- Home

- »

- Medical Devices

- »

-

Wearable Bioelectronic Skin Patches Market Report, 2030GVR Report cover

![Wearable Bioelectronic Skin Patches Market Size, Share & Trends Report]()

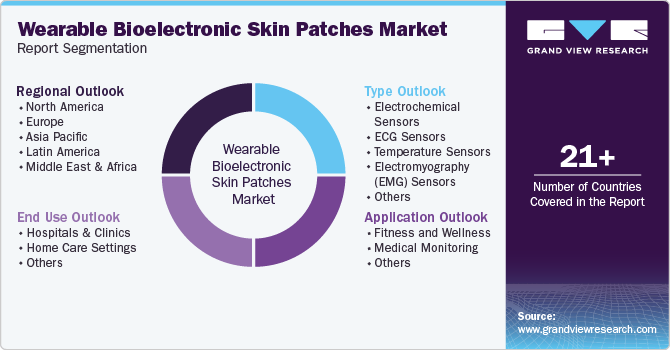

Wearable Bioelectronic Skin Patches Market Size, Share & Trends Analysis Report By Type (Electrochemical Sensors, ECG Sensors, Temperature Sensors), By Application (Fitness & Wellness), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-436-3

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

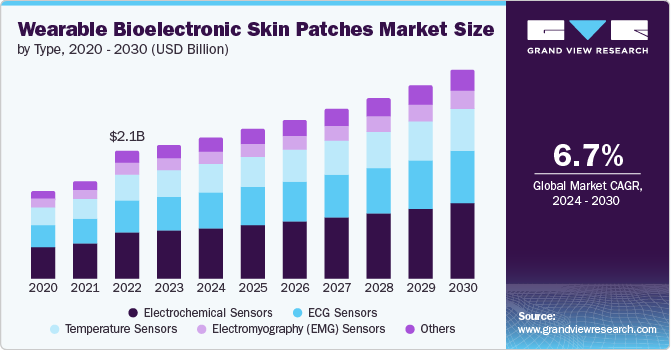

The global wearable bioelectronic skin patches market size was estimated at USD 2.2 billion in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. The market is growing rapidly due to advancements in health monitoring technology and demand for continuous health tracking. These patches monitor physiological parameters like glucose levels and heart rate, driving growth through innovation and the shift to preventive healthcare. Leading companies are investing in R&D to improve functionality and comfort.

Technological advancements in wearable bioelectronic skin patches are expected to drive market growth. Researchers at the University of Tsukuba have developed a lightweight (1 g), thin (1 mm thick) patch that adheres to the skin and accurately measures trace amounts of insensible perspiration, the water vapor that evaporates from the skin even at rest. The patch uses sponges made from a super hydrophilic polymer to quickly absorb small sweat volumes, with the sweat dyed for easy visual assessment of hydration levels. It also features a sensor to continuously monitor pH and concentrations of sodium, potassium, and glucose ions, providing real-time data on these metrics.

Additionally, in 2019, a research team from the University of California, San Diego, has developed a soft and stretchable wearable patch that can regulate the skin's temperature, keeping it at a preferred level despite changes in the surrounding environment. These patches are powered by a flexible and stretchable battery pack that can be integrated into clothing.

Wearable skin patches are designed to be lightweight, comfortable, and easy to use, providing health data without requiring users to invest significant time or effort. This convenience is crucial for people with busy lifestyles who need efficient ways to track their health. Unlike bulky medical devices or frequent doctor visits, skin patches can be worn continuously and inconspicuously, allowing users to monitor their health while engaging into their regular activities. This integration helps maintain consistent health tracking without disrupting daily routines.

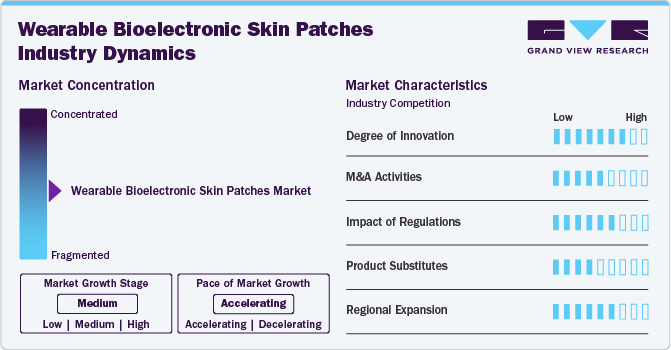

Market Concentration & Characteristics

The wearable bioelectronic skin patches industry is characterized by innovations in materials and design, as well as advancements in sensor technology. These patches enable continuous monitoring of vital signs and glucose levels, and are increasingly used for fitness tracking, stress monitoring, and general wellness, thereby catering to a broad range of consumer needs.

The wearable bioelectronic skin patch market exhibits a moderate degree of innovation. Advances in sensor technology have enabled the development of highly sensitive sensors that can detect minute changes in physiological parameters, such as glucose, pH levels, and electrolytes. For instance, in April 2023, MIT researchers have created a wearable patch that uses painless ultrasonic waves to create tiny channels in the skin for drug delivery. This technology could be used for treating various skin conditions and administering hormones, muscle relaxants, and other medications.

Wearable skin patches that are classified as medical devices must undergo rigorous approval processes, such as those required by the FDA in the U.S. or CE marking in Europe. This process includes demonstrating that the devices are safe and effective for their intended use. Manufacturers must obtain certifications and comply with specific regulations related to medical device manufacturing, including Good Manufacturing Practices (GMP).

Mergers and acquisitions (M&A) in the wearable bioelectronic skin patches industry are increasing as companies aim to broaden their market presence, enhance their product offerings, and advance their technological capabilities. For instance, in February 2024, X-trodes has announced that the U.S. FDA has granted 510(k) clearance for its Smart Skin solution, marketed as X-trodes System M. This new wireless wearable technology is designed for advanced electrophysiological monitoring.

The market includes a variety of substitute technologies, such as traditional medical devices, smartwatches, implantable sensors, and emerging smart clothing. Each of these technologies provides unique capabilities and levels of sophistication. The rate of technological advancement differs among these substitutes; for instance, smartwatches and fitness trackers are updated frequently with new features, whereas implantable sensors may experience slower progress due to regulatory limitations.

Regional expansion in the wearable bioelectronic skin patches industry is shaped by diverse factors, including varying local health demands, regulatory requirements, and economic conditions. The growth potential is influenced by regional healthcare infrastructure, which impacts the adoption of wearable technologies, and by cultural attitudes towards health and wellness.

Type Insights

The electrochemical sensors segment accounted for the largest market share of 40.9% in 2023. These sensors are crucial for continuously monitoring various biomarkers, such as glucose, lactate, and electrolytes, providing real-time health data. Their widespread use in diabetes management, sports health, and general wellness drives their market dominance. For instance, in April 2024, onsemi launched a next-generation electrochemical sensor solution for industrial, environmental, and healthcare applications. This new sensor features enhanced accuracy and stability at very low currents, making it ideal for precise monitoring in challenging conditions. Its advanced technology improves performance and reliability across various uses.

Electrochemical sensors are valued for their accuracy, reliability, and ability to deliver personalized health insights, which enhances their adoption. The segment's growth is further supported by advancements in sensor technology and increased consumer demand for non-invasive, real-time health monitoring solutions.

The temperature sensors segment is projected to experience the fastest CAGR of 6.9% over the forecast period. This growth is driven by increasing demand for continuous body temperature monitoring in various healthcare applications, advancements in sensor technology, and the rising focus on personalized and real-time health tracking solutions.

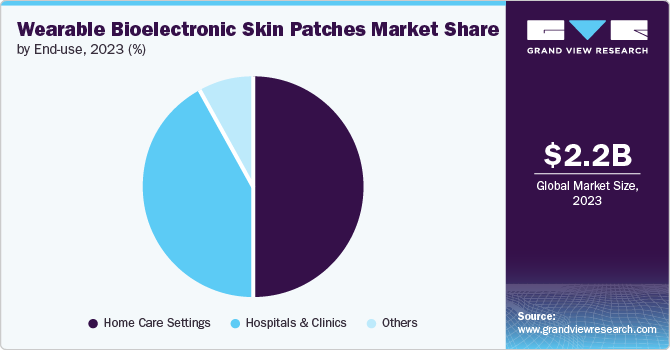

End-use Insights

The home care settings segment accounted for the largest revenue share of 46.8% in 2023 and is expected to witness the fastest growth over the forecast period. This dominance is attributable to the growing preference for self-administration of medications and the increasing adoption of wearable bioelectronic skin patches for managing chronic conditions such as diabetes, autoimmune disorders, and cancer. Several wearable bioelectronic skin patches enable patients to conveniently administer their medications at home, eliminating the need for frequent visits to healthcare facilities. This convenience factor, coupled with the hands-free and discreet nature of wearable bioelectronic skin patches, has made them the preferred choice for patients seeking to integrate their treatment seamlessly into their daily lives, which contributes to the high demand for these devices in the homecare settings.

The hospitals and clinics segment is projected to witness significant growth over the forecast period. This growth is driven by the rising prevalence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, which require the administration of biologics and specialty medications. The wearable bioelectronic skin patches offer healthcare providers in hospital and clinical settings a convenient and reliable solution to administer these complex therapies, improving patient outcomes and reducing the burden on healthcare facility staff.

Application Insights

The fitness and wellness segment accounted for the largest market share of 44.5% in 2023 and is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period, driven by increasing consumer demand for health monitoring and personal fitness tracking. These patches offer real-time data on metrics such as heart rate, physical activity, and calorie expenditure, enhancing user engagement in health management. The integration of advanced sensors allows for continuous monitoring of physiological parameters, promoting healthier lifestyles.

Innovations in this segment focus on improving accuracy and comfort, contributing to its dominant market share. For instance, in September 2022, FitTech Global introduced a skin-like wearable featuring a sweat sensor designed to address athlete dehydration, particularly during Asia's heatwave crises. This innovative patch continuously monitors sweat levels, providing real-time hydration data to help athletes manage their fluid intake and avoid dehydration in extreme heat conditions. As consumers become more health-conscious, the demand for fitness and wellness-focused bioelectronic skin patches is expected to grow further.

Regional Insights

North America wearable bioelectronic skin patches market dominated the overall global market and accounted for the 33.1% revenue share in 2023. This is attributed due to its advanced healthcare infrastructure, high consumer demand for health and wellness technologies, and significant investments in medical research. Major players like 3M, Philips, and GE Healthcare are prominent in the region, driving growth through technological innovations and strategic initiatives. Favorable regulatory environments and a focus on chronic disease management further bolster market expansion.

U.S. Wearable Bioelectronic Skin Patches Market Trends

The wearable bioelectronic skin patch market in the U.S. held a significant share of North America market in 2023. This can be attributed owing to its advanced healthcare system, high technology adoption rates, and substantial consumer interest in health and wellness solutions. Similarly, the FDA is supportive of the innovation of wearable bioelectronic skin patches to enhance the quality of care and utilize self-administration offered by wearable bioelectronic skin patches. There is robust demand for wearable devices that offer continuous health monitoring, driven by increasing awareness of preventive care and the management of chronic conditions like diabetes and cardiovascular diseases.

Europe Wearable Bioelectronic Skin Patches Market Trends

The wearable bioelectronic skin patch market in Europe is witnessing significant growth, driven by increasing consumer awareness about health and wellness drives demand for wearable bioelectronic skin patches that provide continuous monitoring and early detection of health issues. The rising prevalence of chronic conditions, such as diabetes and cardiovascular diseases, fuels the need for continuous health monitoring solutions provided by wearable bioelectronic patches. The IDF Diabetes Atlas reports that approximately 61 million people in Europe had diabetes in 2021, with this number anticipated to rise to around 67 million by 2030. The rising prevalence of chronic diseases, coupled with greater access to advanced wearable bioelectronic skin patches, is anticipated to boost market growth in the region.

The UK wearable bioelectronic skin patch market is experiencing substantial growth, driven by innovations in bioelectronic and sensor technologies that are improving the functionality, accuracy, and comfort of these devices. Wearable patches offer cost-effective solutions for continuous monitoring and early detection of health issues, which can reduce overall healthcare expenses. An aging demographic in the UK is driving demand for health monitoring solutions to manage age-related health conditions effectively, thereby surging the market growth.

The wearable bioelectronic skin patch market in France is experiencing notable growth due to the country’s emphasis on healthcare innovation and digital health technologies, which promotes the advancement and adoption of these wearable devices. Significant investments in R&D by French companies and research institutions are fostering technological advancements and innovations in wearable skin patches. French government policies and programs aimed at advancing healthcare technology and improving patient care contribute to market expansion.

The Germany wearable bioelectronic skin patch market is seeing significant growth, driven by the country’s advanced healthcare system, which facilitates the adoption and integration of cutting-edge wearable technologies, such as electronic skin patches. Germany's rapidly aging population, coupled with a high prevalence of chronic diseases like diabetes, heart disease, and cancer, is driving market growth. According to the World Bank, the number of people aged 65 and over in Germany has risen from 17.1 million in 2015 to over 19.2 million in 2023. This expanding elderly demographic, along with the rising incidence of chronic conditions, is fueling the growth of the market in Germany.

Asia Pacific Wearable Bioelectronic Skin Patches Market Trends

The wearable bioelectronic skin patch market in Asia Pacific is seeing substantial growth due to the increasing elderly population in countries like Japan, China, and India, which is driving the demand for advanced health management tools including wearable bioelectronic skin patches. Rapid urbanization and increasing prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular conditions are driving the demand for continuous health monitoring solutions, thereby surging the product demand.

The Japan wearable bioelectronic skin patch market in Japan is anticipated to experience significant growth due to the country’s rapidly aging population, which is driving a strong demand for advanced health monitoring solutions to address age-related health challenges. The World Bank reports that Japan's elderly population has risen from 34.7 million in 2015 to approximately 37.4 million in 2023. The growing elderly population is anticipated to further boost the demand for wearable bioelectronic skin patches in the country, driving market growth.

In 2023, the wearable bioelectronic skin patch market in China is projected to expand significantly within the Asia Pacific region. China, a leader in technological innovation, is advancing bioelectronic and sensor technologies, which are crucial for the development and adoption of wearable skin patches. Additionally, supportive government policies and initiatives focused on enhancing healthcare and promoting digital health technologies are driving market growth.

The India wearable bioelectronic skin patch market is expanding due to increasing public awareness of health and wellness, which is driving greater interest in preventive health monitoring devices, including wearable bioelectronic skin patches. Innovations in bioelectronic and sensor technologies are enhancing the functionality and accessibility of wearable skin patches, contributing to their adoption in India. Increased investment in healthcare technology and research by both government and private sectors is driving advancements and expansion in the market.

Latin America Wearable Bioelectronic Skin Patches Market Trends

The wearable bioelectronic skin patch market in Latin America is anticipated to experience substantial growth in 2023. Various Latin American governments are investing in healthcare modernization and digital health technologies, which support the development and adoption of wearable electronic skin patches. Moreover, rapid urbanization and population growth are creating a greater need for advanced health management tools and technologies.

The Saudi Arabia wearable bioelectronic skin patch market is poised for significant growth, driven by the country's extensive healthcare modernization efforts and increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions. As a part of its Vision 2030 initiative, the Saudi government is investing in advanced health technologies and digital health solutions, which supports the adoption of wearable skin patches. Additionally, rapid urbanization, rising health awareness, and substantial economic development are further fueling demand for these innovative health monitoring devices.

Key Wearable Bioelectronic Skin Patches Company Insights

The wearable bioelectronic skin patch market is highly competitive, featuring key players such as 3M, Koninklijke Philips, GE Healthcare, and Insulet Corporation, among others. These leading companies are actively pursuing a range of organic and inorganic strategies, including product launches, partnerships, acquisitions, mergers, and regional expansion, to address their customers' unmet needs.

Key Wearable Bioelectronic Skin Patches Companies:

The following are the leading companies in the wearable bioelectronic skin patches market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Koninklijke Philips

- GE Healthcare

- MC10

- Intelesens Ltd

- Gentag, Inc.

- Epicore Biosystems, Inc.

- iRhythm Technologies, Inc.

- Insulet Corporation

- The Surgical Company

Recent Developments

-

In June 2024, Researchers from the University of Chicago and Columbia University, including Bozhi Tian, have developed an innovative bioelectronic patch designed to monitor and treat chronic skin conditions. This device combines cutting-edge electronics, living cells, and hydrogel, and has demonstrated promising results in experiments with mice.

-

In June 2024, Researchers at the University of Missouri have enhanced their on-skin wearable bioelectronic device by adding wireless charging via magnetic connection, eliminating the need for batteries. This upgrade was made by Zheng Yan’s lab, known for its soft bioelectronics expertise.

-

In September 2022, Epicore Biosystems has teamed up with 3M and Innovize to advance and scale the development of its sweat-sensing wearable technology.

Wearable Bioelectronic Skin Patches Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.3 billion

Revenue forecast in 2030

USD 3.5 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

3M; Koninklijke Philips; GE Healthcare; MC10; Epicore Biosystems, Inc; iRhythm Technologies; Inc.; Insulet Corporation; The Surgical Company; ROTEX Global; Intelesens Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Bioelectronic Skin Patches Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For of this study, Grand View Research has segmented the global wearable bioelectronic skin patches market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrochemical Sensors

-

ECG Sensors

-

Temperature Sensors

-

Electromyography (EMG) Sensors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fitness and Wellness

-

Medical Monitoring

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wearable bioelectronic skin patches market size was estimated at USD 2.2 billion in 2023 and is expected to reach USD 2.3 billion in 2024.

b. The global wearable bioelectronic skin patches market is expected to grow at a compound annual growth rate of 6.72% from 2024 to 2030 to reach USD 3.50 billion by 2030.

b. North America dominated the wearable bioelectronic skin patches market with a share of 33.1% in 2023. This is attributable to advancements in health monitoring technology and demand for continuous health tracking

b. Some key players operating in the wearable bioelectronic skin patches market include 3M, Koninklijke Philips, GE Healthcare, MC10, Epicore Biosystems, Inc, iRhythm Technologies, Inc., Insulet Corporation, The Surgical Company, ROTEX Global, Intelesens Ltd

b. Key factors driving the wearable bioelectronic skin patches market growth include the technological advancements, rising awareness regarding wearable bioelectronic skin patches, investments in R&D by leading players to improve comfort and functionality.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."