expected to grow at an exponential rate over the forecast period. Emphasis on reducing environmental footprint has motivated the government in developing countries to aid wind farms. This, in turn, is likely to propel the market in Asia Pacific over the forecast period.

Europe was the second-largest market for wind turbine operations and maintenance in 2022. The region dominated the offshore installation category and also incurs high operations & maintenance costs. The UK has the highest offshore capacity, globally, with Germany, Spain, France, Italy, and Denmark being the other key contributors in Europe.

Central & South America is expected to grow at the fastest CAGR of 17.4% during the forecast period. The market is driven by a combination of economic, environmental, and policy-related factors. The increasing energy demand, cost competitiveness of wind power, job creation potential, climate change mitigation efforts, an abundance of wind resources, environmental regulations, renewable energy targets, government incentives and support, and power purchase agreements all contribute to the growth and development of the industry in the region

Central & South America and the Middle East are projected to witness exceptional growth over the next few years. South Africa emerged as a key player in the wind energy market over the past few years and the trend is expected to continue over the forecast period. The country has further planned to upscale its wind projects in the near future.

Key Companies & Market Share Insights

Various companies aim to improve life extension projects for turbines. Furthermore, they are emphasizing to shorten the maintenance interval period. The companies are strengthening technical capabilities to offer services at remote locations. Such initiatives by various companies are expected to have a positive impact on the industry growth over the forecast period.

Key Wind Turbine Operations and Maintenance Companies:

- Siemens Gamesa Renewable Energy, S.A.

- Suzlon Group

- GENERAL ELECTRIC

- ENERCON GmbH

Recent Developments

-

In June 2023, Enercon, a prominent Germany-based wind turbine manufacturer, entered into a partnership with Kalyon Enerji, a renewable energy investor, for a significant 260 MW wind project in Turkey. Under the stipulations of this agreement, Enercon is poised to furnish and set up 64 units of its cutting-edge E-138 EP3 wind turbines for the Kalyon’s Yeka Res-3 initiatives.

-

In April 2023, ENERCON GmbH collaborated with Enerjisa Üretim Santralleri A.Ş. through a memorandum of understanding, outlining the provision of two cutting-edge ENERCON E-175 EP5 wind energy converters. Under this arrangement, ENERCON is committed to installing two prototype units of its state-of-the-art flagship model within Turkey by the culmination of 2024. This model boasts a remarkable 175-meter rotor diameter and an impressive nominal power output of 6 MW.

-

In April 2023, Siemens Gamesa Renewable Energy, S.A. secured a contractual agreement with an Indian subsidiary of ArcelorMittal. This contract entails the delivery of 46 units of the SG 3.6-145 wind turbines for a substantial 166 MW project located in Andhra Pradesh, India.

-

In May 2023, General Electric unveiled an enhanced online marketplace tailored for onshore wind components. This digital platform empowers wind farm operators to conveniently procure all necessary spare parts and essential wind farm supplies in a single transaction, as it has a selection of over 100,000 items readily available for purchase.

-

In March 2023, Siemens Gamesa Renewable Energy, S.A. disclosed that it had been selected by RWE to provide 132 units of RecyclableBlades technology for the Sofia offshore wind project.

-

In February 2023, General Electric announced its selection by the Germany-based company Wpd to supply 16 onshore wind turbines for three of its wind farms. These farms are slated for construction 100 km southeast of Hamburg in Landkreis Uelzen, Niedersachsen. All three projects will feature GE 5.5 MW turbines with rotor diameters of 158 m, contributing to a combined installed capacity of 88 MW. The collaboration also encompasses a 15-year full-service agreement with an optional 5-year extension.

Wind Turbine Operations And Maintenance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.09 billion

Revenue forecast in 2030

USD 27.24 billion

Growth rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; Denmark; France; Netherlands; Poland; Portugal; Spain; Sweden; UK; Ireland; Italy; Belgium; Australia; China; India; Japan; New Zealand; South Korea; Argentina; Brazil; South Africa

Key companies profiled

Siemens Gamesa Renewable Energy, S.A.; Suzlon Group; GENERAL ELECTRIC; ENERCON GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wind Turbine Operations And Maintenance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wind turbine operations and maintenance market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

- Europe

-

Germany

-

Denmark

-

France

-

Netherlands

-

Poland

-

Portugal

-

Spain

-

Sweden

-

UK

-

Ireland

-

Italy

-

Belgium

-

-

Asia Pacific

-

Australia

-

China

-

India

-

Japan

-

New Zealand

-

South Korea

-

-

CSA

-

Argentina

-

Brazil

-

-

MEA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wind turbine operations and maintenance market size was estimated at USD 15.86 billion in 2022 and is expected to reach USD 17.09 billion in 2023.

b. The global wind turbine operations and maintenance market is expected to grow at a compound annual growth rate of 7.0% from 2023 to 2030 to reach USD 27.24 billion by 2030.

b. Onshore application dominated the wind turbine operations and maintenance market with a share of 91.2% in 2022, owing to quicker maintenance and lower costs in comparison to offshore application.

b. Some of the key players operating in the wind turbine operations and maintenance market include ENERCON GmbH, NORDEX SE, Vestas, GENERAL ELECTRIC, and Siemens Gamesa Renewable Energy, S.A.U.

b. The key factors that are driving the wind turbine operations and maintenance market include increasing the efficiency of wind turbines. The maintenance of wind turbines helps reduce failure rates and avoid outages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.