- Home

- »

- Renewable Energy

- »

-

Wind Power Market Size And Share, Industry Report, 2030GVR Report cover

![Wind Power Market Size, Share & Trends Report]()

Wind Power Market (2025 - 2030) Size, Share & Trends Analysis Report By Location (On-shore, Off-shore), By Application (Utility, Non Utility), By Region (North America, Europe, Asia Pacific, MEA), And Segment Forecasts

- Report ID: 978-1-68038-064-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wind Power Market Summary

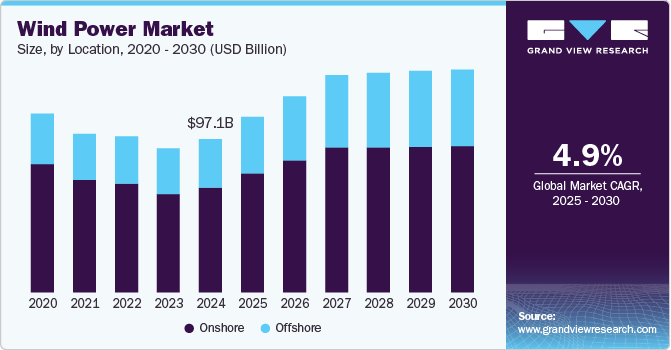

The global wind power market size was estimated at USD 97.05 billion in 2024 and is projected to reach USD 141.09 billion by 2030, growing at a CAGR of 4.9% from 2025 to 2030. The growing need to replace conventional sources of energy with renewable sources is projected to drive the market for wind power in the upcoming years.

Key Market Trends & Insights

- Asia Pacific dominated the wind power market with the largest revenue share of 40.71% in 2024.

- The wind power market in the U.S. is anticipated to grow at the fastest CAGR during the forecast period.

- Based on location, the on-shore segment led the market with the largest revenue share of 75.52% in 2024.

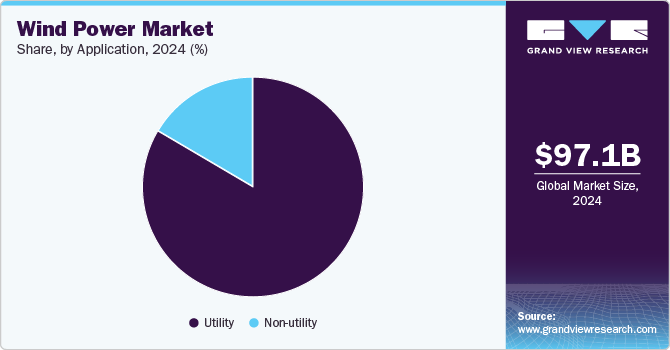

- Based on application, the utility segment led the market with the largest revenue share of 83.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 97.05 Billion

- 2030 Projected Market Size: USD 141.09 Billion

- CAGR (2025-2030): 4.9%

- Asia Pacific: Largest market in 2024

Solar and wind power generation, which were considered expensive two decades ago, are now considered more cost-competitive than new-built coal or gas plants today. Moreover, in the coming years, it is expected to become more cost-efficient to build new wind and solar than to run existing coal or gas plants. The urge for dependable, clean, and cheap power is expected to drive market growth in the future. Favorable policy structures and regulatory frameworks by various governments across various countries to promote renewable power generation are further expected to propel the market globally.

Drivers, Opportunities & Restraints

The market is primarily driven by several key factors, including government policies and incentives, technological advancements, and growing environmental concerns. Governments worldwide are implementing supportive frameworks such as tax credits, feed-in tariffs, and renewable energy targets to stimulate investment in wind energy.

Technological innovations have led to decreased costs and improved efficiency of wind turbines, making wind energy increasingly competitive with traditional fossil fuels23. In addition, the urgent need to address climate change and reduce carbon emissions has heightened the demand for clean energy sources, further propelling the growth of the wind power sector globally.

The market faces several significant restraints that hinder its growth potential. Grid integration challenges are paramount, as the variability and intermittency of wind energy complicate the balancing of supply and demand, necessitating substantial upgrades to existing grid infrastructure.

Location Insights & Trends

Based on location, the on-shore segment led the market with the largest revenue share of 75.52%in 2024. Onshore wind power has emerged as the most appreciated renewable source of energy across the regions owing to its low cost over offshore wind power coupled with easy installation process and reduction in Greenhouse Gases (GHG). Globally, the cost of installation of the onshore and offshore wind power projects has declined and is projected to be declined in the upcoming years which is further expected to drive the market growth.

The Levelized Cost of Electricity (LCOE) for installed onshore wind projects is already modest as compared to the fossil fuel source of generation and is further set to decrease the installed cost and will help to improve the performance of the wind power plants in the future. China, in the Asia Pacific region, will continue to dominate the onshore wind power industry, followed by North America. Brazil, India, Vietnam, and Australia are expected to be the potential markets for offshore wind power installation; however, varying political support in these countries is expected to propel the market growth.

Application Insights & Trends

Based on application, the utility segment led the market with the largest revenue share of 83.5% in 2024. The non-utility sector includes both commercial and residential wind power installations. Non-utility applications counted for a lower market share than utility on account of the infeasibility of applying wind turbines due to land constraints.

Wind turbines for utility-scale applications are typically installed in large, multi-turbine wind farms, which are connected to the nation's transmission system. Large-scale utility-scale wind power projects involve multiple land, construction, and other permits, as well as careful management of relationships with different stakeholders involved in the process. The easing of barriers to the installation of utility-scale projects is expected to drive the growth of the utility-scale segment.

Regional Insights

The wind power market in North America is poised for significant growth. The region benefits from a robust regulatory framework that includes tax incentives and renewable energy targets, encouraging investment in both onshore and offshore wind projects. Technological innovations, such as larger and more efficient turbines, are reducing costs and enhancing energy output, making wind power a competitive alternative to traditional energy sources.

U.S. Wind Power Market Trends

The wind power market in the U.S. is anticipated to grow at the fastest CAGR during the forecast period. The integration of wind energy into existing power grids is improving reliability and stability, further promoting its adoption. With ongoing investments and a commitment to sustainability, the U.S. is set to play a crucial role in the regional transition towards renewable energy sources.

Asia Pacific Wind Power Market Trends

Asia Pacific dominated the wind power market with the largest revenue share of 40.71% in 2024. The market growth in the Asia-Pacific region is driven by a combination of robust economic growth, increasing energy demands, and favorable government policies aimed at promoting renewable energy. Countries like China and India are leading the charge, making substantial investments in both onshore and offshore wind projects to harness their abundant wind resources. The region's commitment to reducing greenhouse gas emissions and addressing climate change is further bolstered by supportive regulatory frameworks that include subsidies and renewable energy mandates.

The wind power market in China is characterized by its status as the world’s largest in terms of installed capacity and ongoing rapid expansion of new facilities. The country benefits from vast land and extensive coastlines, which provide exceptional wind resources conducive to both onshore and offshore developments. Government policies play a crucial role in this growth, with ambitious targets aimed at increasing the share of renewable energy in the national energy mix, particularly through wind power. China accounted for the highest installation in the region due to ongoing initiatives and investments undertaken by the government to augment the industry growth. China’s onshore wind power industry is projected to rise steadily in the coming years as the government is encouraging the expansion of renewable infrastructure, to reduce the stake of thermal power and reduce pollution in the country’s power generation. This is likely to determine the progress of wind power projects in the country which, in turn, is projected to drive the market growth.

The Japan wind power market is experiencing significant growth, driven by government initiatives and a commitment to renewable energy. The country has been focusing on expanding its wind energy capacity, particularly in onshore and offshore segments, as part of its strategy to achieve carbon neutrality. Recent policies have encouraged investments and the development of new projects, including public auctions for offshore wind farms aimed at diversifying operators and expediting infrastructure development.

Europe Wind Power Market Trends

The wind power market in Europe is witnessing transformative trends, particularly in the offshore segment, which is becoming increasingly vital for achieving the continent's renewable energy goals. Europe leads globally in offshore wind capacity, with significant investments directed towards expanding these projects due to their higher efficiency and stronger wind resources compared to onshore sites. Countries like Germany and the UK are at the forefront, with ambitious targets to enhance their offshore capabilities as part of broader strategies to ensure energy security and reduce carbon emissions.

The Germany wind power market is undergoing significant transformation, with a strong emphasis on expanding offshore wind capacity due to its higher efficiency and energy yield compared to onshore installations. The government has set ambitious targets for renewable energy generation, aiming to significantly increase the share of wind power in the national energy mix while phasing out nuclear and coal sources.

The wind power market in the UK is driven by several key factors that support its rapid growth and integration into the energy landscape. A strong government commitment to renewable energy, including ambitious targets for wind capacity expansion, underpins this momentum, alongside increasing public support for clean energy initiatives. The UK's favorable geographic conditions, characterized by extensive coastlines and high wind speeds, enhance the viability of both onshore and offshore wind projects.

Central & South America Wind Power Market Trends

The wind power market in Central and South America is poised for substantial growth, driven by favorable government policies and increasing investments in renewable energy projects. Brazil stands out as the dominant player in the region, with significant advancements in onshore wind capacity and plans for offshore development, reflecting its vast potential for harnessing wind energy. Other countries like Chile and Colombia are also making strides, with new projects aimed at diversifying their energy portfolios and achieving climate goals.

Middle East & Africa Wind Power Market Trends

The wind power market in the Middle East and Africa is primarily driven by increasing investments in renewable energy, government support for clean energy initiatives, and the declining costs associated with wind power generation. Countries in the region are actively pursuing ambitious renewable energy targets to reduce reliance on fossil fuels and address climate change concerns. Technological advancements in wind turbine efficiency and the expansion of onshore wind capacity are also significant factors contributing to market growth.

Key Wind Power Company Insights

The wind power industry is characterized by a diverse range of companies that play significant roles in both project development and technology supply. Major players include Acciona Energia SA, Siemens Gamesa Renewable Energy, General Electric Company, and Vestas Wind Systems AS, which are recognized for their contributions to both onshore and offshore wind projects across various regions.

Key Wind Power Companies:

The following are the leading companies in the wind power market. These companies collectively hold the largest market share and dictate industry trends.

- GE Wind

- Vestas, Siemens Wind Power

- Suzlon Group, Goldwind

- United Power

- Acciona, Nordex SE

- Sinovel Wind Group

- EDF Renewable Energy

- ReGen Powertech

- Vensys Energy

- ABB Limited

- NextEra Energy Inc.

- Northland Power Inc.

- DONG Energy

Recent Developments

-

In October 2024, Envision Energy launched new 5MW onshore wind turbine with a rotor diameter of 182 meters specifically for the Indian market. This innovative platform significantly increases annual energy output by over 40% compared to the previous EN 156/3.3MW model, and it features enhanced smoke and fire detection systems. The launch underscores Envision's commitment to improving energy efficiency and safety for its customers.

-

In October 2024, Tata Power announced investment in wind turbines exceeding 3 gigawatts (GW) to support its wind-solar hybrid renewable energy projects across India over the next three to five years. This initiative aims to enhance the company's renewable energy capacity and could involve contracts valued at over ₹21,000 crore, with potential increases in total capacity to nearly 5 GW. Major manufacturers such as Siemens Gamesa, Senvion India, Envision Energy, and Suzlon Energy are competing for the contract.

Wind Power Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 111.15 billion

Revenue forecast in 2030

USD 141.09 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Capacity in MW, Revenue in USD million/billion, and CAGR from 2018 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Location, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

GE Wind; Vestas; Siemens Wind Power; Suzlon Group; Goldwind; United Power; Acciona; Nordex SE; Sinovel Wind Group; EDF Renewable Energy; ReGen Powertech; Vensys Energy; ABB Limited; NextEra Energy Inc.; Northland Power Inc.; DONG Energy

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wind Power Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wind power market report based on the location, application, and region:

-

Location Outlook (Capacity, MW; Revenue, USD Million, 2018 - 2030)

-

On shore

-

Off shore

-

-

Application Outlook (Capacity, MW; Revenue, USD Million, 2018 - 2030)

-

Utility

-

Non Utility

-

-

Regional Outlook (Capacity, MW; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wind power market size was estimated at USD 97.05 billion in 2024 and is expected to reach USD 111.15 billion in 2025.

b. The global wind power market is expected to witness a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 141.09 billion by 2030.

b. Onshore segment accounted for a share of 75.52% in the global wind power market in 2024. However, offshore segment is expected to be the fastest growing segment in terms of location for wind power from 2025 to 2030. The offshore wind power projects are projected to create a possibility for relishing projects in the deep-water sites where the high speed creates a much favorable situation for operations and thus driving the market for offshore locations.

b. Some key players operating in the wind power market include GE Renewable, Siemens Gamesa, ENERCON GmbH, Vestas, Suzlon Group, Goldwind, Nordex SE, Sinovel, Dongfang Electric Corporation.

b. Key factors driving the wind power market growth include technological advancement along with government initiatives to promote installation of wind turbine farms coupled with increasing investment in renewable energy is expected to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.