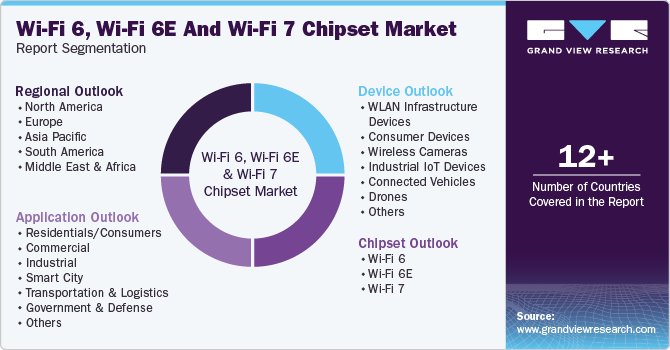

Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 Chipset Market Size, Share, & Trends Analysis Report By Chipset (Wi-Fi 6, Wi-Fi 6E, Wi-Fi 7), By Device (WLAN Infrastructure Devices, Consumer Devices, Wireless Cameras), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-334-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2019 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

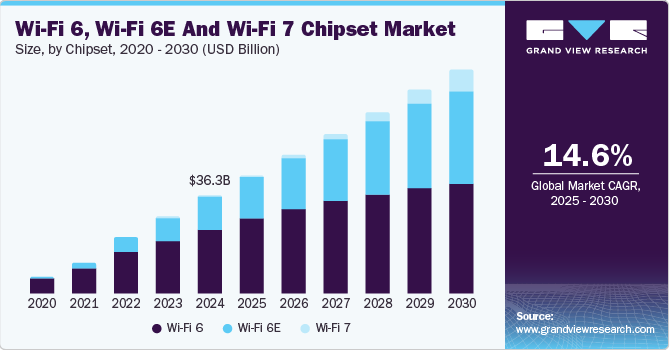

The global Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 chipset market size was estimated at USD 39.03 billion in 2024 and is expected to grow at a CAGR of 13.6% from 2025 to 2030. The growing need for an enhanced network, low latency, and bandwidth communications across enterprises is estimated to drive the Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 chipset industry during the forecast period. The significantly increasing data traffic has accelerated the need for superior network connectivity across several verticals, such as corporate and industrial. Thus, it is expected to boost the installations of wi-fi 6 and 6E devices and subsequently increase the demand for their chipsets in the next seven years.

In 2020, Broadcom Inc. unveiled BCM4389, the world debut of the Wi-Fi 6E customer device. The device expands the level to accommodate the about-to-be-workable 6 GHz band alongside broader 160 MHz channel bandwidths, doubling the speeds and cutting latency in half compared to the previous device. The BCM4389 offers real-world rates of over 2 Gbps and up to 5 times better battery consumption, making it an excellent choice for future Augmented Reality/ Virtual Reality (AR/VR) devices and flagship smartphones. The benefits of the new chipset technology over the legacy wireless standard are expected to push its adoption significantly in the upcoming years.

Manufacturing factories are evolving significantly to improve their operational efficiency. The adoption of modern devices such as Augmented Reality/Virtual Reality (AR/VR), wireless cameras, and collaborative robots is gaining momentum across the manufacturing industries. The operation of these devices seamlessly requires enhanced wireless network connectivity. Thus, it is expected to boost the adoption of Wi-Fi 6 and 6E devices and their components over the next seven years. Moreover, globally, rising trends of e-learning across universities and schools need unified network connectivity to deliver uninterrupted services. Thus, it is estimated to propel the global Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 chipset industry growth over the coming years.

Regulatory trends in the market are evolving to accommodate the growing demand for faster and more efficient wireless technologies. Regulatory bodies worldwide, including the Federal Communications Commission (FCC) in the U.S. and the European Telecommunications Standards Institute (ETSI), are increasingly allocating more spectrum for unlicensed use in the 6 GHz band to support the expansion of Wi-Fi 6E and Wi-Fi 7. These regulatory changes are crucial in enabling broader deployment of next-gen Wi-Fi technologies and ensuring minimal interference in high-traffic environments. Additionally, governments are working to standardize technical specifications for Wi-Fi 6 and Wi-Fi 7, fostering global interoperability and providing a clear framework for chipset manufacturers.

Chipset Insights

Based on chipset, the Wi-Fi 6 segment dominated the market in 2024 with the largest revenue share of 65.3%. The significant growth is attributed to the growing demand for high-performance network connectivity, allowing multi-users access simultaneously at constant bandwidth capacity. This segment is expected to witness considerable growth due to the high bandwidth needs of the mass population, where it needs to handle network congestion due to heavy network load. Rapidly growing demand for modern devices with the supporting capability of new wireless frequency bands such as 2.4GHz, 5GHz, and 6GHz is further expected to accelerate the adoption of Wi-Fi 6 chipsets. Additionally, offering BSS coloring features in the chipset technology would enhance the network reliability in a very dense ecosystem by enabling frames from the neighbor’s network. These frames assist in minimizing network interference from other networks and boosting network speed. It is anticipated to witness to a massive demand across residential, commercial, and industrial applications.

The Wi-Fi 7 segment is anticipated to register fastest growth over the forecast period. Wi-Fi 7 is the upgraded version of Wi-Fi 6E, with some enhanced technologies. The IEEE standard name of Wi-Fi 7 is 802.11be. It operates on a wide range of radio frequencies, such as 2.4GHz, 5GHz, and 6GHz. The maximum link rate that it offers is 40,000 Mbit/s. The Multiple Input Multiple Output (MIMO) enhancement and 16 spatial streams increase the video streaming quality and resolution. Wi-Fi 7 has a Hybrid Automatic Repeat Request (HARQ), which helps multiple link adaptation. The Wi-Fi 7 uses the modulation scheme known as 4K QAM, which increases the throughput value. It comes with flexible channel utilization, which reduces the interference in the signal and further enhances connectivity. Wi-Fi 7 offers wireless interface capacity up to 33Gbps and a threshold over 10Gbps throughputs.

Device Insights

Based on device, the WLAN infrastructure devices segment held the maximum market share in 2024. It is attributed to the soaring demand for chipsets to assemble into next-generation routers, gateways, repeaters, and extenders. A robust surge in the need for enhanced bandwidth capacity across enterprise customers is expected to ascend the global deployment of Wi-Fi 6 access points/routers. Furthermore, a high focus on providing superior client services and experience through fueling network bandwidth capacity is estimated to increase the adoption of next-generation WLAN infrastructure. Subsequently, it is likely to increase the Wi-Fi 6, 6E, and 7 chipsets demand for these WLAN devices.

The drone segment is anticipated to register the fastest CAGR over the forecast period. The segment growth is driven by increasing demand for high-speed, reliable wireless connectivity in applications such as aerial imaging, delivery services, and industrial inspections. Wi-Fi 6 and 6E chipsets enhancing drones' ability to transmit large data volumes in real-time, offering lower latency and higher bandwidth to support advanced features like live-streaming, high-resolution video, and remote control. With the introduction of Wi-Fi 7, drones are expected to benefit from even faster data transfer rates, enabling smoother operation in complex environments, more efficient use of available spectrum, and improved overall performance.

Application Insights

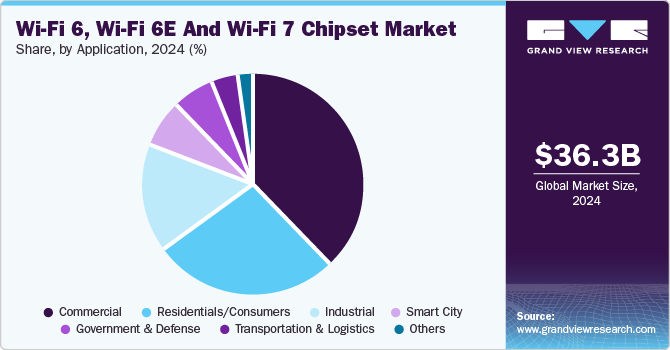

Based on applications, the commercial segment held the maximum market share in 2024. This high growth is attributed to the rapidly increasing demand for superior wireless connectivity across corporate offices. Nowadays, corporate employees are collaborating with their clients and co-workers through video meetings, learning via streaming videos, and hosting numerous cloud applications. This requires high-speed internet connectivity and thereby raises the adoption of Wi-Fi routers and wifi-6, 6E, & 7 enabled end-user devices such as laptops. Resultantly, it is expected to increase the demand for chipsets over the forecast period.

The industrial segment is anticipated to register the fastest CAGR over the forecast period. The growth can be attributed to the increasing adoption of smart manufacturing, industrial automation, and real-time data processing. Wi-Fi 6 and 6E chipsets offer enhanced connectivity, greater bandwidth, and reduced latency, enabling seamless communication between machines, sensors, and control systems in complex industrial environments. These advancements are particularly valuable in applications such as predictive maintenance, asset tracking, and process optimization.

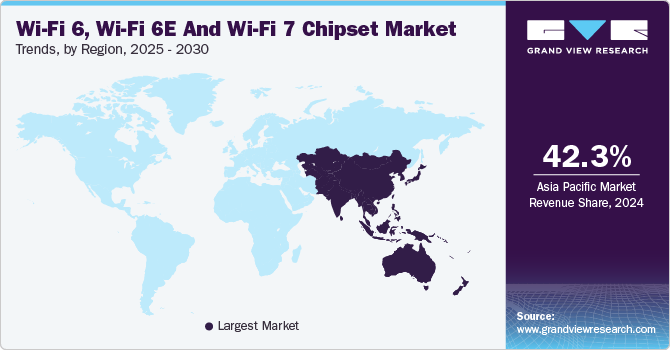

Regional Insights

North America dominated the Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 chipset market in 2024. The market is experiencing significant growth, driven by increasing demand for faster, more reliable internet connections across consumer, enterprise, and industrial sectors. As businesses and consumers upgrade their networks to support high-bandwidth applications like video streaming , gaming, and IoT devices, the adoption of Wi-Fi 6 and Wi-Fi 6E technologies is accelerating, offering enhanced performance and reduced latency through wider channels and better spectrum utilization. The emerging Wi-Fi 7 standard, promising even faster speeds and lower latency, is poised to further drive innovation in the chipset market. With strong investments from leading chipset manufacturers and growing infrastructure deployment, the region is poised for a dynamic evolution in wireless connectivity technologies, with Wi-Fi 7 expected to play a key role in future-proofing networks for the next generation of digital services.

U.S. Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 Chipset Industry Trends

The U.S. Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 chipset market is driven by strong demand for faster and more reliable wireless connectivity across sectors like smart homes, enterprise, and healthcare. Wi-Fi 6 and Wi-Fi 6E are widely adopted in devices such as smartphones, routers, and laptops, offering improved speed and efficiency. With the rise of connected devices, Wi-Fi 7 is expected to further enhance performance, providing faster speeds and ultra-low latency for emerging applications. Intense competition among chipset manufacturers, along with ongoing R&D investment, is shaping the market's growth.

Europe Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset Market Trends

The increasing demand for the high-speed internet and seamless connectivity grows across both consumer and enterprise segments. The widespread adoption of Wi-Fi 6 and Wi-Fi 6E technologies is driven by the region's focus on improving broadband infrastructure and enabling efficient data transfer for applications such as smart cities, IoT, and remote work. As European businesses and consumers increasingly adopt next-gen networking solutions, Wi-Fi 7 is expected to become a key enabler for advanced use cases, including immersive technologies like AR/VR. The market is supported by EU regulations that promote the allocation of spectrum for Wi-Fi advancements, and leading chipset manufacturers are investing heavily in R&D to meet the region’s demand for cutting-edge wireless solutions.

The UK market is expanding as demand for fast, reliable wireless connectivity grows across sectors like retail, education, and healthcare. Adoption of Wi-Fi 6 and 6E is fueled by the need for supporting more devices and high-bandwidth applications. With government initiatives promoting digital transformation, Wi-Fi 7 is expected to enhance future technologies such as smart homes and autonomous vehicles. The market is boosted by R&D investments and new public Wi-Fi network rollouts, positioning the UK as a leader in wireless innovation.

The Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 chipset market in Germany is growing rapidly, driven by the country's strong digital infrastructure and high demand for reliable wireless connectivity in industries such as automotive, healthcare, and smart homes. Germany's emphasis on Industry 4.0 and the increasing adoption of IoT devices are pushing the need for faster and more efficient Wi-Fi networks. The transition to Wi-Fi 6 and 6E is enabling higher speeds and lower latency, while the anticipated arrival of Wi-Fi 7 will further bolster Germany’s position as a leader in technological innovation.

Asia Pacific Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset Market Trends

The Asia Pacific market is expanding rapidly, driven by the region's increasing adoption of digital technologies across industries like healthcare, education, and smart homes. Wi-Fi 6 and 6E adoption is particularly strong in countries such as South Korea, where smart city initiatives and high-speed internet requirements are key drivers. With the growing need for faster, more reliable networks, Wi-Fi 7 is expected to further enhance connectivity and fuel the region’s tech advancements, from consumer electronics to industrial applications.

China’s Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 chipset market is experiencing exponential growth, fueled by the country’s massive digital transformation, including the expansion of smart cities and 5G networks. With a focus on supporting IoT devices, autonomous vehicles, and AI applications, China is adopting Wi-Fi 6 and 6E technologies to handle the growing demand for data-heavy applications. The introduction of Wi-Fi 7 is expected to provide even faster speeds and greater network efficiency, catering to China’s ambitious tech initiatives and global connectivity goals.

The Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 chipset market in India is on the rise, driven by rapid urbanization, increased smartphone penetration, and a growing demand for digital services. The adoption of Wi-Fi 6 and 6E is gaining traction in urban areas, particularly for applications in education, healthcare, and e-commerce. With the government’s push towards a Digital India and greater internet accessibility, Wi-Fi 7 is expected to play a key role in boosting connectivity and enabling next-gen services like smart cities and IoT infrastructure.

Japan's Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 chipset market is advancing as the country continues to lead in technology innovation and smart infrastructure development. The shift towards Wi-Fi 6 and 6E is spurred by the growing demand for high-performance connectivity in sectors like manufacturing, robotics, and entertainment. With the upcoming rollouts of Wi-Fi 7, Japan aims to further improve its digital landscape, facilitating applications such as 8K video streaming, autonomous systems, and enhanced industrial automation.

Key Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 Chipset Company Insights

Some of the key companies in the Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 chipset industry include Broadcom Inc., Qualcomm Technologies, Inc., Intel Corporation, and others. The companies are consistently pushing the boundaries of wireless technology with new chipset releases. The rollout of Wi-Fi 6E and the anticipated transition to Wi-Fi 7 has intensified the race, as companies strive to develop next-generation chipsets that can handle increased spectrum, faster speeds, and ultra-low latency required by future digital services.

-

Broadcom Inc. is a leading global technology company that designs, develops, and supplies a broad range of semiconductor and infrastructure software solutions. The company operates across diverse sectors, including data center, networking, broadband, wireless communications, and enterprise software. Its extensive product portfolio includes broadband modems, network switches, wireless chips, optical sensors, and memory solutions. Broadcom is also a prominent provider of connectivity solutions, including Wi-Fi, Bluetooth, and 5G technology, catering to industries such as telecommunications, automotive, and consumer electronics.

-

Qualcomm Technologies Inc. is a leader in wireless technology and semiconductors, specializing in the design and development of mobile communications and connectivity solutions. The company operates across diverse sectors, including mobile, automotive, IoT, networking, and computing. Qualcomm’s extensive product portfolio includes advanced chipsets for smartphones, 5G infrastructure, automotive solutions, Wi-Fi technology, and IoT devices.

Key Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 Chipset Companies:

The following are the leading companies in the wi-fi 6, wi-fi 6E And wi-fi 7 chipset market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom Inc.

- Qualcomm Technologies, Inc.

- ON Semiconductor Connectivity Solutions, Inc.

- Intel Corporation

- Celeno

- MediaTek Inc.

- Texas Instruments Incorporated

- Cypress Semiconductor Corporation

- STMICROELECTRONICS N.V.

- NXP SEMICONDUCTORS N.V.

Recent Developments

-

In October 2024, Silicon Labs launched the SiWx917 Wi-Fi 6 chipset platform, specifically designed for IoT applications. This ultra-low power chipset offers up to two years of battery life, making it ideal for a wide array of IoT use cases in both residential and industrial sectors. Targeted home applications include HVAC systems, smart locks, cameras, sensors, and appliances, while its industrial applications support predictive maintenance, smart meters, asset tracking, and other sensor-driven solutions.

-

In September 2023, Intel Corporation introduced two new networking chipsets, the Wi-Fi 7 BE200 and BE202, based on the IEEE 802.11be (Wi-Fi 7) specification. The Wi-Fi 7 standard offers data rates up to 40 Gbit/s, with the BE200 chipset utilizing 2x2 TX/RX streams across the 2.4 GHz, 5 GHz, and 6 GHz frequency bands to enhance connectivity and performance.

Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 Chipset Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 47.19 billion |

|

Revenue forecast in 2030 |

USD 89.34 billion |

|

Growth rate |

CAGR of 13.6% from 2025 to 2030 |

|

Base year of estimation |

2024 |

|

Historical data |

2019 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

January 2025 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Chipset, Device, Application and region |

|

Regional scope |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa |

|

Key companies profiled |

Broadcom Inc.; Qualcomm Technologies, Inc.; ON Semiconductor Connectivity Solutions, Inc.; Intel Corporation; Celeno; MediaTek Inc.; Texas Instruments Incorporated; Cypress Semiconductor Corporation; STMICROELECTRONICS N.V.; NXP SEMICONDUCTORS N.V. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Wi-Fi 6, Wi-Fi 6E and Wi-Fi 7 Chipset Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the Wi-Fi 6, Wi-Fi 6E And Wi-Fi 7 chipset market report based on chipset, device, application, and region.

-

Chipset Outlook (Revenue, USD Million; 2019 - 2030)

-

Wi-Fi 6

-

Wi-Fi 6E

-

Wi-Fi 7

-

-

Device Outlook (Revenue, USD Million; 2019 - 2030)

-

WLAN Infrastructure Devices

-

Consumer Devices

-

Smartphones/Tablets

-

Desktops/Laptops

-

AR/VR and Wearables

-

Smart Home Devices

-

Others

-

-

Wireless Cameras

-

Industrial IoT Devices

-

Connected Vehicles

-

Drones

-

Others

-

-

Application Outlook (Revenue, USD Million; 2019 - 2030)

-

Residentials/Consumers

-

Commercial

-

Enterprises/Corporates

-

Airports

-

Stadiums

-

Malls/Shops

-

Hospitals

-

Hotels & Restaurants

-

Educational Campuses

-

Others

-

-

Industrial

-

Smart Manufacturing

-

Energy & Utility

-

Oil & Gas and Mining

-

-

Smart City

-

Transportation & Logistics

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset market size was estimated at USD 39.03 billion in 2024 and is expected to reach USD 47.19 billion in 2025.

b. The global Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset market is expected to grow at a compound annual growth rate of 13.6% from 2025 to 2030 to reach USD 89.34 billion by 2030.

b. North America dominated the Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset market in 2024. This is attributable to the substantial rise in the investments in developing wi-fi 6 and wi-fi 6E-enabled smartphones, routers, and laptops, among others.

b. Some key players operating in the Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset market include Broadcom, Qualcomm, ON Semiconductor, Intel, Celeno, MediaTek Inc., Texas Instruments Incorporated, Cypress Semiconductor Corporation, STMICROELECTRONICS, NXP SEMICONDUCTORS

b. Key factors that are driving the Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset market growth include the rapidly growing need for enhanced network bandwidth and low latency communications across enterprises, high investments in developing next-generation smartphones, and others

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."