- Home

- »

- Consumer F&B

- »

-

White Tea Market Size And Share, Industry Report, 2030GVR Report cover

![White Tea Market Size, Share & Trends Report]()

White Tea Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Organic, Conventional), By Application (Beverage, Cosmetics And Toiletries, Pharma), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-391-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

White Tea Market Size & Trends

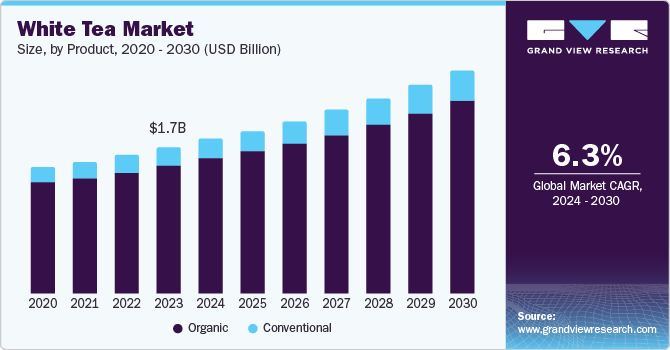

The global white tea market size was valued at USD 1.67 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. The market growth is attributed to its antioxidant and antimicrobial properties, which boosts the immune system. White tea can reduce the occurrence of cardiovascular diseases and oral bacteria. Hence, it also finds application in the pharmaceutical industry.

It is recommended that moderate consumption of white tea beverages help reduce anxiety and increase energy levels. Changing diet patterns and hectic work styles among adults in emerging economies, including China and India, are projected to drive the demand for white tea as a health drink in the coming years.

White tea is easy to prepare and is the least processed tea; therefore, it takes less time and effort to process. Additionally, organic white tea has become popular due to its purity, health, and environmental consciousness. The shift in consumer preferences toward purchasing organic products has led to a profitable market segment for organic white tea, fueling the market's growth.

The growing influence of different cultures and increased globalization are the factors fueling the market's expansion. Consumers are increasingly willing to try new taste preferences as they are exposed to diverse cultures, cuisines, and beverages. This has caused a surge in the use of exotic and distinctive items such as white tea. Furthermore, the rise of social media and digital platforms has made sharing information and experiences about various tea varieties easier, helping expand the white tea market.

China, India, Kenya, Sri Lanka, and Vietnam, among others, are the leading producers of white tea. The slow adoption of these products in the abovementioned countries, due to the predominant consumption of black and green tea, is expected to hurt the white tea market's growth. Most of these countries export white tea products to the developed countries of North America and Europe.

Product Insights

The conventional segment accounted for the largest revenue share of 87.7% in 2023. These products are cost-effective and are available in varied mild, subtle, and delicate flavors including floral & fruity flavors, such as grassy, melon, peach, vanilla, apricot, honey, herbs, citrus and chocolate. Furthermore, easy accessibility & low prices of the products through various offline modes including grocery stores & supermarkets is expected to drive the conventional product segment over the forecast period.

The organic segment is expected to register the fastest CAGR during the forecast period.A consumer preference for health and environmental sustainability drives the increasing demand for organic products. Organic white tea is perceived as a more natural option, free from synthetic pesticides and chemicals. Furthermore, organic farming methods support soil health and biodiversity, resonating with the values of environmentally aware consumers. Furthermore, organic white tea is associated with better quality and superior flavor, appealing to selective consumers willing to pay a high price for premium and eco-friendly products.

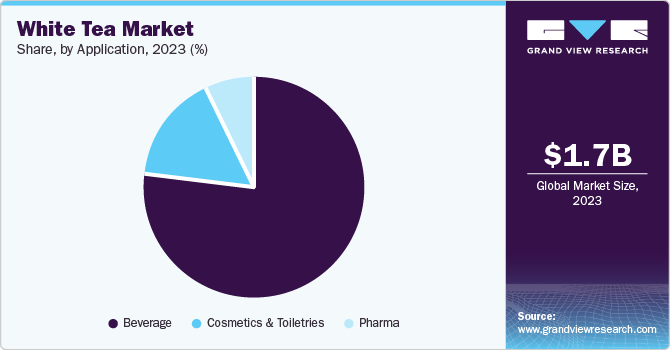

Application Insights

The beverage segment dominated the market in 2023. Tea is a widely enjoyed beverage worldwide, and white tea stands out due to its unique twist with delicate flavor, gentle taste, and possible health advantages. Furthermore, it capitalizes on the increasing consumer interest in health and wellness, fueling a desire for natural and minimally processed beverages. The manufacturers have introduced a broader range of white tea beverage options, such as iced teas, flavored blends, and ready-to-drink beverages, catering to the demands of premium and health-conscious beverage enthusiasts.

The cosmetics and toiletries segment are projected to grow at the fastest CAGR over the forecast period. Skin-soothing and antioxidant properties of white tea are anticipated to boost its usage in skincare products. Some of the famous white tea-based skincare brands include Korres Natural Products, Giovanni Cosmetics, and Kiss My Face among others. Leading hospitality companies, including Marriott International, Inc. provide premium white tea toiletry products to their customers. They supply white tea formulations in the form of candles, room fresheners, and oil and scent diffusers.

Distribution Channel Insights

The offline segment dominated the market in 2023. This is attributed to

several factors including high foot traffic and wide reach, which cater to a diverse range of consumers and producers. Easy access allows consumers to easily find and buy white tea products, which increases product reach. The offline distribution channels usually offer a wide range of brands and products. Moreover, offline channels such as retail stores, and supermarkets provide a streamlined distribution system, enabling them to reach a broad audience efficiently without forming numerous partnerships with small retailers. The operational efficiency benefits producers and consumers, helping offline distribution channels dominate the market.The online segment is projected to grow at a significant rate over the forecast period. The factors include convenience, information accessibility, targeted marketing, subscription models, and global reach. Online retail offers convenience and accessibility. Consumers can explore various products from different brands and origins worldwide, regardless of geographical boundaries. In addition, e-commerce businesses frequently take advantage of subscription services by providing regular shipments, which helps maintain a stable customer base and steady income for producers. Online platforms remove location limitations, enabling global producers to access new markets and customers to explore different types from various regions.

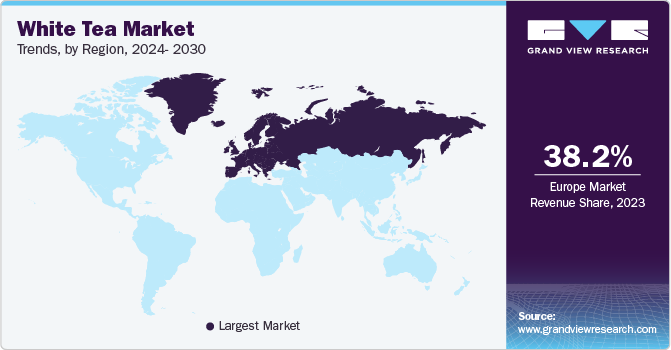

Regional Insights

North America white tea market was identified as a lucrative region in 2023. North American consumers increasingly focus on health and wellness, choosing natural and minimally processed drinks like white tea. Due to their higher purchasing power, consumers in various North American countries, such as the U.S. and Canada, can purchase premium and specialized beverages. Furthermore, effective marketing campaigns by white tea companies have effectively portrayed the product as a refined and health-conscious drink choice, contributing to the market's growth in North America.

U.S. White Tea Market Trends

The U.S. white tea market is expected to grow rapidly in the coming years due to the high purchasing power of individuals in the country. The increasing levels of discretionary income enable customers to explore premium and unique beverage options, leading to a more receptive market for higher-priced white tea products.

Europe White Tea Market Trends

The Europe white tea market held the largest share in 2023. The increased consciousness among consumers about health and personal grooming in developed countries such as the U.K. and Germany is expected to drive market growth. Moreover, the region has high purchasing power, and more consumers inclined towards investing in premium products. Furthermore, the market's growth is fueled by the widespread popularity of tea culture and prominent tea brands and retailers in Europe.

The UK white tea market is expected to grow rapidly in the coming years due to the well-established tea culture in the UK, which provides a robust foundation for white tea's acceptance, as consumers are already accustomed to incorporating tea into their daily routines.

Asia Pacific White Tea Market Trends

Asia Pacific's white tea market is anticipated to witness significant growth over the forecast period.The region's abundant cultural history and enduring custom of drinking tea help establish a solid market base. White tea, which traces its roots back to Asia, is culturally important and firmly ingrained in age-old tea customs. Moreover, the growing awareness of health among customers in nations such as China and Japan cause an increase in the demand for natural and antioxidant-filled drinks. Additionally, the increasing demand for specialty and premium teas, higher disposable incomes, and urbanization contribute to market expansion in the Asia Pacific area.

China's white tea market is expected to grow rapidly in the coming years. China has a robust and rich tradition and heritage in growing and making tea. This extensive knowledge allows the country to consistently create high-quality white tea, thus solidifying its status as a leader on the global stage.

Key White Tea Company Insights

Some of the key companies in the white tea market include Wight Tea Company, Sancha Tea, Teaxpress.com, The Chinese Tea Company, Dilmah Ceylon Tea Company PLC, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. The companies compete based on product differentiation and new product launches. In January 2019, Unilever launched Dove Go Fresh apple and white tea antiperspirants with 48 hours of sweat protection features.

- Wight Tea Company was founded by a sibling duo to create unique handcrafted blends of white, green, herbal, and black tea. It offers different wholesale choices for retail, cafes, restaurants, bars, corporate gifts, and other hospitality requirements.

Key White Tea Companies:

The following are the leading companies in the white tea market. These companies collectively hold the largest market share and dictate industry trends.

- Wight Tea Company

- Sancha Tea

- Teaxpress.com

- The Chinese Tea Company.

- Dilmah Ceylon Tea Company PLC.

- ViconyTeas- Chinese Tea Supplier & Wholesaler

- White Cloud World Teas

- Rare Tea Company

- Goodricke Group Limited

- The East India Company LTD

Recent Developments

-

In June 2024, Elizabeth Arden announced the launch of White Tea Eau Florale. It is an interpretation of White Tea fragrance and has been launched in travel retail in multiple locations.

-

In December 2022, Elizabeth Arden announced the extension of its White Tea range in White Tea Skin Solutions, a new skincare line. The new solution has been formulated with Epigallocatechin Gallate Glucoside (EGCG), nature’s potent antioxidant.

White Tea Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.76 billion

Revenue forecast in 2030

USD 2.54 billion

Growth Rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil and South Africa

Key companies profiled

Wight Tea Company; Sancha Tea; Teaxpress.com; The Chinese Tea Company.; Dilmah Ceylon Tea Company PLC.; ViconyTeas- Chinese Tea Supplier & Wholesaler; White Cloud World Teas; Rare Tea Company; Goodricke Group Limited; The East India Company LTD

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

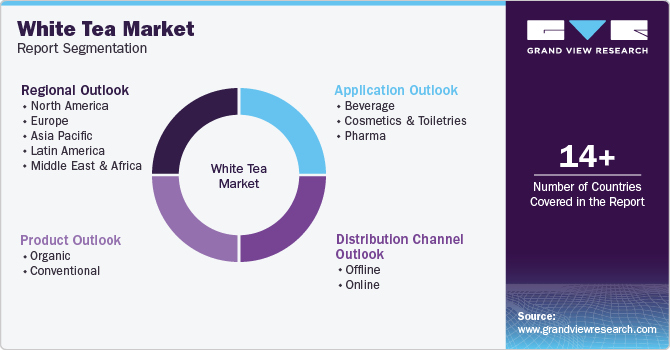

Global White Tea Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global white tea market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beverage

-

Cosmetics and Toiletries

-

Pharma

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.