Web Performance Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-378-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Web Performance Market Size & Trends

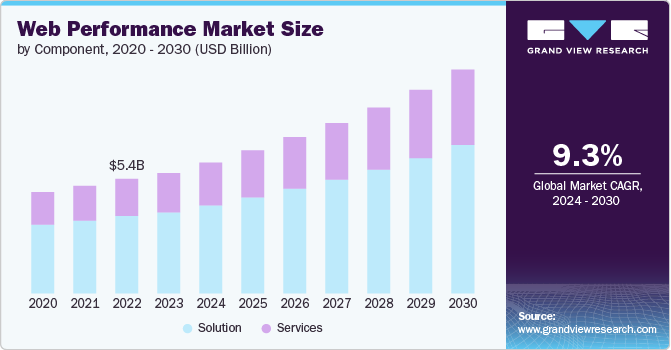

The global web performance market size was estimated at USD 5.65 billion in 2023 and is projected to grow at a CAGR of 9.35% from 2024 to 2030. The market is centered on optimizing the speed, reliability, and user experience of web applications. It encompasses performance monitoring tools, content delivery networks (CDNs), optimization services, and web hosting solutions. Driven by the increasing importance of user experience (UX), the rapid growth of e-commerce, and the SEO advantages of fast-loading sites, this market is expanding.In e-commerce, high-performance websites are crucial for providing smooth shopping experiences and seamless transactions.

Website speed directly impacts conversion rates and sales; faster loading times lead to higher customer satisfaction and reduced bounce rates. When pages load quickly, users are more likely to stay, browse, and make purchases. Slow websites frustrate visitors, causing them to abandon their carts and seek alternatives, which significantly hurts sales. Therefore, optimizing website speed is essential for online retailers to maximize conversions and revenue. Pinterest improved their website's performance by reducing perceived wait times by 40%, leading to a 15% increase in both search engine traffic and sign-ups. Similarly, COOK enhanced their site by cutting average page load time by 850 milliseconds, resulting in a 7% increase in conversions, a 7% decrease in bounce rates, and a 10% rise in pages per session.

Search engines, such as Google, factor page load speed into their ranking algorithms because faster websites provide a better user experience. Websites that load quickly are more likely to rank higher in search results, which drives more organic traffic to these sites. Improved ranking leads to increased visibility, attracting more potential customers, and enhancing overall traffic. Thus, optimizing page speed is a vital SEO strategy for online businesses aiming to improve their search engine rankings and attract more visitors naturally. Moreover, the proliferation of mobile devices and increasing global internet accessibility necessitate optimized web experiences across various devices and network conditions. Mobile users expect fast, seamless browsing, and any delay can lead to higher bounce rates and lost opportunities. As internet usage expands worldwide, diverse network conditions demand robust performance optimization to ensure consistent, efficient access. This trend drives the need for web performance tools and strategies to enhance load times, reliability, and overall user satisfaction.

Component Insights

Based on component, the solution segment led the market with the largest revenue share of 67% in 2023. User experience (UX) is pivotal for customer retention and conversion rates in today's digital landscape. Slow-loading websites and applications directly correlates with increased bounce rates and decreased user engagement. To address this, businesses are prioritizing web performance monitoring and optimization solutions. These tools focus on improving key UX metrics like load times, responsiveness, and overall reliability. By ensuring swift and seamless interactions, companies not only enhance user satisfaction but also mitigate the risk of losing potential customers to competitor sites. Moreover, optimizing UX contributes to improved search engine rankings, as search algorithms increasingly favor fast-loading and user-friendly websites. Ultimately, investing in web performance solutions not only enhances digital experiences but also strengthens a brand's competitive edge by meeting and exceeding user expectations in an increasingly competitive online marketplace.

The services segment is expected to grow at the fastest CAGR of 9.85% during the forecast period. Many businesses lack the internal expertise and resources to implement and manage complex web performance solutions effectively. Consulting services fill this gap by offering expert guidance on strategy, implementation, and optimization of web performance tools and technologies. Furthermore, continuous monitoring and improvement through managed services ensures that websites and applications maintain peak performance levels consistently. By proactively monitoring metrics such as load times, responsiveness, and reliability, managed service providers can swiftly identify and address performance issues. This approach not only enhances user experience but also adapts to evolving user expectations and technological advancements. Regular maintenance and optimization activities ensure that web assets remain competitive and aligned with business goals, providing businesses with the agility and reliability needed to thrive in a dynamic digital environment.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 55% in 2023. Scalability in cloud-based solutions enables businesses to dynamically adjust computing resources such as processing power, storage, and bandwidth in response to fluctuating web traffic. This flexibility ensures that websites and applications can seamlessly accommodate sudden spikes in user activity without experiencing downtime or performance degradation. Cloud platforms provide auto-scaling capabilities that automatically allocate additional resources during peak periods and scale them down during quieter times, optimizing cost efficiency. This scalability not only enhances user experience by maintaining consistent performance but also supports business growth and agility, allowing organizations to respond rapidly to changing market demands and operational needs.

The on-premise segment is expected to grow at the fastest CAGR of 7.6% during the forecast period. On-premise deployments offer businesses extensive customization and control over their infrastructure and software environments. This flexibility is particularly valuable for organizations with specific performance requirements or proprietary technology stacks that are not easily adaptable to standardized cloud offerings. By hosting solutions locally, businesses can tailor hardware configurations, network setups, and software deployments to precisely match their operational needs. This level of control allows for fine-tuning of performance parameters and ensures compatibility with existing systems, optimizing efficiency and supporting unique business processes without the constraints often associated with cloud-based environments.

Enterprise Size Insights

Based on enterprise, the large enterprises segment led the market with the largest revenue share of 57% in 2023. High traffic volumes during peak periods pose significant challenges for large enterprises, impacting website and application performance. Scalable web performance solutions are critical in these scenarios, dynamically adjusting resources to accommodate sudden spikes in user activity. By ensuring consistent load times, responsiveness, and reliability, enterprises can maintain optimal user experience and minimize bounce rates. Scalability also supports operational efficiency by preventing downtime and ensuring that digital platforms remain accessible and responsive under heavy demand. This capability not only enhances customer satisfaction but also preserves brand reputation during critical business events such as sales promotions or product launches.

The SMEs segment is expected to grow at the fastest CAGR of 10.5% over the forecast period.Enhancing web performance gives SMEs a competitive edge by delivering fast-loading websites and responsive applications. These improvements directly impact user experience, leading to higher search engine rankings, increased user satisfaction, and improved conversion rates. A seamless online experience not only attracts and retains customers but also boosts engagement and loyalty. In competitive markets, where customer expectations are high, superior web performance distinguishes SMEs from competitors by ensuring that potential customers have a positive interaction with their digital presence. This positive impression can translate into higher sales, stronger brand reputation, and sustained growth in their market segment.

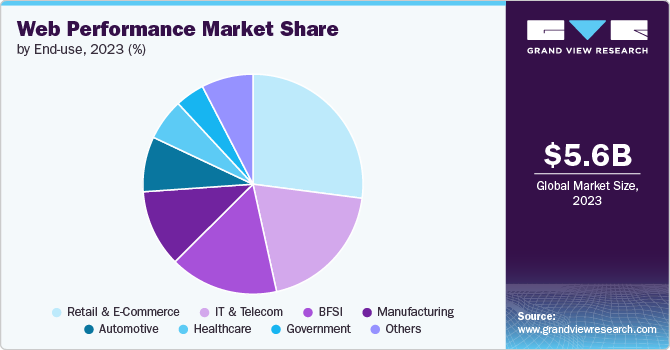

End-use Insights

Based on end use, the retail & e-commerce segment led the market with the largest revenue share of 27% in 2023. In the e-commerce industry, user experience is critical for retaining customers and driving sales. Fast-loading websites and responsive applications ensure that users can quickly access information, browse products, and complete transactions without delays or frustration. This seamless experience reduces bounce rates by keeping users engaged and satisfied throughout their journey. Positive interactions foster trust and loyalty, encouraging repeat visits and word-of-mouth referrals. In a competitive market where every click matters, prioritizing web performance enhances customer satisfaction, increases conversion rates, and ultimately strengthens the brand's position by delivering exceptional online experiences that meet or exceed customer expectations.

The IT & telecom segment is expected to grow at the fastest CAGR of 10.1% over the forecast period. As industries undergo digital transformation, the IT & Telecom sector must meet rising demands for dependable web applications, cloud services, and robust network infrastructure. Effective web performance solutions are critical in delivering enhanced user experiences and optimizing operational efficiency. This ensures that businesses can scale their digital services efficiently, maintain competitiveness, and meet the evolving expectations of their customers in a fast-paced digital economy.

Regional Insights

North America dominated the web performance market with the largest revenue share of 38% in 2023.The market in North America is driven by increasing internet penetration, e-commerce growth, and the demand for seamless user experiences. According to GSMA's October 2023 data, 85% of North Americans use mobile internet, with 14% experiencing a usage gap. With a significant number of users accessing the internet via mobile devices, optimizing web performance for mobile is crucial. Mobile users expect fast, responsive experiences, and any lag or delay can lead to high bounce rates and reduced engagement. This demand drives the adoption of specialized web performance solutions tailored for mobile environments, ensuring that websites and applications load quickly and run smoothly on various mobile devices and network conditions. Enhanced mobile web performance not only improves user satisfaction and retention but also boosts search engine rankings and conversion rates, making it a vital aspect of digital strategies for businesses in North America.

U.S. Web Performance Market Trends

The web performance market in the U.S. is anticipated to grow at a significant CAGR of 8.2% from 2024 to 2030. The booming e-commerce sector in the U.S. necessitates robust web performance solutions to manage high traffic volumes, particularly during peak times like sales events and holidays. Fast, reliable websites are crucial for delivering a seamless user experience, reducing cart abandonment rates, and ensuring customer satisfaction. Advanced web performance tools optimize load times, enhance responsiveness, and ensure site reliability, providing a competitive edge in a crowded market. In addition, these solutions help e-commerce businesses maintain strong search engine rankings, improve conversion rates, and foster customer loyalty, ultimately driving sales growth and sustaining their market position in an increasingly digital economy.

Asia Pacific Web Performance Market Trends

The web performance market in Asia Pacific is expected to grow at a significant CAGR of 11.3% from 2024 to 2030. The growth of the ecommerce industry in the Asia Pacific region is a key driver of expansion in the market. In addition, the rising incidence of security breaches and cyber-attacks targeting enterprise websites is expected to support market growth. According to data from ETCIO published in August 2023, nearly half of the Asia Pacific population is now connected to mobile internet, marking a significant decrease in the mobile internet usage gap from 60% in 2017 to 47% in 2022. This shift reflects improved device affordability and digital literacy. Businesses are adopting advanced web performance solutions to ensure their websites and applications load quickly and operate smoothly on mobile devices. Enhanced mobile web performance improves user satisfaction, reduces bounce rates, and increases engagement, which is critical for retaining customers and driving growth in the highly competitive digital landscape of the Asia Pacific region.

Europe Web Performance Market Trends

The web performance market in Europe is anticipated to grow at the significant CAGR of 9.5% from 2024 to 2030. Businesses across the Europe region are embracing digital transformation at a rapid pace, integrating digital technologies to enhance their online presence and streamline operations. This shift increases the demand for robust web performance solutions that ensure websites and applications run smoothly and efficiently. Enhanced web performance is critical for improving user experience, driving customer engagement, and maintaining competitive advantage. As companies digitize their operations, they rely on web performance tools to monitor, optimize, and maintain high standards of speed, reliability, and responsiveness, ultimately supporting their growth and efficiency in an increasingly digital marketplace.

Key Web Performance Company Insights

Key players operating in the global market include Akamai, ZenQ, CA Technologies, New Relic, ThousandEyes, Cavisson, F5 Networks, Neustar, CDNetworks, Netmagic, Micro Focus, Cloudflare, Dynatrace, IBM, Radware Ltd. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Web Performance Companies:

The following are the leading companies in the web performance market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai

- ZenQ

- CA Technologies

- New Relic

- ThousandEyes

- Cavisson

- F5 Networks

- Neustar

- CDNetworks

- Netmagic

- Micro Focus

- Cloudflare

- Dynatrace

- IBM

- Radware Ltd.

Recent Developments

-

In July 2024, Catchpoint launched a solution aimed at empowering front-end web development teams with comprehensive enterprise insights. This tool provides detailed visibility into web performance metrics crucial for optimizing user experiences. By offering real-time monitoring and analytics, Catchpoint enables teams to proactively identify and address issues that affect website responsiveness and reliability. This initiative aims to enhance efficiency in web development processes, ensuring high standards of performance across digital platforms

-

In May 2024, Honeycomb introduced a frontend observability solution designed to enhance visibility and insights into application performance at the user interface level. This tool focuses on providing real-time data and analytics to developers, enabling them to diagnose and resolve issues affecting frontend performance effectively. By emphasizing observability, Honeycomb aims to optimize user experiences by identifying bottlenecks, improving code efficiency, and ensuring smooth operation of frontend applications across various devices and browsers

Web Performance Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.14 billion |

|

Revenue forecast in 2030 |

USD 10.50 billion |

|

Growth rate |

CAGR of 9.35% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Akamai; ZenQ; CA Technologies; New Relic; ThousandEyes; Cavisson; F5 Networks; Neustar; CDNetworks; Netmagic; Micro Focus; Cloudflare; Dynatrace; IBM; Radware Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Web Performance Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global web performance market report based on component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Web Performance Monitoring

-

Web Performance Optimization

-

Web Performance Testing

-

-

Services

-

Consulting & Implementation Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Manufacturing

-

Government

-

Retail & E-commerce

-

Automotive

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global web performance market was valued at USD 5.65 billion in 2023 and is expected to reach USD 6.14 billion in 2024.

b. The global web performance market is expected to grow at a compound annual growth rate of 9.35% from 2024 to 2030 to reach USD 10.50 billion by 2030.

b. The solution segment held the largest revenue share of more than 67% in 2023 in the global web performance market. User experience (UX) is pivotal for customer retention and conversion rates in today's digital landscape. Slow-loading websites and applications directly correlate with increased bounce rates and decreased user engagement. To address this, businesses are prioritizing web performance monitoring and optimization solutions. These tools focus on improving key UX metrics like load times, responsiveness, and overall reliability.

b. Key players operating in the web performance market include Akamai, ZenQ, CA Technologies, New Relic, ThousandEyes, Cavisson, F5 Networks, Neustar, CDNetworks, Netmagic, Micro Focus, Cloudflare, Dynatrace, IBM, Radware Ltd.

b. The web performance market is centered around optimizing the speed, reliability, and user experience of web applications. It encompasses performance monitoring tools, content delivery networks (CDNs), optimization services, and web hosting solutions. Driven by the increasing importance of user experience (UX), the rapid growth of e-commerce, and the SEO advantages of fast-loading sites, this market is expanding.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."