- Home

- »

- Medical Devices

- »

-

Wearable EEG Headsets Market Size & Share Report, 2030GVR Report cover

![Wearable EEG Headsets Market Size, Share & Trends Report]()

Wearable EEG Headsets Market Size, Share & Trends Analysis Report By Application (Trauma & Surgery, Disease Diagnosis), By Product, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-292-7

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Wearable EEG Headsets Market Trends

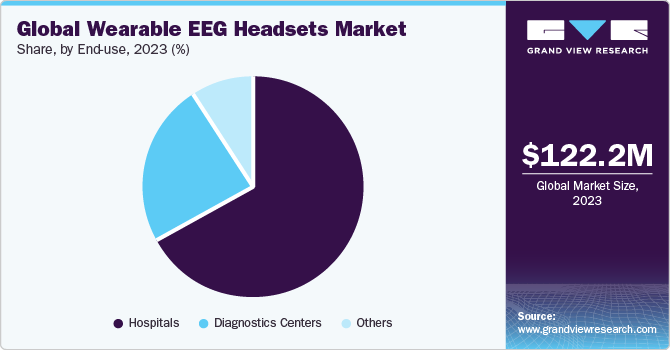

The global wearable EEG headsets market size was estimated at USD 122.2 million in 2023 and is expected to grow at a CAGR of 10.47% from 2024 to 2030. Major factors contributing to the market growth include growing prevalence of neurological disorders, increasing geriatric population, technological advancements, and demand for non-invasive monitoring solutions across many industries, including healthcare, gaming, sports, and research. For instance, in January 2024, Scientists at Stanford University have created a wearable electronic cap that can interpret brain waves (EEGs), enabling individuals to control robots, clean surfaces, stroke a robotic dog, and even prepare a basic meal solely through their brain signals.

The use of wearable EEG (electroencephalogram) headsets has increased, particularly as a response to the growing number of neurological conditions such as epilepsy and sleep apnea, mainly attributed to the widespread adoption of sedentary lifestyles. For instance, the World Health Organization (WHO) reported in January 2024 that epilepsy affects approximately 50 million individuals globally, ranking it among the most prevalent neurological disorders. Wearable EEG is an efficient device for addressing these conditions by facilitating early detection and continuous monitoring. Unlike traditional EEG machines that necessitate a hospital or clinic visit, wearable EEG headsets offer the convenience of home use, significantly simplifying the integration of these devices into everyday routines.

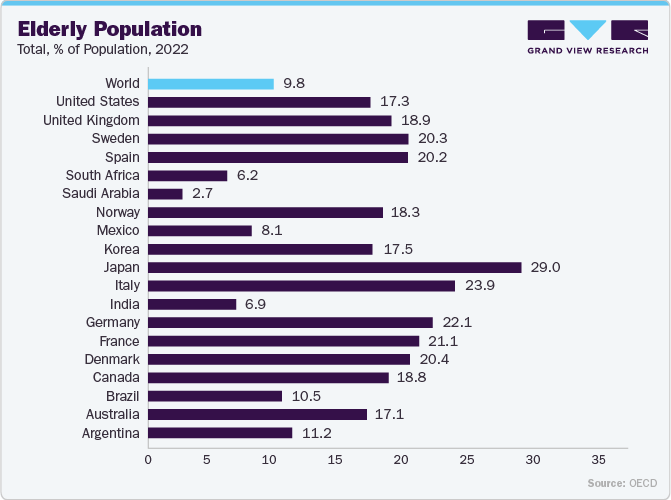

The growing geriatric population is likely to boost the adoption of wearable EEG devices. This is because older adults are more susceptible to various neurological disorders, among other health issues. In addition, as the lifespan of the geriatric population increases, the demand for monitoring and managing health conditions also rises. This trend suggests a positive outlook for the expansion of wearable EEG technology in healthcare, particularly for aging populations. For instance, as per NCBI, Neurological disorders are common among the elderly, impacting 5% to 55% of individuals aged 55 and above. These conditions often lead to severe health complications, including increased risk of death, disability, the need for care in a facility, and hospitalization.

Another major factor propelling the market for wearable EEG devices is the increase in traumatic brain injuries (TBI), which is on the rise. TBIs caused by a bump, blow, or shock to the head affect the brain either permanently or temporarily. Sports-related injuries, slips and falls, injuries from firearms, domestic abuse, and auto accidents are some of the leading causes of TBIs. In both industrialized and developing nations, TBI is one of the main causes of mortality and morbidity and a significant public health issue. Around 1.5 million Americans with TBI receive treatment each year, according to a CDC report released in 2020. Similar to this, according to the journal published by Headway, in the UK in 2019-20, there were 137,403 admissions for stroke. Therefore, it will increase the product demand and further boost the market growth.

Market Concentration & Characteristics

The market growth stage is medium and the pace of growth is accelerating. It is witnessing significant innovation, marked by the adoption of advanced technologies such as machine learning algorithms, longer battery life, and improved connectivity features. These advancements have culminated in the creation of wearable EEG headsets that are more efficient, versatile, and user-friendly. Consequently, these devices now have a much wider range of applications, extending beyond medical monitoring and diagnosis to include consumer uses such as stress management, sleep improvement, and boosting cognitive performance enhancement. This surge in diverse applications is a key factor driving the industry's rapid growth.

The growing R&D activities in the wearable EEG device technology are expected to contribute to industry growth. For instance, in January 2024, Gate Neurosciences, Inc., a biotech firm at the clinical stage, focusing on creating advanced neuroscience treatments through precision medicine, entered into a strategic partnership with Beacon Biosignals. This collaboration aims to enhance the application of electroencephalogram (EEG) biomarkers throughout the company's clinical developments in the fields of neuropsychiatry and cognition.

Wearable EEG devices have seen significant innovation due to constant technological advancements, placing them at the forefront of medical diagnostics. For instance, in November 2023, Advanced Brain Monitoring, Inc. declared the incorporation of its portable, wireless 24-channel EEG system into the Stratus EEG cloud-based clinical software platform, aimed at facilitating seizure monitoring in either home or hospital settings.

Companies that manufacture wearable EEG devices are undertaking merger and acquisition activities. This strategic approach seeks to improve technological capabilities, expand industry reach, and maintain competitiveness. For instance, in January 2024, Aditxt, a biotech firm based in the U.S., acquired brain monitoring technologies and devices that use EEG from Brain Scientific.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a crucial role in shaping the development and application of wearable EEG devices.

Manufacturers are seeking product approvals from government authorities to stay competitive. The growing demand and adoption of wearable brain imaging devices is also an important factor driving the industry’s growth. For instance, in May 2023, Cumulus Neuroscience was granted 510(k) clearance by the FDA for its dry-sensor electroencephalograph (EEG) headset.

The geographical reach of wearable EEG devices has been expanding at a moderate to high level. For instance, in January 2023, ANT Neuro announced the establishment of ANT Neuro Australia, the latest addition to its group, serving as a Sales and Support organization based in Melbourne, Australia.

Application Insights

The disease diagnosis segment held the largest revenue share of 31.67% in 2023. In the healthcare sector, wearable EEG devices are becoming increasingly common for the diagnosis and monitoring of neurological illnesses such epilepsy, dementia, Alzheimer's disease, and Parkinson's disease. Compared to traditional EEG equipment, these devices are non-invasive, portable, or wireless, making them more practical and available. In addition, the prevalence of chronic diseases such as cancer, diabetes, cardiovascular disease, obesity, and respiratory issues is expected to aid the market's growth over the course of the forecast period.

The trauma & surgery segment is expected to grow at a fastest CAGR over the forecast period. These devices offer real-time monitoring of brain activity, which is crucial for detecting any neurological changes during and after surgeries, or in patients recovering from traumatic injuries. This capability allows for immediate intervention, potentially reducing the risk of long-term damage.

Wearable EEG devices can also be used for the diagnosis and treatment of various problems that affect brain function, such as anxiety, depression, and sleep disorders. Likewise, by giving medical practitioners real-time monitoring and feedback, wearable EEG devices have the ability to completely change the way neurological illnesses are diagnosed and treated. We may anticipate seeing many more uses for wearable EEG devices in the detection and treatment of diseases as technology develops since they provide a non-invasive, portable, and readily available alternative to conventional EEG equipment. Consequently, it is expected to encourage segment growth.

Product Insights

The 32-channel EEG segment held a 32.65% share of the global revenue in 2023 and is expected to grow at the fastest CAGR over the forecast period. The market is anticipated to continue expanding as a result of numerous uses for this channel in the recording of electrical events in the brain to diagnose neurological diseases as well as other uses in the brain-computer interface.

Moreover, factors such as effectiveness, ease of use, high output, technological innovation, and universal acceptance by healthcare professionals are predicted to further fuel the segment's growth. In addition, because of their widespread acceptance among healthcare professionals and their effectiveness, high productivity, and technological advancements. Thus, the adoption of 32-channel EEG devices by medical professionals and developments in this equipment's technology are the primary drivers of growth.

The 5-channel EEG held a significant revenue share in 2023, owing to the simplicity, portability, and cost-effectiveness of the product. The minimized electrode count eases the installation process, saving time and enhancing user-friendliness for both medical practitioners and participants. This ease of use further applies to the upkeep and calibration of the system, given the reduced number of components involved. Moreover, the compact design of the 5-channel system bolsters its mobility, providing greater adaptability across a variety of testing scenarios, such as in medical facilities, research labs, and even during field studies.

End-use Insights

The hospital segment dominated the market by capturing a share of 67.10% in 2023. This is attributed to the portability and ease of use of these devices in hospitals which enhances patient comfort, reduces hospital stays and the need for repeated visits. As this technology continues to evolve, its integration into hospital settings promises to revolutionize in various applications. In January 2022, London-based Lawrence + Memorial Hospital introduced a new rapid response EEG brain monitoring device.

The diagnostic centers segment is expected to grow at the fastest CAGR over the forecast period. This is owing to the cost advantages associated with wearable EEG devices, which generally demand a smaller initial investment compared to conventional EEG systems, and their user-friendliness, which reduces the necessity for highly skilled staff. This feature is particularly efficient for diagnostic centers looking to provide efficient and cost-effective services. In addition, the move towards outpatient services and patient-focused care models in the healthcare industry enhances the option of wearable EEGs for diagnostic centers to broaden their offerings and meet patient demands for services.

Insight from the Industry expert

Companies utilizing strategic partnerships such as product approvals are set to secure a competitive advantage throughout their product portfolio. Below are few insights from the key industry experts:

“Receiving 510(k) clearance from the FDA marks a major milestone for Cumulus and for our biopharma innovator partners in the US and Europe who need the ability to capture clinical-grade EEG signals from patients while at-home to accelerate their development programmes for precision CNS medicines.”

-Cumulus Neuroscience chief scientific officer Brian Murphy

“Standard lab-based EEG systems require a trained technician, up to 45 minutes to set up, and the application of many wires and gel to a patient's head, which can be intimidating and uncomfortable. The Cumulus Neuroassessment Platform, which includes our EEG headset, removes those barriers entirely. This recognition validates the care and thoughtfulness that went into the design of our headset, as well as the precision placed in our technology. We are excited about the possibilities the platform creates for the future of CNS drug development and the future of healthcare."

-Aman Bhatti, MD, CEO, Cumulus

“Our community will immediately benefit from the ability to study how the brain works in a range of new circumstances and environments,"

“Adding new sensors to our platform that can accurately measure brain signals in natural settings creates exciting new opportunities for clinical research. The freedom to continuously measure and analyze real-world data without the limitations of the lab is a game-changer.”

-Tan Le, founder and CEO of EMOTIV

Regional Insights

North America accounted for the largest share of the global wearable EEG headsets market in 2023, with 41.15%, because of its well-developed healthcare infrastructure, the high concentration of market players, increased government funding, advancements in technology in healthcare facilities, and growing public awareness of available technologies.

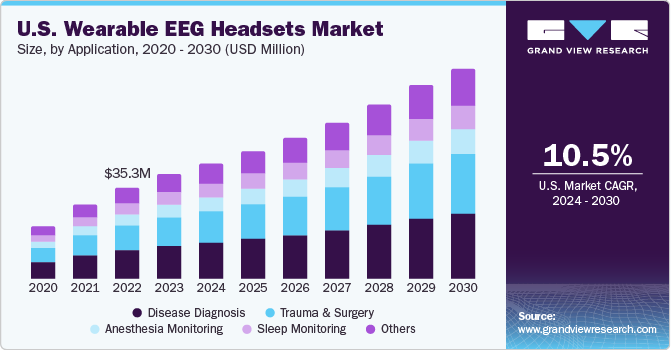

U.S. Wearable EEG Headsets Market Trends

The presence of major market players in the country such as Advanced Brain Monitoring; Natus Medical, Inc.; and Emotiv Inc., engaged in various strategic initiatives to stay competitive, is expected to contribute to the growth of the U.S. market. Furthermore, a rise in mental health issues in the country is also a major contributor to the market growth. According to a 2021 report by the U.S. National Institute of Mental Health (NIMH), an estimated 57.8 million adults aged 18 or older were living with Any Mental Illness (AMI), while an estimated 14.1 million adults aged 18 or older were living with Serious Mental Illness (SMI).

The wearable EEG headsets market in Canada is expected to grow owing to the rising number of R&D activities and various government initiatives to support them. For instance, through the allocations made in the 2011, 2016, and 2019 budgets, along with additional funding provided in 2021, the Canadian government has said to provide a total of USD 200 million to Brain Canada via the CBRF Program. This funding aims to back Canadian neuroscience research that holds the most promise for leading to breakthroughs in understanding the brain and improving brain health, as well as developing new therapies and methods.

Europe Wearable EEG Headsets Market Trends

The wearable EEG headsets market in Europe also held a significant revenue share in 2023.Increasing prevalence of Traumatic Brain Injuries (TBIs) is among the factors expected to contribute to growth of this market over the forecast period. As per an article published by Neurosurgery in June 2022, the estimated incidence of TBI for population of all ages and TBI severity were 47.3 to 694 per 100,000 population and 83.3 to 849 per 100,000 population, respectively.

The UK wearable EEG headsets market is expected to grow owing to the rising prevalence of neurological disorders in the country. For instance, an article published by Epilepsy Action in January 2023, states that in the UK, the incidence of epilepsy is more than 9 individuals per 1,000 people annually. Consequently, it is estimated that around 633,000 individuals in the UK are affected by epilepsy.

The growth of the wearable EEG headsets market in Germany is driven by the enhanced recognition and acceptance of mental health and neurological conditions. This development has increased the need for diagnostic and monitoring solutions that are both non-invasive and easily accessible.

The France wearable EEG headsets market is expected to grow during the forecast period. Francehas shown a strong commitment to healthcare innovation, particularly in the digital health and neurotechnology sectors, which has naturally extended to the adoption of wearable EEG technologies in the country.

Asia Pacific Wearable EEG Headsets Market Trends

The wearable EEG headsets market in Asia Pacific is expected to grow at a lucrative CAGR over the forecast period. This can be attributed to the growth of the R&D industry, expansion of healthcare reforms, and rising prevalence of neurological diseases. In addition, a large population base and an increase in funding from the public and private sectors support the market's expansion.

The China wearable EEG headsets market is expected to grow attributed to the presence of a regulatory environment that encourages innovation, along with a substantial potential customer base. Technological advancements have significantly enhanced the accessibility and usability of these devices, making them suitable for everyday consumer use.

The wearable EEG headsets market in Japan is expected to grow due to the country's swiftly aging population. This demographic change leads to a higher incidence of neurological disorders, including dementia and Alzheimer's disease, where EEG devices are crucial for early detection and ongoing monitoring.

The India wearable EEG headsets market is expected to grow owing to the rising number of medical facilities. For instance, in July 2022, the Government of India launched two brain health clinics under the Karnataka Brain Health Initiative (Ka-BHI) at Jayanagar General Hospital. Such initiatives from the government are creating opportunities for key EEG device manufacturers to supply products and fulfill the rising demand.

Latin America Wearable EEG Headsets Market Trends

The wearable EEG headsets market in Latin America is expected to grow over the forecast period, due to investments by market players in the region, proximity to North America, and free-trade agreements with major countries such as the U.S., Canada, Japan, and several European countries.

MEA Wearable EEG Headsets Market Trends

The wearable EEG headsets market in MEA is expected to witness growth during the forecast period, owing to the increased prevalence of neurological disorders and rapidly aging population, as well as growing demand for home-based monitoring devices.

Key Wearable EEG Headsets Company Insights

The continuous demand for wearable EEG devices by end-users has created numerous market opportunities for major players to capitalize on. Market players are involved in undertaking various initiatives to hold a prominent share. For instance, in December 2023, Quantum Applied Science & Research has received an award of USD 4.6 Million to further develop its technology for sensing brain activity non-invasively (electroencephalography, or EEG). In addition, there are various companies entering this space some of the startups are Cortivision; Cognixion; Wearable Sensing; Ceribell, Inc.; and BrainScope Company Inc.

Key Wearable EEG Headsets Companies:

The following are the leading companies in the wearable EEG headsets market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Brain Monitoring, Inc.

- Cadwell Industries Inc.

- Neuroelectrics

- g.tec medical engineering GmbH

- Electrical Geodesics, Inc.

- Natus Medical Incorporated

- ANT Neuro

- Brain Products GmbH

- Compumedics Neuroscan

- Emotiv Inc.

Recent Developments

-

In March 2023, EEGSmart announced the launch of its flagship product, the UMind Mirror. UMind Mirror is a wearable Brain-Computer Interface (BCI) device that collects electroencephalography (EEG) data from users in various contexts such as sleep, meditation, and entertainment.

-

In March 2023, the world's first brain monitors for point-of-care seizure detection, developed by Ceribell, Inc., was included on Fast Company's esteemed annual list of the World's Most Innovative Companies for 2023.

-

In January 2021, The Neuronaute electroencephalogram (EEG) System and the IceCap EEG wearable device received 510(k) clearance from the FDA for application in patients with epilepsy.

Wearable EEG Headsets Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 134.7 million

Revenue forecast in 2030

USD 244.9 million

Growth rate

CAGR of 10.47% from 2024 to 2030

Actual period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Advanced Brain Monitoring, Inc.; Cadwell Industries Inc.; Neuroelectrics; g.tec medical engineering GmbH; Electrical Geodesics, Inc.; Natus Medical Incorporated; ANT Neuro; Brain Products GmbH; Compumedics Neuroscan; Emotiv Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Wearable EEG Headsets Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global wearable EEG headsets market report based on application, product, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Trauma & Surgery

-

Disease Diagnosis

-

Anesthesia Monitoring

-

Sleep Monitoring

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

5-channel EEG

-

14-channel EEG

-

32-channel EEG

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wearable EEG devices market size was estimated at USD 122.2 million in 2023 and is expected to reach USD 134.7 million in 2024.

b. The global wearable EEG devices market is expected to grow at a compound annual growth rate of 10.47% from 2024 to 2030 to reach USD 244.9 million by 2030.

b. North America dominated the wearable EEG devices market with a share of 41.15% in 2023. This is attributable to its well-developed healthcare infrastructure, advancements in technology in healthcare facilities, high patient admission rates, the region's strong industry player presence, increased government funding, growing public awareness of available technologies, and the high concentration of market players in the U.S.

b. Some key players operating in the wearable EEG devices market include Advanced Brain Monitoring, Inc., Cadwell Industries Inc., Neuroelectrics, g.tec medical engineering GmbH, Electrical Geodesics, Inc., Natus Medical Incorporated, ANT Neuro, Brain Products GmbH, Compumedics Neuroscan, Emotiv Inc.

b. Key factors that are driving the market growth include the rising demand for non-invasive brain monitoring solutions across a variety of industries, including healthcare, gaming, sports, and research.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."