Wearable Computing Market Size, Share & Trends Analysis Report By Connectivity (Wi-Fi, 4G/5G), By Product Type (Fitness Trackers, Smart Watches), By Application (Consumer, Non-consumer), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-100-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global wearable computing market size was valued at USD 59.34 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 20.2% from 2023 to 2030.The factors driving the sales of wearable computing products are technology breakthroughs in wearable devices, rising consumer acceptance of wearable technology, such as fitness bands and smartwatches, and the rising appeal of wearable medical and health equipment. Smartwatches and fitness bands are increasingly popular among swimmers, athletes, runners, gym goers, and cyclists, boosting the demand for wearable computing devices worldwide. Wearable devices are increasingly integrated with smartphones and other Internet of Things (IoT) devices.

This integration allows seamless data transfer, remote control functionality, and enhanced user experience. Wearables can display notifications, control music playback, and even answer phone calls, making them an extension of the smartphone ecosystem. Products, such as fitness trackers, smartwatches, and health monitors, have gained widespread popularity as they provide real-time data on heart rate, sleep patterns, step count, and other health-related metrics, allowing individuals to monitor and manage their well-being. For instance, Apple Inc., based in the U.S., launched the Apple Watch, a popular smartwatch that integrates health and fitness features with other smartphone functionalities. It includes heart rate monitoring, ECG measurement, fall detection, and workout tracking.

The health and fitness segment has been a major driver of the market growth. For instance, Fitbit, a consumer electronics and fitness company based in the U.S., offers a range of wearable devices, including fitness trackers and smartwatches. These devices track activities, monitor heart rate & sleep patterns and provide personalized fitness insights. Wearable technology is finding applications beyond fitness and health monitoring. It is used in sports, entertainment, fashion, and healthcare industries. For example, athletes use wearables to track performance metrics; smart clothing with embedded sensors is used in healthcare settings to monitor vital signs. For instance, in September 2019, Google LLC collaborated with Levi Strauss & Co., a clotting brand based in the U.S.

This collaboration introduced a smart jacket that integrates technology into clothing. The jacket has touch-sensitive fabric and allows users to control their smartphones, access navigation, and receive notifications through gestures on the jacket's sleeve. The market for Augmented Reality (AR) and Virtual Reality (VR) in combination with wearable computing has been experiencing significant growth in recent years. These technologies offer immersive and interactive experiences, transforming the gaming, entertainment, education, healthcare, and enterprise industries. For example, VR headsets, such as the Oculus Rift, HTC Vive, and PlayStation VR, that offer immersive gaming experiences have gained popularity among gamers.

Product Type Insights

The fitness trackers segment dominated the market with a revenue share of 35.0% in 2022. The growing emphasis on health and wellness has increased consumer awareness about the importance of physical activity and fitness tracking. Individuals seek ways to monitor and manage their health, increasing the demand for fitness trackers. Fitness trackers have evolved from basic step counters to more advanced devices incorporating additional features. These features may include heart rate monitoring, GPS tracking, sleep analysis, stress monitoring, blood oxygen level measurement, and guided workouts. Integrating such features enhances fitness trackers' functionality and value proposition.

For instance, in November 2022, Withings, a consumer electronics company based in France, introduced a series of smartwatches with advanced health monitoring features, including ECG trackers, activity, sleep, heart rate, blood oxygen level, and provide insights on cardiovascular health, breathing disturbances during sleep, and recovery from workouts.The Head Mount Displays (HMD) segment, particularly in the context of AR and VR, is expected to grow during the forecast years. HMDs are devices worn on the head that provide visual and auditory information to the user, immersing them in a digital or virtual environment. Moreover, HMDs now incorporate advanced tracking and sensing technologies, such as inside-out tracking, eye tracking, and hand gesture recognition. These features enable more precise and interactive experiences, allowing users to interact with virtual objects and environments more naturally.

Connectivity Insights

The Bluetooth connectivity segment dominated the market with a revenue share of 37.4% in 2022. Bluetooth connectivity allows wearables to seamlessly integrate with smartphones, enabling features, such as notifications, call management, music control, and data synchronization. Wearable devices can be used as extensions of smartphones, enhancing their functionality and user experience. Moreover, Bluetooth connectivity enables wearables to act as hubs for Internet of Things (IoT) devices. Users can control and monitor IoT devices, such as smartwatches controlling smart home devices or fitness trackers interacting with IoT-enabled healthcare devices.

The 4G/5G connectivity segment is expected to grow at the fastest CAGR from 2023 to 2030. 5G offers significantly faster download and upload speeds, reduced latency, and improved network capacity, enabling wearables to deliver real-time data and experiences. With 4G/5G connectivity, wearables can stream high-definition videos, music, and other multimedia content seamlessly. This enhances the user experience for applications like video calling, music streaming, and video playback. Moreover, 4G/5G connectivity allows wearables to connect to cloud-based services, enabling data syncing, storage, and analysis. Wearable devices can seamlessly upload and sync data with the cloud, providing users with access to their information from various devices and locations.

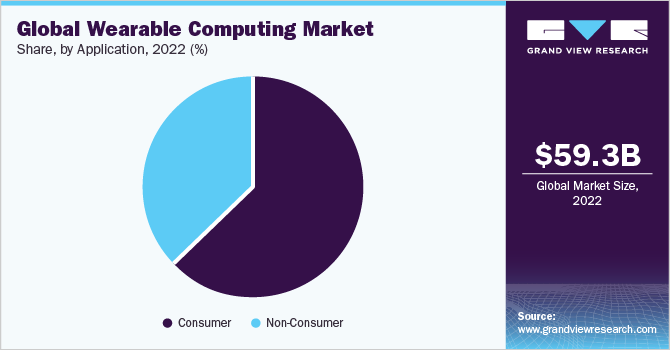

Application Insights

The consumer segment led the market with a revenue share of 62.6% in 2022. This segment includes wearable devices for personal use, entertainment, and lifestyle enhancement. Wearables designed for personal safety, such as panic buttons, location trackers, and SOS alert systems, have gained popularity among consumers. These devices provide peace of mind and enhanced safety measures, especially for vulnerable populations like children, seniors, and individuals in high-risk professions. Moreover, smart clothing integrates technology and sensors into garments, enabling biometric monitoring, posture correction, temperature regulation, and gesture control. The fashion-forward approach of smart clothing appeals to consumers looking for wearable devices that seamlessly blend with their style.

These growth trends highlight the increasing adoption and demand for wearable devices in various consumer applications. The non-consumer application segment refers to using wearable devices in various industries and professional settings. These applications enhance productivity, safety, efficiency, and data-driven decision-making. Wearable devices are being increasingly adopted in the healthcare industry. For example, wearable devices monitor patients remotely, allowing healthcare professionals to track vital signs, collect data, and provide timely care. This trend has seen significant growth, especially with the increasing demand for telehealth and the need for remote patient monitoring solutions.

Regional Insights

North America dominated the market with a revenue share of 40.7% in 2022. North America, particularly the United States, has been a hub for technological advancements and innovation in wearable computing. The region has a strong presence of key market players, driving the development and adoption of wearable deviceslike Fitbit and smartwatches like Apple Watch for health monitoring and lifestyle tracking. Moreover, the healthcare industry in North America has embraced wearable devices for remote patient monitoring, chronic disease management, and improving healthcare outcomes. The region's focus on telehealth and the increasing adoption of wearable fitness trackers and smartwatches contribute to the market growth.

For instance, Cloud DX, a Canadian company, offers wearable devices for remote monitoring of vital signs and chronic disease management.The Asia Pacific region is expected to grow with the fastest CAGR of 22.0% from 2023 to 2030. Asia Pacific is witnessing significant growth due to rapid technological advancements and the presence of major manufacturing hubs. Countries like China, Japan, South Korea, and India are leading the adoption of wearable devices. For instance, Xiaomi Inc., a Chinese company, has gained popularity with its affordable fitness trackers, such as the Mi Band series. Moreover, rising disposable income and changing lifestyles in Asia have contributed to the increased adoption of wearable devices for fitness tracking, fashion, and entertainment purposes.

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborations among the key players. For instance, in October 2022, Microsoft Corporation delivered the U.S. Army the first batch of its Integrated Visual Augmentation System (IVAS). The headsets are built with advanced features like passive targeting, infrared and night vision, situational awareness, tactical edge computing, and Microsoft Azure cloud computing. Some of the prominent players in the global wearable computing market include:

-

Apple Inc.

-

Fossil Group

-

Garmin Ltd.

-

Google LLC

-

NIKE, Inc.

-

Samsung

-

Sony Corp.

-

Sensoria

-

Huawei Technologies Co.

-

Xiamoi Inc.

Wearable Computing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 67.47 billion |

|

Revenue forecast in 2030 |

USD 244.43 billion |

|

Growth rate |

CAGR of 20.2% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product type, connectivity, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; UAE; Saudi Arabia; Brazil; South Africa; KSA |

|

Key companies profiled |

Apple Inc.; Fossil Group; Garmin Ltd.; Google LLC; NIKE, Inc.; Samsung; Sony Corp.; Sensoria; Huawei Technologies Co.; Xiamoi Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Wearable Computing Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the wearable computing market report based on product type, connectivity, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Smart Watches

-

Smart Jewelry

-

Fitness Trackers

-

Body-worn Cameras

-

Head Mount Displays

-

Others

-

-

Connectivity Outlook (Revenue, USD Million, 2017 - 2030)

-

Bluetooth

-

Wi-Fi

-

4G/5G

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer

-

Non-Consumer

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wearable computing market size was estimated at USD 59.35 billion in 2022 and is expected to reach USD 67.48 billion in 2023.

b. The global wearable computing market is expected to grow at a compound annual growth rate of 20.2% from 2023 to 2030 to reach USD 244.44 billion by 2030.

b. North America dominated the wearable computing market with a share of 40.7% in 2022. This is because the region has a well-developed ecosystem for wearable technology, including a mature supply chain, a strong retail presence, and extensive distribution networks.

b. Some key players operating in the wearable computing market include Apple Inc., Fossil Group, Garmin Ltd., Google LLC, NIKE, Inc., Samsung, Sony Corporation, Sensoria, Huawei Technologies Co., Xiamoi Inc.

b. Key factors driving the wearable computing market growth are technology breakthroughs in wearable devices, rising consumer acceptance of wearable technology such as fitness bands and smartwatches, and the rising appeal of wearable medical and health equipment.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."