- Home

- »

- Advanced Interior Materials

- »

-

Wear Plates Market Size And Share, Industry Report, 2030GVR Report cover

![Wear Plates Market Size, Share & Trends Report]()

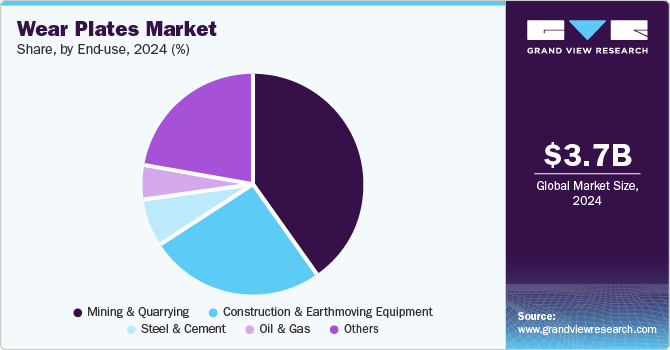

Wear Plates Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Steel, Ceramics), By End Use (Mining & Quarrying, Steel & Cement, Construction & Earthmoving Equipment, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-525-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wear Plates Market Size & Trends

The global wear plates market size was valued at USD 3.74 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. The increasing demand for wear-resistant materials, critical in industries like mining, construction, and manufacturing, proliferates the market. These industries rely heavily on machinery and equipment exposed to extreme conditions, such as abrasion, corrosion, and impact. Wear plates, often made from high-strength alloys or composite materials, help extend the lifespan of critical components by reducing wear and tear. As these industries grow, so does the demand for wear plates to maintain operational efficiency and reduce downtime caused by equipment failure.

Manufacturers are developing high-performance wear plates that offer enhanced durability and resistance to a wider range of harsh environments. Innovations such as the introduction of carbide-based wear plates or ceramics are becoming popular due to their ability to withstand extreme conditions like high temperatures, heavy impact, and corrosive environments. These advancements allow industries to optimize their operations and reduce maintenance costs, which, in turn, drives demand for these high-performance solutions.

Expanding industrial infrastructure in emerging economies also significantly affects the wear plates market's growth. As countries in Asia-Pacific, Latin America, and Africa continue to industrialize, the demand for machinery and equipment in construction, mining, and other heavy industries has surged. The need to protect expensive machinery from wear and tear, combined with the increasing adoption of automated processes in these sectors, has raised the importance of wear-resistant materials. This trend is expected to continue, fostering higher demand for wear plates in emerging markets.

Additionally, the growing sustainability and energy efficiency trend is driving the wear plates market. Companies across various industries increasingly focus on reducing waste, improving energy efficiency, and minimizing downtime. Wear plates contribute to these objectives by extending the service life of the equipment and reducing the need for frequent replacements or repairs, which leads to fewer resources being consumed over time. The role of wear plates in promoting sustainability aligns with global efforts to reduce carbon footprints, making them an attractive option for industries aiming to improve both productivity and environmental impact.

Drivers, Opportunities & Restraints

The industry is primarily driven by the growing demand for equipment durability in various industries, including mining, construction, and manufacturing. As such industries experience a rise in production and output, the need for components that can withstand harsh operating conditions, such as high impact, friction, and abrasion, becomes critical. Wear plates are designed to extend the lifespan of machinery by protecting key components, reducing maintenance costs, and enhancing productivity. For instance, in November 2024, Sandvik Rock Processing launched its innovative HX900 wear protection plates in Africa. These plates are designed for various applications, including feeders, chutes, and heavy equipment like loaders and buckets. Additionally, technological advancements in materials, such as the development of high-performance alloys and composite wear plates, contribute to the growth of this market by offering superior wear and corrosion resistance.

The industry is poised for significant growth due to opportunities in emerging markets, particularly in the Asia-Pacific region. As industries such as construction, infrastructure development, and heavy manufacturing continue to expand in countries like China, India, and Southeast Asia, there is a growing need for reliable wear protection solutions. Additionally, the increasing trend of automation and mechanization in industries such as agriculture and mining presents opportunities for wear plate manufacturers to design customized solutions that cater to more specialized and high-performance needs. Furthermore, adopting wear-resistant plates in industries like oil and gas and energy creates lucrative growth opportunities for market players.

Although these materials provide long-term value by reducing maintenance and replacement costs, the upfront investment can hinder budget-constrained operations. Additionally, there is a lack of awareness in some regions regarding the benefits of wear plates, which may slow market penetration.

Material Insights

Steel wear plates, particularly those made from high-strength and abrasion-resistant steel alloys, offer superior protection against impact, friction, and corrosion. This durability enhances the lifespan of machinery and reduces operational downtime, contributing to cost savings and improving overall efficiency. The rapid industrialization in emerging economies and expanding infrastructure projects worldwide further drive the demand for the market, particularly in sectors such as mining and construction, where equipment is subjected to harsh environments.

Ceramics is anticipated to register the fastest CAGR over the forecast period. Ceramics are highly valued for their exceptional hardness, wear resistance, and ability to withstand extreme temperatures and corrosive environments. These properties make them ideal for applications where traditional materials like metals fail to deliver long-lasting performance. As industries prioritize efficiency and durability, the adoption of ceramic wear plates is rising, particularly in heavy machinery and equipment subjected to abrasive and erosive conditions.

End Use Insights

As mining activities intensify to meet the rising needs of industries such as construction, automotive, and electronics, the wear and tear on equipment has escalated. Wear plates, essential for protecting heavy machinery from abrasion, impact, and corrosion, have seen heightened demand. For instance, in 2023, the surge in lithium mining for electric vehicle batteries and the expansion of copper mining for renewable energy infrastructure has driven the need for durable wear plates.

Construction & earthmoving equipment is anticipated to register the fastest CAGR over the forecast period. With rapid urbanization and the need for improved transportation networks, including roads, bridges, and airports, the construction sector has been expanding significantly. As a result, there is a growing demand for heavy machinery such as excavators, loaders, and bulldozers, all of which require wear plates to enhance durability and extend operational life. Improving efficiency and minimizing machine failure in these sectors pushes the demand for high-quality, wear-resistant materials in the machinery's construction and repair processes.

Regional Insights

North America wear plates market has experienced significant growth, driven primarily by expanding industries such as mining, construction, and manufacturing. For instance, the U.S. Geological Survey 2023 reported a 12% year-on-year increase in mining activities, particularly in regions rich in critical minerals like lithium and cobalt, essential for the growing EV industry. This surge in mining operations has directly fueled the need for durable wear plates to enhance the longevity and efficiency of heavy machinery.

U.S. Wear Plates Market Trends

The wear plates market in the U.S. is growing. As industries in the U.S. continue to expand, especially in sectors like mining and construction, the need for durable and high-performance materials to withstand harsh working conditions rises. Additionally, with technological advancements, wear plates are being designed with enhanced materials such as high-strength steel and alloys, improving their efficiency and resistance to wear, thus fueling market growth.

Asia Pacific Wear Plates Market Trends

The wear plates market in Asia Pacific is growing as countries such as China, India, and Southeast Asian nations are investing heavily in the construction, mining, and manufacturing sectors, which are key end-users of wear plates. The increasing demand for durable and high-performance materials to withstand harsh operating conditions in these industries has fueled the adoption of wear plates. Additionally, the expansion of the automotive and aerospace industries in the region has further boosted the market, as wear plates are essential for machinery and equipment that require resistance to abrasion, impact, and corrosion.

Europe Wear Plates Market Trends

The wear plates market in Europe held a significant market share in 2024. Europe's manufacturing sector is characterized by high-quality production standards, which demand materials capable of withstanding wear and tear in harsh operating conditions. The European Union's regulations promoting environmental sustainability and energy efficiency encourage industries to opt for solutions that minimize waste and lower operational costs. As European industries strive to modernize their machinery and optimize production processes, the demand for wear plates that offer durability, reliability, and cost-effectiveness is expected to continue growing, further bolstering the market.

Central & South America Wear Plates Market Trends

The wear plates market in Central & South America is anticipated to grow significantly over the forecast period. Countries such as Chile, Peru, and Brazil have seen increased mining activities, particularly in copper, lithium, and iron ore extraction. For instance, Chile, the world’s largest copper producer, reported a 5% year-on-year increase in copper production in 2023, reaching approximately 5.6 million metric tons. This surge in mining output has directly fueled the demand for wear plates, essential for protecting equipment from abrasion and corrosion in harsh mining environments.

Middle East & Africa Wear Plates Market Trends

The wear plates market in the Middle East & Africa is driven by rapid urbanization and infrastructure development in countries such as the UAE, Saudi Arabia, and South Africa that have increased demand for wear-resistant materials for construction equipment, mining machinery, and heavy industrial applications. Additionally, the region's focus on diversifying economies away from oil dependency has spurred investments in manufacturing, mining, and energy sectors, further boosting the need for durable wear plates.

Key Wear Plates Company Insights

Some of the key players operating in the market include SSAB, ThyssenKrupp, and others.

-

SSAB is a specialized steel manufacturer recognized for its innovative approach to producing high-quality steel grades tailored for various applications. SSAB’s flagship product line includes Hardox wear plates, renowned for their exceptional abrasion resistance and durability. These wear plates are designed to withstand extreme wear conditions while maintaining structural integrity, making them ideal for heavy-duty applications in mining, construction, and recycling sectors.

-

ThyssenKrupp is a global industrial group based in Germany. It is known for its diversified operations in various sectors, including steel production, automotive technology, and engineering services. ThyssenKrupp offers premium wear plates under the brand name perdur, which are designed to provide high wear resistance while maintaining excellent forming properties.

Key Wear Plates Companies:

The following are the leading companies in the wear plates market. These companies collectively hold the largest market share and dictate industry trends.

- ANSTEEL

- ArcelorMittal

- Baohua Resistant Steel

- Baosteel Group

- Bisalloy

- Dillinger

- Essar Steel Algoma

- JFE

- NLMK Clabecq

- NSSMC

- SSAB

- ThyssenKrupp

- TISCO

- Wuyang Steel

- Xinyu Iron & Steel

Recent Developments

-

In December 2024, SSAB expanded its Hardox wear plate portfolio by adding Hardox HiAce. This new wear steel is designed to withstand wear in acidic and corrosive environments, complementing the existing Hardox product range. Hardox HiAce is engineered to offer enhanced resistance when materials are exposed to corrosive substances, extending the lifespan of equipment and components in such harsh environments.

Wear Plates Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.94 billion

Revenue forecast in 2030

USD 5.45 billion

Growth Rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

SSAB; JFE; ThyssenKrupp; Dillinger; ArcelorMittal; Essar Steel Algoma; NSSMC; Wuyang Steel; Xinyu Iron & Steel; NLMK Clabecq; Baosteel Group; Baohua Resistant Steel; Bisalloy; ANSTEEL; TISCOTop of Form; Bottom of Form

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wear Plates Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wear plates market report on the basis of material, end use, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Ceramics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Mining & Quarrying

-

Steel & Cement

-

Construction & Earthmoving Equipment

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wear plates market size was estimated at USD 3.74 billion in 2024 and is expected to reach USD 3.94 billion in 2025.

b. The global wear plates market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 5.45 billion by 2030.

b. The steel segment dominated the market with a revenue share of over 66% in 2024.

b. Some of the key vendors of the global wear plates market are SSAB; JFE; ThyssenKrupp; Dillinger; ArcelorMittal; Essar Steel Algoma; NSSMC; Wuyang Steel; Xinyu Iron & Steel; NLMK Clabecq; Baosteel Group; Baohua Resistant Steel; Bisalloy; ANSTEEL; TISCO; among others.

b. The key factor that is driving the growth of the global wear plates market is the growing demand for durable materials in industries such as mining, construction, and manufacturing. This is fueled by the need to reduce maintenance costs and improve the longevity of equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.