- Home

- »

- Alcohol & Tobacco

- »

-

White Spirits Market Size & Share, Industry Report, 2030GVR Report cover

![White Spirits Market Size, Share & Trends Report]()

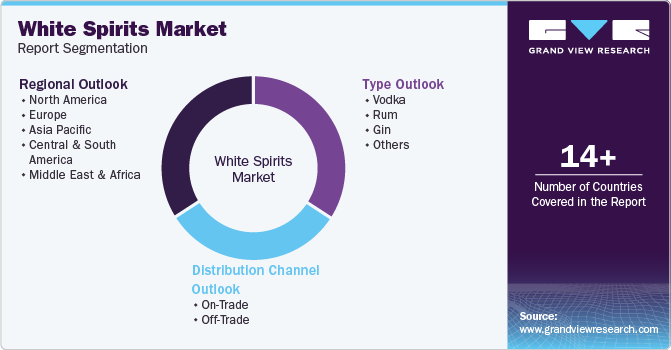

White Spirits Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Vodka, Rum, Gin), By Distribution Channel (On-trade, Off-trade), By Region (North America, Europe, APAC, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-3-68038-090-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

White Spirits Market Summary

The global white spirits market size was valued at USD 61.5 billion in 2023 and is anticipated to reach USD 93.5 billion by 2030, growing at a CAGR of 6.4% from 2024 to 2030. The global trend towards premium products and the growing popularity of cocktail culture have led to a surge in demand for high-quality white spirits.

Key Market Trends & Insights

- Asia Pacific white spirits market dominated the market revenue share with 28.4% in 2023.

- The India dominated the Asia Pacific white spirits market in 2023.

- Based on type, the vodka segment dominated the market and accounted for a revenue share of 61.1% in 2023.

- Based on distribution channel, the off-trade segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 61.5 Billion

- 2030 Projected Market Size: USD 93.5 Billion

- CAGR (2024-2030): 6.4%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

Consumers increasingly seek unique and sophisticated spirits to enhance their drinking experiences. This shift has encouraged producers to invest in innovative product development and marketing strategies to cater to the changing preferences of consumers. The market is fueled by economic growth and increasing disposable incomes. As economies grow and disposable incomes continuously improve, people are more inclined to treat themselves to high-end products such as premium spirits. The growing purchasing power drives the demand for white spirits, especially in developing economies. Moreover, the increasing global inclination towards casual drinking and the success of cocktail establishments and eateries are playing a part in the market's expansion.

Various factors, such as industrial use, consumer tastes, and economic expansion, influence the white spirits alcohol market worldwide. The growing need for white spirits in different industrial fields drives this market. White spirits are commonly used as solvents in manufacturing paints, coatings, adhesives, and printing inks. Expanding the construction, automotive, and manufacturing sectors, especially in developing areas, is closely linked to the need for white spirits. The growing urbanization and efforts to improve infrastructure in various regions also lead to higher levels of white spirits consumption.

Type Insights

The vodka segment dominated the market and accounted for a revenue share of 61.1% in 2023.The versatility and neutral flavor of vodka make it a popular choice for a wide range of cocktails and mixed drinks. Furthermore, compared to other white spirits, such as whiskey and gin, vodka's cost-effective production makes it more affordable and readily accessible. The growing demand for vodka-based cocktails, especially in developing countries, has continued to expand its market. In addition, the increasing focus on health and wellness has shifted towards beverages with lower alcohol levels. Moreover, vodka's dominance in the white spirits market has been reinforced by the worldwide growth of vodka brands and their effective marketing strategies.

The gin segment is expected to register a significant CAGR of 6.4% during the forecast period. The growing popularity of craft gin, due to its unique flavors and high-quality ingredients, has attracted a large consumer base. This trend has led to a surge in demand for premium gin brands, driving market growth. Moreover, the increasing popularity of gin-based drinks, especially traditional drinks such as the Negroni and Martini, has helped drive the segment's growth. Additionally, the growing interest in craft spirits and the demand for distinctive and flavorful experiences have contributed to the popularity of gin. Additionally, the effective marketing strategies and branding initiatives implemented by gin manufacturers have boosted recognition and enhanced consumer favorability towards gin alcohol.

Distribution Channel Insights

The off-trade distribution channel accounted for the largest revenue share in 2023. The convenience and accessibility of off-trade channels, such as supermarkets, hypermarkets, and liquor stores, make them a preferred choice for consumers. The wide range of products available in off-trade channels allows consumers to compare prices and select their favorite brands easily. Additionally, the growing trend of home consumption, fueled by factors such as changing lifestyles and economic conditions, has increased the demand for white spirits purchased through off-trade channels. Furthermore, the ability of off-trade channels to offer bulk discounts and promotional activities attracts consumers and contributes to the segment's market expansion.

The on-trade distribution channel is expected to register the fastest CAGR during the forecast period. The on-trade channel is growing due to the rise in cocktail culture, the increasing number of bars, restaurants, and nightclubs, and an upward trend towards social drinking. Furthermore, the increasing demand for high-quality and handcrafted alcoholic beverages frequently highlighted and supported in establishments that sell alcohol for consumption on-site, is also contributing to the expansion of this market.

Regional Insights

The North American white spirits market is growing at the fastest CAGR during the forecast period. The demand for white spirits in North America has increased due to the rising popularity of cocktails and mixed drinks and the trend of hosting events at home. The region's thriving tourism industry and frequent international events and festivals have also increased the market's growth.

U.S. White Spirits Market Trends

The U.S. white spirits market held a substantial market share in 2023. The U.S. is at the forefront due to a flourishing cocktail culture and a desire for premium-quality spirits. Major players prioritize developing new products and marketing strategies to meet the demands of a wide range of consumer tastes and preferences.

Asia Pacific White Spirits Market Trends

Asia Pacific white spirits market dominated the market revenue share with 28.4% in 2023 owing to the region's burgeoning population, rising disposable incomes, and swift urbanization, there has been a marked increase in the demand for alcoholic beverages. This demand is further fueled by the cultural significance of social gatherings and celebrations prevalent in many Asian countries, which often include the consumption of white spirits. Additionally, the growing popularity of Western-style bars and restaurants, coupled with the rising trend of at-home cocktail cultures, is pushing the demand for premium white spirits even higher in the area.

The India dominated the Asia Pacific white spirits market in 2023 pertaining to the alcoholic beverage market is due to several factors. One of these is the growing young population in the country, which has significant purchasing power. This younger demographic is more willing to explore and try different types of alcoholic drinks, including craft beers and high-quality spirits. Their preference for unique and diverse experiences has created a demand for creative and high-quality alcoholic beverages. As a result, producers and manufacturers are introducing a wider variety of products to meet this demand and expand the market for alcoholic beverages.

Europe White Spirits Market Trends

Europe white spirits market was identified as a lucrative region in 2023. The region's long-standing tradition of alcohol consumption and a well-established culture of drinking, with a growing interest in premium and artisanal spirits, have contributed to its attractiveness. Additionally, cocktails and mixed drinks' increasing popularity have fueled the demand for white spirits in Europe. Furthermore, the region's strong tourism industry and the presence of numerous international events and festivals have also played a role in driving the market's growth.

The UK white spirits market is expected to grow rapidly in the coming years. This dynamic market is thriving due to innovations by manufacturers in the spirits industry. The resurgence in consumer preferences and a variety of creative choices have created demand for spirits in the country.

Key White Spirits Market Company Insights

Some of the key companies in the white spirits market include Diageo, BACARDI, Pernod Ricard, Suntory Global Spirits, Inc., Stock Spirits Group., Proximo Spirits, and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

BACARDI has played a significant role in shaping the white spirits market. The company offers various products, such as rum, vodka, gin, tequila, whiskey, and other spirits. The company has been at the forefront of innovation by offering new products and flavors to cater to evolving consumer preferences. Bacardi's marketing strategies and collaborations with celebrities and events have also contributed to its success.

-

Diageo's portfolio features well-known white spirits brands worldwide. The company has a solid presence in global markets, and its products are readily accessible to consumers everywhere. Diageo makes significant investments in marketing and innovation to boost sales and launch new products. The company is dedicated to sustainability and has implemented several programs to minimize its environmental footprint.

Key White Spirits Companies:

The following are the leading companies in the white spirits market. These companies collectively hold the largest market share and dictate industry trends.

- Diageo

- BACARDI

- Pernod Ricard

- Suntory Global Spirits, Inc.

- Stock Spirits Group.

- Proximo Spirits,

- Alberta Distillers, LTD

- William Grant & Sons

- JACOB RIEGER & CO.

- Rémy Cointreau

Recent Developments

-

In November 2022, Bacardi introduced its first Indian whisky by launching a new blend known as Legacy. This new blend is Bacardi's first 'made-in-India whisky innovation' and the sole premium Indian whisky in their lineup. Legacy, representing India's 'culture and passion,' has been crafted using handpicked Indian grains and a blend of Indian and Scottish malt whiskies.

White Spirits Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 64.3 billion

Revenue forecast in 2030

USD 93.5 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; New Zealand; Brazil; South Africa

Key companies profiled

Diageo; BACARDI; Pernod Ricard; Suntory Global spirits, Inc.; Stock Spirits Group.; Proximo Spirits,; Alberta Distillers, LTD; William Grant & Sons; JACOB RIEGER & CO.; Rémy Cointreau

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global White Spirits Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global white spirits market report based on type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Vodka

-

Rum

-

Gin

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.