- Home

- »

- Medical Devices

- »

-

Wearable Patch Market Size, Share And Growth Report 2030GVR Report cover

![Wearable Patch Market Size, Share, & Trends Report]()

Wearable Patch Market (2025 - 2030) Size, Share, & Trends Analysis Report By Type (Temperature, Glucose), By Technology (Regular, Connected), By Application (Clinical, Non-clinical), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-226-6

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wearable Patch Market Summary

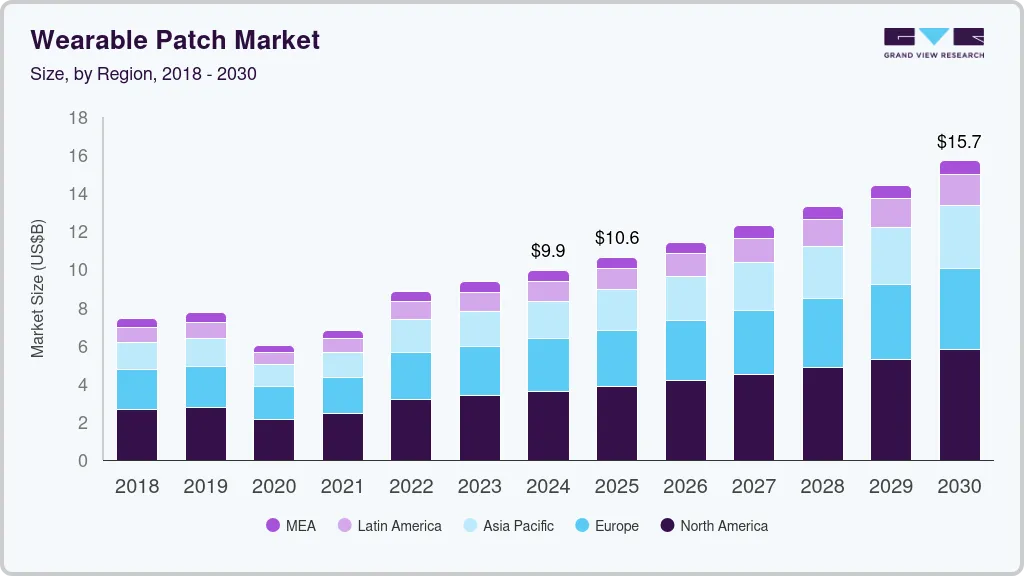

The global wearable patch market size was estimated at USD 9,947.2 million in 2024 and is projected to reach USD 15,710.1 million by 2030, growing at a CAGR of 8.1% from 2025 to 2030. A wearable patch, also known as an electronic skin or smart patch, is used for disease monitoring, diagnostics, and drug delivery.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Thailand is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, connected wearable accounted for a revenue of USD 8,146.7 million in 2024.

- Connected Wearable is the most lucrative technology segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9,947.2 Million

- 2030 Projected Market Size: USD 15,710.1 Million

- CAGR (2025-2030): 8.1%

- North America: Largest market in 2024

It mainly benefits elderly patients with chronic conditions such as diabetes. The market is projected to grow significantly due to increasing R&D investments in wearable patch development. Wearable patches, such as scopolamine and transdermal patches, are directly attached to the affected body parts for disease monitoring. For example, a nicotine patch is used in Nicotine Replacement Therapy (NRT), which releases nicotine into the body and helps prevent smoking.

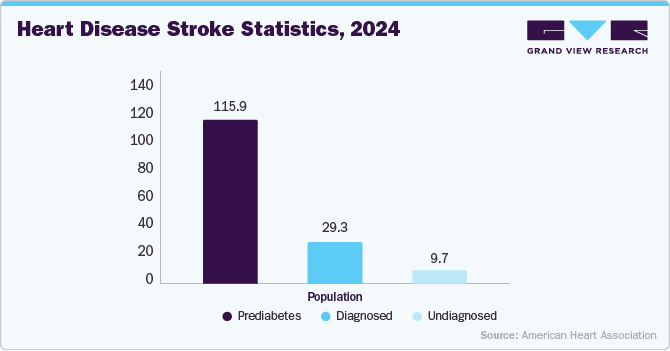

The wearable patches market is experiencing significant growth, driven by advancements in healthcare technology and rising demand for remote patient monitoring. These patches, often equipped with sensors, track various health metrics such as glucose levels, heart rate, and body temperature, providing real-time data to healthcare providers. They are non-invasive, user-friendly, and enhance patient compliance. The market benefits from aging populations, and a shift towards personalized medicine, increasing prevalence of chronic diseases such as atrial fibrillation and diabetes, which are causing stroke incidents at a higher rate, which is expected to drive the market over the projected period. For instance, according to euronews data published in May 2024, a new arm patch allows non-diabetics to track their blood sugar levels in real time using their smartphones. This wearable patch provides continuous glucose monitoring, helping users maintain balanced energy levels and make informed dietary choices.

Likewise, the increasing prevalence of atrial fibrillation is a major factor driving the market. For instance, in September 2023, FDA-approved devices such as Wellysis's S-Patch Ex and SmartCardia's 7L patch have advanced features that enhance real-time cardiac monitoring. These devices are designed to give doctors a detailed view of patients' cardiac activity over several days, aiding in detecting atrial fibrillation, arrhythmias, and other heart conditions. As these devices offer comprehensive and continuous health data, they meet the rising demand for effective, non-invasive monitoring solutions, thus contributing to market expansion.

According to two American Heart Association presidential advisories published in June 2024, heart disease and stroke may affect at least 60% of U.S. adults by 2050. Researchers also predict that by 2050, the prevalence of cardiovascular disease will rise to 15% of the population, up from 11.3% in 2020, excluding individuals with high blood pressure. This includes a projected doubling of stroke rates. The expressions that support our sayings are,

"The last decade has seen a surge of cardiovascular risk factors such as uncontrolled high blood pressure, diabetes and obesity, each of which raises the risks of developing heart disease and stroke, it is not surprising that an enormous increase in cardiovascular risk factors and diseases will produce a substantial economic burden. The last of the Baby Boomers will hit 65 in 2030, so about 1 in 5 people in the U.S. will be over 65, outnumbering children for the first time in U.S. history. Since cardiovascular risk increases with age, the aging population increases the total burden of cardiovascular disease in the country. By 2060, more than two-thirds of children will belong to underserved, disenfranchised populations, which traditionally have higher rates of cardiovascular disease and risk factors,"

- Dr. Dhruv S. Kazi, vice chair of the advisory writing group

Increasing technological advancement in wearable patches is also a major reason for the growth of the market. For instance, according to ScienceDaily data published in May 2024, researchers at the California University in San Diego have developed a wearable ultrasound patch for non-invasive, continuous monitoring of cerebral blood flow. This soft, stretchy patch can be worn on the temple and provides three-dimensional data on brain blood flow, overcoming limitations of traditional transcranial Doppler ultrasound. It offers hands-free, consistent monitoring, crucial for detecting fluctuations and potential strokes, especially during a patient’s hospital stay. This innovation, the first of its kind, enhances the ability to monitor and manage neurological conditions effectively.

In addition, the integration of artificial intelligence and data analytics in wearable patches improves diagnostic capabilities and personalized treatment plans, further driving market growth. For instance, in May 2023, researchers at Monash University have developed an AI-powered wearable patch that monitors multiple health signs, including speech, neck movement, touch, breathing, and heart rates. The ultra-thin patch, worn on the neck, uses a frequency/amplitude-based neural network to automatically track and analyze these biometrics, offering a comprehensive solution for remote health monitoring. The convergence of these factors creates a robust ecosystem for the expansion and innovation of wearable health technologies.

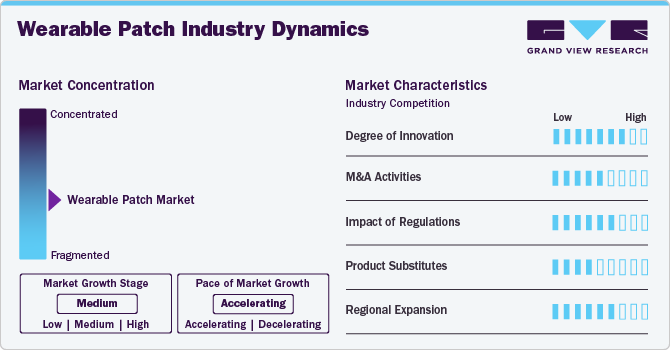

Market Concentration & Characteristics

The wearable patch market is characterized by a growing concentration of key players such as Abbott, Koninklijke, Philips N.V., and Dexcom, driven by biosensing technology advancements and increasing healthcare demand for continuous monitoring solutions. These patches offer real-time tracking of health metrics like glucose levels, cardiac activity, and hydration, enhancing patient management and outcomes. The market is marked by significant R&D investments, collaborations, and product innovations, ensuring robust growth. Companies focus on developing user-friendly, non-invasive, and highly accurate devices for various medical applications, from chronic disease management to sports performance monitoring.

The wearable patch industry exhibits a high degree of innovation, driven by advancements in AI, flexible electronics, and biosensing technologies. These patches enhance chronic disease management, remote patient monitoring, and overall healthcare delivery, making them indispensable in modern medicine. For instance, in May 2024, Luxnine's BodyLog chest patch, honored with the CES 2024 Innovation Award, offers real-time vital signs monitoring, fall detection, and post-incident analysis. It tracks heart rate, oxygen levels, and respiration, aiding elderly care with continuous health oversight and lifestyle suggestions. In addition, it assesses incident severity and analyzes heart rate variability (HRV) after falls and emergencies.

Regulations in the wearable patch industry significantly influence product development, market entry, and consumer trust. Compliance with standards like FDA approvals in the U.S. or CE markings in Europe ensures safety, efficacy, and data security. However, stringent regulations may pose barriers to innovation, increasing costs and delaying product launches. They also create a level ensuring fair competition and protecting consumers from substandard products. Balancing regulatory oversight with fostering innovation is crucial to advancing wearable patch technologies, enhancing healthcare outcomes, and maintaining industry growth while upholding safety and reliability standards worldwide.

Mergers and acquisitions in the wearable patch industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, according to WTWH Media LLC data published in May 2024, Philips obtained ePatch as part of its acquisition of BioTelemetry for USD 2.5 billion in early 2021. Later that year, the company also acquired Cardiology and its AI platform. These additions aim to improve patient comfort, expand healthcare accessibility, and potentially enhance clinical outcomes, all while lowering costs.

In the wearable patch industry, product substitutes can emerge in various forms. Competing devices like smartwatches or fitness trackers offer some overlapping functionalities such as basic health monitoring or activity tracking, potentially diverting consumer interest away from specialized patches. Moreover, advancements in telemedicine and remote monitoring technologies provide alternative solutions for healthcare providers, reducing the immediate need for certain patch-based monitoring solutions. However, wearable patches continue to distinguish themselves with specific features like continuous vital signs monitoring and medical-grade accuracy, appealing to users requiring targeted health monitoring and care management solutions that go beyond general fitness tracking capabilities.

Companies are targeting various regions due to the rising prevalence of chronic respiratory conditions, increasing healthcare investments, and improving medical infrastructure. The regional diversification not only boosts global market presence for companies but also enhances access to advanced wearable patches in underserved areas, promoting overall healthcare improvements. For instance, in May 2024, Philips has rolled out its ePatch and AI analytics platform to 14 hospitals in Spain to monitor heart patients.

Type Insights

The glucose patch segment accounted for the largest market share of 44.1% in 2024. This dominance is driven by the increasing prevalence of diabetes and the growing need for continuous glucose monitoring systems. Innovations in sensor technology and biocompatible materials enhance the accuracy and comfort of glucose patches, making them more appealing to users. In addition, rising awareness of diabetes management and supportive regulatory frameworks further boost the segment's growth. With a focus on personalized healthcare, the glucose patch segment continues to lead, addressing the critical needs of diabetic patients for real-time monitoring and improved quality of life.

The heart rate and ECG patch segment shows the fastest CAGR over the forecast period. This rapid growth is driven by increasing cardiovascular disease prevalence and heightened awareness of heart health monitoring. Innovations in wearable technology, such as improved sensor accuracy and user-friendly designs, are enhancing adoption rates. For instance, In November 2023, researchers from Australia and India developed a small, lightweight, gel-free hexagonal ECG patch, claiming it is perfect for point-of-care diagnostics. These portable ECG patches have the potential to transform remote and ambulatory healthcare, and possibly even preventive medicine. In addition, the rising demand for remote patient monitoring and preventive healthcare measures contributes to this segment's expansion. Supportive government initiatives and growing investments in healthcare technology further accelerate the development and market penetration of heart rate and ECG patches, making them a key area of focus.

Technology Insights

The connected wearable segment accounted for the largest market share of 76.5% in 2024 and shows the fastest CAGR over the forecast period due to the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions has spurred demand for continuous and real-time health monitoring, making wearable patches an attractive solution for managing these conditions. Advances in sensor technology and wireless communication have significantly improved the accuracy, reliability, and functionality of these patches, enabling better data collection and integration with digital health ecosystems. In addition, the rising adoption of telemedicine and remote patient monitoring, accelerated by the COVID-19 pandemic, has further propelled the market as healthcare providers and patients seek convenient and non-invasive ways to track health metrics. Consumer interest in personal health and fitness tracking, alongside the growing geriatric population requiring long-term care solutions, also contributes to the market's expansion.

Application Insights

The non-clinical segment accounted for the largest market share of 57.0% in 2024. The rising consumer interest in personal fitness and wellness is a primary driver for non-clinical applications as individuals seek advanced tools to monitor physical activity, sleep patterns, hydration levels, and overall well-being. Technological advancements have made wearable patches more sophisticated, enabling them to provide detailed and accurate data that can be seamlessly integrated with mobile apps and other digital platforms, enhancing user engagement and experience. In addition, the proliferation of sports and fitness enthusiasts who demand real-time performance tracking and personalized training insights has significantly boosted the adoption of these patches. For instance, in February 2024, Sweanty, a new startup, introduced a wearable patch designed to monitor hydration levels through sweat analysis. This innovative patch aims to help athletes and individuals maintain optimal hydration, preventing dehydration-related issues. The technology offers real-time feedback, enhancing performance and overall health management.

The clinical segment shows the fastest CAGR over the forecast period. The increasing prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and respiratory conditions, drives the demand for continuous, real-time health monitoring solutions provided by wearable patches. These devices offer significant advantages in managing chronic conditions by enabling remote patient monitoring, which reduces the need for frequent hospital visits and enhances patient compliance and outcomes. Technological advancements in sensor technology, data analytics, and wireless communication have improved the accuracy and functionality of clinical wearable patches, making them reliable tools for healthcare providers.

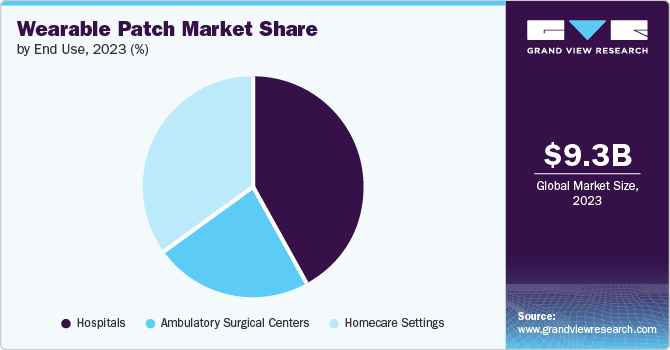

End Use Insights

The hospitals segment accounted for the largest revenue share of 41.4% in 2024. This dominance is attributed to the growing adoption of wearable patches for continuous patient monitoring, particularly for chronic diseases and post-operative care. Hospitals are increasingly integrating these patches into their healthcare systems to enhance patient outcomes through real-time data collection and remote monitoring capabilities. In addition, the rising incidence of chronic conditions, coupled with the need for efficient and cost-effective healthcare solutions, drives the demand for wearable patches in hospitals. For instance, according to Guardian News & Media Limited in July 2022, Researchers state that even without a wireless version, these patches can have an immediate impact in hospitals by monitoring patients' internal conditions while they are in bed, similar to how stick-on electrodes are used for heart activity monitoring.

The homecare settings segment shows the fastest CAGR over the forecast period. This growth is driven by increasing demand for remote patient monitoring and personalized healthcare solutions, especially among the elderly and chronically ill. Wearable patches offer convenience, continuous health tracking, and real-time data transmission, making them ideal for homecare use.

Regional Insights

North America wearable patch market dominated the overall global market and accounted for the 36.0% revenue share in 2024. The market is expected to expand significantly in North America due to rising demand for advanced healthcare solutions, robust research and development efforts, and promotion of innovative therapies. In addition, North America's prominence as a leading manufacturing hub for sophisticated wearable medical devices is anticipated to propel market growth in the region.

U.S. Wearable Patch Market Trends

The U.S. wearable patch market held a significant share of North America's wearable patch market in 2024, as chronic conditions are becoming more prevalent, especially among the geriatric population. Increasing investments in the technological advancement of wearable medical devices and rising R&D spending are factors contributing to the growth of the market in this region. With a strong healthcare infrastructure and continuous advancements in medical therapies, the U.S. market for wearable patch is poised for growth.

Europe Wearable Patch Market Trends

The Europe wearable patch market is witnessing dynamic growth, supported by technological innovations and increasing healthcare needs. Startups like French medical firm RDS, which recently secured USD 14.3 million in seed funding for its patented Remote Patient Monitoring (RPM) solution Multisense in October 2023, exemplify the sector's vitality. These patches offer advanced capabilities such as real-time monitoring of vital signs, facilitating early intervention, and personalized patient care. Key trends include the integration of AI and IoT for data analytics and enhancing predictive health insights. Biocompatible materials and ergonomic designs are improving patch wearability and adherence.

In the UK, the wearable patch market is experiencing notable growth, driven by advancements in healthcare technology and rising demand for remote monitoring solutions. Key trends include the integration of advanced sensors for real-time health data collection. Government initiatives supporting digital health adoption and collaborations between tech companies and healthcare providers are accelerating market growth.

The France wearable patch market is evolving with a focus on health monitoring for chronic conditions like diabetes and cardiovascular diseases. For instance, according to the IDF Report 10th edition, by 2045, France is expected to have 4,225.7 thousand individuals aged 20-79 living with diabetes. French healthcare policies emphasizing patient-centered care and technological advancements support market expansion.

The Germany wearable patch market is experiencing notable growth as the German manufacturers have established a strong reputation for producing high-quality medical devices. The country’s rigorous quality control standards and adherence to safety regulations further enhance this reputation. As a result, healthcare providers trust German-made medical devices leading to increased sales and market dominance.

Asia Pacific Wearable Patch Market Trends

The Asia Pacific wearable patch market is experiencing significant growth driven by increasing healthcare awareness and adoption of digital health solutions. Key trends include the integration of advanced sensors for continuous health monitoring, especially for chronic diseases like diabetes and cardiovascular conditions. Innovations in flexible electronics and biocompatible materials are enhancing comfort and usability. The market is also seeing expansion in applications beyond healthcare, such as fitness tracking and remote patient monitoring. Regulatory support and collaborations between tech firms and healthcare providers are further propelling market growth, positioning the region as a hub for wearable patch innovation and adoption.

The wearable patch market in Japan is poised for rapid growth, driven by innovations like battery-free, high-tech patches for monitoring lifestyle-related diseases such as heart disorders, stress indicators, and sleep apnea. These advancements offer continuous health monitoring with minimal discomfort, appealing to Japan's aging population and their increasing focus on health management.

The wearable patch market in China is expected to grow in the Asia Pacific in 2023, due to the increasing demand for wearable patches and technological advancements. For instance, in November 2019, scientists in China have developed a wearable silk patch capable of measuring various health biomarkers, such as glucose, lactate, and potassium, in real-time. The patch targets healthcare and sports applications, leveraging silk's biocompatibility and sensitivity to biological changes. This innovation addresses growing demands for personalized health solutions in the region.

In India, wearable patches are gaining traction for healthcare monitoring due to their convenience and continuous data collection capabilities. They cater to diverse needs, from chronic disease management to fitness tracking. The market is expanding with innovations in remote patient monitoring and increasing adoption by healthcare providers and consumers alike. For instance, in August 2022, IIT Bhubaneswar developed a wearable patch that measures health parameters, enhancing continuous health monitoring. This innovation aims to provide accurate real-time data on vital signs, which can be crucial for timely medical interventions. The wearable patch is part of efforts to advance healthcare technology and improve patient outcomes in India.

Latin America Wearable Patch Trends

The Latin American wearable patch market is fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for wearable patches as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

The wearable patch market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Wearable Patch Company Insights

The competitive scenario in the wearable patch market is highly competitive, with key players such as Smith’s Group plc, Medtronic; and ConvaTec Group holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Wearable Patch Companies:

The following are the leading companies in the wearable patch market. These companies collectively hold the largest market share and dictate industry trends.

- AliveCor, Inc

- VivaLNK, Inc

- Cardiac Insight Inc

- VitalConnect

- LifeSignals, Inc

- L’Oreal Group

- Dexcom, Inc

- GENTAG, Inc

- Abbott Laboratories

- Koninklijke Philips N.V.

- Sensium Healthcare Ltd

- Leaf Healthcare, Inc

- Qualcomm Technologies, Inc

Recent Developments

-

In February 2024, Epicore Biosystems, a digital health company, has partnered with the U.S. Anti-Doping Agency (USADA) to use its advanced sweat-sensing wearables for drug detection. The Discovery Patch, a single-use, flexible microfluidic patch, provides real-time hydration insights and enhances anti-doping efforts by utilizing sweat analysis alongside traditional urine and blood tests.

-

In November 2023, DuPont and STMicroelectronics collaborated to develop the intelligent Liveo DuPont biosensing patch. This wearable device combines advanced materials and sensor technology to enable remote monitoring of vital signs, including heart activity. The patch incorporates ST's electronics, such as accelerometers, AI-enabled sensors, microcontrollers, and Bluetooth modules. DuPont’s soft skin conducting tape ensures the patch's compatibility with the skin. This innovative device aims to improve patient monitoring by offering a flexible, easy-to-use solution for continuous health tracking.

-

In June 2022, Engineers at UC San Diego have developed a microneedle wearable patch capable of measuring glucose, alcohol, and muscle fatigue in real time. This "lab-on-the-skin" device tracks multiple biomarkers in interstitial fluid, offering potential for chronic disease monitoring and sample collection for clinical laboratory testing

-

In October 2021, Epicore Biosystems developed a wearable patch capable of analyzing sweat composition, which can be used to monitor patients with cystic fibrosis. The patch is designed to measure chloride levels, a critical marker for cystic fibrosis, as well as zinc and iron, to assess nutritional status. This device allows for non-invasive, real-time monitoring outside hospital settings, providing significant advantages over traditional methods.

Wearable Patch Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.64 billion

Revenue forecast in 2030

USD 15.71 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application and end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

AliveCor, Inc.; VivaLNK, Inc.; Cardiac Insight Inc.; VitalConnect; LifeSignals, Inc.; L’Oreal Group; Dexcom, Inc.; GENTAG, Inc.; Abbott Laboratories; Koninklijke Philips N.V.; Sensium Healthcare Ltd; Leaf Healthcare, Inc.; Qualcomm Technologies, Inc.; Medtronic Plc; Hill-Rom Holdings, Inc.; iRhythm Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Patch Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wearable patch market report on the basis of type, technology, application end use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Temperature Patch

-

Glucose Patch

-

Heart rate and ECG Patch

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Regular Wearable

-

Connected Wearable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Non-clinical

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Homecare Settings

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wearable patch market size was estimated at USD 9.95 billion in 2024 and is expected to reach USD 10.64 billion in 2025.

b. The global wearable patch market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 15.71 billion by 2030.

b. North America dominated the wearable patch market with a share of 36.0% in 2024. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the wearable patch market include Medtronic Plc, Hill-Rom Holdings, Inc. (Welch Allyn), iRhythm Technologies, Inc., AliveCor, Inc., Vivalnk, Inc., Cardiac Insight Inc., VitalConnect, LifeSignals, Inc., L’oreal Group, Dexcom, Inc., GENTAG, Inc., Abbott Laboratories, and Koninklijke Philips N.V.

b. Key factors driving the wearable patch market growth include the rising prevalence of the chronic disease, increasing awareness regarding wearable patches, and a growing aging population with atrial fibrillation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.