- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Weight Loss Supplement Ingredients Market Report, 2030GVR Report cover

![Weight Loss Supplement Ingredients Market Size, Share & Trends Report]()

Weight Loss Supplement Ingredients Market (2024 - 2030) Size, Share & Trends Analysis Report By Ingredient, By Form (Capsules/Tablets, Powder), By Application (Fat Burners, Appetite Suppressants), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-327-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

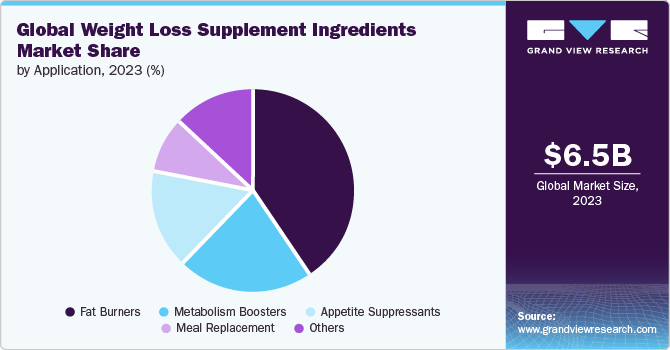

The global weight loss supplement ingredients market size was estimated at USD 6.49 billion in 2023 and is expected to grow at a CAGR of 6.9% from 2024 to 2030.The rising global obesity rates have spurred a significant increase in demand for weight loss supplement ingredients. As awareness about the health risks associated with obesity grows, individuals are increasingly motivated to address their weight issues to improve their overall well-being and reduce the risk of obesity-related conditions such as heart disease, diabetes, and hypertension.

According to the "Dietary Guidelines for Chinese Residents" published by the Chinese Nutrition Society in 2022, the prevalence of overweight and obesity among adults in China has surged significantly. The report reveals that in 2022, the proportion of overweight and obese adults in China reached 50.7%. Increasing health consciousness among individuals has led to a growing preference for natural and safe weight loss options. Technological advancements have also facilitated the development of innovative ingredients with enhanced efficacy, further contributing to market expansion.

The growing consumer preference for natural and organic ingredients in supplements is another key driver for the growth of the market. This shift reflects a broader trend toward healthier lifestyle choices and a desire for transparency in product formulations. Consumers increasingly seek weight loss supplements formulated with botanical extracts, vitamins, and minerals sourced from natural origins, driven by concerns over synthetic additives and their potential side effects. This preference stems from the perceived health benefits of natural ingredients, as well as the trust and transparency offered by brands prioritizing natural formulations.

According to the ADM report "The Dietary Supplement Consumer of Tomorrow published in 2022," 33% of U.S. consumers prefer supplements sourced from natural sources. This preference reflects a growing trend among consumers who seek out products perceived as more wholesome and aligned with natural lifestyles.

Manufacturers are responding to consumer demand by launching supplements containing natural and organic ingredients. This strategic move aligns with the growing preference among consumers for products perceived as healthier and safer alternatives to those with synthetic additives. By incorporating botanical extracts, vitamins, and minerals sourced from natural origins, these supplements cater to health-conscious individuals seeking holistic approaches to wellness.

In January 2024, GNC introduced a new weight loss supplement called Total Lean GlucaTrim, designed to aid in weight loss while promoting lean muscle mass and maintaining healthy blood sugar and insulin levels. The product is targeted toward health-conscious consumers seeking weight loss solutions without requiring a prescription. Total Lean GlucaTrim features Slimvance, a proprietary blend by GNC comprising turmeric, moringa, and curry leaf extracts, known for their potential to enhance metabolism.

Furthermore, advancements in research and technology that enable the creation of innovative formulations that enhance the efficacy and safety of weight loss supplement ingredients are increasing. In July 2021, ADM collaborated with i-Health Inc. to develop the Culturelle Metabolism + Weight Management product, featuring ADM's proprietary BPL1 strain. Culturelle is a leading global probiotic brand. The BPL1 strain, scientifically known as Bifidobacterium animalis subsp. lactis BPL1 (CECT 8145), is supported by extensive research indicating its potential benefits for metabolic health and weight management. ADM has also identified the specific biochemical interaction through which BPL1 impacts metabolic health biomarkers.

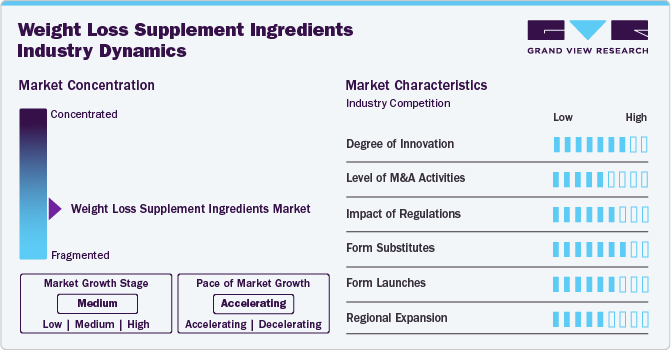

Market Concentration & Characteristics

The weight loss supplement ingredients market shows a significant degree of innovation, with players introducing advanced formulas and incorporating natural ingredients into their supplement products. This innovation is evident in the use of natural and organic ingredients, and the development of diverse formulations such as gummies, chewable tablets, and powders. Additionally, there is a growing emphasis on appetite control, fat burning, and boosting metabolism through thermogenesis and macronutrient absorption. The market also witnesses the inclusion of herbal ingredients.

The mergers and acquisitions are in the range of low to medium in the market. Companies undergoing mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage each other’s strengths. For instance, in January 2024, Chr. Hansen and Novozymes completed the statutory merger agreement to form a leading global biosolutions partner, establishing the company Novonesis. Under the merger agreement, Novozymes announced the purchase of Chr. Hansen for USD 12.3 billion. The establishment of Novonesis brings together 10,000 people worldwide and an expertise that spans more than 30 different industries.

Regulations have a significant impact on the market, as they dictate the permissible ingredients, labeling requirements, and safety standards for these products. Regulatory bodies such as the FDA, EFSA, and others are applying more stringent evaluation criteria for weight loss ingredients, especially those making specific claims. In December 2022, The European Commission updated Regulation (EC) No. 1925/2006 based on EFSA's safety assessment of (-)-epigallocatechin-3-gallate (EGCG) in green tea extracts. The amendment imposes a limit of 800 mg of EGCG per daily portion of food from green tea extracts. Labels must reflect this limit and provide warnings for vulnerable groups like children, adolescents, and pregnant or lactating women.

In the market, potential substitute for toxic or harmful substances include chitosan, chromium and xanthan gum among others. As consumers become more aware of the risks associated with certain ingredients in weight loss supplements, the demand for safer alternatives is likely to increase.

The market has seen a rise in form launches, with a focus on innovative formulations and natural ingredients. Manufacturers are introducing specialized products targeting specific consumer needs, such as fat burning and appetite control. Gummies and chewable tablets are gaining popularity due to their versatility in serving diverse preferences and lifestyles.

The market is experiencing regional expansion due to increasing consumer awareness about health and wellness, rising obesity rates, and growing demand for natural and organic products. Companies are expanding their presence in regions such as Asia-Pacific, Latin America, and the Middle East to tap into the growing market potential. This expansion is driven by factors like changing lifestyles, urbanization, and a shift towards preventive healthcare practices. Additionally, regulatory support for dietary supplements in these regions is also contributing to the market growth as consumers seek effective and safe weight management solutions.

Ingredient Insights

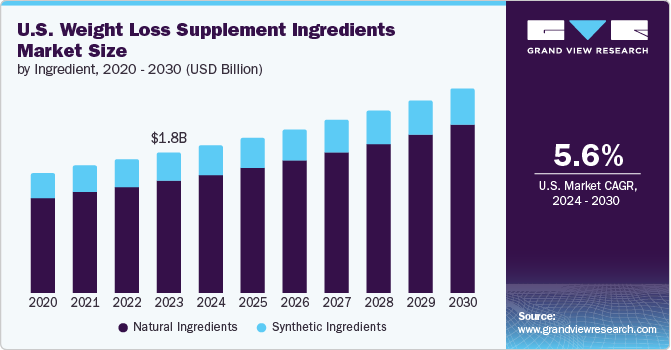

Natural weight loss supplement ingredients accounted for a significant revenue share of 80.3% in 2023. Natural weight loss ingredients have gained significant popularity in the market due to their perceived safety and efficacy. Manufacturers are continually innovating and formulating new natural weight loss supplements to meet consumer demands. These products often incorporate a blend of natural ingredients known for their metabolism-boosting, appetite-suppressing, or fat-burning properties. In January 2024, GNC introduced a new weight loss aid called Total Lean GlucaTrim, designed to aid in weight management, promote lean muscle development, and maintain optimal blood sugar and insulin levels. This supplement boasts Slimvance, GNC’s unique blend of turmeric, moringa, and curry leaf extracts, aimed at enhancing metabolism. In addition, it incorporates Reducose, an extract from white mulberry leaves packed with alkaloids and flavonoids, known for fostering healthy post-meal blood glucose and insulin reactions.

Synthetic weight loss supplement ingredients are expected to witness a significant CAGR during the forecast period. Increase in individuals are seeking quick and convenient ways to manage their weight is driving the demand for synthetic ingredients. Synthetic weight loss ingredients offer a more streamlined approach compared to traditional methods like diet and exercise, making them appealing to consumers looking for efficient solutions. Moreover, pharmaceutical companies are investing heavily in research and development to create novel synthetic weight loss ingredients that can be marketed as safe and effective treatments for obesity.In October 2023. Lallemand Inc. launched Engevita HiPRO Beyond, a sustainable alternative single-cell protein, containing all the essential amino acids (EAA), including branched-chain amino acids (BCAA).

Application Insights

The market for fat burners accounted for a revenue share of 41.1% in 2023. This can be attributed to the growing demand for healthy weight management. Manufacturers are increasingly introducing innovative fat burner supplements to propel the market further. In July 2021, Youtheory, a Southern California-based supplement company, launched its daily fat burner. Designed specifically for individuals seeking effective weight management, Youtheory's Daily Fat Burner is a potent formula that combines scientifically-backed ingredients for optimal fat burning.

The market for appetite suppressants is expected to grow at a significant CAGR from 2024 to 2030. The demand for weight loss supplement ingredients in appetite suppressants is growing due to the increased Focus on weight loss and wellness by individuals.Appetite suppressants work by increasing feelings of fullness, delaying gastric emptying, and regulating appetite hormones such as leptin and ghrelin. They are often used by individuals seeking to control their food intake and adhere to calorie-restricted diets.

Form Insights

The market for capsules/tablets supplements accounted for a share of 30.6% in 2023. Effective weight loss capsules and tablets with scientifically-backed ingredients attract a broader consumer base, including individuals who may have been skeptical of traditional supplements or pharmaceuticals. This has led to an expansion of the weight loss supplements market as more people seek out innovative solutions for weight management.

In a small-scale trial conducted by California-based Viking Therapeutics (VKTX.O) in March 2024, its experimental tablet, known as VK2735, demonstrated promising results. The trial involved seven participants who were administered the highest dose of 40 milligrams of VK2735. After adjusting for placebo effects, these individuals experienced a weight loss of 3.3% over a period of 28 days. Moreover, the tablet proved effective in helping patients achieve an average weight reduction of 1.1% when administered at half the strength dosage.

The gummies supplements segment is anticipated to witness the fastest CAGR during 2024 to 2030. This can be attributed to the ease with which gummies can be formulated to contain a combination of ingredients tailored to specific weight loss goals or preferences. It allows for comprehensive formulations that target multiple aspects of weight loss, such as metabolism, appetite suppression, and fat burning. Some gummies also contain additional vitamins, minerals, and other nutrients that support overall health and well-being.

Furthermore, manufacturers are increasingly leveraging a variety of ingredients and technologies to create weight loss gummies that are both effective and appealing to consumers. They incorporate ingredients such as fiber, vitamins, minerals, and herbal extracts known for their potential to support weight loss and metabolism. In April 2020, OptiBiotix Health PLC, a prominent developer of compounds addressing obesity, cardiovascular disease, and diabetes, introduced its latest product: high-fiber gummies infused with its proprietary SlimBiome technology. Through the launch, the company aims to deliver digestive health and weight management advantages and showcase its expertise in life sciences.

Regional Insights

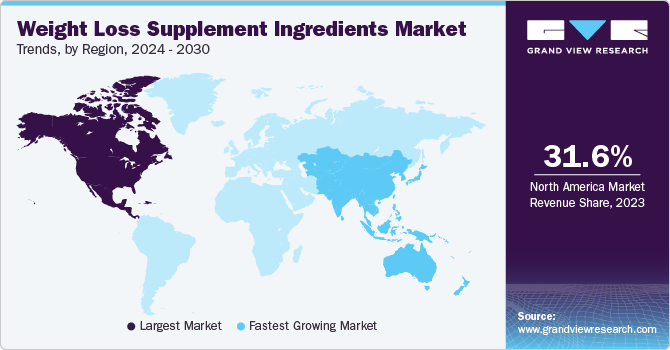

In 2023, the market in North America accounted for a revenue share of 31.6%. The region faces a significant challenge with a large population grappling with rising obesity rates and lifestyle-related diseases due to dietary habits characterized by high consumption of processed and ready-to-eat foods, which may not necessarily promote good health. This scenario has led to a shift in the food industry, where functional foods and supplements have emerged as potential solutions, offering health benefits beyond basic nutrition. This is contributing to the growth of weight loss supplement ingredients too.

U.S. Weight Loss Supplement Ingredients Market Trends

The market in the U.S. is expected to grow at a CAGR of 5.6% from 2024 to 2030. One of the key drivers of growth in the U.S. market is the nation's surge in popularity of weight loss supplements due to increasing obesity.In 2022, the prevalence of obesity increased in a greater number of states, with 22 states reporting that at least 35% of adults were obese, compared to 19 states in 2021. This data is derived from the Behavioral Risk Factor Surveillance System, a survey jointly conducted by the CDC and state health departments, where adults were classified as obese if their body mass index was 30 or higher, based on self-reported height and weight measurements.

Europe Weight Loss Supplement Ingredients Market Trends

In 2023, Europe market accounted for a revenue share of 28.7%. The growing awareness and emphasis on fitness among the younger population is expected to drive the demand for energy and weight management supplement ingredients. In addition, the rising acceptance of sports as a viable career option is another factor anticipated to boost the demand for sports nutrition products for athletes looking to reduce body weight to compete in a lighter weight class. Also, these supplement ingredients can be used as part of a gradual fat reduction strategy or a rapid weight loss protocol, which, in turn, benefits the overall growth of this market.

Asia Pacific Weight Loss Supplement Ingredients Market Trends

The Asia Pacific market is expected to grow at a CAGR of 8.2% from 2024 to 2030. The market is anticipated to witness increasing demand for weight supplement ingredients as key participants like Herbalife International, Inc., Pharmacare Laboratories Australia, and Kapiva introduce their brands in the untapped markets of Southeast Asia. China, Japan, and India are among the largest markets for dietary supplements in Asia Pacific, owing to the presence of a large consumer base in these countries.

Middle East & Africa Weight Loss Supplement Ingredients Market Trends

In 2023, the Middle East and Africa market accounted for a revenue share of 7.5%. The market is mainly driven by rising disposable incomes and increasing consumer awareness of the health benefits of dietary supplements. Moreover, transitioning demographics in the region, including the rise of the young and working population, have increased spending on products related to health and well-being.

Central & South America Weight Loss Supplement Ingredients Market Trends

Central & South America market is expected to grow at a CAGR of 8.2% from 2024 to 2030 owing to the increasing receptiveness of young and adult consumers toward health and wellness trends. As more individuals embrace a healthy lifestyle, the demand for weight loss supplement products is expected to increase.

Key Weight Loss Supplement Ingredients Company Insights

Key market players such as Archer Daniels Midland; Kerry Inc.; Cargill Inc., and Lonza Group Ltd. among others contribute significantly to the innovation and growth of the weight loss supplement ingredients sector by introducing new formulations, leveraging scientific research on effective ingredients, and adapting to changing consumer preferences for healthier lifestyles.

-

Archer Daniels Midland offers weight loss supplement ingredients that include probiotics such as DE111, ES1, and BPL1. These probiotics have been clinically studied and shown to support metabolic health, healthy BMI, weight management, and overall well-being when combined with a balanced diet and exercise regimen. ADM’s weight loss supplement ingredients are backed by gold-standard stability assurance, comprehensive customer support, strain isolation, clinical trials, and production methods to ensure the highest quality and efficacy.

-

Kerry Inc is a major player in the market. The company offers a wide range of functional ingredients for various health applications, including weight management. Kerry’s weight management solutions include natural fibers like inulin and oligofructose, which have been shown to promote satiety and support healthy gut bacteria. Additionally, Kerry offers botanical extracts like green tea extract and garcinia cambogia extract, which are commonly used in weight loss supplements due to their thermogenic properties.

Key Weight Loss Supplement Ingredients Companies:

The following are the leading companies in the weight loss supplement ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- Archer Daniels Midland

- Kerry Inc

- Cargill Inc

- Lonza Group Ltd.

- BASF SE

- IFF

- DSM

- Glanbia PLC

- Lallemand Inc

- Chr. Hansen Holding AS

Recent Developments

-

In January 2024, Chr. Hansen’s and Novozymes completed the statutory merger agreement to form a leading global biosolutions partner, establishing the company Novonesis. Under the merger agreement, Novozymes announced the purchase of Chr. Hansen for USD 12.3 Billion. The establishment of Novonesis brings together 10,000 people worldwide and expertise that spans more than 30 different industries.

-

In February 2023, ADM announced the opening of a state-of-the-art production facility in Spain with an investment worth over USD 30 Million to meet the growing demand for probiotics. The site will produce ADM’s award-winning weight loss probiotic BPL1 strain and the heat-treated BPL1 postbiotic, as well as other ADM proprietary strains, for serving a wide range of customers. This strategy will help in the expansion of the company’s weight loss supplement ingredients production capacity and help in serving the growing customer demand for effective weight loss supplement products.

-

In April 2022, Kerry Group completed the acquisition of Natreon, a U.S.-based science-backed branded Ayurvedic botanical extract company. This strategy was aimed at helping the company expand its product portfolio by including botanical ingredients for the dietary supplement and food and beverage industries.

Weight Loss Supplement Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.90 billion

Revenue Forecast in 2030

USD 10.29 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Ingredient, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Archer Daniels Midland; Kerry Inc; Cargill Inc; Lonza Group Ltd.; BASF SE; IFF; DSM; Glanbia PLC; Lallemand Inc; Chr. Hansen Holding AS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Weight Loss Supplement Ingredients Market Report Segmentation

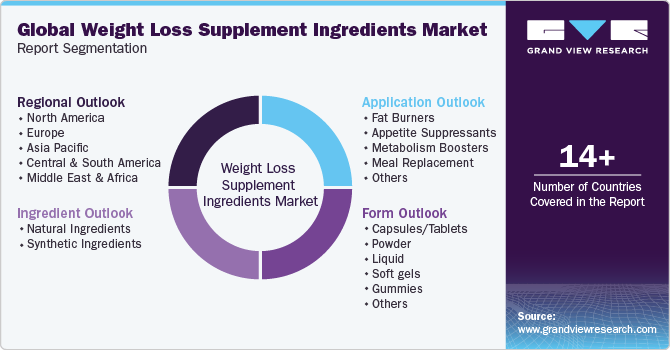

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global weight loss supplement ingredients market report based on ingredient, form, application, and region:

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Ingredients

-

Green Tea Extract

-

African Mango

-

Conjugated Linoleic Acid (CLA)

-

Green Coffee Bean Extract

-

Chitosan

-

Probiotics

-

Hoodia

-

Raspberry Ketone

-

Berberine

-

Capsaicin

-

Glucomannan

-

Others

-

-

Synthetic Ingredients

-

Caffein Anhydrous

-

Ephedrine

-

Chromium Picolinate

-

Others

-

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules/Tablets

-

Powder

-

Liquid

-

Soft gels

-

Gummies

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018-2030)

-

Fat Burners

-

Appetite Suppressants

-

Metabolism Boosters

-

Meal Replacement

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

- Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global weight loss supplement ingredients market size was estimated at USD 6.49 billion in 2023 and is expected to reach USD 6.90 billion in 2024.

b. The global weight loss supplement ingredients market is expected to grow at a compounded growth rate of 6.9% from 2024 to 2030 to reach USD 10.29 billion by 2030.

b. In 2023, the weight loss supplement ingredients market in North America captured a revenue share of 31.6%, due to due to increasing obesity and growing awareness and emphasis on fitness among the younger population.

b. Some key players operating in the market include Archer Daniels Midland; Kerry Inc; Cargill Inc; Lonza Group Ltd.; BASF SE; IFF; DSM; Glanbia PLC; Lallemand Inc; Chr. Hansen Holding AS.

b. The growth can be attributed to the increasing health consciousness among individuals which has led to a growing preference for natural and safe weight loss options. Technological advancements have also facilitated the development of innovative ingredients with enhanced efficacy, further contributing to market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.