- Home

- »

- Medical Devices

- »

-

Wearable Sleep Trackers Market Size & Share Report, 2030GVR Report cover

![Wearable Sleep Trackers Market Size, Share, & Trends Report]()

Wearable Sleep Trackers Market (2024 - 2030) Size, Share, & Trends Analysis Report, By Product (Watches, Bands, Earbuds), By Application (Insomnia, Sleep Apnea), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-325-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wearable Sleep Trackers Market Summary

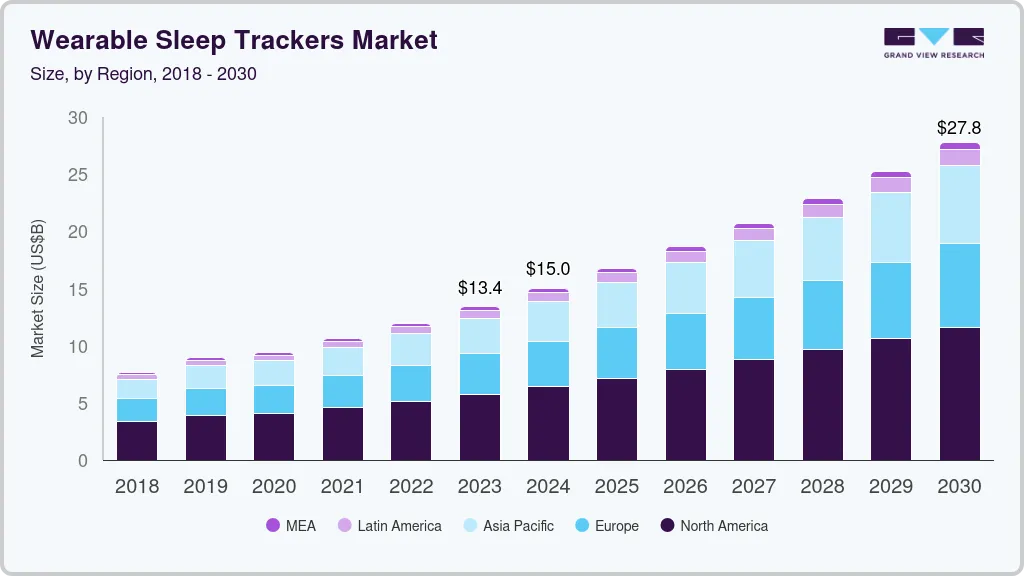

The global wearable sleep trackers market size was estimated at USD 13,411.3 million in 2023 and is projected to reach USD 27,764.6 million by 2030, growing at a CAGR of 10.8% from 2024 to 2030. Increasing availability of a variety of sleep tracking devices is fostering market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Kuwait is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, watches accounted for a revenue of USD 10,775.4 million in 2023.

- Bands is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 13,411.3 Million

- 2030 Projected Market Size: USD 27,764.6 Million

- CAGR (2024-2030): 10.8%

- North America: Largest market in 2023

In June 2023, an Indian start-up called Ultrahuman introduced its health-focused wearable ring known as the Ultrahuman Ring Air. This device is the lightest sleep-tracking wearable in the world, weighing only 2.45g, which is approximately 11 times lighter than the average smartwatch. Such growing advancement in sleep tracking devices is anticipated to boost the sleep tracking process.

Growing research activities for the development of advanced wearable devices are expected to boost the demand of wearable sleep trackers. For instance, in December 2023, a grant of USD 25,000 from the PhRMA Foundation was given to Dr. Moczygemba for research on sleep tracking. Dr. Moczygemba's study focuses on the testing and validation of wearable sensors to enhance health outcomes for people experiencing homelessness (PEH). Individuals experiencing homelessness encounter very difficult sleep environments; this study examines the practicality and potential of wearable sleep trackers. With the USD 25,000 planning grant from the PhRMA Foundation, Moczygemba will be able to compete in 2024 for one of two USD 500,000 research grants.

Governments worldwide are implementing various initiatives to raise awareness about the importance of sleep among the population. For instance , the National Sleep Foundation (NSF) is dedicated to promoting and educating the public about sleep health throughout the year. As the primary authority on advocating for sleep health, the NSF conducts two annual public awareness campaigns, Drowsy Driving Prevention Week (DDPW) and Sleep Awareness Week (SAW). In addition, the foundation provides consumer insights, benchmarking research, and thought leadership resources, all of which are crucial in fulfilling the NSF's objectives and mission. Such increasing government initiatives for sleeping awareness will have a positive impact on wearable sleep trackers.

Growing spending on wearable devices across the globe is accelerating market growth. For instance, according to the India Monthly Wearable Device Tracker by the International Data Corporation (IDC), the wearable market in India recorded a 34% growth in 2023, reaching a new high of 134.2 million units. The period from October to December saw a growth of 12.7% year-over-year (YoY), with 28.4 million units shipped. Such growing demand for smart wearable devices is propelling market growth.

The presence of different features in the sleep tracking devices will further escalate their demand. For instance, the Mi Smart Band 6 is a highly recommended affordable fitness tracker. It has sleep tracking capabilities that monitor the duration of sleep, including deep, light, and REM sleep stages. It also monitors nightly blood oxygen saturation levels and assesses the quality of sleep. In addition, the Mi Smart Band 6 includes stress tracking, SpO2 monitoring, women's health tracking, and continuous heart rate monitoring. The availability of these different features in one device is expected to drive market growth.

Market Concentration & Characteristics

The market is continually advancing because of sensor technology enhancements, machine learning algorithms, and user-centric design. Advancements in miniaturization and battery life have facilitated comfortable all-night wear, enabling the provision of continuous, precise data. Moreover, the incorporation of artificial intelligence permits personalized sleep insights and recommendations, improving user experience and promoting better sleep hygiene. Furthermore, the merging of wearable technology with mobile applications and cloud-based data analytics further enhances their usefulness.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for sleep tracking devices. In May 2023, Oura, the firm that developed a wearable health tracking ring, purchased Proxy, a startup focused on digital identification. This acquisition broadens ŌURA’s dominant position in health wearables and demonstrates its intention to incorporate digital identity technology into its current hardware and software products.

The regulatory landscape for wearable sleep trackers is complex. Regulatory authorities such as the FDA and the European Medicines Agency (EMA) have established comprehensive guidelines to ensure the safety, accuracy, and effectiveness of these devices. In the U.S., the FDA categorizes many wearable sleep trackers under its general wellness device policy. Similarly, in the EU, the Medical Device Regulation (MDR) mandates that sleep trackers meeting certain risk criteria comply with rigorous safety and performance standards. In addition, data privacy regulations, such as the GDPR in Europe, impose strict requirements on how personal health data collected by these devices is handled and protected.

There are various substitutes in the market for wearable sleep trackers such as fitness bands and smartwatches. Smartphone apps with built-in sensors and algorithms offer an alternative option to track sleep without the need for additional hardware. Non-wearable sleep trackers, including smart mattresses and under-the-mattress sensors, provide a less disturbing method of monitoring sleep patterns. Traditional methods such as sleep diaries and professional sleep studies conducted in medical settings also offer valuable insights into sleep quality.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Adding more features to the devices will help the company gain a competitive edge. In June 2023, Oura added more features for sharing on social media and tracking sleep to its smart ring. The company's most recent function, Circles, allows ring users to create special groups for sharing readiness, activity, and sleep scores.

Product Insights

The watches segment led the market with the largest revenue share of 80.3% in 2023. The increasing usage of smartwatches is driving segmental growth. For instance, according to the 2024 Coolest Gadgets report, 12.2% of Americans used smartwatches in 2023, and 3 out of 10 internet users are projected to use them in 2024. Nearly 92% of global users utilize smartwatches for health and fitness monitoring. Additionally, the presence of key market players such as Apple Inc., Fitbit, and Fossil Inc. among others in the watch market is contributing to market growth. Moreover, the development of more accurate and non-invasive monitoring technologies, such as improved sensors that can track sleep stages more precisely will escalate market growth.

The bands segment is anticipated to witness at a significant CAGR over the forecast period. The increasing product launches are anticipated to boost segmental growth. In April 2024, Huawei announced the launch of Huawei Band 9 fitness tracker. The band offers sleep and sports tracking in a lightweight design that seamlessly integrates into daily life. It features a 1.47-inch AMOLED panel with a 65% screen-to-body ratio and comes with a fluoroelastomer strap. The display panel provides over 10,000 watch faces, allowing for more personalization of this simple wellness tracking band.

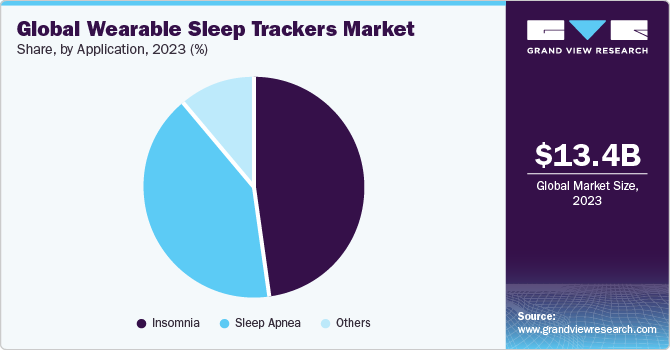

Application Insights

Based on application, the insomnia segment led market with the largest revenue share of 48.1% in 2023. The increasing prevalence of insomnia worldwide is driving market growth. For instance, according to the publication in NIH 2023, 10% of adults in Europe suffer from chronic insomnia, which involves ongoing struggles with falling asleep and/or staying asleep, as well as impairments in daily functioning. Furthermore , as per the Sleep Care Online statistics for 2023, chronic sleep deprivation or insomnia is a prevalent sleep disorder that impacts 1 in 3 adults globally. Such growing patient pools will accelerate the demand for wearable sleep trackers.

The sleep apnea segment is anticipated to witness at a significant CAGR over the forecast period. Increasing government initiatives to raise awareness about sleep apnea is fostering market growth. For instance, in February 2023, the "More than a Snore" national campaign was initiated to increase understanding of obstructive sleep apnea, a long-lasting condition characterized by the recurring blockage of the upper airway during sleep. The project is a joint effort supported by a grant given to the American Academy of Sleep Medicine by the National Center for Chronic Disease Prevention and Health Promotion.Such campaigns will increase the demand for wearable sleep trackers to monitor sleep.

Regional Insights

North America dominated the wearable sleep trackers market with the largest revenue share of 43.0% in 2023.High levels of disposable income and a strong culture of health & wellness awareness drive consumer interest in sleep tracking technologies. Furthermore, the region's advanced healthcare infrastructure and the integration of wearable technology with telemedicine also contribute to market growth.

U.S. Wearable Sleep Trackers Market Trends

The wearable sleep trackers market in U.S. held the largest share of 87.7% of North America in 2023. Rising concerns about the impacts of sleep disorders and the importance of sleep for overall well-being is driving market growth. Furthermore, increasing cases of sleep apnea in U.S. is fostering market growth. For instance, according to a report from the American Medical Association in 2022, approximately 30 million individuals in the U.S. experience sleep apnea, yet only 6 million have received a diagnosis for the condition. This will increase the demand for wearable sleep trackers.

The Canada wearable sleep trackers market is anticipated to register at a significant CAGR during the forecast period. The integration of advanced features such as heart rate monitoring, sleep stage tracking, and smart alarms in these devices has made them popular among the population. Moreover, the growing trend toward health and fitness tracking is supplementing market growth.

Europe Wearable Sleep Trackers Market Trends

The wearable sleep trackers market in Europe is anticipated to register at a significant CAGR during the forecast period.The region's strong regulatory framework supporting medical-grade wearables are expected to spur market growth.Moreover, rising aging population, which is more susceptible to sleep disorders, drives the need for effective sleep monitoring solutions. For instance, according to a 2019 cross-sectional study by BioMed Central Ltd, the prevalence of insomnia symptoms among the elderly in Poland ranges from 20% to 40%.

The Germany wearable sleep trackers market is anticipated to register at a considerable CAGR during the forecast period. The presence of leading market players and innovative local startups in Germany are driving market growth. Moreover, increasing prevalence of sleep disorders is anticipated to escalate market growth. For instance, as per the Springer Nature article published in 2023, obstructive sleep apnea (OSA) is a prevalent chronic condition and is a separate risk factor for various health problems, with an estimated high occurrence of 30% for men and 13% for women in Germany.

The wearable sleep trackers market in UK is anticipated to register at a considerable CAGR during the forecast period. The growing consumer awareness of the adverse effects of sleep deprivation and the benefits of monitoring sleep patterns are fueling market growth. A study conducted by the Sleep Charity highlights the common occurrence of unrecognized sleep disorders in British adults, leading to a demand for government intervention. The investigation shows that 90% of adults encounter sleep issues, and many individuals suffer from untreated conditions such as insomnia or sleep apnea. These growing cases of sleep disorders will contribute to the demand for wearable sleep trackers.

Asia Pacific Wearable Sleep Trackers Market Trends

The wearable sleep trackers market in Asia Pacific is anticipated to register at the fastest CAGR during the forecast period. The region's high prevalence of sleep-related issues, owing to the stressful lifestyles and long working hours, creates a significant market opportunity for sleep tracking devices. Furthermore, rising healthcare expenditure coupled with improving accessibility to sleep tracking devices is supplementing market growth.

The China wearable sleep trackers market held the largest share in 2023. The increasingly sedentary lifestyle is expected to boost market growth. In March 2024, the China Sleep Research Society (CSRS) conducted a survey that found only 29 percent of participants consistently went to bed before 11 p.m., with 47 percent typically falling asleep after midnight.

The wearable sleep trackers market in Japan is anticipated to register at a significant CAGR during the forecast period. Growing government initiatives in Japan is fueling market growth. In April2023, the Ministry of Health, Labor, and Welfare established a target for 60% of the Japanese population to achieve adequate sleep, which is defined as six to eight or nine hours depending on age, by fiscal 2032.

Latin America Wearable Sleep Trackers Market Trends

The wearable sleep trackers market in Latin America is anticipated to register at the fastest CAGR during the forecast period. The launch of various initiatives by market players to promote better sleep health is expected to accelerate market growth. For instance, in May 2023, ResMed, a digital health, sleep, and respiratory care company, launched the Dreamers campaign in ten markets across Asia and Latin America to raise awareness about the importance of sleep health.

The Brazil wearable sleep trackers market is anticipated to register at a considerable CAGR during the forecast period. The growing trend of personalized health and fitness in the region supports market growth. Moreover, the growing technological advancement in the wearable devices are supplementing market growth.

Middle East & Africa Wearable Sleep Trackers Market Trends

The wearable sleep trackers market in Middle East & Africa is anticipated to register at a significant CAGR during the forecast period.The widespread use of smartphones and improving internet infrastructure are supporting market growth. Increasing patient population suffering from sleep apnea will escalate market growth. For instance , as per the NIH report published in 2021, it was estimated that one-fifth of working adults in Kuwait were at high risk for OSA, with the prevalence varying according to personal characteristics and lifestyle factors.

Key Wearable Sleep Trackers Company Insights

Key participants in the global market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions. Some of the key players operating in the market includeFitbit, Apple Inc., Garmin Ltd., and ResMed.

Key Wearable Sleep Trackers Companies:

The following are the leading companies in the wearable sleep trackers market. These companies collectively hold the largest market share and dictate industry trends.

- ResMed

- Garmin Ltd.

- Fitbit

- Apple Inc.

- Koninklijke Philips N.V.

- Huawei Device Co., Ltd.

- Xiaomi

- Fossil Inc

- Ōura Health Oy.

- Zepp Health Corporation Ltd.

Recent Developments

-

In April 2024, ŌURA launched Oura Labs, a new in-app platform. Oura Labs is part of the Oura Membership and is designed to engage members in the research and development process to accelerate innovation

-

In January 2023, Earable, a startup focused on sleep-tracking, secured USD 6.6 million in funding. The investment was led by Founders Fund and Smilegate Investment as the company gets ready to launch a wearable headset designed to enhance sleep quality and productivity

-

In August 2023, Oura joined forces with Talkspace, a prominent online behavioral health firm. This collaboration allows members of Oura to directly share personalized sleep information with their designated licensed therapist through Talkspace's secure, encrypted platform

Wearable Sleep Trackers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.0 billion

Revenue forecast in 2030

USD 27.76 billion

Growth rate

CAGR of 10.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ResMed; Garmin Ltd.; Fitbit; Apple Inc.; Koninklijke Philips N.V.; Huawei Device Co., Ltd.; Xiaomi; Fossil Inc; Ōura Health Oy.; Zepp Health Corporation, Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Sleep Trackers Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the wearable sleep trackers market report based on product, application, and region:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Watches

-

Bands

-

Earbuds

-

Others

-

-

Application Outlook (Revenue USD Million, 2018 - 2030)

-

Insomnia

-

Sleep Apnea

-

Others

-

-

Regional Outlook (Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wearable sleep trackers market size was estimated at USD 13.4 billion in 2023 and is expected to reach USD 15.0 billion in 2024.

b. The global wearable sleep trackers market is expected to grow at a compound annual growth rate of 10.8% from 2024 to 2030 to reach USD 27.76 billion by 2030.

b. In 2023, the watches segment dominated the wearable sleep trackers market and accounted for the largest revenue share of 80.3%. The increasing usage of smartwatches is driving segmental growth.

b. Some key players operating in the wearable sleep trackers market include ResMed, Garmin Ltd., Fitbit, Apple Inc., Koninklijke Philips N.V., Huawei Device Co., Ltd., Xiaomi, Fossil Inc, Ōura Health Oy., Zepp Health Corporation, Ltd.

b. Key factors that are driving the market growth include governments worldwide are implementing various initiatives to raise awareness about the importance of sleep among the population, growing spending on wearable devices across the globe, and rising advancements in sleep tracking devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.