Webbing Market Size, Share & Trends Analysis Report By Product (Carbon Fibers, Para Aramid Synthetic Fibers), By Application (Automotive, Sporting Goods, Furniture), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-244-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Webbing Market Size & Trends

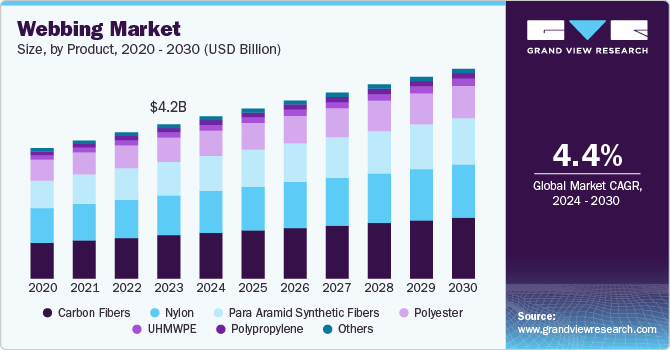

The global webbing market size was valued at USD 4.17 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. Factors driving market growth include stringent automotive safety regulations, industrial growth, military demands for durable fabrics, technological advancements in webbing products, and increased recreational activities. Moreover, the trend towards sustainable and eco-friendly solutions is fueling demand for green webbing initiatives.

The automotive industry is a significant driver of the webbing market, driven by growing concerns for vehicle safety. Governments worldwide are implementing legislation to ensure that vehicles on the road are equipped with high-quality seat belts, which are typically made from nylon and polyester webbing. This regulatory shift is creating a positive market momentum for webbing product acquisition.

Industrialization, particularly in developing countries, is also driving demand for webbing. The material’s strength, resistance to abrasion and chemical effects, and ability to sustain stretching make it an ideal choice for safety harnesses and protective attire used in various industries, including automotive and industrial. As economies grow, consumers’ purchasing power increases, allowing them to invest in safety products that enhance their operations.

The outdoor recreation industry is another significant growth driver for webbing. The number of people participating in outdoor activities such as camping, hiking, and climbing has increased, leading to a greater demand for webbing materials used in equipment such as backpacks and climbing gear. According to the Outdoor Industry Association, the outdoor recreation participant base grew 2.3% in 2022. This trend is expected to continue, driving demand for webbing products and fueling growth in the industry.

Product Insights

Carbon fibers led the market with a revenue share of 27.9% in 2023. Webbing’s exceptional tensile strength, five times stronger than steel, makes it an ideal material for manufacturing. Its lightweight properties allow for the creation of strong, yet weight-minimized, webbing products, particularly beneficial in industries where every pound counts, such as aviation and manufacturing, where reduced weight can significantly impact profitability.

The para aramid synthetic fibers segment is expected to register the second-fastest CAGR of 4.7% over the forecast period. Para-aramid webbing is a critical material in military applications, particularly for harnesses and straps, due to its enhanced durability and high-strength performance in high-risk operations. Its applications span construction, aerospace, automotive, safety harnesses, lifting slings, and other industries where high strength is essential, resulting in longer service life and reduced maintenance needs.

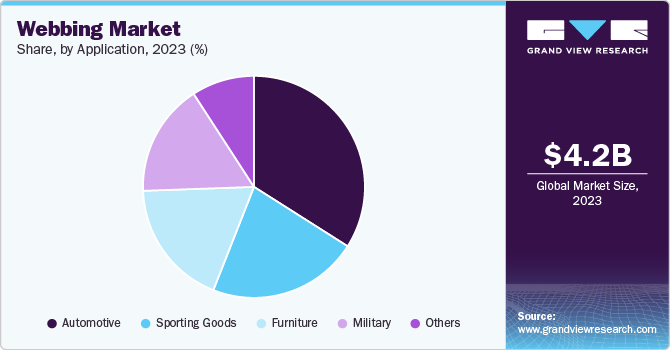

Application Insights

Automotive applications dominated the webbing market with a market share of 34.0% in 2023. Stringent regulations on safety by governments worldwide have driven the adoption of automotive webbing applications. Regulatory bodies, such as the U.S.’ National Highway Traffic Safety Administration, have established strict guidelines for automotive safety. As a result, manufacturers are compelled to utilize high-quality, safe webbing materials that meet these specifications to ensure compliance and maintain consumer trust.

The military segment is expected to register significant growth of 4.6% during the forecast period. The military demands exceptional safety and reliability in its webbing applications, particularly in parachutes, harnesses, and other critical equipment. High standards are enforced to ensure only the highest-quality products are used, given the potential catastrophic consequences of failure. Multifunctional webbing products also enhance their appeal to military services, boosting sales and efficiency.

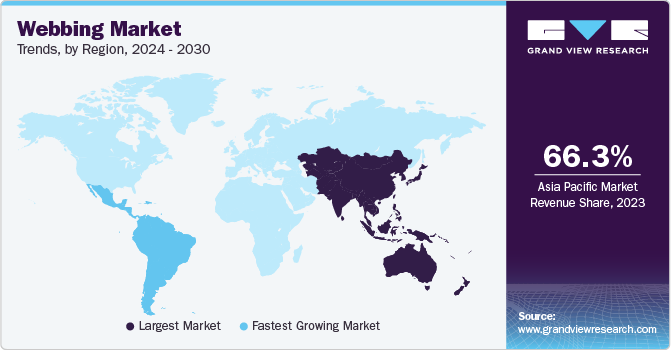

Regional Insights

Asia Pacific webbing market dominated the global webbing market with a revenue share of 66.3% in 2023. The region has experienced rapid industrialization and economic growth over the past few decades, driven by the emergence of China, India, and other Southeast Asian countries as manufacturing hubs. As a result, there is a strong demand for automotive webbing products in various sectors, including automotive, aerospace, construction, and consumer goods markets.

The webbing market in China dominated the Asia Pacific webbing market with a market share of 24.4% in 2023. China has established itself as a global leader in production by leveraging advanced technologies, a large and skilled workforce, and economies of scale. The country has invested heavily in mechanizing the textile industry, ensuring that webbing products meeting export standards are equipped with cutting-edge technology. Moreover, China’s lower labor costs compared to Western nations provide a significant competitive advantage.

Latin America Webbing Market Trends

Latin America webbing market is expected to register the fastest CAGR of 4.7% during the forecast period. Latin America boasts significant natural resources, including raw materials for synthetic fibers such as nylon and polyester. Brazil and Argentina’s large agricultural sectors are major producers of these fibers. The region has also developed robust manufacturing industries, encompassing fabric production, weaving, and finishing processes, with multiple countries having established strong manufacturing capabilities.

The webbing market in Brazil is projected to experience growth over the forecast period, driven by the country’s emergence as a leading economy in Latin America. Brazil’s improved GDP growth rates have boosted consumer spending and business investments, leading to increased demand for high-quality webbing materials used in manufacturing, accessories, and safety products, among other applications.

North America Webbing Market Trends

North America webbing market is anticipated to experience growth during the forecast period, driven by the increasing emphasis on safety standards across various industries. Key sectors such as automotive, aerospace, and construction are utilizing webbing products to ensure safety, with mandatory applications such as high-strength webbing materials for seat belts in automobiles, driven by government regulations.

U.S. Webbing Market Trends

The webbing market in U.S. held a substantial share in 2023, driven by its robust supply chain infrastructure, enabling the production and distribution of webbing products domestically and globally. Local sourcing of raw materials and advanced manufacturing capabilities allow U.S.-based companies to respond quickly to changing market demands, maintain quality, and remain competitive in the global market.

Europe Webbing Market Trends

Europe webbing market had a substantial market share in 2023, with local manufacturers investing in research and development to enhance their product offerings. Notable technological advancements, such as the development of high-strength synthetic fibers such as nylon and polyester, have enabled European companies to deliver superior products that meet the demands of various industries and customer segments.

The webbing market in Germany is expected to grow in the forecast period, driven by its strategic location within Europe, providing access to other European and global markets. The country’s well-established export infrastructure enables webbing manufacturers to efficiently export their products worldwide, further enhancing Germany’s position as a key player in the global market.

Key Webbing Company Insights

Some key companies in the webbing market include National Webbing Products Co.; American Cord & Webbing Co., Inc.; and American Webbing and Fittings, Inc.; among others. Market players are countering competition by implementing strategies such as new product launches, expanded distribution, and geographic expansion to gain a competitive edge in the market.

-

National Webbing Products Co. is a manufacturer and supplier of webbing products, catering to various industries including military, recreation, and automotive. The company offers a range of webbing materials, including nylon, polyester, cotton, and polypropylene, which can be customized to meet customer specifications.

-

American Webbing and Fittings, Inc is a manufacturer of high-quality webbing products and related fittings. Its extensive product range includes nylon, polyester, polypropylene, and other materials, serving various industries such as military, outdoor recreation, and industrial applications.

Key Webbing Companies:

The following are the leading companies in the webbing market. These companies collectively hold the largest market share and dictate industry trends.

- National Webbing Products Co.

- American Cord & Webbing Co., Inc.

- American Webbing and Fittings, Inc.

- E. Oppermann GmbH

- Leedon Webbing

- Sturges Manufacturing Co., Inc.

- Murdock Webbing Company, Inc.

- Webbing Products Pty Ltd.

- Dun & Bradstreet, Inc.

Recent Developments

-

In June 2024, Webbing Products Pty Ltd. demonstrated the effectiveness of its line-of-sight protective sleeves through a video showcasing the production and rigorous testing of its protective sleeving range, which has been successfully completed.

Webbing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.39 billion |

|

Revenue forecast in 2030 |

USD 5.68 billion |

|

Growth rate |

CAGR of 4.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, Argentina, Saudi Arabia, South Africa |

|

Key companies profiled |

National Webbing Products Co.; American Cord & Webbing Co., Inc.; American Webbing and Fittings, Inc.; E. Oppermann GmbH; Leedon Webbing; Sturges Manufacturing Co., Inc.; Murdock Webbing Company, Inc.; Webbing Products Pty Ltd.; Dun & Bradstreet, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Webbing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global webbing market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyester

-

Nylon

-

Polypropylene

-

Carbon Fibers

-

Para Aramid Synthetic Fibers

-

UHMWPE

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Sporting Goods

-

Furniture

-

Military

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Italy

-

Spain

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."