- Home

- »

- Healthcare IT

- »

-

Wellness Apps Market Size And Share, Industry Report 2030GVR Report cover

![Wellness Apps Market Size, Share, & Trends Report]()

Wellness Apps Market (2025 - 2030) Size, Share, & Trends Analysis Report By Type (Exercise And Weight Loss Apps), By Platform (Android, iOS), By Device (Smartphones), By Subscription (Paid, Free), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-435-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wellness Apps Market Size & Trends

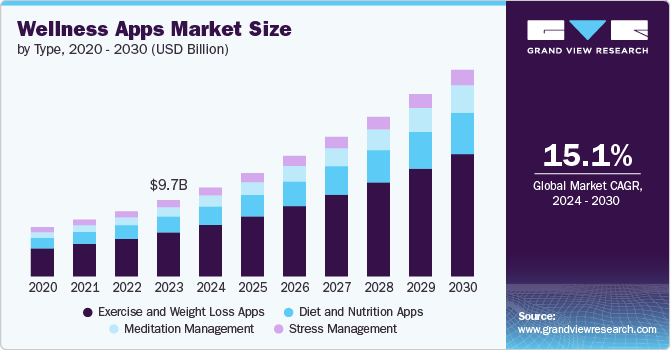

The global wellness apps market size was valued at USD 11.27 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 14.9% from 2025 to 2030. The growing awareness of health and wellness globally, driven by concerns about sedentary lifestyle, obesity rates, and the role of physical activity in maintaining overall well-being, is fueling the demand for wellness apps. Furthermore, increasing wellness apps launches across the globe are supplementing market growth. In March 2024, Cristiano Ronaldo revealed the introduction of Erakulis, an app focused on health and wellness. Erakulis is set to provide services in mental health, nutrition, and fitness, along with virtual consultations with health and wellness professionals.

Smartphones have evolved from being devices of communication & entertainment to devices that can monitor health and fitness. Mobile apps for smartphones have simplified life by providing convenience for everyday tasks. With the widespread use of smartphones and the ready availability of advanced technology, innovators are investing in opportunities to provide high-quality healthcare and convenience to consumers through various mobile platforms. These platforms will help users track their health routines.

The Mobile Economy 2024 report by the GSM Association (GSMA) revealed that in 2023, approximately 5.6 billion individuals worldwide availed mobile services. It is projected that the number of distinct mobile subscribers will surge to 6.3 billion by 2030. Moreover, the increasing penetration of smartphones is another crucial factor expected to drive market growth. The Mobile Economy 2023 report indicates that smartphone adoption stood at approximately 76% in 2022 and is anticipated to increase to 92% by 2030. Hence, the growing adoption of smartphones is expected to drive market growth over the forecast period.

Another factor expected to propel market growth is the growing adoption of 5G technology across the globe. As per a report published by GSMA in 2023, the global penetration of 5G is estimated to be 54% by 2030. Additionally, the enhanced bandwidth and minimal latency of 5G are expected to make it easier to share higher-resolution images and videos, enhancing the quality and significance of virtual communication. As a result, there will be a decrease in the necessity for in-person visits to medical facilities, benefiting individuals in remote locations who may not have convenient access to hospitals or clinics.

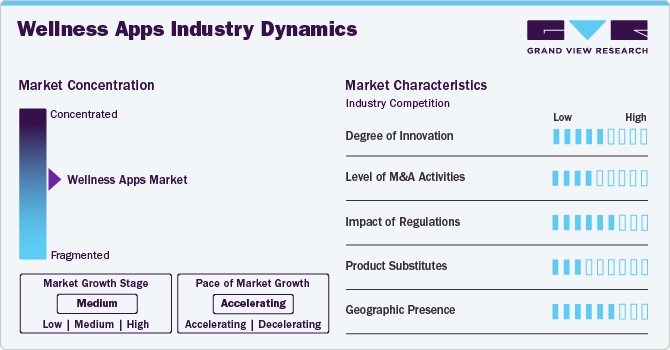

Market Concentration & Characteristics

The market for wellness apps worldwide is known for its high level of innovation, as new technologies and approaches are continually being developed and introduced. For instance, in March 2024, Galvan revealed enhancements to its wellness application, Galvan+, enabling users to input and securely store their personal health information. This user-generated and user-owned health data may consist of personal health details including vaccinations, surgeries, medical conditions, medications, and allergies.

Industry players implement various business strategies to increase revenues, promoting global market growth. The market players undertake partnerships, mergers & acquisitions, and product launches to expand their product portfolio, further contributing to industry growth. In March 2024, Noise acquired the AI women’s wellness platform SocialBoat. This move is a strategic part of Noise’s broader plan to further innovation in smart rings.

The companies that develop wellness apps must follow various regulations to ensure the safety of patients and data. Additionally, several regulatory bodies are working to simplify the regulations for digital health apps. For example, in December 2022, the Federal Trade Commission (FTC), along with the HHS Office of Civil Rights (OCR), the Office of the National Coordinator for Health Information Technology (ONC), and the Food and Drug Administration (FDA), collaborated to update the widely used Mobile Health Apps Interactive Tool. This tool is designed to help developers of health-related mobile apps, including those regulated by HIPAA, understand the federal laws and regulations that may be relevant to their operations.

In the wellness apps market, product substitutes come in various forms, offering alternatives for consumers seeking health and wellness solutions. Traditional methods such as in-person therapy, physical fitness classes, and wellness retreats serve as direct substitutes, providing a more personalized and tangible experience compared to digital apps.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Growing funding creates more opportunities for market players to enter new regions. The innovative mental health care solutions provider, the Feeling Great app, secured USD 8 million in seed funding in August 2024 to extend its reach to users globally with its AI-powered platform.

Type Insights

In 2024, the exercise and weight loss apps segment dominated the wellness apps market and accounted for the largest revenue share of 58.9%. The exercise & weight loss apps segment growth can be driven by the increasing obesity rates & related health issues and the growing awareness of health concerns. Integration of advanced technologies, such as AI and Machine Learning (ML), is poised to fuel market growth over the forecast period. This segment offers applications across multiple platforms, such as iOS, Android, and others, addressing diverse needs, including lifestyle monitoring, weight management, and exercise monitoring. With obesity becoming a global challenge, there is a rising demand for effective weight loss solutions through these apps, prompting companies to capitalize on this trend by continually enhancing their offerings.

The meditation management segment in the wellness apps market is anticipated to witness the fastest growth over the forecast period. Growing funding opportunities for developing various meditation management apps signify market growth opportunities. For instance, according to Crunchbase, the total funding for Calm, a meditation app, rose from USD 28 million in 2018 to USD 218 million in 2020. Additionally, the app's funding saw a surge of around 52% from 2019 to 2020. This substantial rise in funding signifies market growth potential from 2024 to 2030.

Platform Insights

The iOS segment held the largest revenue share of 50.3% in 2024. The high adoption of iOS devices is one of the major factors propelling growth and is expected to continue to boost the segment over the forecast period. For instance, according to the Demandsage report, as of 2023, there are 153 million iPhone users in the U.S. In addition, according to the Backlinko report, in 2023, Apple delivered 231.8 million iPhones across the globe. Furthermore, robust brand loyalty is one of the major factors driving segment growth. According to Apple Customer Loyalty Statistics, 92% of people who have previously owned iPhones are inclined to continue with Apple for their next purchase.

The Android segment in wellness apps market is anticipated to register a significant growth over the forecast period. Apps for wellness can be acquired on Android devices and can accomplish different tasks, such as establishing fitness objectives, monitoring calorie consumption, collecting exercise suggestions, and participating in other physical activities. Moreover, the widespread adoption of android smartphones globally is expected to drive segment growth over the forecast period. As per the Backlinko report, global quarterly smartphone sales in Q4 2023 were dominated by Android smartphones, accounting for 56% of the total sales. Furthermore, the Android operating system has undergone continuous improvements. These include enhanced health & fitness tracking features, Application Programming Interface (API) integrations, and machine learning capabilities. These enhancements strengthen the functionality and accuracy of wellness apps.

Device Insights

The smartphones segment held the largest revenue share of 60.3% in 2024. Growth in the segment can be attributed to the increasing penetration of smartphones globally. According to an article in The Hindu, over 2 billion 5G smartphones were shipped worldwide in the last quarter of 2023, with China, the U.S., and Western Europe accounting for almost 70% of all shipments. In addition, the availability of 5G smartphones increased as the price difference between 5G and 4G chipsets narrowed, contributing to segment growth. According to the 2024 Kepios report, nearly all the world’s internet users, amounting to 96.3%, utilize a mobile phone to access the internet at least occasionally. Moreover, mobile phones currently represent about 57.8% of online time and contribute to 60% of the world’s web traffic. Hence, the increasing usage of the internet on smartphones is expected to propel segment growth over the forecast period.

Wearable devices segment in wellness apps market is anticipated to register a significant growth over the forecast period. The growing health consciousness among consumers and the increasing prevalence of chronic diseases, such as diabetes & cardiovascular diseases, are expected to boost the demand for wearable devices in the market. According to the IDC report, there was a 34% growth in India’s wearable market in 2023, with 134.2 million units recorded, and smartwatch shipments increasing by 74% year-on-year to reach 53.2 million units. Mobile phone integration, wireless connection, and long battery life are among the key features that users seek in a wearable device. Moreover, rapid advancements in the designs of these wearables are propelling their demand in the market.

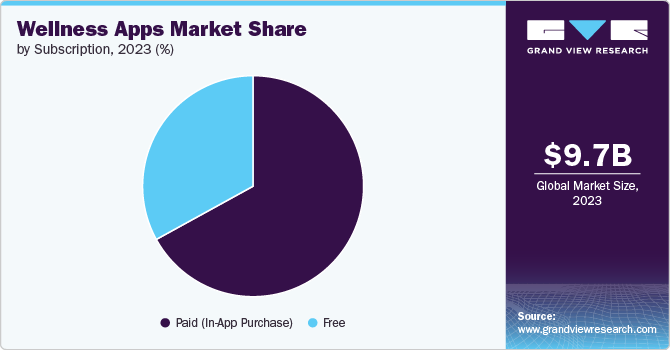

Subscription Insights

The paid (In App Purchase) segment held the largest revenue share of 66.6% in 2024. Increasing consumer willingness to invest in personalized wellness experiences is driving segmental growth. As users become more health-conscious, they seek tailored solutions that address their specific needs, whether it's mental health support, fitness tracking, or meditation guidance. Paid features often provide enhanced content, advanced analytics, or personalized coaching, which can significantly improve user engagement and outcomes, thereby fostering market growth. For instance, according to the Business of Apps, in 2023, Headspace had 2.8 million paid subscribers, while Calm had an estimated 4.5 million subscribers in the same year.

Free segment in wellness apps market is anticipated to register a significant growth over the forecast period. These apps are highly appealing to a wide audience, especially in emerging markets, because they offer essential features without any upfront cost. Additionally, the increasing use of smartphones and internet connectivity allows people from different demographics to explore wellness apps at no cost. Such factors are supplementing the growth of the free wellness app market. For instance, Noom Vibe offers a wellness app at no cost that enables people worldwide to live a healthier and longer life. The app provides an enjoyable way to develop healthy habits within a supportive community. Its main features consist of a step and habit tracker with incentives, real-time chats with coaches, and connection with a community.

Regional Insights

North America wellness apps market dominated in 2024 and accounted for the largest revenue share of 36.3%. Numerous factors, such as growth in coverage networks, rapid usage of smartphones, rise in prevalence of chronic diseases, and increase in geriatric population, are expected to drive the adoption of fitness apps in North America. Increasing awareness regarding fitness & daily health monitoring has led to a rise in the adoption of wellness apps and a significant rise in the number of new players in the region.

U.S. Wellness Apps Market Trends

The U.S. wellness apps market held the largest share of 84.1% in the North American region in 2024 due to innovative software development, advanced healthcare management, and numerous key players operating across segments, such as network and mobile operations. Additionally, increasing usage of wellness apps is fostering market growth. According to a survey, in December 2022, around 40% and 35% of adults use health apps & wearables. Furthermore, as per ZIPPIA estimates, as of 2022, there were 307 million smartphone users in the U.S., with 86% of adults using smartphones.

Canada wellness apps market is anticipated to register the fastest growth during the forecast period. An increase in awareness and interest in health and fitness has helped increase the demand for wellness apps in Canada. Several wellness startups have entered the market for people to continue or begin their fitness journey. Canada’s most used and engaging fitness applications include Fitbit; Samsung Health; Strava: Run, Bike, Hike, and others.

Europe Wellness Apps Market Trends

Europewellness apps market is anticipated to register significant growth during the forecast period. This can be attributed to increasing awareness about healthy lifestyles, a growing number of fitness centers & health clubs, and rising demand for wellness & workout apps by user groups. The launch of new products and increased marketing & promotional activities by manufacturers are some factors expected to contribute to market growth during the forecast period.

Germany wellness apps market is anticipated to register a considerable growth rate during the forecast period. Growing awareness among population regarding the benefits of sleep pattern and monitoring their current state of health is leading to a rise in the demand for wellness applications in Germany. Furthermore, as the number of smartphone users is rising, the adoption of wellness apps is growing. For instance, in June 2024, the most used and leading fitness app in Germany was Komoot, with 40 million registered users across the globe, and one in four adults in Germany has an account with Komoot. Thus, these factors are expected to promote the Germany wellness app market growth during the forecast period.

The UK wellness apps market is anticipated to register a considerable growth rate during the forecast period. The increasing demand for mobile healthcare apps among consumers in the UK is expected to supplement market growth. For instance, according to data published by Business of Apps, 25% of people in the UK used workout/fitness apps, and 15% used nutrition/diet apps in 2023. Furthermore, virtual app vendors focus on developing & launching innovative solutions and extending their geographical reach through key strategies such as partnerships, product launches, collaborations, and approvals. They offer free premium access to users and support in maintaining their health & fitness at home.

Asia Pacific Wellness Apps Market Trends

Asia Pacific wellness apps market is anticipated to register the fastest growth rate during the forecast period. The increasing awareness of health and wellness among the region’s population has driven the demand for wellness solutions, with apps providing a convenient and accessible means to maintain fitness routines. In addition, the widespread adoption of smartphones and improved internet connectivity have made wellness apps more accessible to a broader audience. According to The Mobile Economy 2024 by GSMA, unique mobile subscriptions in Asia Pacific reached 1.8 billion by the end of 2023.

China wellness apps market held the largest share in 2023. The growing patient population and increasing internet penetration in China can spur the country’s market. According to data from the China Internet Network Information Center (CNNIC), as of December 2023, China has 1.092 billion Internet users, an increase of 24.8 million since December 2022. Internet penetration has increased by 1.9%, reaching 77.5%.

India wellness apps market is anticipated to register a considerable growth during the forecast period driven by advancements in artificial intelligence (AI) and its integration into wellness solutions. Apps including HealthifyMe, Fitelo, and Fitterfly leverage AI to offer personalized, data-driven health insights and recommendations. HealthifyMe utilizes AI to analyze continuous glucose monitor (CGM) data, enabling the development of a virtual CGM that predicts glucose spikes and drops.

Latin America Wellness Apps Market Trends

Latin America wellness apps market is anticipated to register the significant growth during the forecast period. Latin America is considered to have a large pool of healthcare human resources and tech entrepreneurs. This is one of the key factors driving the wellness apps market in Latin America. In addition, increasing expenditure on electronic & mobile devices by buyers is contributing to market growth. In addition, according to a report by GSMA, the smartphone user base in Brazil grew to 155 million in 2023 from 143.4 million in 2022, which has enhanced the availability and exposure of fitness apps among the Brazilian population.

Brazil wellness apps market is anticipated to register a significant growth during the forecast period. The increasing adoption of digital technology and the growing healthcare sector are some of the key factors boosting the wellness apps market in Brazil. As per the Kepios estimates, in January 2023, Brazil had 181.8 million internet users. This indicates a large pool of users turning to wellness apps.

MEA Wellness Apps Market Trends

MEA wellness apps market is anticipated to register significant growth during the forecast period. South Africa, Saudi Arabia, and the UAE are some of the promising countries in the Middle East market. Advancements in healthcare systems are expected to bring wellness apps into action in these countries.

The wellness apps market in South Africa is experiencing rapid growth due to the increasing smartphone penetration, improving internet connectivity, and government initiatives promoting wellness app adoption. Wearable devices, mHealth apps, and AI are key trends shaping the wellness app landscape. For instance, according to Healthnews, in 2023, there were an estimated 16.07 million health & fitness app downloads in South Africa, with an average of 0.354 downloads per Internet user.

Key Wellness Apps Company Insights

Key participants in the wellness apps market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Wellness Apps Companies:

The following are the leading companies in the wellness apps market. These companies collectively hold the largest market share and dictate industry trends.

- Mindscape

- Calm

- Headspace Inc.

- Appster

- Under Armour, Inc.

- Kayla Itsines

- Apple Inc.

- Sleepace

- Withings

Recent Developments

-

In June 2024, Lifesum, the top nutrition app globally, plans to revolutionize customized wellness in Europe by acquiring LYKON, the premier biomarker-driven personalized nutrition firm in Germany.

-

In May 2024, ThincHer, the University of Adelaide's entrepreneurship program for young women situated within ThincLab, initiated a new partnership with Sweat, a globally recognized fitness application popular among women. This partnership aims to enhance the entrepreneurial and leadership skills of female students while also addressing the importance of fitness and mental health support.

-

In April 2024, Adayu Mindfulness, a company within the Fortis Healthcare Group, in partnership with deep-tech company United We Care, launched Adayu, an app that is available for free, aiming to meet essential mental healthcare needs.

-

In August 2023, Fitbit, Inc launched an update for its Fitbit app to provide a comprehensive overview of user health and wellness. It offers a streamlined three-tab interface, allowing users to conveniently monitor their daily objectives & metrics, access motivational insights & guidance, and review personalized achievement & progress summaries.

Wellness Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.09 billion

Revenue forecast in 2030

USD 26.19 billion

Growth Rate

CAGR of 14.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, device, subscription, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Mindscape, Calm, Headspace Inc., Google, Appster, Under Armour, Inc., Kayla Itsines, Apple Inc., Sleepace, Withings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wellness Apps Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the wellness apps market report on the basis of type, platform, device, subscription, and region:

-

Type Outlook (Revenue USD Million, 2018 - 2030)

-

Exercise And Weight Loss Apps

-

Diet And Nutrition Apps

-

Meditation Management

-

Stress Management

-

-

Platform Outlook (Revenue USD Million, 2018 - 2030)

-

iOS

-

Android

-

Web Based

-

-

Device Outlook (Revenue USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

Wearable Devices

-

-

Subscription Outlook (Revenue USD Million, 2018 - 2030)

-

Paid (In App Purchase)

-

Free

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wellness apps market size was estimated at USD 11.27 billion in 2024 and is expected to reach USD 13.09 billion in 2025.

b. The global wellness apps market is expected to grow at a compound annual growth rate of 14.9% from 2025 to 2030 to reach USD 26.19 billion by 2030.

b. In 2024, the exercise and weight loss apps segment dominated the wellness apps market and accounted for the largest revenue share of 58.9%. The exercise & weight loss apps segment growth can be driven by the increasing obesity rates & related health issues and the growing awareness of health concerns.

b. Some key players operating in the wellness apps market include Mindscape, Calm, Headspace Inc., Google, Appster, Under Armour, Inc., Kayla Itsines, Apple Inc., Sleepace, Withings.

b. The growing awareness of health and wellness globally, driven by concerns about sedentary lifestyle, obesity rates, and the role of physical activity in maintaining overall well-being, is fueling the demand for wellness apps.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.