- Home

- »

- Medical Devices

- »

-

Wearable Medical Devices Market Size, Industry Report 2030GVR Report cover

![Wearable Medical Devices Market Size, Share & Trends Report]()

Wearable Medical Devices Market Size, Share & Trends Analysis Report By Product (Diagnostic Devices, Therapeutic Devices), By Site (Handheld, Shoe Sensors), By Grade Type, By Distribution Channel, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-724-7

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Wearable Medical Devices Market Trends

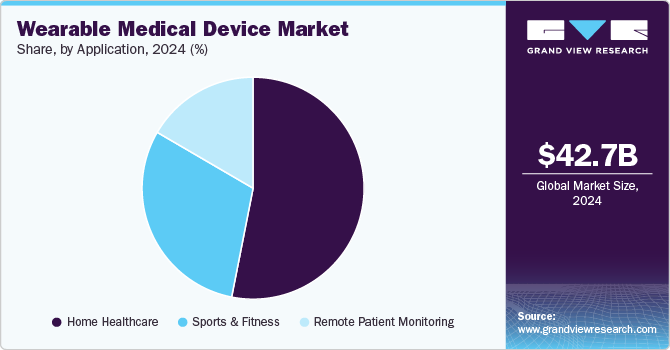

The global wearable medical devices market size was estimated at USD 42.74 billion in 2024 and is projected to grow at a CAGR of 25.53% from 2025 to 2030. The anticipated growth in industries like remote patient monitoring and home healthcare is set to impact the market, along with an increased focus on fitness and a health-oriented lifestyle. The market holds significant opportunities driven by technological advancements, merger and acquisition activities, increasing number of clinical trials, and heightened awareness of personal health monitoring.

Due to sedentary routines, lifestyle-related disorders such as diabetes and hypertension are expected to rise, necessitating continuous monitoring of physiological parameters. Portable medical devices enable the amalgamation of healthcare data, providing real-time access for physicians and minimizing errors. The increasing mortality rate from non-communicable diseases emphasizes the need for personalized monitoring and care, contributing to an increased demand for wearable medical products.

The COVID-19 pandemic has expanded the utility of wearable medical devices in healthcare. Innovative products, like the Ava Bracelet, initially designed as a fertility tracker, are now repurposed to detect early signs of viral infections. Monitoring parameters such as heart rate variability, breathing rate, and skin temperature, the bracelet proves valuable in tracking COVID-19 symptoms, presenting a distinctive opportunity during the global health crisis.

The escalating prevalence of chronic diseases and rising mortality rates are causing major concern, prompting healthcare providers to focus on personalized care, particularly through continuous remote patient monitoring. Wearable medical devices, capable of 24-hour wear without disrupting daily routines, are gaining traction due to their various advantages. Consequently, the demand for these devices is expected to surge over the forecast period.

Wearable medical devices are playing a pivotal role in the cardiovascular device market. These innovative technologies, ranging from smartwatches to continuous monitoring devices, offer new avenues for real-time health tracking, early detection of cardiovascular issues, and personalized patient care. The integration of wearable devices in cardiovascular healthcare reflects a transformative shift towards preventive and proactive healthcare solutions, ultimately enhancing patient outcomes and disease management.

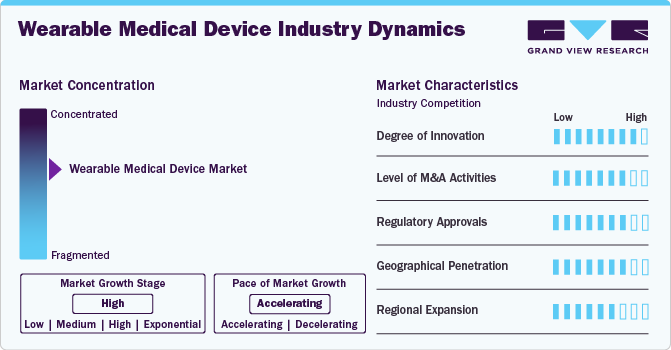

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The wearable medical device industry is characterized by a high degree of growth. The wearable medical device industry is characterized by dynamic market trends and technological advancements. The industry showcases a surge in innovation, with devices offering enhanced monitoring, diagnostics, and treatment capabilities. The market is marked by high levels of competition, evident in diverse product portfolios and strategic collaborations. Overall, the wearable medical device industry is defined by its ever-evolving landscape, emphasizing accessibility, personalization, and advancements in remote patient care.

Key strategies implemented by players in the wearable medical device industry are new product launches, regulatory approval, acquisitions, partnerships, and other strategies. For instance, in January 2024 , Cloud DX, a North American provider of virtual care and remote patient monitoring platforms, unveiled a significant contract to develop a wrist-based wearable capable of tracking ECG and various vital signs. This innovative device is poised to play a crucial role in the client's wellness solution, a patented platform designed to monitor multiple vital signs and offer personalized daily recommendations. Anticipated as the commencement of a prolonged and mutually beneficial collaboration, this contract is expected to have a substantial impact on the wearable medical device industry, showcasing advancements in remote patient monitoring and reinforcing the industry's commitment to personalized health solutions.

Rapid advancements in wearable medical technology have paved the way for cutting-edge devices that offer enhanced monitoring, diagnostics, and treatment capabilities. From smartwatches tracking vital signs to implantable devices providing real-time health data, the market is characterized by a surge in novel solutions designed to revolutionize patient care and empower individuals in managing their health proactively. This significant degree of innovation underscores the industry's commitment to addressing evolving healthcare needs through accessible and sophisticated wearable medical technologies.

Industry players are strategically aligning through acquisitions and partnerships to enhance their technological capabilities, expand product portfolios, and gain a competitive edge. This surge in M&A activities reflects the dynamic landscape of the wearable medical device industry, with companies seeking strategic collaborations to advance innovation, address evolving healthcare demands, and solidify their positions in this rapidly growing sector.

The industry is navigating a landscape of stringent regulations and standards to ensure the safety, efficacy, and compliance of these innovative devices. Companies are actively engaging with regulatory bodies to secure necessary approvals for their products, reflecting a commitment to meeting industry standards and gaining market trust. As wearable medical devices continue to advance, obtaining regulatory clearances remains a critical step to bring these technologies to market and contribute to the evolution of personalized healthcare.

Companies are strategically expanding their presence across diverse regions, aiming to capture emerging market opportunities and cater to the growing demand for innovative healthcare technologies. This global outreach underscores the industry's commitment to making wearable medical devices accessible on a broader scale, addressing healthcare needs across different regions, and contributing to the advancement of remote patient monitoring and personalized healthcare solutions worldwide.

Wearable medical device industry exhibits high fragmentation with numerous players contributing to a diverse landscape. The market is characterized by a multitude of companies offering a wide range of innovative devices, creating a competitive environment. This fragmentation is driven by ongoing advancements in technology, fostering the development of various wearable medical solutions. As a result, the industry is witnessing a dynamic and diverse market with numerous players contributing to the expansion and evolution of wearable medical devices.

Wearable medical devices industry is witnessing notable regional expansion as companies strategically broaden their geographic footprint. This trend reflects a proactive approach to tap into diverse healthcare needs across different regions, capitalize on emerging opportunities, and establish a stronger market presence. Regional expansion allows wearable medical device providers to adapt their offerings to local requirements, comply with varied regulations, and enhance accessibility, contributing to the dynamic growth of the industry on a global scale.

Product Insights

The diagnostic devices segment led the market with the largest revenue share of 61.32% in 2024. The increasing prevalence of neurological disorders is a primary driver for the growth of this segment. A report by the World Federation of Neurology in October 2023 revealed that neurological disorders rank as the second highest cause of death and the leading cause of disability globally. The study found that over 40% of the global population currently suffers from neurological conditions, with this burden projected to nearly double by 2050. The top 10 conditions, including Stroke, Neonatal encephalopathy, Migraine, Dementia, Meningitis, Epilepsy, Neurological complications associated with preterm birth, Nervous system cancers, autism spectrum disorders, and Parkinson’s disease, account for about 90% of total neurological DALYs. In addition, increasing awareness among the population about the capability of neurological wearables to continuously assess cognitive capabilities during everyday activities is expected to further drive the segment.

The therapeutic device segment is anticipated to witness at the fastest CAGR throughout the forecast period, owing to the increasing influx of therapeutic devices. Furthermore, the market is expected to receive a boost from a robust pipeline of therapeutic devices, including intelligent asthma management products, wearable pain reliever devices, and insulin management devices. The segment is categorized into pain management, insulin monitoring, rehabilitation, and respiratory therapy devices, reflecting the diverse range of applications within this burgeoning market.

Site Insights

Based on site, the strap/clip/bracelet segment led the market with the largest revenue share of 51.6% in 2024 and is likely to remain dominant throughout the forecast period. Smartwatches, with the capability to monitor parameters like mobility, respiratory rate, and pulse rate, along with Bluetooth and cloud connectivity, are expected to drive growth in this segment.

Advancements in wrist-worn products, exemplified by Fitbit Ace 3 Next Generation Activity and Sleep Tracker for kids, offer enjoyable fitness tracking by monitoring parameters such as heart rate, skin temperature, and activity counts, contributing to segment expansion. Major players like Samsung and Apple introducing compatible mobile apps for wearable medical instruments further attract individuals to routine health monitoring, fostering overall market growth.

Application Insights

Based on application, the home healthcare segment led the market with the largest revenue share of 53.1% in 2024, due to the increasing geriatric population increasing prevalence rates of target diseases, and the growing need to curb healthcare expenditure as an economically viable initiative are some of the factors responsible for market growth.

)

) The remote patient monitoring segment is anticipated to witness at the fastest CAGR over the forecast period. Globally rising geriatric population base and rising incidences of chronic conditions are expected to be high-impact rendering drivers for the growth of remote patient monitoring devices over the forecast period.

Grade Type Insights

Based on grade type, the consumer-grade segment led the market with the largest revenue share of 77.30% in 2024. These devices offer user-friendly features, focusing on personal health and fitness tracking, making them widely popular among consumers. The convenience, affordability, and increasing health consciousness contribute to the segment's robust performance, establishing it as a key driver in the wearable medical devices industry.

The clinical grade segment is anticipated to witness at the fastest CAGR over the forecast period. This anticipation is driven by the growing demand for advanced monitoring solutions in clinical settings. The increasing adoption of these devices for continuous patient monitoring, remote healthcare management, and integration with healthcare systems contributes to the segment's rapid growth. As healthcare providers increasingly embrace advanced technologies, the clinical-grade wearable medical devices segment is positioned for significant expansion, catering to the evolving needs of the healthcare industry.

Distribution Channel Insights

Based on the distribution channel, the pharmacy segment led the market with the largest revenue share of 39.34% in 2024. This dominance is attributed to the widespread accessibility of pharmacies, offering consumers a convenient avenue to purchase these devices. Pharmacies’ role as health and wellness hubs, coupled with their ability to provide informed advice, positions them as key contributors to the notable revenue share within the wearable medical devices industry.

The online channel segment is anticipated to witness at the fastest CAGR over the forecast period. The segment growth is driven by the increasing consumer preference for online shopping. This trend is fueled by the convenience, accessibility, and diverse product offerings available through e-commerce platforms. As the online retail sector continues to expand, the wearable medical devices market is expected to benefit from a surge in demand facilitated by the seamless and efficient online purchasing experience.

Regional Insights

North America wearable medical devices market dominated with the largest revenue share of 35.76% in 2024, owing to the growing prevalence of cardiovascular disorders, diabetes, and cancer within this region. High adoption of remote patient monitoring and home care devices for regular, continuous, and long-term monitoring of patients and reducing the frequency of hospital visits are anticipated to fuel market growth over the forecast period.

U.S. Wearable Medical Devices Market Trends

The U.S. wearable medical devices market accounted for the largest market share in North America in 2024, primarily driven by technological advancements and an increasing emphasis on preventive healthcare. As consumers become more health-conscious, the demand for devices that monitor vital signs and track fitness levels has surged. Wearable devices, such as smartwatches, fitness trackers, and advanced health monitoring gadgets, provide users with real-time health data, empowering them to make informed decisions about their health and wellness. According to a research article published by MedTech Dive that provides news and trends shaping medical technology among wearable monitors, blood pressure devices emerged as the most popular choice, utilized by 59% of survey respondents. Sleep monitors followed with a usage rate of 21%, while ECG monitors were used by 11% of participants. Biosensors, including glucose monitors, hormone monitors, fall detectors, and respiratory monitors, were adopted by 8% of consumers. In addition, smart clothing items were used by 6% of those surveyed.

Recent innovations have further enhanced the capabilities of wearable medical devices. Features such as continuous heart rate monitoring, ECG analysis, blood oxygen saturation measurement, and even glucose monitoring are becoming commonplace. The integration of artificial intelligence and machine learning has improved data accuracy and analysis, enabling users to receive personalized health insights. Further, various manufacturers around the globe are increasingly implementing strategic initiatives to expand their presence in the U.S. market.

Asia Pacific Wearable Medical Devices Market Trends

The Asia Pacific wearable medical devices market is expected to witness at an exponential CAGR over the forecast period. Major factors boosting market growth are favorable government initiatives for the use of such wearable medical instruments, increasing geriatric population base, and increasing healthcare expenditure in this region. Japan held the largest share of the remote patient monitoring devices market in the Asia Pacific region in 2023 and is expected to maintain its dominance over the forecast period owing to the rapid technological advancements and the growing requirement for home care devices and round-the-clock monitoring. Japanese firms place a high value on health, skin care, and all human consumables.

Key Wearable Medical Devices Company Insights

Key companies are significantly impacting the market by introducing groundbreaking technologies. Innovations such as advanced wearable medical device sensors, continuous monitoring capabilities, and integration with artificial intelligence are reshaping the landscape. Industry leaders leverage these technologies to enhance the accuracy and range of health metrics that wearable devices can track. Moreover, the incorporation of data analytics and cloud connectivity enables seamless data sharing, improving the overall healthcare ecosystem. This technological evolution not only propels the market's growth but also contributes to improved patient outcomes, personalized healthcare, and the transformation of wearable medical devices into indispensable tools for both consumers and healthcare providers.

Key Wearable Medical Devices Companies:

The following are the leading companies in the wearable medical devices market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- Fitbit (Google)

- Garmin Ltd.

- Medtronic

- Omron

- Withings

- VitalConnect

- Polar Electro

- Sotera, Inc.

- INVIZA Corporation

- Dexcom, Inc.

- GE HealthCare

- CONTEC MEDICAL SYSTEMS CO., LTD

- Nanowear Inc.

Recent Developments

-

In January 2024, Nanowear, one of the leaders in at-home healthcare remote diagnostics, announced that its nanotechnology-powered wearable and software platform, SimpleSense, has received FDA 510(k) clearance for its innovative AI-enabled Software-as-a-Medical Device (SaMD). As the first non-invasive, cuffless, continuous blood pressure monitor and diagnostic tool, SimpleSense-BP represents a groundbreaking advancement in the clinical management of hypertension, complementing the platform’s previously cleared cardiopulmonary diagnostics.

-

In January 2024, Sennheiser collaborated with Polar Electro to launch the Momentum Sport earbuds, marking the first time Polar's bio-sensing capabilities extend beyond its own products. These German-engineered earbuds not only deliver high-quality sound but also integrate Polar's fitness technology, incorporating features such as a body temperature sensor and a Photoplethysmography (PPG) heart rate sensor for monitoring hydration levels during workouts. Users can access the comprehensive data analytics ecosystem through the Polar Flow training app, offering expert-tier performance tracking, training analytics, voice guidance, and smart coaching. This collaboration is poised to impact the wearable medical devices market by expanding bio-sensing capabilities into audio devices for enhanced fitness monitoring and guidance.

-

In January 2024, Garmin Ltd. unveiled the Lily 2 series, representing the next evolution of its petite and stylish smartwatches, introducing enhanced health, wellness, and connectivity features. The Lily 2 and Lily 2 Classic models boast an advance redesign, featuring metal watch cases, concealed displays with distinctive patterned lenses, and a range of fashionable color options. With a substantial battery life of up to five days in smartwatch mode, users can delve into new functionalities such as sleep score tracking, dance fitness activities, and Garmin Ltd. Pay contactless payments. This announcement is expected to impact the wearable medical devices market by introducing refined and fashionable smartwatches equipped with advanced health and wellness features.

-

In January 2024, Garmin Ltd. unveiled significant enhancements to its Garmin Ltd. Connect app and website, aiming to deliver a more streamlined and personalized homepage experience centered around health and fitness metrics for users to monitor their individual goals. As of now, certain customers utilizing Garmin Ltd. smartwatches, cycling computers, and accessories can participate in the beta version of Garmin Ltd. Connect, with wider availability anticipated later this year. This update is poised to impact the wearable medical devices market by offering users a more user-friendly platform focused on health and fitness tracking, enhancing the overall wearable device experience.

-

In June 2023, Google introduced its latest Feature Drop, incorporating a series of updates for Fitbit devices. Notable additions include a variety of exercise modes in the Exercise menu for Luxe, Charge 5, and Inspire 3, a menstrual health tile for period tracking and cycle state viewing for Versa 4 and Sense 2, and the inclusion of a Daily Readiness Score, providing insights into whether the body requires rest or a workout, accessible across all Fitbit devices. This development is anticipated to impact the wearable medical devices market by enhancing the functionality and features of Fitbit devices, catering to a broader range of user health and wellness needs.

-

In January 2023, Masimo and Royal Philips broadened their collaboration, utilizing the Masimo W1 advanced health tracking watch to enhance patient monitoring in the realm of home telehealth. The integration of Philips's enterprise patient monitoring ecosystem with the W1 watch is set to propel advancements in telehealth and telemonitoring capabilities. This expansion is poised to impact the wearable medical devices market by fostering innovative solutions for remote patient monitoring and enhancing the synergy between health tracking wearables and telehealth systems.

-

In April 2023, Garmin Ltd. revealed an extended regional availability of the Dexcom Connect IQ apps, catering to consumers managing Type 1 or Type 2 diabetes with the Dexcom G6 or Dexcom G7 Continuous Glucose Monitoring System. These applications empower users to conveniently monitor their glucose levels and trends directly on a compatible smartwatch or cycling computer. This announcement is expected to impact the wearable medical devices market by providing enhanced accessibility to glucose monitoring solutions for individuals with diabetes, further integrating health monitoring into daily wearable technology.

Wearable Medical Device Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 53.98 billion

Revenue forecast in 2030

USD 168.29 billion

Growth rate

CAGR of 25.53% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, site, application, distribution channel, grade type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Koninklijke Philips N.V.; Fitbit (Google); Garmin Ltd.; Medtronic; Omron; Withings; VitalConnect; Polar Electro; Sotera, Inc.; INVIZA Corporation; Dexcom, Inc.; GE HealthCare; CONTEC MEDICAL SYSTEMS CO., LTD; Nanowear Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Medical Device Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wearable medical device market report based on product, site, application, distribution channel, grade type, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep trackers

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal and Obstetric Devices

-

Neuromonitoring Devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

Therapeutic Devices

-

Pain Management Devices

-

Neurostimulation Devices

-

Others

-

-

Insulin/Glucose Monitoring Devices

-

Insulin Pumps

-

Others

-

-

Rehabilitation Devices

-

Accelometers

-

Sensing Devices

-

Ultrasound Platform

-

Others

-

-

Respiratory Therapy Devices

-

Ventilators

-

Positive Airway Pressure (PAP) Devices

-

Portable Oxygen Concentrators

-

Others

-

-

-

-

Site Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Headband

-

Strap/Clip/Bracelet

-

Shoe Sensors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports And Fitness

-

Remote Patient Monitoring

-

Home Healthcare

-

-

Grade Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer-Grade Wearable Medical Devices

-

Clinical Wearable Medical Devices

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacies

-

Online Channel

-

Hypermarkets

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Central & South America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wearable medical devices market size was estimated at USD 42.74 billion in 2024 and is expected to reach USD 54.0 billion in 2025.

b. The global wearable medical devices market is expected to grow at a compound annual growth rate of 25.53% from 2025 to 2030 to reach USD 168.29 billion by 2030.

b. North America dominated the wearable medical devices market with a share of 35.76% in 2024. This is attributable to the rise in chronic diseases that need routine monitoring and the presence of sophisticated healthcare infrastructure.

b. Some key players operating in the wearable medical devices market include Koninklijke Philips N.V., Fitbit (Google), Garmin Ltd., Medtronic , Omron, Withings, VitalConnect, Polar Electro, Sotera, Inc., INVIZA Corporation, Dexcom, Inc., GE HealthCare, CONTEC MEDICAL SYSTEMS CO., LTD, Nanowear Inc., and Apple Inc.

b. Key factors that are driving the wearable medical devices market growth include rising demand for round-the-clock monitoring, growing awareness of fitness, and the advent of technologically advanced products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."