Wedding Services Market Size, Share & Trends Analysis Report By Type (Destination, Local), By Booking (Online, Offline), By Service (Catering Services, Decoration Services, Transport Services), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-409-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Wedding Services Market Size & Trends

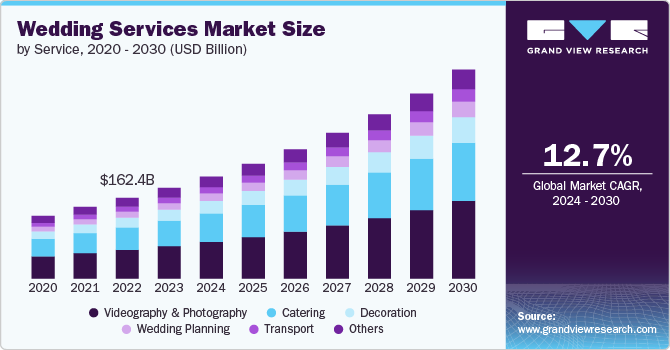

The global wedding services market size was estimated at USD 182.56 billion in 2023 and is expected to grow at a CAGR of 12.7% from 2024 to 2030. The global demand for wedding services is experiencing robust growth due to a combination of increasing disposable incomes, evolving consumer preferences, and cultural shifts toward more personalized and elaborate celebrations.

As individuals and couples increasingly prioritize unique and memorable wedding experiences, there is a rising demand for specialized services such as bespoke event planning, high-end venues, and customized catering. This growth is further supported by societal trends favoring experiential spending and the desire for significant life events to be celebrated with greater extravagance and attention to detail.

The overall rise in marriage rates globally contributes significantly to the demand for wedding services. There has also been a marked increase in societal acceptance of diverse relationships. The legalization of same-sex marriage in many countries has led to a surge in weddings among LGBTQ+ couples. This demographic shift not only increases the overall number of weddings but also diversifies the types of ceremonies being held. As more couples choose to celebrate their love openly and authentically, they are willing to invest significantly in their wedding experiences. There is a corresponding increase in the need for various wedding-related services, including planning, catering, and venue selection. According to the Central Statistics Office (CSO) for the Irish wedding industry, there were 324 Male same-sex marriages, 322 Female same-sex marriages, and 20,513 opposite-sex marriages in 2023.

In addition, the allure of getting married in exotic locations has contributed to a surge in destination weddings. This trend has led to a spike in demand for travel and logistics services, location-specific wedding planners, local vendors, and unique accommodations for guests. Destination weddings often require specialized knowledge of the locale, making services that offer this expertise particularly valuable. According to the WORLDMETRICS.ORG REPORT 2024, 1 in 4 weddings is now a destination wedding and 75% of couples plan a destination wedding to have a unique and memorable experience.

The impact of social media platforms is significantly contributing to market growth. Platforms such as Instagram and Pinterest have redefined wedding expectations, inspiring couples to opt for unique and picturesque weddings. This phenomenon has led to an increased demand for aesthetically pleasing venues, bespoke decorations, and personalized wedding experiences that are 'Instagram-worthy'.

Moreover, couples are seeking personalized experiences that reflect their personalities, stories, and values. This has led to an increased demand for customized services such as unique floral arrangements, personalized wedding stationery, custom menus, and curated entertainment options. Wedding service providers who can offer a tailored experience are in high demand. According to “The Knot 2023 Real Weddings Study,” 63% of couples indicated that personalization was among the most significant considerations for them during the wedding planning process.

Type Insights

The local wedding services accounted for a share of 76.40% in 2023. This can be attributed to the fact that local wedding service providers often offer a wide range of options tailored to various themes and styles, from traditional ceremonies to modern celebrations. This diversity allows couples to find exactly what they want without having to compromise on their vision. Moreover, couples are increasingly preferring local wedding services because they provide convenience in terms of logistics. Being able to meet vendors in person, visit venues, and coordinate details without extensive travel makes the planning process smoother and less stressful.

The destination wedding services market is expected to grow at a CAGR of 16.8% from 2024 to 2030. The rise in popularity of all-inclusive packages is significantly influencing the demand for destination wedding services. These packages typically offer a comprehensive solution that includes venue, catering, accommodations, and sometimes even planning services, making it easier for couples to organize their weddings in their preferred destination without the stress of coordinating multiple vendors. For instance, in July 2024, Weddingz.in, a leading online platform for wedding venues and related services, launched a comprehensive destination wedding planning service aimed at making the process more accessible and affordable for couples across India. The service assists couples by scouting and shortlisting venues based on their budget and preferences, organizing guided visits to selected venues for couples and their families, and negotiating the best deals. In addition, they offer end-to-end wedding planning, execution, and management as an add-on service.

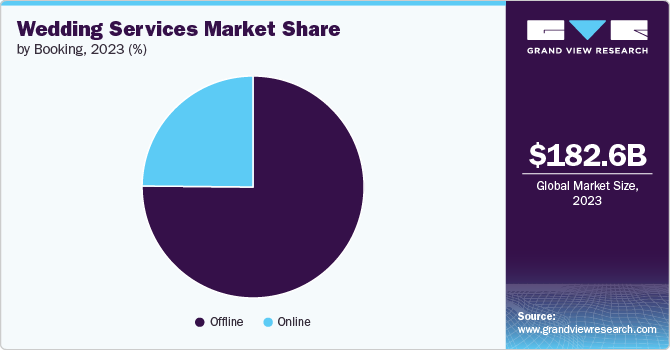

Booking Insights

Offline wedding services bookings accounted for a share of 75.14% in 2023. This can be attributed to the desire for personalized service, trust in face-to-face interactions, and the complexity of wedding planning. Couples often prefer to meet vendors in person to discuss their specific needs and preferences, allowing for a more tailored experience that online platforms may not provide. In addition, the emotional significance of weddings leads couples to seek reassurance through direct communication, fostering trust and confidence in their chosen vendors. The intricate nature of wedding planning also necessitates detailed discussions that are often more effectively conducted in person, making offline bookings a preferred choice for many couples.

Online booking for wedding services is expected to witness a CAGR of 14.3% from 2024 to 2030. The growing trend of online booking for wedding services is primarily driven by the increasing reliance on digital platforms for convenience and accessibility, allowing couples to compare options, read reviews, and secure services from the comfort of their homes. In addition, the rise of social media and wedding planning websites has created a wealth of information and inspiration that encourages couples to explore various vendors online. Moreover, the integration of technology in wedding planning tools enhances user experience through features such as budgeting calculators and customizable checklists, making it easier for couples to manage their plans efficiently. In December 2022, Betterhalf, a platform known for matchmaking services, expanded its offerings by launching online wedding planning services in Bengaluru. The move aims to provide couples with comprehensive tools and resources to plan their weddings efficiently and effectively. The online wedding planning services include features such as vendor management, budget tracking, and personalized planning assistance, catering specifically to the needs of modern couples in Bengaluru, India.

Service Insights

Catering services held a revenue share of 28.05% in 2023. The demand for catering services in the wedding industry is driven by the increasing trend of couples seeking unique and personalized experiences for their special day, coupled with the growing desire for convenience and stress-free planning. This is further fueled by the rising popularity of destination weddings, which often require catering services that can accommodate large numbers of guests.

In addition, the growing importance of food and beverage quality, presentation, and variety in wedding celebrations, as well as the need for catering services to provide exceptional customer service, are also contributing to the rising demand for catering services in this market. For instance, in November 2022, Emirates introduced a new private catering service specifically designed for weddings and large-scale events. This service aims to provide a luxurious dining experience, featuring a diverse menu that can be customized to meet the unique preferences of clients. The catering service leverages Emirates’ culinary expertise and high-quality standards.

Videography & photography services are anticipated to grow with a CAGR of 13.3% from 2024 to 2030. The growth can be attributed to the increasing importance of social media in sharing personal milestones, which drives couples to seek high-quality visual documentation of their special day. In addition, the rise of professional standards and expectations among clients has led to a greater appreciation for skilled photographers and videographers who can capture unique moments creatively. The emotional value attached to wedding memories further fuels this demand, as couples desire to preserve these experiences for future generations.

Regional Insights

The North America wedding services market accounted for a share of 23.18% of the global market in 2023. The demand for wedding services in the region is primarily driven by a combination of cultural significance and the desire for personalized experiences. As weddings are seen as major life milestones, couples are willing to invest significantly in creating memorable events that reflect their unique identities and values.

U.S. Wedding Services Market Trends

The wedding services market in the U.S. is expected to grow at a CAGR of 13.8% from 2024 to 2030. The trends such as destination weddings and the influence of social media have fueled market growth in the region, encouraging couples to seek out diverse and innovative services to enhance their celebrations.

Asia Pacific Wedding Services Market Trends

Asia Pacific wedding services market is expected to grow at a CAGR of 12.5% from 2024 to 2030. The demand for wedding services in Asia Pacific is being driven by the increasing desire for customized experiences, the influence of social media, and the growing inclusivity of different traditions and ceremonies. This encourages service providers to offer a broader range of options, further driving the industry's growth For instance, Hilton India relaunched its Wedding Diaries initiative, introducing a Wedding Ambassador who acts as a liaison between the couple and the hotel. This expert will manage all aspects of wedding planning to ensure a personalized and seamless experience. The initiative also features partnerships with celebrity chefs for customized culinary experiences and offers sustainable options through its Meet with Purpose program, allowing couples to celebrate with reduced environmental impact.

Europe Wedding Services Market Trends

The Europe wedding services market is expected to grow at a CAGR of 12.8% from 2024 to 2030, owing to the increasing number of extravagant celebrations, and a growing trend of destination weddings, which collectively enhance the willingness to spend on various wedding-related services.

Key Wedding Services Company Insights

The global wedding services market is characterized by both established firms and new entrants striving to differentiate themselves through innovative offerings and exceptional service quality. Players are offering customizable packages that cater to diverse client needs, utilizing social media marketing and online platforms for better reach. They are also implementing technology-driven solutions such as virtual planning tools and comprehensive vendor marketplaces to stay ahead of the competition.

Key Wedding Services Companies:

The following are the leading companies in the wedding services market. These companies collectively hold the largest market share and dictate industry trends.

- BAQAA Glamour Weddings and Events

- Nordic Adventure Weddings

- Augusta Cole Events

- A Charming Fête

- David Stark

- Fallon Carter

- Lindsay Landman

- JZ Events

- Colin Cowie

- Eventures Asia

Recent Developments

-

In July 2024, Wedding services startup Meragi successfully secured USD 9.1 million in Series A funding, with the investment led by Accel. The funding round is expected to help Meragi expand its offerings and enhance its platform for wedding planning services.

-

In July 2024, The Knot Worldwide, a prominent global marketplace and family of brands focused on celebrations, unveiled significant new product enhancements for The Knot and WeddingWire. These updates aim to enhance the experience for wedding professionals by optimizing lead quality, improving storefront listings, and offering deeper insights to help vendors connect with more engaged couples.

Wedding Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 205.42 billion |

|

Revenue forecast in 2030 |

USD 420.72 billion |

|

Growth rate |

CAGR of 12.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, booking, service, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa |

|

Key companies profiled |

BAQAA Glamour Weddings and Events; Nordic Adventure Weddings; Augusta Cole Events; A Charming Fête; David Stark; Fallon Carter; Lindsay Landman; JZ Events; Colin Cowie; Eventures Asia |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Wedding Services Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wedding services market report on the basis of type, booking, service and region.

-

Type (Revenue, USD Million, 2018 - 2030)

-

Destination

-

Local

-

-

Booking (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Service (Revenue, USD Million, 2018 - 2030)

-

Catering Services

-

Decoration Services

-

Transport Services

-

Videography & Photography Services

-

Wedding Planning Services

-

Other Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The wedding services market was estimated at USD 182.56 billion in 2023 and is expected to reach USD 205.42 billion in 2024.

b. The wedding services market is expected to grow at a compound annual growth rate of 12.7% from 2023 to 2030 to reach USD 420.72 billion by 2030.

b. Asia Pacific dominated the wedding services market with a share of 37.26% in 2023. Rising disposable incomes among couples in the region enable them to allocate more funds toward destination weddings, enhancing their willingness to invest in travel and exclusive experiences.

b. Key players in the wedding services market are BAQAA Glamour Weddings and Events; Nordic Adventure Weddings; Augusta Cole Events; A Charming Fête; David Stark; Fallon Carter; Lindsay Landman; JZ Events; Colin Cowie; and Eventures Asia.

b. Key factors driving the growth of the wedding services market include a growing inclination toward personalized and extraordinary wedding events, heightened appeal of exotic and visually striking wedding locations, and a notable shift towards personalized and bespoke wedding experiences.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."