- Home

- »

- Advanced Interior Materials

- »

-

Welding Equipment Market Size And Share Report, 2030GVR Report cover

![Welding Equipment Market Size, Share & Trends Report]()

Welding Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Automatic), By Technology (Arc Welding, Resistance Welding), By End-Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-587-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Welding Equipment Market Summary

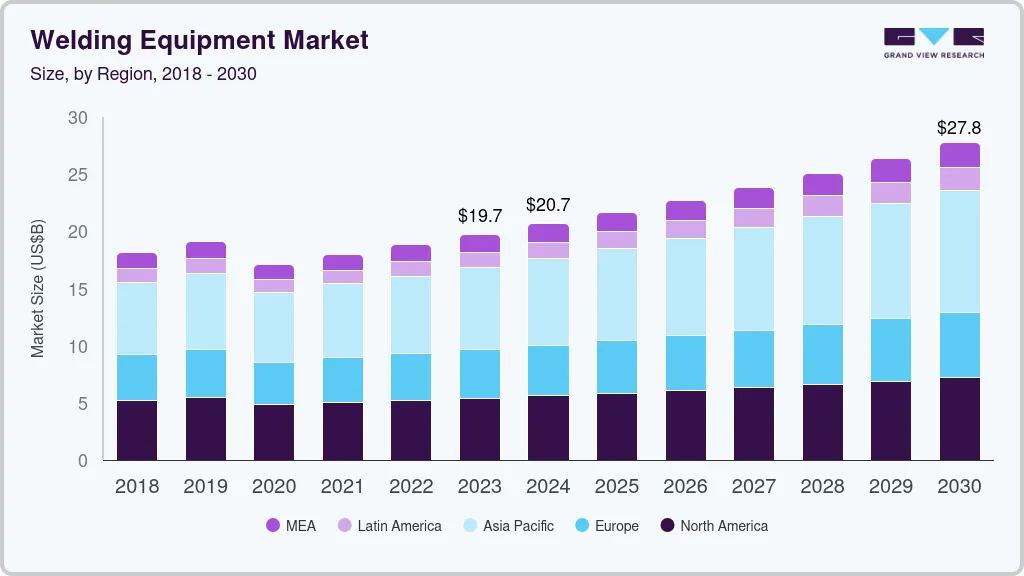

The global welding equipment market size was estimated at USD 19,715.8 million in 2023 and is projected to reach USD 27,765.7 million by 2030, growing at a CAGR of 5% from 2024 to 2030. The market has witnessed considerable growth over the past years owing to the increasing need for welding equipment in a variety of industries, including shipbuilding, offshore exploration, oil & gas, aerospace, automotive, construction, and energy.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, UK is expected to register the highest CAGR from 2024 to 2030.

- By technology, the arc welding technology segment led the market and accounted for 70.6% of the global market revenue in 2023.

- By type, automatic type segment accounted for largest market revenue share in 2023.

- By end use, the automotive end-use segment accounted for largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 19,715.8 Million

- 2030 Projected Market Size: USD 27,765.7 Million

- CAGR (2024-2030): 5%

- Asia Pacific: Largest market in 2023

The demand for welding equipment is also being fueled by consumers' preference for automated devices over manual ones.

In addition, government measures focusing on urban planning and infrastructure development in various nations are predicted to further stimulate the expansion of the construction sector. Thus, the growth of the construction sector is anticipated to have a beneficial effect on the expansion of the welding equipment industry.

Increasing investments in public infrastructure development projects in the U.S. are anticipated to drive the demand for welding equipment in the country. The Government of the U.S. is taking several initiatives to upgrade its public infrastructures. For instance, in June 2021, the U.S. Department of Transportation announced an investment of USD 905.3 million in infrastructure development projects through the discretionary grant program called Infrastructure for Rebuilding America (INFRA) undertaken in the country.

As the U.S. is one of the prime automotive markets in North America, it witnesses high consumption of welding equipment by established players such as Ford, Toyota, GM, Nissan, and Chevrolet. Continuous improvements, development of innovative manufacturing methods, technological advancements, and application of standard and specific welding techniques are expected to help overcome the challenges and aid in the robust growth of the industry in the U.S. For instance, in August 2022, Lincoln Electric launched the POWER MIG 215 MPi. The device is suitable for both home hobbyists and professionals who work in material fabrication, maintenance, and repair or light industrial operations.

The usage of wide range of materials in various industries in the country has necessitated the development of advanced welding processes. Manufacturers are developing new welding machinery and equipment to meet the increased demand. The concept of robotic laser welding is gaining popularity in the U.S., which will lead to its acceptance in the automotive industry due to the constant need for the proper and exact connecting of various automobile components.

Increasing defense expenditure by the U.S. Federal Government is expected to augment the production of naval ships, patrol vehicles, and submarines at a domestic level in the country. The rising usage of mega-ships as they outsize older models is expected to positively impact the growth of the shipbuilding industry in the country. These trends are anticipated to drive the demand for welding equipment in the U.S. as they play a key role in the assembling of ships and carrying out their maintenance and repair operations.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. Welding equipment industry is characterized by a high degree of innovation owing to the rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

The welding equipment market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including increasing the reach of their products in the market and enhancing the availability of their products & services in diverse geographical areas. Key market players adopting this inorganic growth strategy include The Lincoln Electric Company, voestalpine Böhler Welding Group GmbH, Illinois Tool Works Inc., Panasonic Industry Co., Ltd., and Coherent, Inc.

Regulations play a pivotal role in shaping the landscape of the industry, influencing both its dynamics and evolution. Government-imposed standards and safety regulations have a direct impact on the manufacturing, sale, and usage of welding equipment. Stringent safety and environmental regulations drive innovation in welding technologies, pushing manufacturers to develop equipment that meets or exceeds compliance requirements. As the regulatory landscape continues to evolve globally, market participants in the welding equipment sector must navigate and adapt to these compliance standards, fostering a continuous cycle of innovation and improvement within the industry.

The distribution of welding equipment across different end-use industries significantly impacts market trends and demands. For instance, concentration in industries such as automotive, construction, and manufacturing can lead to fluctuations in the demand for welding equipment. Economic conditions and shifts in these key sectors influence the purchasing power and investment decisions of end-users, thereby affecting the overall demand for welding equipment. Moreover, end-use concentration can drive innovation, with manufacturers focusing on developing specialized equipment tailored to the unique needs of dominant industries.

The degree of innovation is a critical factor shaping the landscape of the market. Technological advancements and innovative solutions continually redefine the capabilities and efficiency of welding equipment. Manufacturers in the welding industry are driven to invest in research and development to enhance the performance, precision, and safety features of their products. Innovations such as advanced welding processes, automation, and integration of smart technologies not only improve the effectiveness of welding operations but also cater to the evolving needs of end-users across diverse industries.

Technology Insights

The arc welding technology segment led the market and accounted for 70.6% of the global market revenue in 2023. Arc welding technology is being increasingly utilized owing to its characteristics such as flexibility and the ability to perform in all conditions. Continuous development in robotic arc welding is an important factor driving the arc welding segment in the market.

The resistance welding technology segment is likely to grow at a significant pace over the forecast period. Resistance welding is majorly used in the automotive sector for processes such as projection welding, spot welding, and seam welding. These three types of welding processes are employed on account of their beneficial characteristics including high stability, cost-effectiveness, and low environmental impact. Rising demand for resistance welding from the automobile and transportation sectors is expected to drive the resistance welding market over the forecast period.

Type Insights

Automatic type segment accounted for largest market revenue share in 2023. Owing to their quick weld cycle time, high output, and decreased welding costs. The fast-paced adoption of this equipment in various end-use industries such as automotive, construction, and aerospace is expected to fuel the demand for automatic welding equipment across the world over the forecast period.

The semi-automatic type segment is likely to grow at a fastest CAGR over the forecast period. Semi-automatic welding requires some human involvement during the welding process; however, this interaction is significantly lesser than that required in manual welding. Various examples of semi-automatic welding are metal inert gas (MIG), metal active gas (MAG), and flux cored arc welding (FCAW) welding.

End-use Insights

The automotive end-use segment accounted for largest market revenue share in 2023. Ongoing electrification in the global transportation sector, particularly in automobiles, along with continuous innovations and advancements in automotive technologies, is anticipated to help different environmental agencies mitigate the challenge of climate change. Increasing use of electric vehicles to reduce carbon footprint is anticipated to increase automobile sector demand, consequently boosting the welding equipment industry.

Building and construction application segment is likely to grow at the fastest CAGR over the forecast period. Arc welding is widely used in various construction fabrication applications. Over the past few years, arc welding has witnessed innovation in high-power laser welding and electron-beam welding. These welding types are widely used for welding heavy and complex structures. All the factors above are expected to boost the demand for welding equipment over the forecast period.

Regional Insights

Asia Pacific dominated the market in 2023. Asia Pacific market is expected to exhibit the highest growth rate on account of the robust automotive industry. Increasing demand for electric and hybrid cars is expected to benefit the demand for welding equipment. Furthermore, shifting consumer preferences toward customization and maintaining the ride quality and fuel efficiency of vehicles are likely to heighten the frequency of vehicle maintenance and repair activities, which, in turn, is expected to drive the demand for welding equipment.

Europe is one of the largest producers of automobiles across the globe and attracts maximum foreign direct investment (FDI) in automotive sector. Process innovation, improving R&D, and expansion of automobile production in countries such as Germany, the UK, and France are expected to fuel the growth of automotive sector over the forecast period. Furthermore, the region is marked by the presence of global automobile manufacturers including Volkswagen, BMW, and Mercedes, which focus on increasing the production volume every year, thereby strengthening the demand for welding equipment in the region.

Key Welding Equipment Company Insights

Some of the key players operating in the market include Lincoln Electric, ACRO Automation Systems, Miller Electric Mfg. LLC., Ador Welding Limited

-

Lincoln Electric offers development, design, and manufacturing of arc welding products, plasma, assembly & cutting systems, automated joining, and oxyfuel cutting equipment, and is one of the major players in the brazing and soldering alloys industry.

-

ACRO Automation Systems, Inc offers a wide range of products and services such as automated welding, automated assembly, texting, online inspection solutions, lean manufacturing solutions, flexible robotic systems, high-volume hard-tooled systems, and complete turnkey solutions. It serves a wide range of industries such as automotive, appliances, and consumer goods

Mitco Weld Products Pvt. Ltd, voestalpine Böhler Welding Group GmbH, Carl Cloos Schweisstechnik GmbH, OTC DAIHEN Inc. are some of the emerging market participants in the welding equipment market.

-

Mitco Weld Products Pvt. Ltd offers welding consumables, gas welding & cutting equipment, electric welding accessories, welding power sources, and industrial safety products. It caters to various types of industries such as fabrication, heavy civil and infrastructure, power, hydrocarbon, and defense.

-

The voestalpine Group is divided into five reportable segments: steel, high-performance metals, metal engineering, metal forming, and others. The company's steel division produces advanced hot & cold-rolled strip steel & electro galvanized, hot-dip galvanized, and organically coated strip steel.

Key Welding Equipment Companies:

The following are the leading companies in the welding equipment market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these welding equipment companies are analyzed to map the supply network.

- The Lincoln Electric Company

- ACRO Automation Systems, Inc

- Miller Electric Mfg. LLC

- Ador Welding Limited

- Mitco Weld Products Pvt. Ltd.

- voestalpine Böhler Welding Group GmbH

- Carl Cloos Schweisstechnik GmbH

- OTC DAIHEN Inc.

- Illinois Tool Works Inc.

- Panasonic Industry Co., Ltd.

- Coherent, Inc.

- ESAB

- Polysoude S.A.S.

- Kemppi Oy.

- Cruxweld Industrial Equipments Pvt. Ltd.

Recent Developments

-

In February 2023, Miller Electric Mfg. LLC launched the Copilot Collaborative Welding System in February 2023. It is a cobot with advanced capabilities intended for welders and shops new to robotic welding who are looking for solutions to keep up with demand.

-

In March 2023, voestalpine Böhler Welding Group GmbH launched Böhler Welding`s Crane & Lifting Full Welding Solution. The product helped the company to achieve 50% faster welding speed.

Welding Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.66 billion

Revenue forecast in 2030

USD 27.77 billion

Growth Rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Lincoln Electric; ACRO Automation Systems, Inc; AIR LIQUIDE; ARCON - Mitco Weld Products Pvt. Ltd.; voestalpine Böhler Welding Group GmbH; Carl Cloos Schweisstechnik GmbH; OTC DAIHEN Inc.; Illinois Tool Works Inc.; Panasonic Industry Co., Ltd.; Coherent; Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Welding Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the welding equipment market report based on technology, type, end-use and region.

-

Technology Outlook (Revenue, USD Billion; 2018 - 2030)

-

Arc Welding

-

Shielded Metal/Stick Arc Welding

-

MIG

-

TIG

-

Plasma Arc Welding

-

Others

-

-

Resistance Welding

-

Laser Beam Welding

-

Oxy-Fuel Welding

-

Others

-

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Automatic

-

Semi-Automatic

-

Manual

-

-

End-use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Aerospace

-

Automotive

-

Building & Construction

-

Energy

-

Oil & Gas

-

Marine

-

Others

-

-

Region Outlook (Revenue, USD Billion; 2018 - 2030)

- North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

- North America

Frequently Asked Questions About This Report

b. Welding equipment market size was estimated at USD 19.72 billion in 2023 and is expected to be USD 20.66 billion in 2024.

b. The welding equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 27.77 billion by 2030.

b. Asia Pacific region dominated the market in 2023 by accounting for a share of 36.4% of the market. Shifting consumer preferences toward customization and maintaining the ride quality and fuel efficiency of vehicles are likely to heighten the frequency of vehicle maintenance and repair activities, which, in turn, is expected to drive the demand for welding equipment.

b. Some of the key players operating in the welding equipment market include Lincoln Electric, ACRO Automation Systems, Inc, AIR LIQUIDE, ARCON - Mitco Weld Products Pvt. Ltd., voestalpine Böhler Welding Group GmbH, Carl Cloos Schweisstechnik GmbH, OTC DAIHEN Inc., Illinois Tool Works Inc., Panasonic Industry Co., Ltd., Coherent, Inc.

b. The majority of the demand for welding equipment is associated with end-use industries such as automotive, aerospace, transportation, and construction, which are also experiencing operational difficulties owing to the macro-economic factors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.