Western Blotting Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Application (Biomedical & Biochemical Research, Disease Diagnostics), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-709-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Western Blotting Market Size & Trends

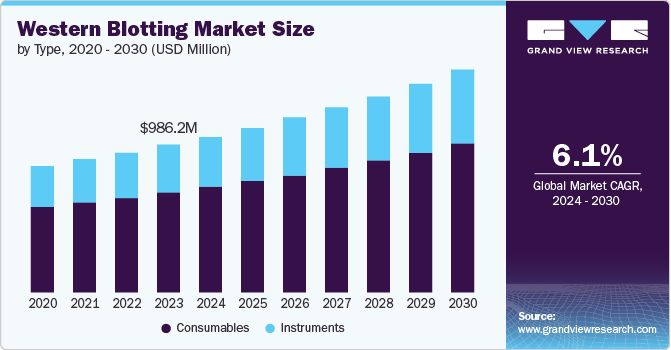

The global western blotting market size was valued at USD 1.97 billion in 2024 and is projected to grow at a CAGR of 6.01% from 2025 to 2030. The rising rate of brain disorders, research initiatives in the biotech and pharma sectors, and funding by the pharmaceutical and biotechnology agencies drive market growth. Introducing advanced diagnostic technologies and the increasing number of cases of chronic diseases associated with the brain contribute to market growth.

Biomedical and biochemical research activities are growing consistently depending on trends in the healthcare industry. As a result, western blotting has become an essential approach for protein analysis in the healthcare sector. Furthermore, improved western blotting products, such as high-sensitivity reagents, computerized structures, and software for better imaging and evaluation, underscores its efficiency, accuracy, and value.

The prevalence of HIV/AIDS in the population is one of the key factors propelling the western blotting market growth. In addition, western blotting is used in the research for Borrelia burgdorferi (Bb), which causes Lyme disorder. Furthermore, the incidences of tissue and neurological disorders, cancers, and cardiovascular issues are rising. The development of various innovations in proteomics technology and the need for high-throughput protein evaluation is anticipated to accelerate western blotting strategies. Therefore, western blotting techniques have experienced numerous technological enhancements in recent years.

Market Concentration & Characteristics

The western blotting industry has seen significant innovation, with advancements in automation, multiplexing, and enhanced sensitivity. Developments in alternative detection methods, improved reagents, and integration with digital platforms have streamlined workflows, increased throughput, and improved accuracy, driving efficiency and broadening applications in research, diagnostics, and drug development.

The western blotting industry exhibits a high level of collaboration and partnership. Companies are partnering with academic institutions, research organizations, and diagnostics firms to advance product innovations, enhance workflow efficiency, and expand applications, fostering growth and improving overall market offerings.

Regulations have a significant impact on the western blotting industry, influencing product development, quality control, and manufacturing processes. Compliance with stringent standards, such as FDA and CE certifications, ensures reliability and safety in research and diagnostics. Regulatory frameworks also drive innovation, as companies must adapt to evolving guidelines for performance and accuracy.

Product expansion in the western blotting industry focuses on diversifying offerings to meet evolving research and diagnostic needs. Companies are introducing new reagents, detection systems, and automated platforms, enhancing sensitivity, speed, and multiplexing capabilities. Expansion into complementary technologies, such as immunohistochemistry and mass spectrometry, further broadens the market’s applications and growth potential.

Regional expansion in the western blotting industry is driven by growing research and diagnostic needs across emerging markets in Asia-Pacific, Latin America, and the Middle East. Companies are focusing on increasing their presence in these regions through local partnerships, distribution networks, and setting up regional manufacturing facilities to cater to the rising demand for advanced research tools.

Product Insights

The consumables segment dominated the market in 2024. Consumables such as reagents, buffers, antibodies, conjugates, kits, membranes, and filter-out sheets can be customized for a single use. The consumables segment witnessed a significant demand based on the augmented sensitivity, efficiency, and specificity of the western blotting method. The development of reagents, antibodies, and kits for overall performance and simplicity has encouraged its wide adoption. Moreover, the production of specialized consumables designed for specific packages or using sophisticated blotting strategies contributes to market growth.

The instrument segment is expected to register a significant CAGR of 4.66% over the forecast period. The continuous demand for superior and efficient devices, speedy adoption of western blotting techniques in research and diagnostic laboratories for protein evaluation, and technological advancements in devices facilitate research and development. The growing focus on improving the sensitivity and accuracy of western blotting, along with the rise in demand, encourages segment growth.

Application Insights

The biomedical & biochemical research segment dominated the industry with a revenue share of 61.59% in 2024. Biomedical studies have increased financing from both the private and non-private sectors. The biomedical studies target to identify several illnesses, design therapy tactics, and create clinical awareness about novel medicinal drugs.

The disease diagnostics segment is expected to witness the highest CAGR of 8.78% from 2025 to 2030. The growing incidences of Factor V, Herplex Symptoms Virus (HSV), Hepatitis B Virus (HBV), and Lyme sickness, incidences of chronic diseases such as cancers and autoimmune disorders, account for segment growth. The demand for personalized treatments, and usage of protein biomarkers for disease diagnosis, contribute to the growth of the disease diagnostics segment. The growing adoption of western blotting in scientific laboratories for detecting disorder-specific antibodies or protein markers and the improvement of multiplexing technology for simultaneous analysis of multiple proteins in a single assay fuels segment growth.

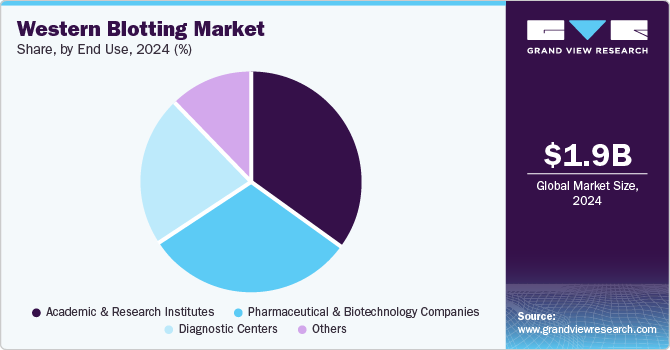

End Use Insights

The academic & research institute segment dominated the market with a revenue share of 35.15% in 2024. The segment has been the leading end-use segment in the market due to its widespread use of western blotting for fundamental research, protein studies, and biomolecular analysis. These institutions drive innovation, supported by government funding and grants for life sciences and biotechnology research. Western blotting's reliability and versatility make it indispensable for studying disease mechanisms, validating biomarkers, and exploring therapeutic targets. Strong collaborations with industry players and ongoing advancements in research technologies sustain this segment's leadership.

The diagnostic centers segment is expected to grow at the highest CAGR of 8.20% over the forecast period due to the increasing prevalence of chronic and infectious diseases, which demand advanced diagnostic tools like Western blotting. Rising investments in healthcare infrastructure, coupled with the adoption of high-sensitivity and automated systems, enhance diagnostic accuracy and efficiency. The growing focus on personalized medicine and early disease detection further drives demand.

Regional Insights

North America western blotting market dominated the global industry with a revenue share of 47.91% in 2024. The presence of manufacturing companies in the region, growing investment in proteomics studies, and a growing awareness of customized medicine encourage growth. Furthermore, North America has a well-established healthcare infrastructure and finances. This economic aid promotes the development of diagnostic procedures in scientific settings for illness analysis and control.

U.S. Western Blotting Market Trends

The western blotting market in the U.S. dominated North America with a revenue share of 91.47% in 2024. The U.S. market is home to several renowned biopharmaceutical groups and research institutes that conduct significant studies and research. The U.S. market has witnessed major investments in life sciences research, mainly proteomics and genomics.

Europe Western Blotting Market Trends

The western blotting market in Europe held a significant share in 2024. The growth in the number of people suffering from HIV is one of the fundamental elements propelling the European market. Growing research and development activities, rapid adoption of personalized treatments, favorable government policies and funding, and the prominence of academic and studies institutes augment the European market growth.

The UK western blotting market held a substantial market share in 2024. The increasing demand for protein evaluation tools driven by research activities, technological improvements, industry growth, customized medication treatment, regulatory support, and collaborative initiatives are key elements propelling the growth of the western blotting market within the UK.

The western blotting market in France is experiencing significant growth. The market is driven by advancements in biotechnology research, diagnostics, and drug development. Strong investments in life sciences and healthcare sectors, along with a well-established academic and research base, support the demand for high-quality Western blotting reagents and automated systems. Regulatory standards and collaborations with European research institutions further fuel market expansion in the region.

Germany western blotting market is expected to grow rapidly in the forecast period due to the growing occurrence of cardiovascular diseases and cancer patients and the rise in technological improvements in the clinical sector. Companies are continuously introducing new products that enhance accuracy, efficiency, and the pace of western blotting strategies.

Asia Pacific Western Blotting Market Trends

The western blotting market in Asia Pacific is expected to witness a CAGR of 6.80% over the forecast period. The biotechnology and pharmaceutical sectors in Asia Pacific are expanding swiftly due to the growing investment from both governmental and private companies. Furthermore, chronic illnesses such as cancers, diabetes, and cardiovascular disease are becoming more common in this region. This has resulted in an emphasis on personalized medicine, and focused drug treatments, with western blotting as a crucial tool within the identification and quantification of biomarkers for illness diagnosis and control.

China western blotting market is expected to witness significant growth in the forecast period due to a rise in research and development activities, healthcare expenditure, prevalence of chronic diseases, and technological advancements.

The western blotting market in Japan is steadily advancing, supported by a strong biopharmaceutical sector. Japan’s well-established pharmaceutical and healthcare sectors, along with cutting-edge technological innovations, foster demand for high-quality Western blotting products. Collaborative efforts between academia, research institutions, and industry leaders further support market expansion, while stringent regulatory standards ensure product quality and reliability.

Middle East & Africa Western Blotting Market Trends

The western blotting market in the Middle East & Africa has experienced considerable growth in recent years. Growing demand for advanced diagnostic tools, along with rising research activities in both academic and pharmaceutical industries, drives the adoption of Western blotting techniques. While the market remains in early stages compared to other regions, partnerships with global suppliers and improving healthcare infrastructure are contributing to its growth potential.

Saudi Arabia western blotting market is growing, fueled by significant investments in healthcare and biotechnology. Increased government investments in biotechnology, pharmaceuticals, and medical research, along with initiatives to enhance diagnostic capabilities, are boosting the demand for advanced research tools like Western blotting. Collaborations with international companies and the establishment of research centers further support the adoption of these technologies, positioning Saudi Arabia as a key player in the Middle Eastern market.

The western blotting market in Kuwait is supported by the country's investments in healthcare and biotechnology. With increasing investments in biotechnology and medical diagnostics, there is rising demand for Western blotting technologies in both academic and clinical settings. Collaborations with global suppliers and the establishment of research institutions are further driving the adoption of advanced diagnostic tools, positioning Kuwait as a developing market within the region.

Key Western Blotting Company Insights

Key companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

Key Western Blotting Companies:

The following are the leading companies in the western blotting market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- LI-COR, Inc.

- Merck KGaA

- F. Hoffmann-La Roche Ltd.

- Bio-Techne Corporation

- GE HealthCare

- QIAGEN

- Advansta Inc.

- Cell Signaling Technology, Inc.

Recent Developments

-

In March 2024, GE Healthcare, a prominent player in clinical diagnostics, unveiled its plan to introduce 40 new products with a focus on designing and producing clinical products in India and the global market. The company plans to cover diagnostic products such as ultrasound, MRI, PET/CT, CT-scan, and patient care gadgets.

-

In June 2023, Bio-Techne, a global life sciences company that offers bioactive reagents and tools for research and clinical diagnostic communities, announced their plans to acquire Lunaphore, Inc. The acquisition is complementary to Bio-Techne’s leading spatial biology franchise, COMET.

Western Blotting Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.08 billion |

|

Revenue forecast in 2030 |

USD 2.78 billion |

|

Growth rate |

CAGR of 6.01% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, KSA, UAE, South Africa and Kuwait. |

|

Key companies profiled |

Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; LI-COR, Inc.; Merck KGaA; F. Hoffmann-La Roche Ltd.; Bio-Techne Corporation; GE Healthcare; QIAGEN; Advansta Inc.; and Cell Signaling Technology, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Western Blotting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global western blotting market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Gel Electrophoresis Instruments

-

Blotting Systems

-

Semi-Dry Blotting Instruments

-

Wet Blotting Instruments

-

-

Imagers

-

Chemiluminescent Imagers

-

Fluorescent Imagers

-

Others

-

-

-

Consumables

-

Reagents

-

Kits

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomedical & Biochemical Research

-

Disease Diagnostics

-

Agriculture

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

APAC

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global western blotting market size was estimated at USD 1.97 billion in 2024 and is expected to reach USD 2.08 billion in 2025.

b. The global western blotting market is expected to grow at a compound annual growth rate of 6.01% from 2025 to 2030 to reach USD 2.78 billion by 2030.

b. North America dominated the western blotting market with a share of 47.91% in 2024. This is attributable to rising incidence of chronic diseases such as HIV/AIDS, hepatitis, and herpes simplex virus in conjunction with increasing number of R&D activities by biotechnological & pharmaceutical companies.

b. Some key players operating in the western blotting market include Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; LI-COR, Inc.; Merck KGaA; F. Hoffmann-La Roche Ltd.; Bio-Techne Corporation; GE Healthcare; QIAGEN; Advansta Inc.; and Cell Signaling Technology, Inc.

b. Key factors that are driving the market growth include huge mortality rate resulting from AIDS, rising prevalence of Lyme disease, and increasing trend towards proteomics research.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."