- Home

- »

- Conventional Energy

- »

-

Wellhead Components Market Size & Share Report, 2030GVR Report cover

![Wellhead Components Market Size, Share & Trends Report]()

Wellhead Components Market (2024 - 2030) Size, Share & Trends Analysis Report By Products (Hangers, Casing Spools), By Application (Offshore, Onshore), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-389-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wellhead Components Market Size & Trends

The global wellhead components market size was estimated at USD 6.25 billion in 2023 and is expected to grow at a CAGR of 4.5% from 2024 to 2030. The market is primarily driven by the increasing demand for oil and gas worldwide. As energy consumption continues to rise, particularly in developing economies, there's a growing need for efficient and reliable wellhead equipment to support exploration and production activities.

Technological advancements in drilling techniques, such as hydraulic fracturing and horizontal drilling, have also been key drivers for the market. These innovations have enabled extracting oil and gas from previously inaccessible reserves, leading to increased drilling activities in unconventional fields. For instance, the shale gas boom in North America has created a surge in demand for wellhead components designed to withstand the high pressures and temperatures associated with these extraction methods.

Additionally, the growing focus on offshore and deep-water exploration is positively influencing the wellhead components market. As easily accessible onshore reserves become depleted, oil and gas companies are increasingly turn to offshore fields to meet global energy demands. This shift requires specialized wellhead components that can operate reliably in harsh marine environments and at great depths. The development of offshore fields in regions such as the Gulf of Mexico, the North Sea, and off the coast of Brazil has been a significant driver for innovations in wellhead technology and component design.

Product Insights

The hanger segment registered the largest revenue share of over 30.0% in 2023. Hangers are critical components of a wellhead assembly that support the weight of the casing or tubing string and seal off the annular space between the casing strings. Hangers come in various types, including slip and mandrel hangers, and are crucial for maintaining good integrity and pressure control.

Flanges are connecting devices used to join pipes, valves, and other equipment in a wellhead system. They provide a secure and leak-tight connection that can withstand high pressures and temperatures. Flanges come in different sizes, pressure ratings, and materials to suit various operating conditions. They are essential for creating modular wellhead assemblies that can be easily maintained or modified as needed.

The casing spools segment is projected to grow at a faster CAGR of 6.7% during the forecast period. They are tubular components installed between the casing head and tubing head to provide support and sealing for additional casing strings. They allow for the hanging of intermediate casing strings and provide a means to monitor and control pressure in the annular spaces between casing strings. Casing spools are essential for wells with multiple casing strings and help maintain well integrity throughout the life of the well.

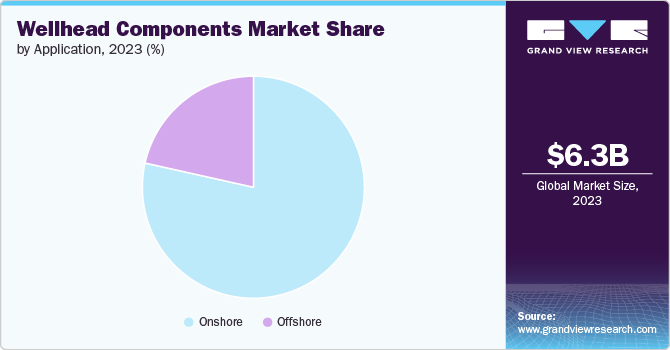

Application Insights

The onshore application segment accounted for the highest revenue share of over 78.0% in 2023. Onshore wellhead components are used in land-based oil and gas extraction operations. These components are designed to withstand the pressures and conditions typically encountered in onshore drilling environments. Onshore wellheads often have simpler configurations compared to their offshore counterparts, as they don't need to account for factors such as water depth or marine conditions. The onshore segment generally sees higher demand due to the greater number of land-based wells and the relative ease of access for maintenance and operations.

Offshore wellhead components are specifically engineered for use in subsea environments, where they must withstand high pressures, corrosive saltwater, and challenging installation and maintenance conditions. These components are typically more complex and robust than onshore equivalents, incorporating features such as subsea control systems and specialized sealing mechanisms. Offshore wellheads often require remote operation capabilities and must be designed to function reliably for extended periods without direct human intervention. While the offshore segment may have fewer individual wells compared to onshore, the technological complexity and specialized nature of offshore components often result in higher value per unit.

Regional Insights

The region's robust oil and gas industry plays a crucial role in shaping the dynamics of the wellhead components market. The U.S. and Canada are among the world's largest producers of oil and natural gas, with extensive onshore and offshore operations. This high level of production activity drives significant demand for wellhead components, which are essential for controlling pressure, regulating flow, and ensuring safe operations at the surface of oil and gas wells. For example, the Permian Basin in Texas and New Mexico witnessed a surge in drilling activity in recent years, requiring a constant supply of high-quality wellhead equipment.

Asia Pacific Wellhead Components Market Trends

Asia Pacific wellhead components market dominated and accounted for the largest revenue share of over 27.0% in 2023. Technological advancements and the adoption of advanced drilling techniques in the region are contributing to market growth. Countries such as Australia and Japan are investing in innovative drilling technologies for deepwater and ultra-deepwater exploration, which drives the demand for specialized wellhead components. Besides, the development of coalbed methane (CBM) and shale gas resources in countries such as China and India are also creating new opportunities for wellhead component manufacturers.

The wellhead components market in China is expected to reach the fastest CAGR from 2024 to 2030. China's manufacturing capabilities and cost-effectiveness play a crucial role in its market dominance. Chinese manufacturers have developed advanced production facilities and techniques, allowing them to produce high-quality wellhead components at competitive prices. This cost advantage has not only satisfied domestic demand but also enabled Chinese companies to export their products globally.

Europe Wellhead Components Market Trends

Europe's growth in the wellhead components market can be attributed to several factors, including advanced technological capabilities, substantial investment in oil and gas infrastructure, and stringent regulatory standards. The region's historical leadership in engineering and manufacturing has provided a robust foundation for producing high-quality wellhead components. Companies in countries such as Germany, Norway, and the UK are recognized for their precision engineering and innovation in the energy sector. This technological prowess allows European manufacturers to produce advanced, reliable, and efficient wellhead components that meet the high demands of modern oil and gas extraction processes.

Key Wellhead Components Company Insights

The competitive environment of the wellhead components market is characterized by the presence of several key players. These companies dominate the market due to their extensive product portfolios, technological advancements, and strong global distribution networks. Competitive strategies such as mergers and acquisitions, partnerships, and significant R&D investments are prevalent as companies strive to enhance their market positions. Market share is predominantly held by the leading players, with SLB and Halliburton often seen as front-runners due to their comprehensive service offerings and industry expertise.

Key Wellhead Components Companies:

The following are the leading companies in the wellhead components market. These companies collectively hold the largest market share and dictate industry trends.

- Halliburton

- SLB

- REIN PROCESS EQUIPMENT (JIANGSU) CO., LTD.

- G.B. Industry Co.

- Apache Pressure Products

- Hartmann Valves GmbH

- Acteon Group Operations (UK) Limited

- INTEGRATED

- Dawsons-Tech Components LLP

- Singoo

- DKG Valve Manufacturing LLC

- Valveworks USA

- TSI Flow Products

- Canary, LLC

Recent Developments

-

In February 2024, Woodside Energy partnered with Dril-Quip to supply subsea wellheads for its deepwater Trion project located off the coast of Mexico. This project, which is expected to significantly contribute to Mexico's oil production, involves the installation of multiple subsea wells.

-

In December 2023, Pason Systems Inc. announced its intention to exercise a call option to purchase all remaining issued and outstanding common shares of Intelligent Wellhead Systems, Inc. for a total consideration of USD 88.3 million, assuming net debt of approximately USD 7.0 million at closing. This strategic decision was expected to position the company to benefit from additional growth opportunities in the wellhead components market.

-

In May 2022, Baker Hughes released a new subsea wellhead technology called the MS-2 Annulus Seal, which is designed to save substantial operational rig costs by reducing the number of rig trips required for installation. The MS-2 can be installed in a single trip, with an integrated lock ring that results in improved rig efficiency by providing immediate lockdown of up to 2 million pounds force without the need for a second trip, saving rig time.

Wellhead Components Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.51 billion

Revenue forecast in 2030

USD 8.48 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; UAE

Key companies profiled

Halliburton; SLB; REIN PROCESS EQUIPMENT (JIANGSU) CO., LTD.; G.B. Industry Co.; Apache Pressure Products; Hartmann Valves GmbH; Acteon Group Operations (UK) Limited; INTEGRATED; Dawsons-Tech Components LLP; Singoo; DKG Valve Manufacturing LLC; Valveworks USA; TSI Flow Products; Canary, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wellhead Components Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wellhead components market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hangers

-

Flanges

-

Master Valve

-

Casing Head

-

Casing Spools

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wellhead components market was estimated at around USD 6.25 billion in 2023 and is expected to reach around USD 6.51 billion in 2024.

b. The global wellhead components market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030, reaching around USD 8.48 billion by 2030.

b. The onshore application segment accounted for the highest revenue market share, over 78.0% in 2023. Onshore wellhead components are used in land-based oil and gas extraction operations and are designed to withstand the pressures and conditions typically encountered in onshore drilling environments.

b. Key players in the market include Halliburton; SLB; REIN PROCESS EQUIPMENT (JIANGSU) CO., LTD.; G.B. Industry Co.; Apache Pressure Products; Hartmann Valves GmbH; Acteon Group Operations (UK) Limited; INTEGRATED; Dawsons-Tech Components LLP; Singoo; DKG Valve Manufacturing LLC; Valveworks USA; TSI Flow Products; and Canary, LLC.

b. The global wellhead components market is mainly driven by the growing demand for oil and gas worldwide. With energy consumption on the rise, especially in developing economies, there is a growing need for efficient and reliable wellhead equipment to support exploration and production activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.