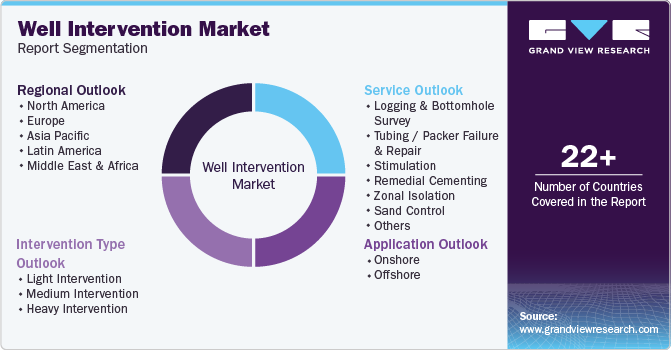

Well Intervention Market Size, Share & Trends Analysis Report By Service (Stimulation, Fishing, Remedial Cementing), By Intervention Type (Light Intervention), By Application (Onshore), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-914-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Well Intervention Market Size & Trends

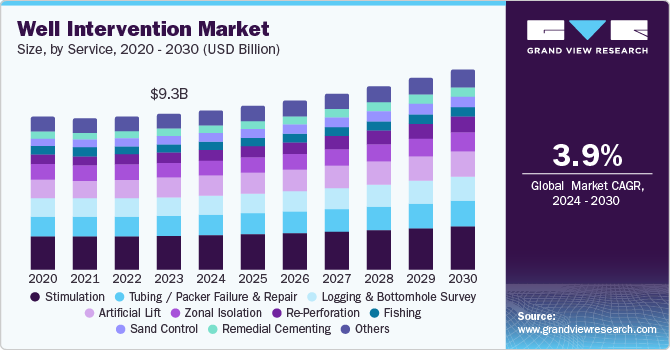

The global well intervention market size was valued at USD 9.30 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. The increasing demand for energy and new oilfield developments are expected to drive market growth, fueled by efforts to boost productivity in conventional fields across key countries. The presence of large, untapped hydrocarbon reserves and the critical role of the oil and gas sector in various economies will likely propel market expansion. In addition, the surge in deep and ultra-deep sea explorations in regions such as the North Sea and the Gulf of Mexico is anticipated to increase the demand for good interventions.

Aged or mature oil and gas fields are major factors driving the growth of the well intervention market. A field is characterized as aged when its overall production capacity declines. The key problem faced by such fields is the uneconomical process of oil production and the technological limitations faced by the operators to recover oil reserves. In addition, such fields are frequently observed to be equipped with obsolete equipment or infrastructure. New well interventions, on the other hand, provide solutions for such problems.

Technological advancements have enhanced the digitalization and automation of intervention services. The industry is flowing with innovations that ensure superior recovery from oil and gas reserves. These developments are supported by huge investments that fuel the market growth. According to an article published by Rystad Energy in July 2023, it was estimated that USD 58.0 billion would be spent globally in 2023 for well interventions to extract more resources from the existing well instead of drilling new ones. This amount is almost 20.0% more than the amount invested in the previous year. The study forecasted about 260,000 well interventions worldwide by 2027.

Service Insights

Stimulation segment dominated the market and accounted for a share of 21.1% in 2023. This high percentage can be attributed to the increasing number of well-stimulation campaigns. For instance, in July 2023, Trendsetter Engineering, Inc. completed the deepwater stimulation of two wells with water depths ranging between 6,500’-7,200’ for the major operators. This campaign was conducted in the Gulf of Mexico and assisted in completing the acid acid treatment of a combined 6 wells. Such demand for stimulation services to improve hydrocarbon flow into the wellbore from the drainage area of an oil or gas reservoir propels the market growth.

Re-perforation segment is expected to grow at the fastest CAGR of 6.1% over the forecast period. Industries can easily establish a flow path between the reservoir near and the wellbore using this technology. Improving technologies and good results in well intervention can increase the adoption of re-perforation services. For instance, in February 2024, GEO Dynamics launched its patented perforation technologies “EPIC” suite collection, which includes open architecture technologies such as EPIC Precision and EPIC Flex. These technologies are specially engineered to withstand the harshest conditions, can be used for a wide range of good designs, and offer reliable plug-and-play completions.

Intervention Type Insights

The light intervention segment dominated the market and accounted for a share of 57.7% in 2023. Light well intervention is widely accepted as it can repair issues without completely closing production. For instance, in May 2023, TechnipFMC plc was awarded a two-year agreement by Equinor for the provision of riderless light well intervention (RLWI) services to boost production.

Heavy intervention segment is expected to grow at the fastest CAGR of 4.9% over the forecast period. The demand for this type of good intervention can increase in the coming years owing to the need to replace damaged or used parts from the bore well, such as tired tubular, tubing strings, and pumps. In light intervention, replacing the major parts might be compromised due to active wells. Whereas in heavy, good intervention, replacement of parts and complete repair is possible. These advantages of heavy intervention are supposed to boost market growth.

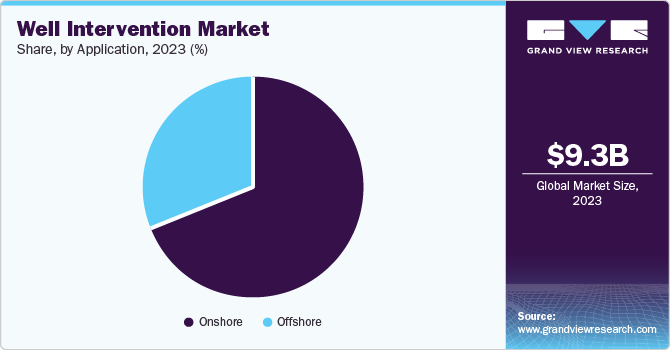

Application Insights

The onshore segment dominated the market and accounted for a share of 68.8% in 2023. The global demand for good intervention is increasing due to the rising development of new oilfields. In addition, drilling new onshore wells are expected to increase the application of well intervention services, thus propelling market growth during the forecast period. For instance, in November 2023, Sinopec (China Petroleum & Chemical Corporation) completed drilling a 9,432-meter-ultra-deep gas and oil well in China.

The offshore segment is expected to grow at the fastest CAGR of 4.7% over the forecast period, owing to the increasing plans and projects to drill offshore oil wells. For instance, in November 2023, Sea1 Offshore signed a letter of intent with Helix Energy to extend charter contracts for the well intervention vessels Siem Helix 1 and Siem Helix 2 at better day rates. The new six-year contracts are expected to start on January 1, 2025, and January 1, 2026. These 2016-built vessels were 158 meters long, 31 meters wide, and could accommodate 150 people.

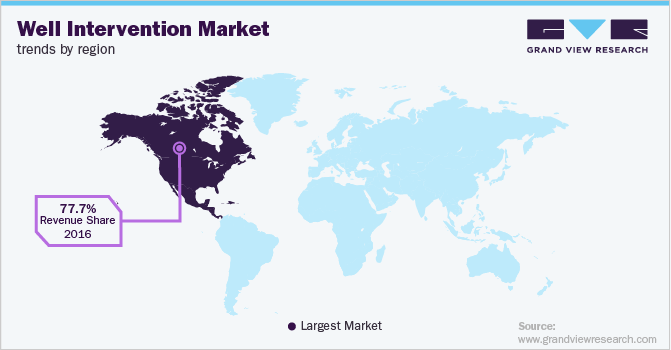

Regional Insights

North America well intervention market accounted for the largest revenue share of 39.5% in 2023. The regional market witnessed a surge in crude oil and natural gas production. Factors such as the quest for finding potential untapped oil and gas reserves, increasing offshore drilling activities in the Gulf of Mexico, and the shale boom are expected to drive market growth over the forecast period. For instance, as per the data published in May 2023, C-Innovation completed 46th well intervention in the Gulf of Mexico. The company is an affiliate of Edison Chouest Offshore (ECO), which provides turnkey intervention services to the subsea industry. It had also recently completed three new riserless zone perforations.

Europe Well Intervention Market Trends

Europe well intervention market was identified as a lucrative region in this industry and is anticipated to grow significantly in the coming years. With most of Europe's oil and gas production occurring offshore, this highlights the need for well intervention services to maintain and enhance output from existing platforms. The maturity of these offshore fields and the regulatory requirements for safety and environmental compliance further drive demand for well intervention in the region. Technological advancements in intervention methods also contribute to market growth by improving efficiency and reducing operational costs. According to the European Commission, most of Europe's oil and gas production occurs offshore, with EU countries reporting 311 installations in European waters in 2022, down from 347 in 2021.

The well intervention market in UK expected to grow rapidly in the coming years due to the key players undergoing strategic activities as aging oil fields and enhanced recovery techniques become essential. Several pipelined projects to drill new oil and gas wells, along with rising demand for maintenance of the pre-existing wells, are anticipated to drive the market growth. For instance, in February 2024, Serica Energy, a UK-based company, planned to drill four wells in the region of the North Sea that was expected to start in 2024 and might extend till 2026. These new wells are expected to be drilled along with the well intervention activities in the Bruce and Keith fields.

Asia Pacific Well Intervention Market Trends

Asia Pacific well intervention market is expected to grow at the fastest CAGR of 4.9% over the forecast period, owing to rising energy requirements. Fluctuating oil prices affect new exploration activities and trigger oil and gas companies to seek cost-effective solutions and maintain or improve productivity. For instance, in January 2024, Karoon Energy, an Australia-based company, was working on a field in the Santos Basin offshore Brazil to escalate the issue and restart production. The company had planned to undertake this activity using a lightweight, well intervention vessel (LWIV) and aimed to bring the well back online.

Central & South America Well Intervention Market Trends

Central and South America well intervention market is expected to grow significantly over the forecast period owing to the presence of mature oil fields that have decreased the production rate, as such situations alert the authorities to emphasize extending the life of mature oil fields and help improve the production. For instance, in December 2023, Petrobras introduced tenders to engage in a contract and fulfill its need for advanced well intervention vessels. The company was hunting large light well intervention vessels (LWIV) or workover operations in mature Brazilian fields. It had planned a series of well intervention and abandonment operations, primarily in the Campos basin. These activities aimed to revitalize the operations of mature oil fields and contribute to market growth.

Middle East & Africa Well Intervention Market Trends

Middle East and Africa well intervention market is anticipated to grow significantly over the forecast period. Numerous ongoing operations in the Middle East & Africa region in major oilfields play vital role in the oil and gas industry growth. For instance, in June 2023, Expro Group landed a five-year contract worth USD 30 million for Well Intervention and Integrity services with TotalEnergies EP Uganda, specifically for the Tilenga project. This achievement is attributed to the company's cutting-edge environmental solutions that aid in reducing carbon emissions and its dedicated efforts to hire locally in partnership with the Petroleum Authority of Uganda.

Key Well Intervention Company Insights

Some of the key companies in the well intervention market include SLB, Baker Hughes Company, HALLIBURTON COMPANY, Weatherford, NOV., Helix Energy, Oceaneering International, Inc., Expro Group, Hunting PLC, Archer (Deepwell AS), Welltec A/S, and TechnipFMC plc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

SLB is an oilfield services company with a presence in various sectors. It offers products and services in segments such as decarbonizing the industry, innovating in oil and gas, scaling new energy systems, and delivering digital at scale. The company offers a vast product and service portfolio under the well intervention category.

-

Baker Hughes Company is an energy technology company that provides various equipment and services classified under two major categories: “Oilfield services & equipment” and “Industrial & energy technology.” The OFSE comprises four product lines: Intervention and Measurements, Subsea and Surface Pressure Systems, Well Construction, Production Solutions, and Completions.

Key Well Intervention Companies:

The following are the leading companies in the well intervention market. These companies collectively hold the largest market share and dictate industry trends.

- SLB

- Baker Hughes Company

- HALLIBURTON COMPANY

- Weatherford

- NOV.

- Helix Energy

- Oceaneering International, Inc.

- Expro Group

- Hunting PLC

- Archer (Deepwell AS)

- Welltec A/S

- TechnipFMC plc

Recent Developments

-

In March 2024, Wellvene Limited announced a partnership with Marwell AS to enhance its market presence and increase its earnings. This strategic move seeks to fulfill the region's well intervention needs and improve the efficiency of plug and abandonment tasks.

-

In January 2024, Coretrax (Expro Group) acquired Wireline Drilling Technologies to strengthen well intervention capabilities and expand its presence in the Middle East.

-

In June 2023, HALLIBURTON COMPANY and Nabors Industries Ltd. announced an agreement on well-construction automation solutions. The collaboration aimed to automate the drilling process and other well construction services with the help of technology.

Well Intervention Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.52 billion |

|

Revenue forecast in 2030 |

USD 12.01 billion |

|

Growth rate |

CAGR of 3.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, Intervention Type, Application, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Norway, Russia, France, Netherlands, China, India, Australia, Malaysia, Brazil, Argentina, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

SLB; Baker Hughes Company; HALLIBURTON COMPANY; Weatherford; NOV.; Helix Energy; Oceaneering International, Inc.; Expro Group; Hunting PLC; Archer (Deepwell AS); Welltec A/S; TechnipFMC plc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Well Intervention Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global well intervention market report based on service, intervention type, application, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Logging And Bottomhole Survey

-

Tubing / Packer Failure and Repair

-

Stimulation

-

Remedial Cementing

-

Zonal Isolation

-

Sand Control

-

Artificial Lift

-

Fishing

-

Re-Perforation

-

Others

-

-

Intervention Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Light Intervention

-

Medium Intervention

-

Heavy Intervention

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Norway

-

Russia

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."